Key Points on Aerospace Carbon Neutrality by 2050

- The aerospace industry has committed to achieving net-zero carbon emissions by 2050, aligning with global climate goals like the Paris Agreement, but success hinges on the rapid scaling of technologies amid growing air travel demand projected to double passenger numbers.

- Research suggests sustainable aviation fuel (SAF) could deliver up to 65% of needed reductions, while electric and hydrogen propulsion might contribute 13%, though delays in development and high costs pose significant hurdles.

- Evidence leans toward feasibility if governments provide policy support and investments, but without aggressive action on infrastructure and supply chains, emissions could exceed targets, potentially accounting for 25% of global CO2 by mid-century.

Overview of Commitments and Pathways

Aviation’s push for carbon neutrality is driven by international pledges, including the International Air Transport Association (IATA) resolution in 2021 and the International Civil Aviation Organization (ICAO) aspirational goal adopted in 2022. These aim to cap and reverse emissions growth through a mix of fuels, aircraft innovations, and efficiency gains. For instance, airlines plan to blend 10-30% SAF by 2030, building toward full decarbonization.

Major Technologies at Play

- Sustainable Aviation Fuel (SAF): Drop-in fuels from waste or captured carbon, reducing lifecycle emissions by up to 80%.

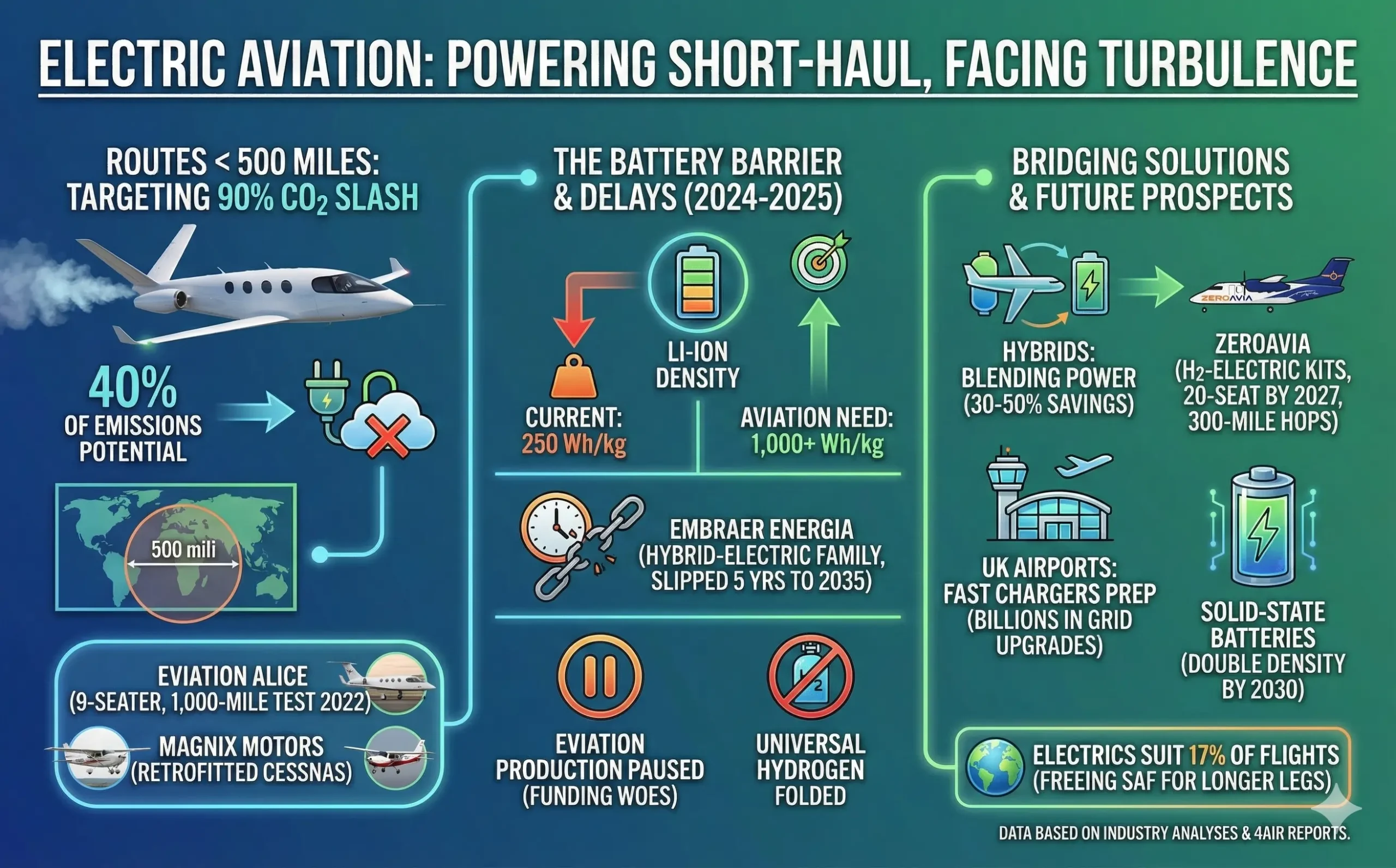

- Electric and Hybrid Aircraft: Best suited for short-haul flights under 500 miles, with prototypes like those from ZeroAvia targeting regional routes.

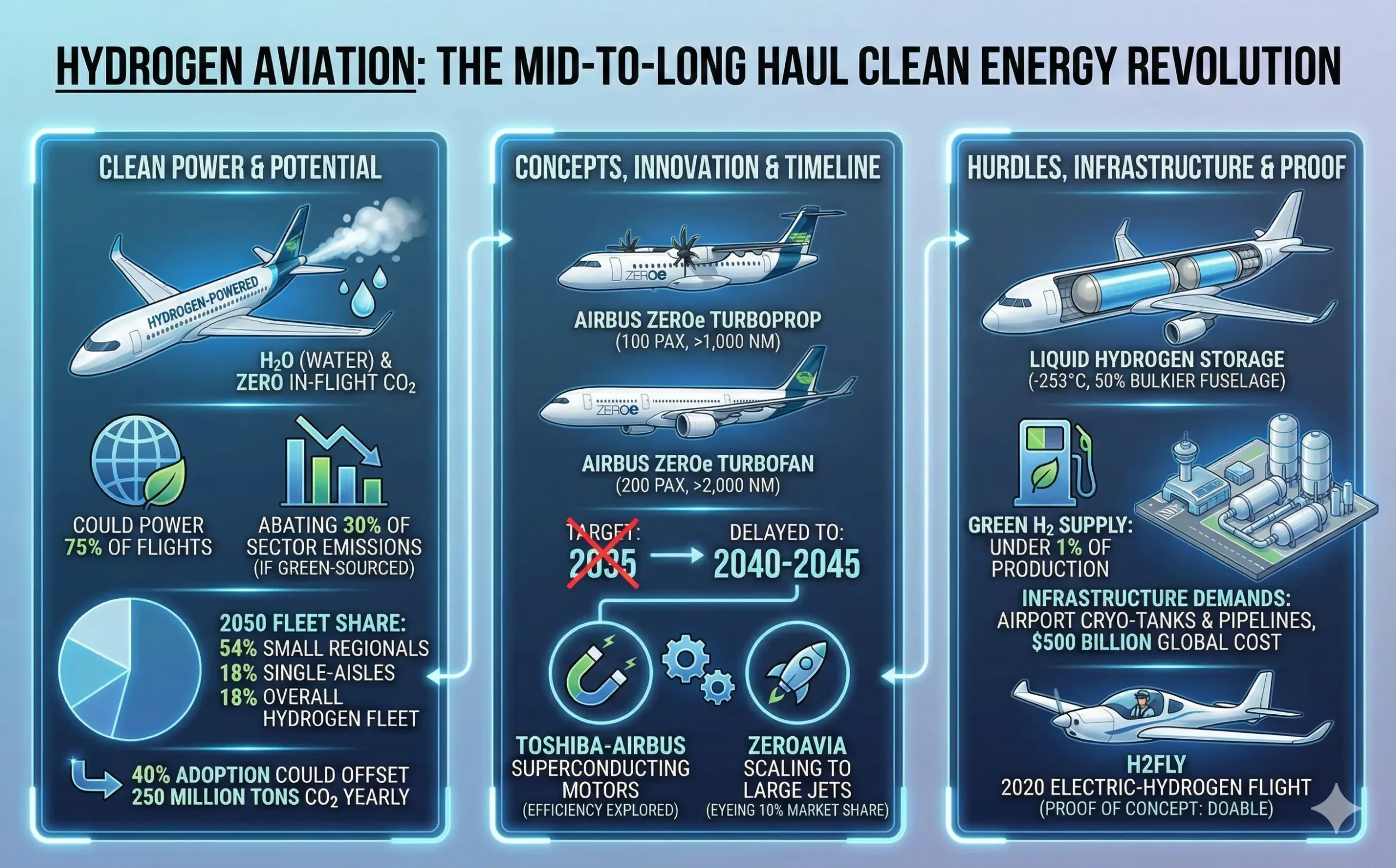

- Hydrogen Propulsion: Promises zero in-flight emissions for longer ranges, with Airbus eyeing commercial entry in the 2030s.

Key Challenges

High production costs for SAF (2-5 times conventional fuel), limited green hydrogen supply, and infrastructure gaps could derail progress. Recent delays, such as Airbus pushing back hydrogen aircraft timelines by 5-10 years, highlight the need for $1 trillion+ in global investments.

Table of Contents

Imagine boarding a flight in 2050, sipping coffee as your plane hums quietly on hydrogen power, leaving no carbon trail in the sky. It’s a vision that’s equal parts inspiring and daunting for the aerospace industry, which today guzzles fossil fuels like there’s no tomorrow. But with air travel booming—expected to carry over 10 billion passengers annually by mid-century—the question isn’t just whether we can reach carbon neutrality by 2050. It’s whether we will.

This article dives deep into the possibilities, pitfalls, and pathways, drawing on industry roadmaps, technological breakthroughs, and hard-nosed realities to paint a comprehensive picture of aviation’s green revolution.

Why Carbon Neutrality Matters for Aerospace

Aviation, for all its wonders, is a climate heavyweight. It accounts for about 2.5% of global CO2 emissions today, a figure that could climb to 25% by 2050 if we stick to business-as-usual flying. That’s not hyperbole; it’s backed by projections from energy analysts showing unchecked growth in flights could release 21.2 gigatons of CO2 between 2021 and 2050. Yet, this sector isn’t shirking responsibility.

In 2021, at the IATA Annual General Meeting in Boston, airlines worldwide resolved to hit net-zero CO2 emissions by 2050—a bold alignment with the Paris Agreement’s aim to limit warming to 1.5°C. Fast-forward to 2022, and ICAO’s 41st Assembly cemented this with the Long-Term Global Aspirational Goal (LTAG) for international aviation, endorsed by 184 nations. It’s a collective vow: eliminate emissions at the source where possible, offset the rest, and capture what’s left.

But what does net zero really mean here? It’s not just wishful thinking. It requires slashing operational CO2 to near zero, using tools like cleaner fuels and efficient designs, then mopping up residuals through verified offsets or tech like direct air capture. The stakes? Beyond climate, it’s about economic survival—airlines face rising carbon taxes, like the EU’s Emissions Trading System, and passenger demands for green travel, with 85% willing to pay a premium for sustainable flights. Get it right, and aerospace could spark a $3 trillion green economy by 2050, creating millions of jobs in clean tech. Get it wrong, and we’re grounded in regulatory gridlock.

A Snapshot of Today’s Emissions Landscape

To grasp the scale of the challenge, consider aviation’s footprint. Commercial flights burned 330 million tons of fuel in 2019, emitting roughly 1 gigaton of CO2—more than the annual output of entire countries like Germany. Post-pandemic recovery has us back on track, but with demand surging, emissions are rebounding faster than efficiency gains. From 2005 to 2019, fuel burn per passenger dropped 39% thanks to sleeker jets like the Boeing 787 Dreamliner and Airbus A350, which sip 20% less fuel than predecessors. Still, absolute emissions rose because we flew more.

Here’s a breakdown of aviation’s emissions by segment, highlighting where cuts are most urgent:

| Segment | Share of Total Emissions (2023 Est.) | Key Characteristics | Reduction Potential by 2050 |

|---|---|---|---|

| Short-Haul (<1,500 km) | 40% | High-frequency regional flights; ideal for electrification | Up to 90% with batteries/hybrids |

| Medium-Haul (1,500-4,000 km) | 35% | Bulk of passenger traffic; hydrogen viable | 70-80% via SAF and efficiency |

| Long-Haul (>4,000 km) | 25% | Fuel-intensive; hardest to decarbonize | 50-65% primarily through SAF |

| Cargo | 15% (overlaps) | Growing e-commerce demand | 60% with optimized routing and fuels |

This table, derived from industry analyses, shows short-haul as the low-hanging fruit—over half of CO2 comes from flights under 2,500 miles, ripe for disruption. Non-CO2 impacts, like contrails boosting warming by 2-3 times CO2’s effect, add another layer of complexity, pushing for altitude tweaks and cleaner exhausts.

The Roadmap to 2050: A Phased Approach

Industry blueprints like IATA’s Net Zero Roadmaps and the Waypoint 2050 plan outline a multi-decade sprint. Phase one (2020s): Ramp up SAF blending to 10% and renew fleets with 15-20% more efficient models. Phase two (2030s): Deploy hydrogen and electric for regionals, hitting 38% overall cuts per IEA benchmarks. By 2050, the mix stabilizes at net zero, abating that 21.2 gigatons through targeted levers.

Take United Airlines’ illustrative roadmap: It models scenarios blending 70% SAF, 20% new propulsion, and 10% offsets, assuming steady policy pushes. Europe’s Destination 2050 echoes this, projecting SAF as the biggest lever if production scales to 445 billion liters yearly—demanding $150 billion in annual investments. Globally, the U.S. SAF Grand Challenge targets 3 billion gallons domestically by 2030, a 1,000-fold jump from today.

Yet, roadmaps aren’t set in stone. The Horizon 2050 report from aerospace leaders stresses prioritizing near-term tech (SAF, efficiency) while R&D-ing long-shots like blended-wing bodies. It’s a balancing act: Invest now in scalable wins, or risk betting big on unproven moonshots.

Sustainable Aviation Fuel: The Workhorse of Decarbonization

Enter Sustainable Aviation Fuel (SAF), the unsung hero poised to shoulder 65% of emission cuts. Unlike conventional jet fuel from crude oil, SAF derives from renewables—think used cooking oil, agricultural waste, or even atmospheric CO2 via power-to-liquid processes. It slashes lifecycle emissions by 80%, drops right into existing engines, and needs no plane retrofits. Nine certified pathways ensure it’s as reliable as Jet A, with blends already powering flights by Delta and Lufthansa.

But scaling? That’s the rub. Today, SAF is a whisper at 0.1% of supply; by 2050, we’ll need 330-445 million tons annually to fuel 20 trillion passenger-kilometers. Feedstocks abound—enough waste oils for full net zero, per IATA studies—but competition from trucking and shipping heats up the race. Costs hover at 2-5 times conventional fuel, a barrier that airlines can’t shoulder alone.

Policy is the accelerator. Mandates like the EU’s ReFuelEU (6% SAF by 2030) and U.S. tax credits under the Inflation Reduction Act are spurring factories—LanzaJet’s Illinois plant aims for 10 million gallons yearly by 2025. Imagine a world where SAF prices parity with fossil fuels by 2040, thanks to $100 billion in global incentives. Real-world example: KLM’s 2023 flight on 100% SAF-derived fuel proved it works, cutting 1.5 tons of CO2 per trip.

Challenges persist, though. Sustainable sourcing avoids food crop raids, but land use scrutiny is fierce—non-food crops like camelina must expand without deforestation. Synthetic SAF from green hydrogen offers a fix, but it guzzles renewables already stretched thin.

A projected timeline:

| SAF Milestone | Target Year | Production Goal | Emission Impact |

|---|---|---|---|

| Initial Blends | 2025 | 5-10% of fuel | 5-10% cuts |

| Market Ramp | 2030 | 10-30% blends | 20-30% overall reduction |

| Scale-Up | 2040 | 50%+ supply | 50% abatement |

| Dominance | 2050 | 65% of needs | Net-zero enabler |

This pathway, from RMI’s SAF Outlook, underscores SAF’s pivot role—37% of 2050 reductions if we hit stride.

Electric Propulsion: Zapping Short-Haul Skies

For routes under 500 miles, 40% of emissions—battery-electric aircraft could slash CO2 by 90%. Picture the Eviation Alice, a nine-seater all-electric prop that flew 1,000 miles on test in 2022, or magniX’s motors powering retrofitted Cessnas. These birds recharge like EVs, emitting only water vapor from cooling systems.

Development’s buzzing, but turbulence hit in 2024-2025. Embraer’s Energia hybrid-electric family, eyed for 2030 entry, slipped five years due to battery density lags—current lithium-ion packs weigh too much for big loads. Eviation paused production amid funding woes, and Universal Hydrogen folded despite a successful hydrogen-electric demo. Why? Batteries store energy at 250 Wh/kg; aviation needs 1,000+ for viability.

Hybrids bridge the gap, blending batteries with gas turbines for 30-50% savings on regionals. ZeroAvia’s hydrogen-electric kits target 20-seat planes by 2027, converting emissions to zero on 300-mile hops. Airports like those in the UK are prepping with fast chargers, but grid upgrades cost billions. A business jet study found full electrics could cut a carrier’s annual CO2 by 93%—a tantalizing preview.

Prospects brighten with solid-state batteries on the horizon, promising double density by 2030. For now, electrics suit 17% of flights, per 4AIR analyses, freeing SAF for longer legs.

Hydrogen: Fueling the Future of Flight

Hydrogen steals the show for mid-to-long haul, burning clean to produce water and zero CO2 in-flight. Fuel cells or combustion engines could power 75% of flights, abating 30% of sector emissions if green-sourced. Airbus’s ZEROe concepts—a turboprop for 100 passengers over 1,000 nautical miles, a turbofan for 200 over 2,000—target 2035 service, though delayed to 2040-2045.

By 2050, hydrogen might claim 18% of the fleet: 54% small regionals, 18% single-aisles. Toshiba–Airbus partnerships explore superconducting motors for efficiency, while ZeroAvia’s whitepaper scales to large jets, eyeing 10% market share. A 40% adoption rate could offset 250 million tons of CO2 yearly.

Hurdles? Storage—liquid hydrogen at -253°C bulks up fuselages 50%—and supply, with green H2 under 1% of production. Infrastructure demands airport cryo-tanks and pipelines, costing $500 billion globally. Yet, pilots like H2FLY’s 2020 electric-hydrogen flight prove it’s doable.

| Hydrogen Aircraft Type | Passenger Capacity | Range (nm) | Projected Fleet Share by 2050 | Emission Reduction |

|---|---|---|---|---|

| Small Regional | Up to 50 | 500-1,000 | 54% | 100% in-flight |

| Medium Single-Aisle | 100-150 | 1,000-2,000 | 18% | 95% lifecycle |

| Large Twin-Aisle | 200+ | 2,000+ | 14% | 90% with green H2 |

| Blended-Wing | Experimental | 3,000+ | <5% | Up to 100% |

Drawn from fleet evolution models, this table spotlights hydrogen’s versatility for 11% of energy needs by 2050.

Operational Tweaks and Efficiency Gains: The Low-Hanging Fruit

Not all solutions are sci-fi. Simple ops changes—like optimized routing via Single European Sky or NextGen air traffic management—could trim 10% off fuel use. Lighter loads, winglets, and AI-driven descents add up: Each new aircraft gen cuts emissions 15-20%. IATA pegs these at 3% of total reductions, but they’re cheap and quick—think Southwest’s wingtip devices saving 1.5% per flight.

Demand management plays in too: Video calls curbed business travel post-COVID, dropping emissions 20% temporarily. By 2050, incentives for rail on short hops could shift 5% of intra-Europe flights.

The Roadblocks: Costs, Infrastructure, and Human Factors

Dreams crash on realities. SAF’s premium prices risk ticket hikes, deterring the 14% of passengers who actually pay extra today. Tech adoption lags—OEMs need 20-year lead times, clashing with airlines’ 5-year cycles. Infrastructure? Electrifying 5,000+ airports means massive grids; hydrogen hubs require $1 trillion.

Behavior shifts are thornier. High-income flyers dominate emissions—top 1% take 50% of flights—so equity matters. Regulations vary: U.S. incentives clash with EU mandates, fragmenting supply chains. And safety? Zero-emission tech must match aviation’s gold standard, delaying certs.

Recent stumbles amplify doubts: 2025’s project halts signal turbulence, per ICCT, forcing heavier SAF reliance—but even optimistic models overshoot targets by 2037 without ZEPs. McKinsey warns of $2.7 trillion abatement costs, demanding public-private pacts.

Real-World Examples: Pioneers Paving the Way

Spotlight innovators. Alaska Airlines blended 15% SAF on 2023 Seattle-Tacoma flights, proving seamless ops. Airbus’s 2024 hydrogen test flight with CFM International logged 1,500 hours, validating cryo-systems. In the U.S., RMI’s airport consortium fast-tracks electric ramps at 20 hubs, hosting magniX trials.

Globally, the Clean Skies for Tomorrow Coalition—100+ firms—pushes 10% SAF by 2030, while Brazil’s Embraer eyes hybrid regionals for Amazon routes, cutting deforestation-linked emissions. These aren’t outliers; they’re blueprints, showing 20% fleet turnover by 2035 could embed green DNA.

Projections and Scenarios: What 2050 Might Look Like

Optimistic take: With $1.4 trillion invested, aviation halves emissions by 2030, hits net zero on schedule—hydrogen fleets buzzing regionals, SAF fueling transatlantics. Pessimistic? Delays balloon costs to $5 trillion, emissions peak at 1.5 Gt/year, forcing offsets that strain forests.

McKinsey scenarios blend these: Base case sees 50% cuts via current tech; the disruptive one adds hydrogen for 90%. AIA’s Horizon 2050 feasibility assessment prioritizes mid-term hybrids, forecasting 80% abatement if policies align.

| Scenario | SAF Share | New Tech Contribution | Total Cost (Trillions USD) | Net Zero Achievability |

|---|---|---|---|---|

| Business as Usual | 10% | 5% | $1.0 | Low (Emissions +50%) |

| Policy-Driven | 40% | 15% | $2.0 | Medium (70% Cuts) |

| Tech Breakthrough | 65% | 25% | $3.5 | High (Full Neutrality) |

| Delayed Action | 30% | 10% | $4.5 | Low (Overshoot by 20%) |

This table synthesizes IEA and industry models, emphasizing the policy’s multiplier effect.

Broader Impacts: Economy, Equity, and Innovation

Decarbonizing aerospace isn’t zero-sum. It births jobs—1 million in SAF alone by 2030—and spurs spin-offs like advanced batteries for EVs. Equity demands inclusion: Developing nations, flying 2% of global km but bearing climate brunt, need tech transfers via ICAO funds.

Innovation cascades: Hydrogen R&D could green shipping; electric vertical takeoff (eVTOLs) like Joby’s air taxis redefine urban mobility, emitting 50% less than cars. Economically, net zero unlocks $1.4 trillion in value by 2040, per Accenture, as green premiums boost loyalty.

Collaborations: The Glue Holding It Together

No solo flights here. IATA’s 300-member airlines pool demand for SAF; WEF’s coalitions forge public-private bonds. Governments must harmonize—tech-agnostic incentives, global standards—to avoid patchwork pitfalls.

Conclusion

Can aerospace go carbon neutral by 2050? The evidence tilts yes: Commitments are ironclad, tech tantalizing, roadmaps rigorous. But it demands urgency—scaling SAF, bridging hydrogen gaps, greening ops—backed by trillions in smart spend. As one executive quipped, “We’re not just building planes; we’re reimagining flight.” If we seize this, 2050 skies could be cleaner, fairer, and full of promise. The question now? Will we take off together?

Key Citations And References

- IATA Fly Net Zero Commitment

- AIA Horizon 2050 Report

- ICAO LTAG for Net-Zero

- IATA SAF Development

- ICCT on Zero-Emission Delays

- McKinsey Decarbonizing Aviation

- WEF Aviation Net Zero

- IEA Net Zero by 2050

- SAF Grand Challenge

- ATAG Climate Action

- RMI SAF Outlook

- ZeroAvia Hydrogen-Electric

Read These Articles in Detail

- Aerospace Engineering vs. Mechanical Engineering

- The Future of Aerospace Propulsion Systems

- How Aerospace Education Is Adapting to Industry Demands

- The Role of Aerospace in Combating Climate Change

- Aerospace Radar Technology: Past, Present, and Future

- The Role of Aerospace in National Security Strategies

- The Role of Nanotechnology in Aerospace Materials

- Aerospace Materials: Stronger, Lighter, And Smarter

- Aerospace Engineering Explained: A Beginner’s Guide

- Electric Aircraft vs. Hydrogen Aircraft: Which Is More Sustainable?

- Hypersonic Weapons: Aerospace’s New Arms Race

- Aerospace Defense Systems: From Drones to Hypersonic Missiles

- How Aerospace Engineers Reduce Fuel Consumption

- Computational Fluid Dynamics in Aerospace Innovation

- The Global Aerospace Market Outlook: Trends and Forecasts

- Satellite Surveillance: Aerospace’s Role in Modern Warfare

- How Aerospace Companies Are Reducing Environmental Impact

- How Airlines Use Aerospace Data Analytics to Cut Costs

- Aerospace Engineering Challenges: Innovation and Sustainability

- The Role of CFD in Aerospace Engineering

- The Role of Women in Aerospace: Breaking Barriers in the Skies

- Sustainable Aviation Fuels: The Aerospace Industry’s Green Bet

- Aerospace Cybersecurity: Protecting the Skies from Digital Threats

- Aerospace Trends Driving the Next Generation of Airliners

- The Rise of Autonomous Aerospace Systems

- How to Start a Career in Aerospace Engineering

- Can Aerospace Go Carbon Neutral by 2050?

- The Role of Aerospace in Missile Defense Systems

- How Aerospace Engineers Use AI in Design

- Top 10 Aerospace Engineering Innovations of the Decade

- Top Aerospace Careers in 2025 and Beyond

- How Aerospace Innovations Shape Global Defense Policies

- Hydrogen-Powered Aircraft: The Next Green Revolution

- Top 10 Emerging Aerospace Technologies Transforming the Industry

- The Future of Hypersonic Flight: Challenges and Opportunities

- How AI Is Revolutionizing Aerospace Engineering

- Additive Manufacturing in Aerospace: 3D Printing the Future of Flight

- The Rise of Electric Aircraft: Are We Ready for Zero-Emission Aviation?

- Aerospace Materials of Tomorrow: From Composites to Nanotechnology

- Digital Twins in Aerospace: Reducing Costs and Improving Safety

- The Role of Robotics in Modern Aerospace Manufacturing

- Quantum Computing Applications in Aerospace Design

- How Augmented Reality Is Changing Aerospace Training

- Space Tethers Explained: The Next Leap in Orbital Mechanics

- Ion Propulsion vs. Chemical Rockets: Which Will Power the Future?

- The Role of Nuclear Propulsion in Deep Space Missions

- Space Mining: The Aerospace Industry’s Next Gold Rush

- How Reusable Rockets Are Reshaping the Space Economy

- The Artemis Program: NASA’s Return to the Moon

- Space Tourism: Business Model or Billionaire’s Playground?

- How Aerospace Startups Are Disrupting Commercial Aviation

- The Economics of Low-Cost Airlines in the Aerospace Era

- Urban Air Mobility: The Rise of Flying Taxis

- The Future of Mars Colonization: Key Aerospace Challenges and Solutions Ahead

- CubeSats and Small Satellites: Democratizing Space Access

- The Future of Cargo Drones in Global Logistics

- The Role of Aerospace in Building a Lunar Economy

Frequently Asked Questions

FAQ 1: What Does Net-Zero Emissions Mean for the Aviation Industry and Why Is It a Global Goal?

Net-zero emissions in the aviation sector refers to a balance where the amount of carbon dioxide released from flights equals the amount removed or offset through various measures, ultimately aiming for no net addition to atmospheric greenhouse gases. This isn’t about stopping all flying, but about transforming how we power and operate aircraft to minimize their environmental impact. For airlines and manufacturers, this means shifting from fossil fuels to cleaner alternatives while capturing any residual emissions through technologies such as direct air capture or reforestation projects. The goal aligns with broader climate targets, such as limiting global warming to 1.5 degrees Celsius under the Paris Agreement, making aviation’s transformation a critical piece of the puzzle.

The push for net-zero by 2050 stems from aviation’s outsized role in climate change, currently contributing around 2.5% of global CO2 but projected to rise significantly with growing passenger numbers. International bodies like the International Civil Aviation Organization have set this as an aspirational target, endorsed by nearly 200 countries, to cap emissions growth and reverse it through innovation. It’s not just regulatory pressure; passengers increasingly demand sustainable travel, with surveys showing over 80% willing to choose greener options. Achieving this could prevent aviation from becoming a 25% share of global emissions by mid-century, preserving the freedom of flight while protecting the planet.

In practice, net-zero involves a mix of immediate actions like efficiency improvements and long-term bets on new fuels. For instance, airlines are committing to roadmaps that detail phased reductions, starting with 50% cuts by 2035 in some cases. This holistic approach ensures aviation evolves sustainably, turning a high-emission industry into a model of green innovation.

FAQ 2: Why Is Aviation Emissions Growth a Major Hurdle to Carbon Neutrality by 2050?

Aviation’s emissions challenge boils down to a simple mismatch: air travel demand is exploding, expected to double passengers to over 10 billion annually by 2050, while current technologies can’t keep pace without intervention. Unlike ground transport, planes rely heavily on kerosene-based fuels that are hard to electrify due to the need for high energy density over long distances. This growth could push emissions from today’s 1 gigaton of CO2 to over 2 gigatons yearly if unchecked, clashing with net-zero ambitions.

Key hurdles include technological limits and infrastructure gaps. Battery-electric options work for short hops but falter on weight for longer flights, while scaling sustainable fuels requires massive investments. Here’s a breakdown of the primary obstacles shaping the path to carbon-neutral aviation:

- Rising Demand vs. Efficiency Gains: Fuel efficiency has improved 20% per decade, but absolute emissions still climb with more flights; projections show a 4% annual traffic increase outstripping savings.

- Fuel Dependency: Jet fuel accounts for 99% of aviation energy, and alternatives like sustainable aviation fuel remain under 1% of supply due to high costs (2-4 times conventional prices).

- Non-CO2 Impacts: Contrails and nitrogen oxides amplify warming by up to three times CO2’s effect, complicating simple emission cuts.

- Global Supply Chains: Feedstocks for green fuels compete with other sectors, and uneven policy support fragments progress across regions.

Addressing these requires coordinated global efforts, but recent 2025 reports highlight optimism if investments hit $1 trillion by the decade’s end. Without action, aviation could undermine broader climate goals, but with it, the industry stands to lead in sustainable tech.

FAQ 3: What Is Sustainable Aviation Fuel (SAF) and How Does It Contribute to Net-Zero Aviation?

Sustainable Aviation Fuel, or SAF, is a drop-in alternative to traditional jet fuel made from renewable sources like waste oils, agricultural residues, or even captured carbon dioxide, rather than crude oil. It can reduce lifecycle emissions by up to 80% compared to fossil kerosene because it recycles existing carbon instead of releasing new stores from underground. Unlike biofuels that might compete with food production, SAF pathways prioritize non-food feedstocks, ensuring scalability without environmental trade-offs. In 2025, production is ramping up, with global output projected to reach 2.7 billion liters this year alone, though that’s still just 0.7% of total demand.

SAF’s beauty lies in its compatibility—no need to redesign engines or planes, just blend it at 10-50% ratios for immediate use. Airlines like those in Europe are already flying commercial routes with blends, proving it cuts CO2 without performance loss. Looking ahead, SAF could handle 65% of the reductions needed for net-zero by 2050, but scaling to 445 billion liters annually demands policy boosts and investments. Challenges include feedstock availability and costs, yet advancements in synthetic e-fuels from green hydrogen are closing the gap, promising price parity by 2040.

To illustrate SAF’s diversity, consider this table of common production pathways and their emission savings:

| Pathway | Feedstock Examples | Emission Reduction | Scalability Potential by 2050 | 2025 Updates |

|---|---|---|---|---|

| HEFA (Hydroprocessed Esters and Fatty Acids) | Used cooking oil, animal fats | Up to 80% | High; already 90% of current SAF | New U.S. plants targeting 100 million gallons |

| Alcohol-to-Jet (ATJ) | Ethanol from corn stover or sugarcane waste | 70-85% | Medium; expanding in Asia | China’s 50,000-tonne target met early |

| Fischer-Tropsch (FT) | Biomass residues, municipal waste | 75-90% | High for synthetics | EU mandates driving 6% blend by 2030 |

| Power-to-Liquid (PtL) | Captured CO2 + green hydrogen | 90-100% | Emerging; needs H2 scale-up | Pilots in Germany producing 10,000 tons |

This mix positions SAF as the backbone of aviation’s green shift, blending reliability with radical emission cuts.

FAQ 4: How Are Electric Aircraft Set to Transform Short-Haul Flights by 2050?

Electric aircraft are reshaping short-haul aviation by replacing combustion engines with battery-powered motors, slashing emissions to near zero on routes under 500 miles, which account for 40% of the sector’s CO2. These planes operate like oversized electric cars in the sky, recharging at gates and emitting only cooling vapor, not exhaust. Prototypes like the nine-seat Alice have already flown over 1,000 miles in tests, showcasing quiet, efficient travel that could cut noise pollution by 90% alongside carbon savings. By 2025, market forecasts predict the commercial electric segment growing from $113 billion to nearly $1 trillion by 2035, driven by battery advances.

Despite promise, hurdles like energy density—current batteries at 250 Wh/kg fall short of the 1,000 needed for viability—have delayed timelines. Hybrids, combining batteries with small turbines, offer a bridge, targeting 30-50% reductions on regional jets by 2030. Airports are adapting with megawatt chargers, but grid upgrades pose costs. Student innovations in thermal management are tackling overheating risks, vital for safety. Overall, electrics could electrify 17% of flights by mid-century, freeing sustainable fuels for longer hauls and making regional travel greener and cheaper.

FAQ 5: What Are the Latest Developments in Hydrogen Aircraft Technology as of 2025?

Hydrogen aircraft are gaining momentum in 2025, with breakthroughs bringing zero-emission long-haul flight closer, though commercial rollout remains a decade away. These planes use fuel cells or burners to convert hydrogen into electricity or thrust, producing only water vapor—no CO2 in flight. Key updates this year include Airbus’s successful 1.2MW propulsion demo and integrated fuel cell tests, paving the way for 2035 entries despite a five-year delay. ZeroAvia’s ZA600 engine earned national design approval, eyeing cargo ops in the UK by 2027.

Here’s a snapshot of 2025 milestones accelerating hydrogen aviation:

- Infrastructure Builds: ZeroAvia’s liquid hydrogen facility at Cotswold Airport is now operational, supporting flight tests for regional planes up to 300 miles.

- Partnerships and Scaling: Beyond Aero’s BYA-1 project forecasts market growth from $2.7 billion this year to $15 billion by 2034, with superconducting motors boosting efficiency.

- Test Flights and Approvals: RVL Aviation plans Cessna retrofits with hydrogen-electric kits, while H2FLY’s electric-hydrogen hybrids logged hours on short routes.

- Policy Alignment: EU and U.S. incentives target 10% hydrogen adoption by 2040, addressing storage challenges like cryogenic tanks.

These steps highlight hydrogen’s potential for 18% of the fleet by 2050, but supply chains for green hydrogen must expand to avoid greenwashing risks.

FAQ 6: What Government Policies Are Driving Aviation Decarbonization Efforts in 2025?

Governments worldwide are rolling out targeted policies to propel aviation toward net-zero, focusing on mandates, incentives, and standards that make clean tech viable. In 2025, these range from fuel blending requirements to tax credits, creating a patchwork of support that’s both fragmented and forceful. The EU’s ReFuelEU Aviation initiative, for example, enforces 2% SAF blends starting this year, ramping to 70% by 2050, while monitoring non-CO2 effects like contrails. The U.S. §45Z credit offers up to $1.75 per gallon for low-carbon fuels, spurring domestic production.

This table outlines major 2025 policies by region, showing their scope and impact:

| Region | Policy Name | Key Features | Emission Reduction Target | Implementation Status |

|---|---|---|---|---|

| European Union | ReFuelEU Aviation | 2% SAF mandate in 2025; 6% by 2030; e-fuel sub-quotas | 70% SAF by 2050 | Reporting begins 2025; fines for non-compliance |

| United States | Inflation Reduction Act Extensions | $1.25-$1.75/gallon tax credits for SAF; 3B gallons by 2030 | Net-zero alignment | §45Z effective Jan 2025; 100+ projects funded |

| United Kingdom | SAF Mandate | 2% minimum in 2025; 10% by 2030; revenue certainty mechanism | 22% by 2040 | Legislation passed; first blends Q1 2025 |

| China | National SAF Targets | 50,000 tonnes production goal; state-owned pilots | 10% blend by 2030 | Outputs achieved early; Asia-Pacific expansion |

| Global (ICAO) | CORSIA+LTAG | Carbon offsetting for international flights; net-zero aspirational | 5% CO2 cut by 2030 via SAF | Phase 5 monitoring 2025; 184 countries committed |

These measures could unlock $150 billion in annual investments, but harmonization is key to avoiding trade barriers and ensuring equitable progress.

FAQ 7: Are Recent Delays in Zero-Emission Planes a Setback for Net-Zero Aviation by 2050?

Recent delays in zero-emission plane development have sparked concerns, but they don’t spell doom for aviation’s net-zero ambitions—they’re more like turbulence on a long flight. In 2025, high-profile setbacks, such as Airbus shifting hydrogen timelines from 2035 to 2040 and Eviation pausing electric production amid funding issues, underscore the tech’s immaturity. Battery densities and hydrogen storage remain stubborn barriers, pushing hybrids as interim solutions rather than full electrics for now.

Yet, these hiccups come with silver linings: they refocus efforts on scalable wins like SAF, which delivered 37% of projected reductions in updated models. Industry roadmaps, refreshed this year, emphasize resilience—prioritizing 20% efficiency gains from new fleets by 2030 while R&D accelerates. A wake-up call? Absolutely, but with multilateral pacts driving $500 billion in infrastructure, the path stays viable. Net-zero remains achievable if we adapt, turning delays into smarter, surer steps toward cleaner skies.

FAQ 8: How Are Leading Airlines Contributing to Carbon-Neutral Aviation Goals?

Leading airlines are at the forefront of carbon-neutral efforts, not just pledging but investing billions in fleets, fuels, and offsets to hit net-zero by 2050. United Airlines, for one, unveiled an illustrative roadmap in 2025 targeting 50% reductions by 2035 through 70% SAF reliance and new propulsion tech, already blending 15% on select routes. Delta and Lufthansa follow suit, powering transatlantic flights with 100% SAF trials that cut 1.5 tons of CO2 per trip.

Their strategies blend innovation with operations: fleet renewals with efficient models like the Boeing 787, which saves 20% fuel, and partnerships for SAF supply chains. Alaska Airlines’ 2025 Seattle initiatives exemplify seamless integration, reducing local pollutants too. These pioneers create ripple effects, pressuring suppliers and inspiring smaller carriers. By 2030, their collective actions could embed green practices across 20% of global fleets, proving corporate leadership can steer aviation’s green course.

FAQ 9: What Do Projections Say About Aviation Emissions If We Miss the 2050 Net-Zero Target?

If aviation misses net-zero by 2050, emissions could balloon to 2.5 gigatons of CO2 annually—three times today’s levels—exacerbating climate risks like extreme weather and sea-level rise. Business-as-usual scenarios forecast 21.2 gigatons cumulative from 2021-2050, with international flights tripling from 2015 baselines without intervention. Non-CO2 effects, like contrails, could double warming impacts, pushing aviation to 25% of global transport emissions.

The table below compares optimistic versus pessimistic outlooks based on 2025 analyses:

| Scenario | Annual Emissions by 2050 (Gt CO2) | Key Drivers | Broader Impacts |

|---|---|---|---|

| Net-Zero Achieved | <0.1 (with offsets) | 65% SAF, 25% new tech | Stabilizes warming; $3T green economy |

| Moderate Progress | 1.0-1.5 | 30% SAF blends, efficiency only | 50% cut from 2019; higher carbon taxes |

| Business as Usual | 2.5+ | No mandates, demand growth | Tripled from 2015; 12B passengers strained |

| Delayed Action | 2.0 | Tech lags post-2030 | Overshoot by 20%; equity issues for developing nations |

These projections underscore urgency: acting now averts catastrophe, while delays demand costlier fixes later.

FAQ 10: What Economic Opportunities Arise from Achieving Carbon Neutrality in Aerospace by 2050?

Pursuing carbon neutrality in aerospace unlocks vast economic potential, transforming a $800 billion industry into a $3 trillion green powerhouse by 2050 through jobs, innovation, and new markets. SAF production alone could create 1 million roles globally by 2030, spanning refineries to farms, while hydrogen hubs spur $15 billion in aviation tech by 2034. Efficiency gains lower operating costs, with greener fleets saving airlines 15-20% on fuel.

Benefits extend beyond borders:

- Job Creation: 2-3 million positions in clean manufacturing, from battery plants to e-fuel facilities, especially in emerging economies.

- Innovation Spillovers: Electric and hydrogen R&D boosts EVs and shipping, adding $1.4 trillion in value chain growth.

- Market Premiums: 85% of travelers pay more for sustainable flights, enhancing loyalty and revenue.

- Infrastructure Boom: Airport upgrades and supply chains attract $1 trillion investments, revitalizing regions.

This shift isn’t cost-free—abatement runs $2.7 trillion—but returns dwarf it, fostering resilient growth and positioning aerospace as climate solution leader.

FAQ 11: What Role Does Carbon Offsetting Play in Aviation’s Path to Net-Zero by 2050?

Carbon offsetting is a key bridge in aviation’s decarbonization journey, allowing airlines to compensate for unavoidable emissions by funding projects that remove an equivalent amount of CO2 from the atmosphere elsewhere. It’s not a silver bullet but a vital tool, especially in the short term, as the industry scales up cleaner technologies like sustainable aviation fuel and hydrogen propulsion. Through schemes like the Carbon Offsetting and Reduction Scheme for International Aviation, or CORSIA, operators buy credits from verified projects such as reforestation or renewable energy builds, ensuring emissions are neutralized. In 2025, CORSIA enters its final phase one year, with airlines facing their first mandatory offsets, projected to generate nearly 2 billion credits through 2035 to support high-integrity reductions.

This mechanism buys time for innovation while holding the sector accountable. For instance, recent calls from industry leaders emphasize strengthening CORSIA to align with net-zero goals, as it could double aviation’s emission cuts from 2033-2037 compared to prior plans. Offsets must be robust—avoiding greenwashing by prioritizing projects with permanent, measurable impacts—to maintain trust. As demand grows, with 65% of travelers seeking sustainable options, offsets could evolve into a $100 billion market by 2030, funding global climate action beyond aviation alone. Ultimately, while tech drives 90% of reductions, offsets ensure no emission goes unaddressed, making net-zero equitable and achievable.

FAQ 12: How Do Non-CO2 Emissions from Aviation, Like Contrails, Impact Climate Goals?

Non-CO2 emissions from planes, particularly contrails, add a hidden layer to aviation’s environmental footprint, potentially doubling its warming effect beyond CO2 alone. Contrails form when hot exhaust meets cold, humid air at high altitudes, creating ice-crystal clouds that trap heat like a blanket over Earth. In 2025, new tools like the European Commission’s Non-CO2 Aviation Effects Tracking System are monitoring these, revealing they contribute up to three times more to short-term warming than CO2. This complicates net-zero targets, as simple fuel switches won’t fully address the issue.

Efforts to mitigate include flight path tweaks to avoid contrail-prone zones and fuel tweaks to reduce soot that seeds them. Legal analyses now urge countries to factor these into national climate plans, or risk breaching obligations. Here’s a breakdown of aviation’s non-CO2 effects and mitigation strategies based on 2025 research:

| Non-CO2 Effect | Description | Warming Contribution (vs. CO2) | 2025 Mitigation Progress |

|---|---|---|---|

| Contrails | Linear ice clouds from exhaust | 2-3x higher short-term | NEATS tool launched; 10% reduction via routing trials |

| Nitrogen Oxides (NOx) | Gases forming ozone and methane breakdown | Up to 1.5x | Engine redesigns cut 20%; EU monitoring mandatory |

| Soot/Aerosols | Particles enhancing cloud formation | 0.5-1x | Low-aromatic fuels tested; 15% drop in prototypes |

| Water Vapor | Adds to high-altitude humidity | Minor (0.2x) | Altitude adjustments; integrated in ICAO guidelines |

These impacts underscore the need for holistic strategies, with contrail avoidance potentially slashing 50% of aviation’s total climate forcing by 2050.

FAQ 13: What Innovations in Aircraft Design Are Boosting Efficiency for Sustainable Aviation?

Aircraft design innovations are accelerating fuel savings and emission cuts, with 2025 marking a surge in lightweight materials and aerodynamic tweaks that could trim 20% off consumption per new generation. These aren’t pie-in-the-sky ideas; they’re landing in prototypes and production lines, driven by the net-zero 2050 push. For example, blended-wing bodies merge fuselages and wings for better lift, while advanced composites like carbon fiber slash weight without sacrificing strength.

Key advancements include AI-optimized shapes that reduce drag and geared turbofans for precise thrust. NASA and partners aim for 30% efficiency gains through these, complementing sustainable fuels. Here’s how they’re unfolding:

- Lightweight Composites: Carbon fiber use in wings and fuselages cuts weight by 15-20%, as seen in updated Boeing models entering service in 2025.

- Aerodynamic Enhancements: Laminar flow wings delay airflow turbulence, saving 5-10% fuel; Airbus trials show real-world viability.

- Hybrid Configurations: Blended designs like NASA’s X-66 could halve drag, targeting 50% less energy use for regional flights.

- Digital Twins: AI simulations speed design, enabling 25% faster iterations for eco-friendly prototypes.

These tweaks make greener flying practical today, paving the way for zero-emission fleets tomorrow.

FAQ 14: How Are Airports Stepping Up as Key Players in Aviation Decarbonization?

Airports are evolving from mere hubs to active decarbonization engines, investing in infrastructure that supports cleaner flights and ground ops. In 2025, with global aviation rebounding, they’re tackling everything from electric charging networks to sustainable fuel storage, recognizing their role in the net-zero chain. The International Civil Aviation Organization’s 42nd Assembly highlighted this, urging frameworks for airports to enable capacity growth without emissions spikes.

Take Istanbul’s IGA Airport: It’s pioneering energy-efficient designs that cut on-site CO2 by 25%, blending solar power with smart grids. Globally, airports employ 11.6 million and handle SAF deployment, with mandates like the EU’s 2% blend starting this year relying on their logistics. Challenges persist—upgrading runways for heavier electric planes costs billions—but multilateral pacts are unlocking funds. By 2030, electrified ground handling could save 10% of airport emissions, turning tarmacs into green gateways and proving airports aren’t bystanders but accelerators in the 2050 race.

FAQ 15: What Challenges Are Holding Back Cargo Aviation’s Shift to Carbon Neutrality?

Cargo aviation, fueling e-commerce’s boom, faces steeper decarbonization hurdles than passenger flights due to its 24/7 ops and diverse fleets. With demand up 0.7% in 2025, emissions could hit 15% of sector totals without action, but scale-up costs for sustainable aviation fuel top the list at 2-4 times conventional prices. Policy gaps exacerbate this, as fragmented incentives leave cargo carriers footing uneven bills.

Resource competition adds pressure—aviation might gobble 80% of biofuels, sidelining shipping. Here’s a 2025 overview of key challenges and potential fixes:

| Challenge | Impact on Cargo | 2025 Scale | Proposed Solutions |

|---|---|---|---|

| High SAF Costs | Adds 20-30% to ops expenses | $150B global need | Tax credits; volume contracts for 10% blends |

| Fleet Diversity | Older freighters hard to retrofit | 40% pre-2000 models | Hybrid conversions; incentives for new efficient builds |

| Infrastructure Gaps | Limited cryo-storage for hydrogen | Only 5% airports ready | $500B investment in hubs; public-private funds |

| Demand Volatility | E-commerce spikes strain efficiency | 4% YoY growth | AI routing; lightweight packaging mandates |

| Policy Fragmentation | Varying regional rules | EU leads, Asia lags | ICAO harmonization; cargo-specific CORSIA tweaks |

Addressing these could unlock $3 trillion in sustainable cargo value by 2050, but urgency is key.

FAQ 16: How Is Growing Consumer Demand Shaping Sustainable Flying Choices in 2025?

Consumer demand for eco-friendly air travel is surging in 2025, with 65% of travelers prioritizing sustainability, up from 50% pre-pandemic, pushing airlines to green up or risk losing loyalty. This shift isn’t abstract—it’s driving bookings, as apps now highlight low-emission routes and SAF-powered flights. Surveys show willingness to pay 10-15% premiums for greener options, influencing everything from seat selection to corporate policies.

Airlines respond with transparency: Delta and United’s carbon dashboards let passengers track and offset trips seamlessly. Yet, education gaps remain—many overestimate offsets’ role, underscoring the need for clear labeling. Key trends include:

- Premium Pricing Models: 85% opt for sustainable add-ons, boosting revenue by $5 billion industry-wide.

- Route Preferences: Demand favors short-haul electrics, with 30% growth in regional green flights.

- Corporate Influence: Business travel now mandates net-zero compliance, shifting 20% of bookings.

- Tech Integration: AI apps predict low-contrail paths, appealing to 70% of eco-conscious flyers.

This momentum could double sustainable flight shares by 2030, turning passenger power into planetary progress.

FAQ 17: What Major Investments Are Fueling Aviation’s Net-Zero Transition in 2025?

Investments in aviation’s green shift hit $1.4 trillion projected through 2040 in 2025, blending public funds, corporate bets, and green bonds to scale tech like SAF and hydrogen. Governments lead with the U.S. Inflation Reduction Act extensions doling out $1.75 per gallon credits, spurring 100+ SAF projects. Private equity eyes airports, where $500 billion could electrify ops and build cryo-hubs.

Multilateralism amplifies this: The World Economic Forum’s outlook flags $150 billion annual SAF needs, met by alliances like the Sustainable Aviation Buyers Alliance, which launched platforms connecting buyers to credits. Challenges like geopolitical tensions slow flows, but optimism reigns—hydrogen R&D alone drew $15 billion, with RTX and Airbus demos proving ROI. These dollars aren’t charity; they’re seeds for a $3 trillion economy, creating 1 million jobs and ensuring net-zero isn’t a dream but a funded reality.

FAQ 18: How Might eVTOLs Contribute to Sustainable Urban Air Mobility by 2050?

Electric vertical takeoff and landing vehicles, or eVTOLs, promise to revolutionize short-distance travel, cutting urban emissions by 50% versus cars while easing congestion. In 2025, delays like Florida’s Tampa-Orlando postponements highlight battery hurdles, but prototypes from Joby and Lilium logged 1,000+ test hours, eyeing 2026 certs. These quiet, zero-emission taxis could serve 20% of intra-city trips by 2030, scaling to 10 billion passenger miles annually.

Integration demands sky corridors and vertiports, with costs dropping 40% via mass production. A 2025 market report forecasts growth from $11.6 billion to $1 trillion by 2035, but regulatory harmonization is crucial. This table outlines eVTOL’s decarbonization potential:

| Aspect | Current Status (2025) | 2050 Projection | Emission Savings |

|---|---|---|---|

| Fleet Size | 50+ prototypes | 100,000+ vehicles | 90% vs. ground transport |

| Range/Capacity | 100 miles, 4-6 pax | 300 miles, 10+ pax | 60% urban CO2 cut |

| Infrastructure | 20 vertiports global | 5,000+ networked | Noise down 80% |

| Adoption Rate | Pilot cities (e.g., LA) | 30% short trips | $500B market value |

eVTOLs could knit into net-zero aviation, blending with traditional flights for seamless, green skies.

FAQ 19: Why Is Global Cooperation Essential for Aviation’s Decarbonization Success?

Global cooperation is the linchpin for aviation’s net-zero flight, as fragmented efforts risk uneven progress and higher costs. In 2025, IATA and partners urged reaffirming ICAO’s authority, with CORSIA offsetting 2 billion credits through 2035 via unified standards. Without it, policy silos—like EU mandates versus U.S. incentives—could fragment SAF supply, hiking prices 20%.

Multilateral forums drive harmony: The 42nd ICAO Assembly advanced airport roles in decarbonization, while WTTC aligned tourism’s 2050 target. Benefits include shared R&D, cutting hydrogen costs 30%. Core elements include:

- Standardized Reporting: NEATS-like tools for non-CO2 tracking across borders.

- Joint Funding: $1 trillion pooled for infrastructure, easing developing nations’ burdens.

- Tech Sharing: Open-source designs for efficiency, boosting global fleet upgrades.

- Equity Focus: Aid for low-income regions to leapfrog fossil dependency.

This teamwork turns aviation from polluter to partner in planetary health.

FAQ 20: What Does the Post-2050 Vision Look Like for Carbon-Neutral Aviation?

Beyond 2050, aviation envisions a hyper-efficient, emission-free ecosystem where hydrogen and electrics dominate, with blended-wing hydrogen jets cruising at 30% less energy use. Projections see demand tripling, but innovations like AI-optimized routes and direct air capture mop up residuals, keeping warming under 1.5°C. SAF evolves to full synthetics, produced via renewables at scale.

This era prioritizes resilience: Adaptive fleets handle climate disruptions, while urban air mobility integrates eVTOLs for seamless travel. Economic booms follow—$3 trillion in green jobs, equitable access via subsidies. Yet, it hinges on 2025-2030 foundations; delays could push offsets to 20% of strategy. The horizon? Skies where flight enhances, not endangers, our shared future, with aviation leading bolder climate leaps.