Key Insights on Sustainable Aviation Fuels

- Sustainable Aviation Fuels (SAF) offer a promising path for the aerospace industry to cut carbon emissions by up to 80% compared to traditional jet fuel, making them a critical tool in the push toward net-zero emissions by 2050.

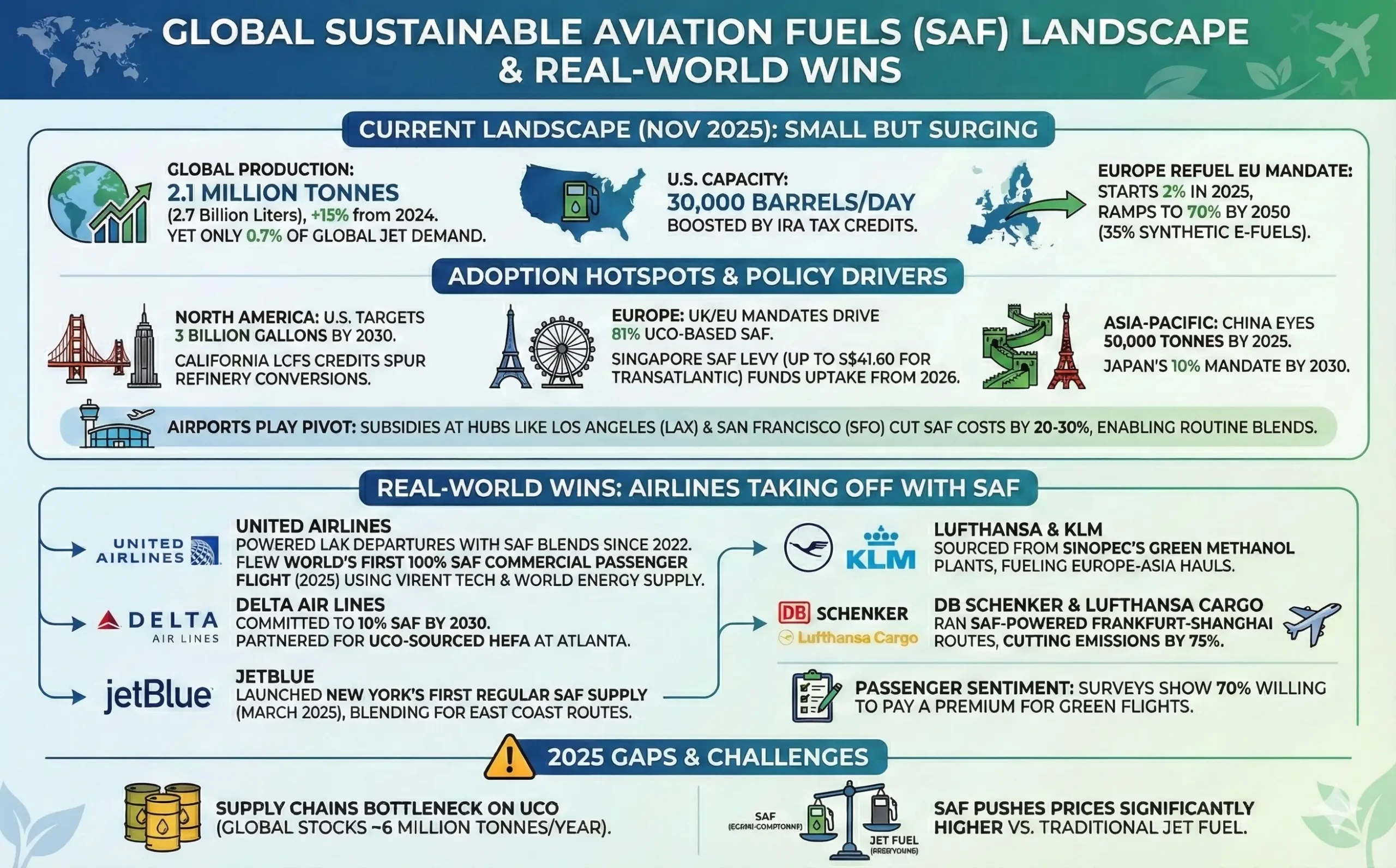

- While production is ramping up—with global output expected to reach around 2 million tonnes in 2025, or just 0.7% of total jet fuel needs—challenges such as high costs (often 2-5 times more expensive) and limited feedstocks persist. However, new mandates in regions like the EU and UK are driving adoption.

- Airlines such as United, Delta, and JetBlue are leading with real-world flights using SAF blends, and projections show the market could explode to 330-445 million tonnes annually by 2050, fueled by policy support and innovation.

Understanding SAF Basics

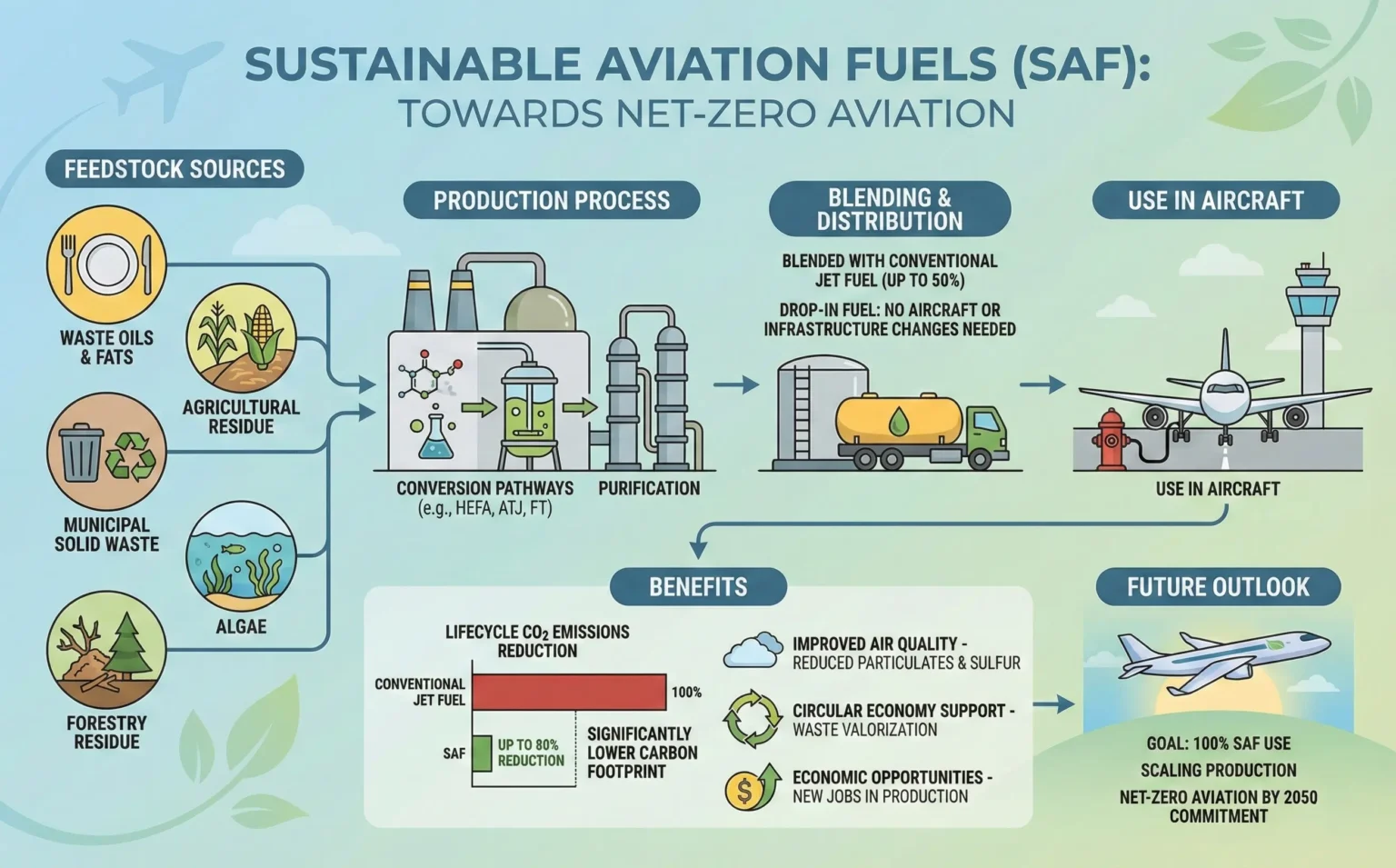

Sustainable Aviation Fuels are drop-in alternatives to conventional kerosene, produced from renewable sources like waste oils or agricultural residues. They work seamlessly in existing aircraft engines without modifications, slashing lifecycle emissions while maintaining performance. Research highlights their role in addressing aviation’s tough decarbonization hurdles, where electric or hydrogen options lag far behind for long-haul flights.

Why Aviation Needs This Green Shift

The sector contributes about 2-3% of global CO2 emissions, a figure set to rise without intervention. SAF could handle 65% of the required reductions for net-zero goals, blending practicality with urgency. It’s not just environmental—scaling SAF promises economic boosts through new jobs in biofuel production and rural economies.

Snapshot of 2025 Progress

By late 2025, U.S. capacity will reach 30,000 barrels per day, with Europe enforcing 2% SAF mandates. Yet, supply lags demand, underscoring the need for bolder investments. Early adopters report smoother operations and positive passenger feedback on greener travel.

Table of Contents

Introduction

Imagine boarding a long-haul flight knowing that the fuel propelling you across continents is not only reliable but also kinder to the planet. This isn’t a distant dream; it’s the reality unfolding with Sustainable Aviation Fuels (SAF), the aerospace industry’s bold wager on a greener future. As air travel rebounds post-pandemic, carrying over 4.5 billion passengers annually by mid-decade, the pressure to decarbonize has never been fiercer. Aviation, a lifeline for global connectivity, accounts for roughly 2-3% of worldwide carbon dioxide emissions, a share that could balloon to 22% by 2050 without swift action.

Advanced biofuels and synthetic fuels are designed to mimic conventional jet fuel while slashing emissions by up to 80% over their lifecycle. Unlike fossil-based kerosene, SAF draws from renewable feedstocks like used cooking oil or captured carbon, offering a drop-in solution that requires no engine tweaks. This makes it uniquely positioned to bridge the gap until breakthroughs in hydrogen or electric propulsion mature. But why bet big on SAF now? The answer lies in ambition—industry leaders like the International Air Transport Association (IATA) and International Civil Aviation Organization (ICAO) have pledged net-zero CO2 by 2050, with SAF earmarked to deliver the lion’s share of those cuts.

This article dives deep into SAF’s world, from its production intricacies to real-world triumphs and looming hurdles. We’ll explore how it’s reshaping aviation, backed by data, examples, and forward-looking analysis. Whether you’re a frequent flyer curious about your carbon footprint or an industry insider eyeing investments, understanding SAF reveals not just a technical fix, but a transformative opportunity for sustainable skies.

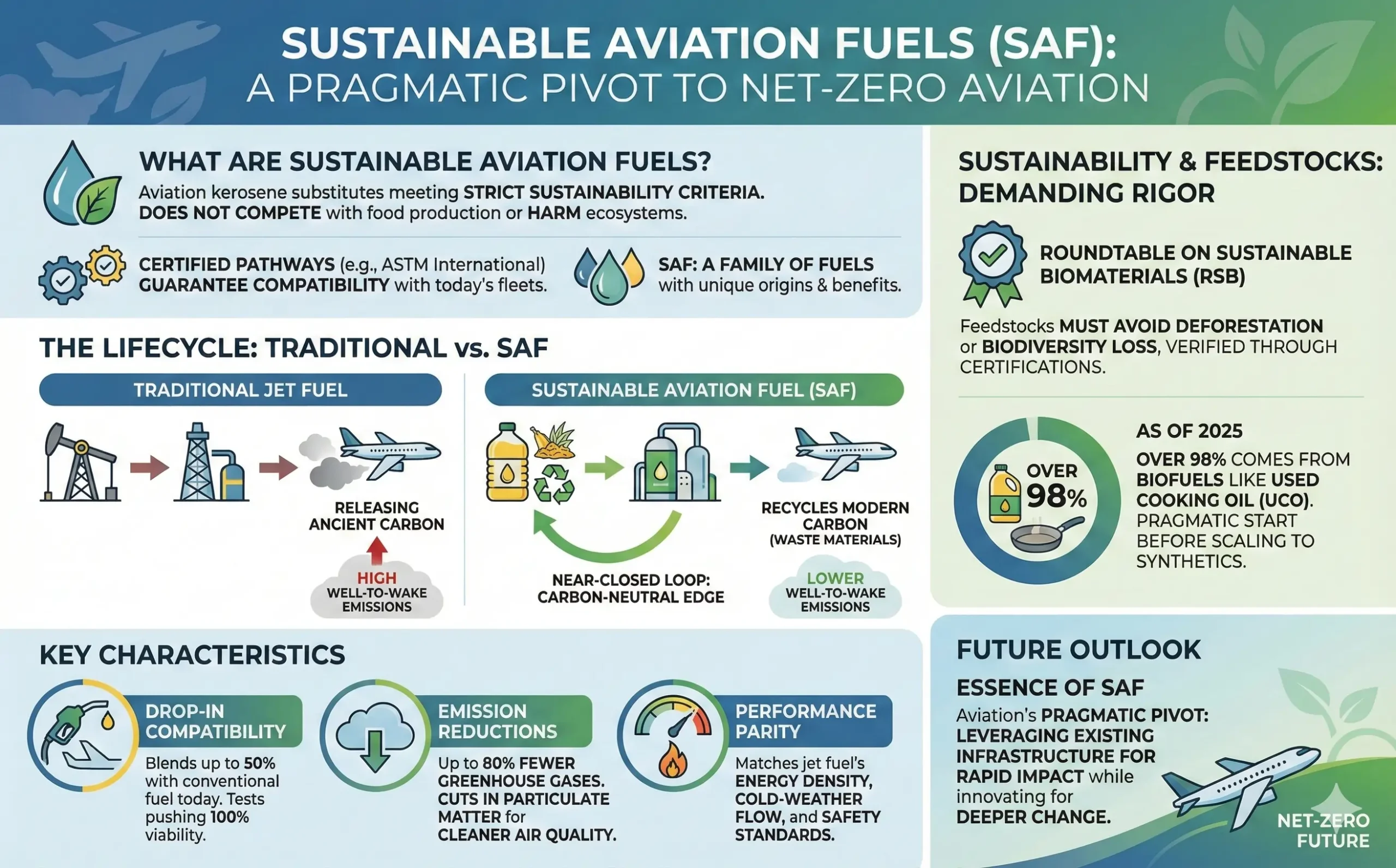

What Are Sustainable Aviation Fuels?

Sustainable Aviation Fuel is any aviation kerosene substitute that meets strict sustainability criteria, ensuring it doesn’t compete with food production or harm ecosystems. Certified pathways, approved by bodies like ASTM International, guarantee compatibility with today’s fleets. SAF isn’t a single product but a family of fuels, each with unique origins and benefits.

Consider the lifecycle: Traditional jet fuel starts with crude oil extraction, refining, and combustion, releasing ancient carbon into the atmosphere. SAF, however, recycles modern carbon—think waste materials that would otherwise rot in landfills—creating a near-closed loop. This “carbon-neutral” edge stems from lower well-to-wake emissions, factoring in everything from feedstock sourcing to final burn.

Key characteristics set SAF apart:

- Drop-in Compatibility: Blends up to 50% with conventional fuel today, with tests pushing 100% viability.

- Emission Reductions: Up to 80% fewer greenhouse gases, plus cuts in particulate matter for cleaner air quality.

- Performance Parity: Matches jet fuel’s energy density, cold-weather flow, and safety standards.

Yet, SAF’s “sustainable” label demands rigor. Feedstocks must avoid deforestation or biodiversity loss, verified through certifications like the Roundtable on Sustainable Biomaterials. As of 2025, nearly all SAF (over 98%) comes from biofuels like those derived from used cooking oil (UCO), reflecting a pragmatic start before scaling to synthetics.

In essence, SAF embodies aviation’s pragmatic pivot: leveraging existing infrastructure for rapid impact while innovating for deeper change.

The Production Puzzle: Feedstocks, Pathways, and Innovations

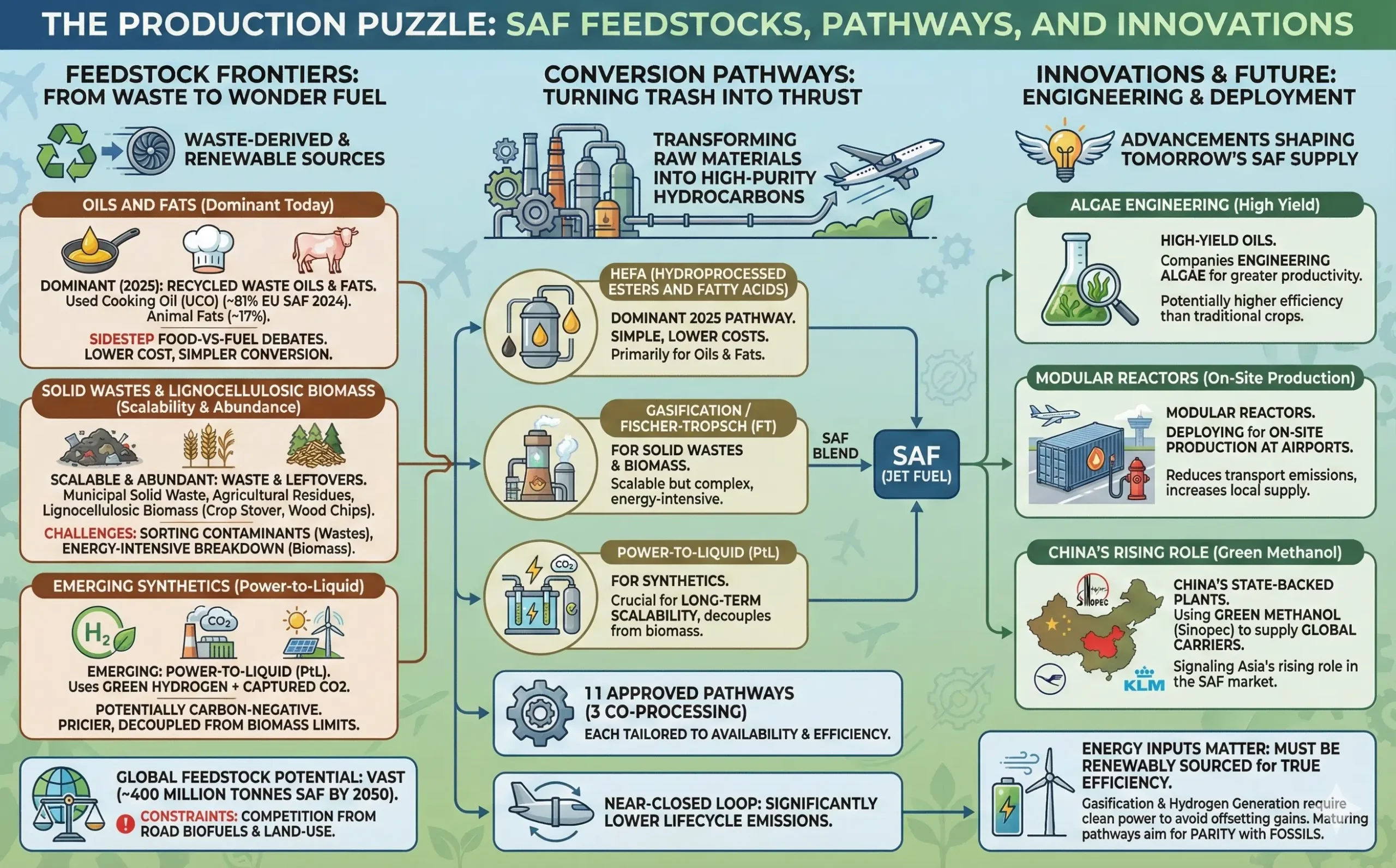

Crafting SAF is both an art and a science, transforming diverse raw materials into high-purity hydrocarbons. The process hinges on feedstocks—the building blocks—and conversion pathways, each tailored to availability and efficiency.

Feedstock Frontiers: From Waste to Wonder Fuel

Feedstocks are SAF’s foundation and are categorized by the ICAO as wastes, residues, and purpose-grown crops. Here’s where ingenuity shines:

- Oils and Fats (Dominant Today): Used cooking oil (81% of 2024 EU SAF) and animal fats (17%) lead, recycled from restaurants and slaughterhouses. These “waste-derived” sources sidestep food-vs-fuel debates.

- Solid Wastes: Municipal solid waste and agricultural residues offer scalability, though sorting contaminants adds complexity.

- Lignocellulosic Biomass: Crop leftovers like corn stover or wood chips are abundant but energy-intensive to break down.

- Emerging Synthetics: Power-to-Liquid (PtL) uses green hydrogen and captured CO2, potentially carbon-negative but pricier.

Global feedstock potential is vast—studies estimate enough for 400 million tonnes of SAF by 2050—but competition from road biofuels and land-use constraints loom large.

Conversion Pathways: Turning Trash into Thrust

Eleven approved pathways exist, with three for co-processing in existing refineries. A quick overview:

| Pathway | Description | Key Feedstocks | Emission Reduction Potential | Maturity Level (2025) |

|---|---|---|---|---|

| HEFA (Hydroprocessed Esters and Fatty Acids) | Hydrogenates oils/fats to remove oxygen, then isomerizes for jet-range molecules. | UCO, animal fats, algae oils | Up to 85% | Commercial (80% of current SAF) |

| ATJ (Alcohol-to-Jet) | Ferments sugars/alcohols into hydrocarbons via dehydration and oligomerization. | Sugarcane, corn; cellulosic ethanol | 70-90% | Commercial pilots scaling |

| FtSPK (Fischer-Tropsch Synthetic Paraffinic Kerosene) | Gasifies biomass/coal into syngas, then synthesizes liquids. | Wood, MSW, natural gas | 80-95% | Demo to commercial |

| HC-HEFA (Hydroprocessed Hydrocarbon Esters and Fatty Acids) | Similar to HEFA but from hydrocracked vegetable oils. | Camelina, carinata crops | 75-85% | Emerging |

| PtL (Power-to-Liquid) | Electrolysis for H2 + CO2 to methanol/syngas, then to fuel. | Captured CO2, renewable electricity | 90-100%+ (negative possible) | Pilot; high growth potential |

HEFA dominates 2025 production due to its simplicity and lower costs, but diversifying to PtL is crucial for long-term scalability, as it decouples from biomass limits.

Innovations abound: Companies are engineering algae for high-yield oils and deploying modular reactors for on-site production at airports. In China, state-backed plants using green methanol from Sinopec aim to supply global carriers like Lufthansa and KLM, signaling Asia’s rising role.

Production isn’t without grit—energy inputs for gasification or hydrogen generation can offset gains if not renewably sourced. Yet, as pathways mature, SAF’s efficiency edges closer to parity with fossils.

Aviation’s Carbon Conundrum: Why SAF is the MVP for Net-Zero

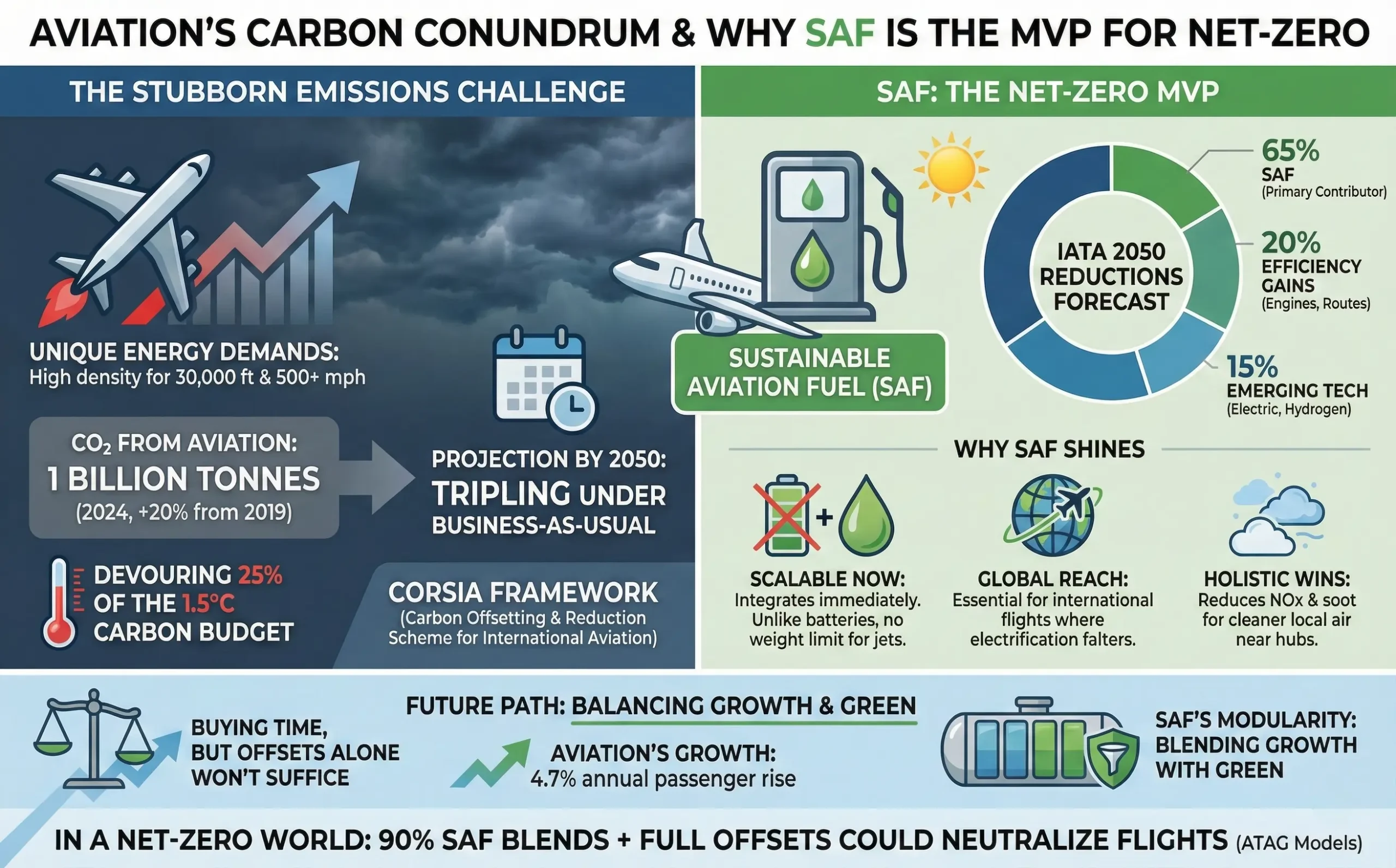

Aviation’s emissions profile is uniquely stubborn. Unlike cars shifting to EVs, planes demand high energy density for 30,000-foot altitudes and 500+ mph speeds. CO2 from aviation hit 1 billion tonnes in 2024, up 20% from 2019, per IATA data. Projections warn of tripling by 2050 under business-as-usual, devouring a quarter of the 1.5°C carbon budget.

The CORSIA framework (Carbon Offsetting and Reduction Scheme for International Aviation) buys time, but offsets alone won’t suffice. Enter SAF: IATA forecasts it delivering 65% of 2050 reductions, with efficiency gains (better engines, routes) covering another 20%, and the rest from emerging tech.

Why SAF shines:

- Scalable Now: Unlike batteries too heavy for jets, SAF integrates immediately.

- Global Reach: Handles international flights where electrification falters.

- Holistic Wins: Reduces NOx and soot, improving local air quality near hubs.

Critics note aviation’s growth—4.7% annual passenger rise—could outpace gains, but SAF’s modularity allows blending growth with green. In a net-zero world, 90% SAF blends with full offsets could neutralize flights, per Air Transport Action Group (ATAG) models.

Current Landscape: Adoption Accelerating in 2025

By November 2025, SAF’s footprint is small but surging. Global production clocks in at 2.1 million tonnes (2.7 billion liters), a 13% jump from 2024, yet merely 0.7% of jet demand. The U.S. boasts 30,000 barrels/day capacity, boosted by tax credits under the Inflation Reduction Act, while Europe’s ReFuelEU mandate kicks off at 2% in 2025, ramping to 70% by 2050 (with 35% synthetic e-fuels).

Adoption hotspots:

- North America: U.S. targets 3 billion gallons by 2030; California’s LCFS credits spur refinery conversions.

- Europe: UK/EU mandates drive 81% UCO-based SAF; Singapore’s SAF levy (up to S$41.60 for premium transatlantic) funds uptake from 2026.

- Asia-Pacific: China eyes 50,000 tonnes by 2025; Japan’s 10% mandate by 2030.

Airports play pivot: Subsidies at hubs like Los Angeles (LAX) and San Francisco (SFO) cut SAF costs by 20-30%, enabling routine blends.

Real-World Wins: Airlines Taking Off with SAF

Pioneers are proving SAF’s mettle:

- United Airlines: Powered LAX departures with SAF blends since 2022; flew the world’s first 100% SAF commercial passenger flight in 2025 using Virent tech and World Energy supply.

- Delta Air Lines: Committed to 10% SAF by 2030; partnered for UCO-sourced HEFA at Atlanta.

- JetBlue: Launched New York’s first regular SAF supply in March 2025, blending for East Coast routes.

- Lufthansa and KLM: Sourced from Sinopec’s green methanol plants, fueling Europe-Asia hauls.

Freight leads too: DB Schenker and Lufthansa Cargo ran SAF-powered Frankfurt-Shanghai routes, cutting emissions by 75%. Passenger sentiment? Surveys show 70% willing to pay a premium for green flights.

Yet, 2025 reveals gaps: Supply chains bottleneck on UCO (global stocks ~6 million tonnes/year), pushing prices to $2,000-3,000/tonne vs. $800 for jet fuel.

| Region | 2025 SAF Production (Million Tonnes) | Mandate/Target | Key Initiatives |

|---|---|---|---|

| North America | 0.8 | 3B gallons by 2030 (U.S.) | Tax credits; airport subsidies |

| Europe | 0.9 | 2% in 2025 → 70% by 2050 | ReFuelEU; UCO recycling mandates |

| Asia-Pacific | 0.3 | 10% by 2030 (Japan); 50K tonnes (China) | State-backed plants; levies |

| Rest of World | 0.1 | Emerging (e.g., UAE waste-to-SAF) | Pilot projects; ICAO alignment |

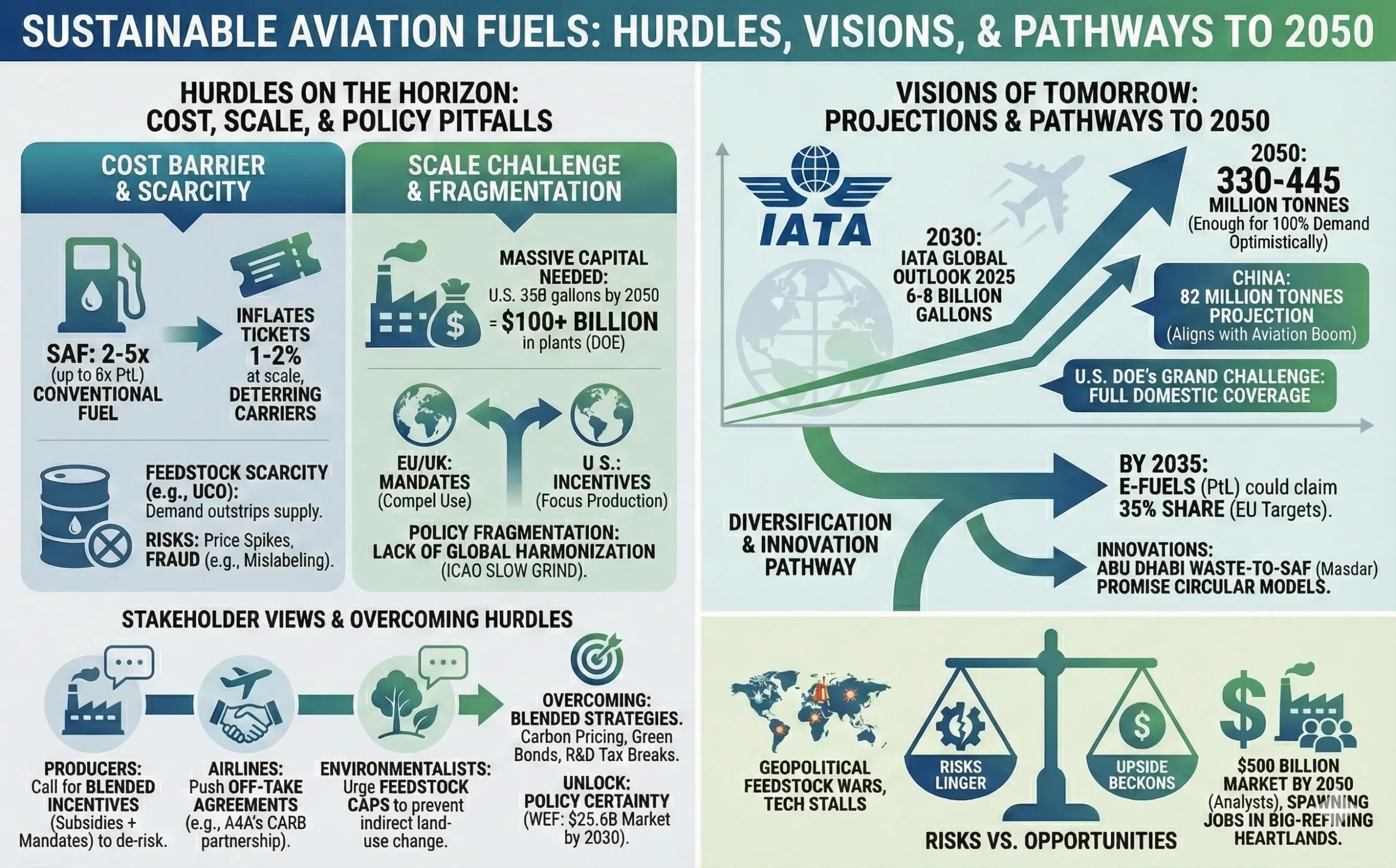

Hurdles on the Horizon: Cost, Scale, and Policy Pitfalls

SAF’s promise collides with prosaic barriers. Cost tops the list: At 2-5 times conventional fuel (up to 8x for PtL), it inflates tickets by 1-2% at scale, deterring cash-strapped carriers. Feedstock scarcity exacerbates this—UCO demand outstrips supply, risking price spikes or fraud (e.g., virgin palm oil mislabeled as waste).

Scalability demands massive capital: Hitting 35 billion gallons U.S. by 2050 requires $100+ billion in plants, per DOE estimates. Technical tweaks, like purifying MSW syngas, add delays. Policy fragmentation hurts too—while EU/UK mandates compel use, U.S. incentives focus production, leaving global harmonization to ICAO’s slow grind.

Stakeholder views vary:

- Producers: Call for blended incentives (subsidies + mandates) to de-risk investments.

- Airlines: Push off-take agreements, like A4A’s CARB partnership for California emissions.

- Environmentalists: Urge feedstock caps to prevent indirect land-use change.

Overcoming these? Blended strategies: Carbon pricing, green bonds, and R&D tax breaks. A 2025 World Economic Forum report flags policy certainty as the unlock, predicting a $25.6 billion market by 2030 with aligned efforts.

Visions of Tomorrow: Projections and Pathways to 2050

Peering ahead, SAF’s trajectory dazzles. IATA’s Global Aviation Sustainability Outlook 2025 envisions 6-8 billion gallons by 2030, ballooning to 330-445 million tonnes by 2050—enough for 100% of demand in optimistic scenarios. China’s 82 million tonnes projection aligns with its aviation boom, while the U.S. DOE’s Grand Challenge eyes full domestic coverage.

Market forecasts paint vibrancy:

| Year | Global SAF Demand (Billion Gallons) | Supply Projection (Billion Gallons) | Key Drivers |

|---|---|---|---|

| 2030 | 10-15 | 6-8 | Mandates; U.S. credits |

| 2040 | 50-70 | 40-60 | PtL scale-up; Asia growth |

| 2050 | 200-250 | 200+ | Net-zero alignment; tech maturity |

Growth hinges on diversification: By 2035, e-fuels could claim 35% share, per EU targets. Innovations like Abu Dhabi’s waste-to-SAF with Masdar promise circular models.

Risks linger—geopolitical feedstock wars or tech stalls—but upside beckons: $500 billion market by 2050, per analysts, spawning jobs in bio-refining heartlands.

Case Studies: SAF in Action Around the Globe

- United’s 100% SAF Milestone: In a 2025 breakthrough, United Airlines partnered with GE Aerospace, Boeing, and Marathon’s Virent for a Chicago-to-San Francisco hop on 100% SAF. Sourced from renewable alcohols, it emitted 80% less CO2, proving full compatibility. CEO Scott Kirby hailed it as “a turning point,” spurring orders for 10 million gallons annually.

- Europe’s Mandate Momentum: Under ReFuelEU, Air France-KLM blended 1% SAF across 2025 flights, sourcing from TotalEnergies’ Dutch plant. Emissions dropped 10,000 tonnes in Q3 alone, with passengers opting for “green fares” at a 5% upcharge.

- Asia’s Quiet Revolution: Pertamina in Indonesia launched Cilacap Green Refinery, churning 300,000 kiloliters/year from UCO for domestic carriers. Meanwhile, Singapore’s levy—S$1-10.40 per economy ticket—funds imports, targeting 1% blend by 2027.

- UAE’s Waste-to-Wings Ambition: Masdar and Tadweer’s Abu Dhabi project converts municipal waste to e-SAF, aiming for commercial scale by 2027. At Dubai Airshow 2025, EU-UAE talks solidified SAF corridors, blending diplomacy with decarbonization.

These stories illustrate SAF’s versatility: From U.S. innovation hubs to Asian policy plays, it’s fostering ecosystems where waste fuels wanderlust.

Economic, Social, and Environmental Echoes

Beyond runways, SAF stirs economies. U.S. plants could generate 100,000 jobs by 2030, revitalizing rural areas with biomass hubs. Socially, it empowers: Women-led cooperatives in India process UCO, weaving equity into green growth.

Environmentally, benefits cascade—biodiversity preservation via residue use, water savings in arid refining. Yet, equity matters: Developing nations need tech transfers to avoid green divides.

Conclusion

Sustainable Aviation Fuels aren’t a silver bullet, but they’re the aerospace industry’s smartest green bet—a pragmatic powerhouse propelling us toward net-zero. As 2025 closes with mandates multiplying and flights greening, the message is clear: Collaboration across borders, industries, and innovations will turn ambition into altitude. The skies await, cleaner and closer than ever. Will you join the ascent?

Key Citations And References

- IATA SAF Fact Sheet

- EIA U.S. SAF Production Update

- SkyNRG & ICF 2025 Outlook

- World Economic Forum Global Aviation Sustainability Outlook 2025

- ICAO SAF Feedstocks

- McKinsey on SAF Scaling

- DOE SAF Grand Challenge

- Nature on SAF Scale-Up Potential

- United Airlines SAF Initiatives

- EU ReFuelEU Progress Report

- ICF on Airports and SAF

- MarketsandMarkets SAF Market Report

- ATAG SAF Projections

- ScienceDirect on SAF Opportunities/Challenges

- BP on SAF Feedstocks and Tech

- IEA Aviation Decarbonization

- JetBlue SAF Supply Milestone

- Carbon Direct on Global Mandates

- Farmdoc Daily U.S. Capacity Estimates

- ICCT on Advanced SAF

Read These Articles in Detail

- Aerospace Engineering vs. Mechanical Engineering

- The Future of Aerospace Propulsion Systems

- How Aerospace Education Is Adapting to Industry Demands

- The Role of Aerospace in Combating Climate Change

- Aerospace Radar Technology: Past, Present, and Future

- The Role of Aerospace in National Security Strategies

- The Role of Nanotechnology in Aerospace Materials

- Aerospace Materials: Stronger, Lighter, And Smarter

- Aerospace Engineering Explained: A Beginner’s Guide

- Electric Aircraft vs. Hydrogen Aircraft: Which Is More Sustainable?

- Hypersonic Weapons: Aerospace’s New Arms Race

- Aerospace Defense Systems: From Drones to Hypersonic Missiles

- How Aerospace Engineers Reduce Fuel Consumption

- Computational Fluid Dynamics in Aerospace Innovation

- The Global Aerospace Market Outlook: Trends and Forecasts

- Satellite Surveillance: Aerospace’s Role in Modern Warfare

- How Aerospace Companies Are Reducing Environmental Impact

- How Airlines Use Aerospace Data Analytics to Cut Costs

- Aerospace Engineering Challenges: Innovation and Sustainability

- The Role of CFD in Aerospace Engineering

- The Role of Women in Aerospace: Breaking Barriers in the Skies

- Sustainable Aviation Fuels: The Aerospace Industry’s Green Bet

- Aerospace Cybersecurity: Protecting the Skies from Digital Threats

- Aerospace Trends Driving the Next Generation of Airliners

- The Rise of Autonomous Aerospace Systems

- How to Start a Career in Aerospace Engineering

- Can Aerospace Go Carbon Neutral by 2050?

- The Role of Aerospace in Missile Defense Systems

- How Aerospace Engineers Use AI in Design

- Top 10 Aerospace Engineering Innovations of the Decade

- Top Aerospace Careers in 2025 and Beyond

- How Aerospace Innovations Shape Global Defense Policies

- Hydrogen-Powered Aircraft: The Next Green Revolution

- Top 10 Emerging Aerospace Technologies Transforming the Industry

- The Future of Hypersonic Flight: Challenges and Opportunities

- How AI Is Revolutionizing Aerospace Engineering

- Additive Manufacturing in Aerospace: 3D Printing the Future of Flight

- The Rise of Electric Aircraft: Are We Ready for Zero-Emission Aviation?

- Aerospace Materials of Tomorrow: From Composites to Nanotechnology

- Digital Twins in Aerospace: Reducing Costs and Improving Safety

- The Role of Robotics in Modern Aerospace Manufacturing

- Quantum Computing Applications in Aerospace Design

- How Augmented Reality Is Changing Aerospace Training

- Space Tethers Explained: The Next Leap in Orbital Mechanics

- Ion Propulsion vs. Chemical Rockets: Which Will Power the Future?

- The Role of Nuclear Propulsion in Deep Space Missions

- Space Mining: The Aerospace Industry’s Next Gold Rush

- How Reusable Rockets Are Reshaping the Space Economy

- The Artemis Program: NASA’s Return to the Moon

- Space Tourism: Business Model or Billionaire’s Playground?

- How Aerospace Startups Are Disrupting Commercial Aviation

- The Economics of Low-Cost Airlines in the Aerospace Era

- Urban Air Mobility: The Rise of Flying Taxis

- The Future of Mars Colonization: Key Aerospace Challenges and Solutions Ahead

- CubeSats and Small Satellites: Democratizing Space Access

- The Future of Cargo Drones in Global Logistics

- The Role of Aerospace in Building a Lunar Economy

Frequently Asked Questions

FAQ 1: What Is Sustainable Aviation Fuel and Why Does It Matter for Reducing Aviation Emissions?

Sustainable Aviation Fuel, often shortened to SAF, represents a game-changer in the world of air travel by offering a cleaner alternative to the traditional fossil-based kerosene that powers most jets today. At its heart, SAF is a type of biofuel or synthetic fuel made from renewable sources like waste oils, agricultural leftovers, or even captured carbon dioxide, rather than drilling deep into the earth for crude oil. What makes it special is its drop-in nature, meaning it can blend seamlessly with regular jet fuel in existing aircraft engines without any modifications, allowing airlines to start cutting emissions right away.

The importance of SAF lies in aviation’s outsized environmental footprint. With the industry responsible for about 2 to 3 percent of global carbon dioxide emissions and that number potentially climbing if unchecked, SAF steps in as a practical solution. Over its full lifecycle from production to combustion, it can slash greenhouse gas emissions by up to 80 percent compared to conventional fuels.

This isn’t just about CO2, either; SAF also reduces harmful particulates and nitrogen oxides that contribute to air pollution around airports. As global passenger numbers rebound toward pre-pandemic levels and beyond, reaching over 4.5 billion annually by mid-decade, tools like SAF become essential for meeting ambitious goals, such as the industry’s pledge for net-zero carbon emissions by 2050. Without it, the dream of sustainable skies remains grounded.

In simple terms, SAF bridges the gap between today’s technology and tomorrow’s innovations, like hydrogen-powered planes, which are still years away for long-haul flights. It’s not a magic fix, but its immediate usability and proven performance make it a cornerstone for greener aviation, encouraging everything from policy shifts to corporate investments.

FAQ 2: How Is Sustainable Aviation Fuel Produced, and What Are the Key Feedstocks Involved?

Producing Sustainable Aviation Fuel (SAF) involves transforming everyday waste and renewable resources into a high-quality liquid that meets the rigorous standards for jet engines. The process starts with selecting sustainable feedstocks, then uses specialized conversion methods to break them down and rebuild them into hydrocarbons that mimic conventional jet fuel. This isn’t a one-size-fits-all approach; there are multiple pathways, each suited to different materials, ensuring flexibility as production scales up.

One of the most common methods is the Hydroprocessed Esters and Fatty Acids (HEFA) pathway, which dominates current output because it’s efficient and leverages existing refinery infrastructure. Here, oils and fats are treated with hydrogen to remove oxygen and create stable fuel molecules. Other routes, like Alcohol-to-Jet (ATJ), ferment sugars or alcohols into longer chains, while Fischer-Tropsch (FtSPK) gasifies solid wastes into syngas before synthesizing it into fuel. Emerging options, such as Power-to-Liquid (PtL), combine green hydrogen from electrolysis with captured CO2, offering potential for even deeper emission cuts but at higher complexity and cost.

Feedstocks are the real stars, chosen for their low environmental impact to avoid issues like deforestation or food crop competition. Here’s a breakdown of the primary ones driving 2025 production:

- Used Cooking Oil (UCO): Recycled from restaurants and food services, it accounts for over 80 percent of European SAF, turning a disposal problem into a resource.

- Animal Fats and Tallow: Byproducts from meat processing, providing a steady supply without extra land use.

- Agricultural Residues: Leftover stalks and husks from crops like corn or wheat, abundant and underutilized.

- Municipal Solid Waste: Sorted non-recyclable trash, helping cities manage waste while fueling flights.

- Synthetic Inputs for PtL: Captured CO2 and renewable electricity, ideal for carbon-negative potential in the long run.

As of late 2025, global production hovers around 2.1 million tonnes, with innovations like modular reactors at airports speeding up the shift from lab to runway. This diversity ensures SAF can grow sustainably, adapting to regional resources while keeping costs in check over time.

FAQ 3: What Are the Main Environmental and Operational Benefits of Switching to Sustainable Aviation Fuel?

Adopting Sustainable Aviation Fuel (SAF) brings a host of benefits that extend far beyond just lowering carbon footprints, making it a multifaceted win for the planet and the skies. Environmentally, the standout advantage is its drastic reduction in lifecycle emissions, where studies show up to an 80 percent drop in greenhouse gases compared to fossil jet fuel. This includes not only CO2 but also methane and nitrous oxide from production and use, helping aviation tackle its role in climate change head-on.

Operationally, SAF performs just like traditional fuel, with the same energy density and cold-weather properties, so pilots and crews notice no difference in flight efficiency or safety. Blends up to 50 percent are already certified, and tests for 100 percent are advancing rapidly, minimizing disruptions during the transition.

To illustrate the broader impacts, consider these key advantages:

- Air Quality Improvements: Lower soot and particulate matter mean cleaner air near busy airports, potentially reducing health risks for communities.

- Biodiversity Protection: By using waste residues instead of virgin crops, SAF avoids land conversion that could harm ecosystems.

- Water and Energy Efficiency: Advanced pathways like PtL can recycle water and rely on renewables, easing strain on scarce resources.

- Noise and Waste Reduction: Cleaner combustion indirectly supports quieter operations through optimized engines designed for low-emission fuels.

In 2025, real-world flights powered by SAF blends have already avoided thousands of tonnes of emissions, proving it’s not just theoretical. As mandates roll out, these benefits compound, fostering a ripple effect toward more resilient, eco-friendly aviation networks worldwide.

FAQ 4: What Challenges Are Holding Back the Widespread Adoption of Sustainable Aviation Fuel in 2025?

Scaling up Sustainable Aviation Fuel (SAF) to meet aviation’s growing needs is no small feat, and 2025 highlights a mix of economic, logistical, and technical hurdles that keep production lagging behind demand. At the forefront is cost: SAF remains two to five times pricier than conventional jet fuel, often $2,000 to $3,000 per tonne versus $800, driven by limited feedstocks and energy-intensive processes. This premium trickles down to airlines, potentially raising ticket prices by 1 to 2 percent, which strains budgets in a competitive market still recovering from pandemic hits.

Feedstock scarcity adds another layer of complexity. With used cooking oil dominating supplies at around 6 million tonnes globally per year, demand is outpacing availability, leading to price volatility and risks of supply chain fraud, like mislabeling virgin oils as waste. Diversifying to solid wastes or synthetics helps, but building the infrastructure for collection, sorting, and conversion requires massive upfront investments, estimated at over $100 billion for U.S. goals alone by 2050.

Policy gaps and regional disparities further complicate the picture. While Europe enforces a 2 percent mandate, fragmented incentives elsewhere slow global momentum, and achieving financial close on new plants remains tricky without guaranteed off-take agreements. Recent analyses point to a “HEFA tipping point,” where overreliance on oil-based pathways could bottleneck progress unless novel sources scale faster.

Despite these obstacles, progress is evident, with capacity nearing 30,000 barrels per day in the U.S. and innovative grants funding research into non-CO2 effects. Overcoming them demands collaborative pushes, from subsidies to tech breakthroughs, to ensure SAF truly takes flight without leaving the industry grounded.

FAQ 5: Which Countries Have SAF Mandates in Place, and What Are Their Key Targets?

As of November 2025, several nations are leading the charge with Sustainable Aviation Fuel (SAF) mandates to drive decarbonization, setting binding quotas for fuel blends at airports and for carriers. These policies vary by region, reflecting local resources and ambitions, but all aim to ramp up from modest starts toward ambitious net-zero alignments by mid-century. Here’s a structured overview of major mandates:

| Country/Region | Starting Mandate (2025) | Ramp-Up Targets | Key Features |

|---|---|---|---|

| European Union | 2% SAF blend | 6% by 2030; 70% by 2050 (35% synthetic e-fuels from 2030) | Applies to all intra-EU flights; focuses on waste-based SAF to avoid food competition. |

| United Kingdom | 2% SAF blend | 10% by 2030; 22% by 2040 (holds at 22% post-2040) | Covers UK departures; includes credits for SAF produced domestically. |

| United States | No federal mandate (voluntary targets) | 3 billion gallons production by 2030; 35 billion by 2050 | Tax credits via Inflation Reduction Act; state-level like California’s LCFS push blends. |

| China | 50,000 tonnes production target | 5% blend by 2030 (proposed) | Part of 14th Five-Year Plan; emphasizes state-backed plants for domestic supply. |

| Japan | Voluntary pilots | 10% blend by 2030 | Government incentives for imports and R&D; aligns with ICAO goals. |

| Brazil | Emerging (2% proposed) | 10% by 2030 | Leverages sugarcane ethanol for ATJ pathways; tied to biofuel expansion. |

| India | 5% blend (phased) | 15% by 2030 | Focuses on regional production from non-edible oils; supports local airlines. |

These mandates, totaling eight worldwide with more in discussion, are projected to boost global demand to 2 million tonnes in 2025 alone. They not only enforce uptake but also spur investments, though harmonization remains key to avoiding trade distortions.

FAQ 6: What Real-World Examples Show Airlines Successfully Implementing SAF in 2025?

In 2025, airlines around the globe are turning Sustainable Aviation Fuel (SAF) pledges into action, with standout implementations demonstrating its viability for everything from short hops to transoceanic routes. Take United Airlines, which made headlines with the world’s first commercial passenger flight using 100 percent SAF on a Chicago-to-San Francisco run in early 2025. Partnering with GE Aerospace, Boeing, and producers like World Energy, the Boeing 737 MAX burned fuel from renewable alcohols, slashing CO2 by 80 percent and gathering invaluable data on full-blend performance. This milestone not only validated SAF’s engine compatibility but also secured commitments for 10 million gallons annually, signaling confidence in scaling.

Across the Atlantic, Air France-KLM has woven SAF into its core operations under the EU’s ReFuelEU initiative, blending 1 percent across thousands of flights and sourcing from TotalEnergies’ Dutch facility. By the third quarter, this effort avoided 10,000 tonnes of emissions, with passengers embracing “green fare” options that add a modest upcharge for fully SAF-powered legs. The group’s transparency in reporting fuel mixes has also built trust, encouraging suppliers to ramp up output.

In Asia, Emirates joined forces with Airbus for Dubai-based trials, fueling A350 test flights with blends from waste oils and reporting seamless integration with no performance dips. Meanwhile, Japan’s All Nippon Airways launched routine SAF use on Tokyo-Honolulu routes, hitting 10 percent blends ahead of national targets and partnering with local refiners for steady supply. These cases highlight a pattern: Early adopters leverage partnerships and mandates to de-risk investments, paving the way for broader fleet transitions. As more carriers follow, 2025’s successes underscore SAF’s role in making aviation’s green shift tangible and trackable.

FAQ 7: What Are the Latest Projections for SAF Production Growth by 2030 and 2050?

Looking ahead, projections for Sustainable Aviation Fuel (SAF) paint an optimistic yet challenging path, with explosive growth needed to hit net-zero targets. Analysts forecast a surge from current levels, driven by mandates, tech advances, and investments, but warn of supply gaps if hurdles like feedstock limits persist. By 2030, global production could reach 6 to 8 billion gallons, covering just a fraction of demand but marking a tenfold increase from 2025’s 2.1 million tonnes.

Longer-term, by 2050, estimates range from 330 to 445 million tonnes annually, enough to power the entire industry in high-ambition scenarios. This would require annual growth rates of 20 to 30 percent, fueled by diversification into e-fuels and policy alignment.

For a clearer picture, here’s a timeline of key forecasts:

| Year | Projected Global Production (Million Tonnes) | Share of Jet Fuel Demand (%) | Driving Factors |

|---|---|---|---|

| 2025 | 2.1 | 0.7 | Mandates in EU/UK; U.S. tax credits |

| 2030 | 18-20 (6-8 billion gallons) | 5-10 | Policy ramps; HEFA/ATJ scaling |

| 2040 | 100-150 | 30-40 | PtL emergence; Asia-Pacific boom |

| 2050 | 330-445 | 90-100 | Full net-zero push; feedstock innovations |

China alone eyes 82 million tonnes by 2050, aligning supply with its aviation expansion. While achievable with sustained effort, these numbers hinge on closing the 23 million tonne shortfall projected by 2035, emphasizing the urgency for collaborative action.

FAQ 8: How Does Sustainable Aviation Fuel Compare to Other Emerging Aviation Technologies Like Hydrogen and Electric Propulsion?

Sustainable Aviation Fuel (SAF) holds its own against rivals like hydrogen and electric propulsion by offering immediate, scalable decarbonization without overhauling aircraft fleets. While electric batteries shine for short regional flights under 500 miles, their low energy density limits range, making them impractical for the 60 percent of emissions from long-haul jets. SAF, in contrast, matches kerosene’s power-to-weight ratio, enabling drop-in use today and up to 80 percent emission cuts right away.

Hydrogen promises zero-emission flights via fuel cells or combustion, potentially eliminating CO2 entirely, but infrastructure lags: Producing green hydrogen at scale and retrofitting planes could take until 2040 for commercial viability. SAF bridges this wait, with blends already in service, though it still relies on biomass or synthetics that aren’t fully carbon-negative yet.

A quick side-by-side reveals SAF’s edge in practicality:

- Emission Reductions: SAF up to 80 percent now; hydrogen 100 percent but post-2035; electric near-zero for shorts only.

- Infrastructure Needs: SAF uses existing pipelines and tanks; hydrogen demands new high-pressure storage; electric requires charging networks.

- Scalability Timeline: SAF at 2 percent global in 2025, ramping fast; others in pilots through 2030.

- Cost Trajectory: SAF dropping to 2x conventional by 2030; hydrogen 3-5x initially.

Ultimately, SAF complements these technologies in a hybrid future, handling bulk reductions while hydrogen and electric target niches, ensuring aviation evolves without stalling progress.

FAQ 9: What Role Do Government Policies Play in Accelerating SAF Adoption Worldwide?

Government policies are the accelerator pedal for Sustainable Aviation Fuel (SAF), providing the mandates, incentives, and frameworks that turn voluntary commitments into measurable action. In 2025, these efforts range from quotas enforcing blends to financial perks de-risking investments, collectively projected to triple production in the coming years.

Key policy levers include:

- Mandates and Quotas: Binding targets like the EU’s 2 percent start ensure demand, spurring suppliers to build capacity.

- Tax Credits and Subsidies: U.S. Inflation Reduction Act offers up to $1.75 per gallon, fueling 30,000 barrels daily output.

- Carbon Pricing and Levies: Singapore’s ticket surcharges fund imports, while CORSIA offsets encourage early uptake.

- R&D Funding: Grants like the UK’s £1.8 million for non-CO2 research drive innovation in pathways.

- International Alignment: ICAO’s global vision for 5 percent CO2 cuts by 2030 harmonizes efforts across borders.

These tools not only boost supply chains but also foster equity, with emerging markets like Brazil gaining from ethanol-focused incentives. As policies evolve, their synergy with private sector deals will be crucial for hitting 2050 goals.

FAQ 10: How Can Individual Travelers Support the Shift to Sustainable Aviation Fuels?

As a traveler, you hold more power than you might think in pushing the aviation industry toward Sustainable Aviation Fuel (SAF), through choices that signal demand and influence airline priorities. Start by opting for carriers with strong SAF commitments, like those blending it on your routes, and use apps or websites to track flight emissions, choosing greener options when possible. Many airlines now offer carbon offset programs tied to SAF investments, allowing you to direct a portion of your ticket toward production funds.

Beyond booking, voice your support: Share feedback praising sustainable initiatives or join petitions for stronger policies, as passenger sentiment sways executives, with surveys showing 70 percent willing to pay a small premium for eco-flights. Educate yourself on SAF’s progress, perhaps by following industry updates, and consider flying less or consolidating trips to reduce overall demand.

On a broader scale, advocate locally for waste reduction, like proper cooking oil recycling, which feeds SAF plants. These steps, multiplied across millions, create market pull, pressuring governments and airlines alike. In 2025, with SAF’s footprint growing, your actions contribute to a collective ascent toward cleaner, more responsible skies, proving that personal choices can propel planetary change.

FAQ 11: What Is the Current Cost Breakdown of Sustainable Aviation Fuel Compared to Traditional Jet Fuel in 2025?

Understanding the cost dynamics of sustainable aviation fuel (SAF) versus conventional jet fuel is crucial for grasping why adoption, while accelerating, still faces barriers. In 2025, the average price of SAF hovers between $2,000 and $3,000 per tonne, making it roughly 2 to 5 times more expensive than traditional kerosene, which trades around $800 per tonne globally. This premium stems from several factors: limited feedstock availability, energy-intensive production processes, and the need for rigorous sustainability verifications. However, incentives like tax credits in the U.S. and subsidies in Europe are narrowing the gap, with projections suggesting SAF could drop to 2 to 3 times the cost by 2030 as scale improves.

Breaking it down further reveals where the expenses pile up. Feedstock costs, often 40-60% of total production, fluctuate with supply chains—used cooking oil, for instance, has seen prices rise due to competing demands from road biofuels. Conversion technologies add another layer; the dominant HEFA pathway is relatively cheaper at about $1,500 per tonne but relies on finite waste oils, while emerging Power-to-Liquid (PtL) methods can exceed $4,000 per tonne due to green hydrogen requirements. Distribution and blending fees, plus compliance with mandates like the EU’s 2% quota, tack on 10-20% more.

For a clearer comparison, consider this table outlining key cost components based on mid-2025 data:

| Cost Component | SAF Estimate (Per Tonne) | Traditional Jet Fuel (Per Tonne) | Key Drivers for Difference |

|---|---|---|---|

| Feedstock | $800-1,800 | $300-500 | Renewable sourcing vs. crude oil extraction |

| Production/Conversion | $800-1,500 | $300-400 | Advanced tech vs. standard refining |

| Distribution & Compliance | $200-500 | $100-200 | Certification and mandates vs. established logistics |

| Total | $2,000-3,000 | $700-1,100 | Overall premium of 2-5x |

Airlines mitigate this through long-term contracts and airport subsidies, which can reduce effective costs by up to 30%. As production ramps to 6-8 billion gallons by 2030, economies of scale should ease the burden, making SAF a more viable bet for sustainable skies without jacking up ticket prices excessively.

FAQ 12: How Are Airports Playing a Pivotal Role in Boosting SAF Adoption?

Airports are evolving from mere gateways to active catalysts in the sustainable aviation fuel (SAF) transition, leveraging their central position in the supply chain to drive demand and innovation. In 2025, with global SAF output at just 0.7% of needs, hubs like Los Angeles International and San Francisco are subsidizing blends to make them affordable, cutting costs by 20-30% through targeted incentives. This not only encourages airlines to uptake but also builds local infrastructure for storage and delivery, ensuring seamless integration without disrupting operations.

Beyond financial support, airports foster partnerships that aggregate demand, creating bankable off-take agreements for producers. For example, European airports under the ReFuelEU initiative coordinate with fuel suppliers to meet the 2% mandate, pooling resources to secure steady volumes of waste-derived SAF. This collaborative approach mitigates risks for investors, as seen in U.S. pilots where airports like Chicago O’Hare host modular production units right on-site.

Key contributions from airports include:

- Demand Aggregation: Grouping airline needs to negotiate bulk deals, stabilizing prices.

- Infrastructure Upgrades: Installing dedicated pipelines for SAF blending, reducing contamination risks.

- Policy Advocacy: Lobbying for regional incentives, like California’s Low Carbon Fuel Standard credits.

- Pilot Programs: Testing 50% blends on short-haul routes to gather performance data.

- Community Engagement: Educating stakeholders on benefits, from job creation to air quality gains.

These efforts position airports as linchpins, turning policy mandates into practical realities and accelerating the shift to greener aviation ecosystems.

FAQ 13: What Emerging Innovations Are Revolutionizing SAF Production in 2025?

The landscape of sustainable aviation fuel (SAF) production in 2025 is buzzing with breakthroughs that promise greater efficiency and scalability, moving beyond reliance on traditional waste oils. One standout is LanzaJet’s ethanol-to-jet technology, which achieved full ASTM-certified operation at its Freedom Pines plant in November, converting low-carbon ethanol into drop-in fuel with up to 85% emission reductions. This innovation sidesteps feedstock shortages by using agricultural byproducts, potentially unlocking billions of gallons from existing ethanol infrastructure.

Another game-changer is the rise of Power-to-Liquid (PtL) pathways, where renewable electricity and captured CO2 synthesize fuel in pilot facilities across Europe and Asia. While costlier today, advancements in electrolysis have cut green hydrogen expenses by 20% this year, making PtL viable for carbon-negative production. In the U.S., modular biorefineries from companies like Gevo are popping up near airports, enabling on-demand SAF from municipal waste, with outputs hitting 3,000 barrels per day in new Nevada plants.

Biotech is also making waves, with engineered microbes fermenting lignocellulosic biomass into jet-range hydrocarbons faster and with less energy. Asia-Pacific leads here, with Australia’s first commercial ethanol-based plant targeting 100 million liters annually by late 2025. These developments not only diversify feedstocks but also address scalability, projecting a shift from 80% HEFA dominance to a balanced mix by 2030. Challenges like capital needs persist, but with $63 million in UK funding for advanced fuels, the innovation pipeline is fueling optimism for a truly sustainable aviation future.

FAQ 14: What Key Environmental Certifications Validate the Sustainability of SAF?

Ensuring sustainable aviation fuel (SAF) lives up to its name requires stringent certifications that scrutinize its lifecycle from feedstock to flight. These standards prevent greenwashing by verifying emission reductions, land-use impacts, and social benefits, aligning with global frameworks like ICAO’s CORSIA. In 2025, over 98% of SAF undergoes such audits, building trust among airlines and regulators.

Certifications focus on metrics like greenhouse gas savings—up to 80%—while prohibiting deforestation-linked feedstocks. Common schemes include mass balance tracking, where environmental attributes are allocated across blended fuels, and full chain-of-custody for purer claims.

Here’s a table summarizing major certifications active in 2025:

| Certification Scheme | Focus Areas | Key Requirements | Global Reach |

|---|---|---|---|

| ISCC (International Sustainability & Carbon Certification) | Biofuels and e-fuels | GHG accounting, no-deforestation, social labor standards | 100+ countries; 80% of EU SAF |

| RSB (Roundtable on Sustainable Biomaterials) | Advanced feedstocks | Lifecycle assessments, biodiversity protection | CORSIA-approved; used in U.S./Asia pilots |

| RFS (Renewable Fuel Standard) | U.S.-specific volumes | Low-carbon intensity scores (<50 gCO2e/MJ) | Domestic production; tax credit eligible |

| SAFc (SAF Certificates) | Emission attribute trading | Decoupled credits for unblended SAF tonnes | Emerging market; 240,000+ tonnes traded |

| CORSIA-Eligible Pathways | International compliance | 11 approved tech routes; annual audits | Mandatory for 80% of global airlines |

These tools not only enforce accountability but also enable markets for credits, accelerating adoption as certifications evolve to cover non-CO2 effects like contrails.

FAQ 15: What Are the Broader Economic Impacts of the Growing SAF Industry?

The sustainable aviation fuel (SAF) sector is injecting vitality into economies worldwide, creating jobs and spurring investments that ripple through rural and industrial communities. In 2025, with production scaling to 2.1 million tonnes, the U.S. alone anticipates 60,000 direct jobs in refining and feedstock processing, plus 100,000 indirect roles in agriculture and logistics. Globally, cumulative investments could hit $400 billion by 2050, adding $10.2 billion annually to GDP through new plants and supply chains.

This growth revitalizes underserved areas: Farmers benefit from premium markets for crop residues, while biorefineries in places like Nevada and Queensland boost local tax revenues. However, upfront costs—over $100 billion for U.S. targets—demand policy support to avoid uneven distribution.

Notable economic effects include:

- Job Creation: 153,000 peak U.S. positions, emphasizing skilled trades in biotech and engineering.

- GDP Boost: $80-100 billion from spending on facilities and R&D.

- Rural Revitalization: $1.67 billion loans for waste-to-fuel plants support agricultural exports.

- Trade Opportunities: Enhanced ethanol and distillers grains flows to Asia under new agreements.

- Cost Pressures on Airlines: 4.2x premium adds $1.7 billion in compliance fees, but offsets via credits.

As SAF matures, its economic footprint could eclipse traditional fuels, fostering energy independence and equitable green growth.

FAQ 16: How Is Sustainable Aviation Fuel Transforming Cargo and Freight Operations in 2025?

Sustainable aviation fuel (SAF) is quietly revolutionizing cargo aviation, where long-haul efficiency demands make it ideal for emission cuts without sacrificing speed. In 2025, freight leaders like FedEx are rolling out SAF at hubs such as Chicago O’Hare and Miami International, delivering over 240,000 metric tons in partnerships with Phillips 66—enough to slash lifecycle emissions by 737,000 tonnes over three years. This marks the first major U.S. cargo deployment at O’Hare, building on LAX pilots and proving SAF’s reliability for time-sensitive shipments.

DHL Express echoes this momentum, securing multi-year supplies to power Europe-Asia routes, aligning with the 2% EU mandate for departures. Cargo’s edge lies in flexibility: Unlike passenger fleets, freighters can prioritize high-value, green-premium loads, with surveys showing shippers willing to pay 5-10% more for certified low-carbon transport. United Cargo’s Eco-Skies program further integrates SAF into alliances, offering credits for corporate clients.

The shift extends benefits beyond CO2: Reduced particulates improve air quality at busy freight hubs, while stable supply chains—bolstered by guides from groups like Smart Freight Centre—guide decarbonization from intent to impact. As cargo volumes rebound 10% post-pandemic, SAF positions the sector as a sustainability frontrunner, blending profitability with planetary care.

FAQ 17: What Lies Ahead for 100% SAF-Powered Commercial Flights?

The horizon for 100% sustainable aviation fuel (SAF) flights brightens in 2025, with milestones proving full compatibility and paving the way for routine use by decade’s end. United Airlines’ Chicago-San Francisco demo earlier this year, using ethanol-derived SAF, logged zero performance issues, inspiring Airbus to certify all models for 100% blends by 2030. This follows extensive testing, including over 700 hours on Bell 505 helicopters with blended SAF, signaling rotary-wing readiness too.

Projections hinge on regulatory nods: Eleven ASTM pathways now support 100% use in select engines, with IATA forecasting commercial rollout for short-haul by 2028. Challenges like supply—needing 500 million tonnes by 2050—persist, but innovations in PtL could enable negative emissions.

Looking forward:

- Near-Term (2026-2030): 10-20% blends standard; first passenger 100% flights on regional routes.

- Mid-Term (2030-2040): Full certification for long-haul; mandates hit 70% in EU.

- Long-Term (2050): 100% SAF dominant, integrated with hydrogen hybrids.

- Enablers: $63 million UK funds for testing; KLM’s 100% surcharge trials on European legs.

While not yet widespread, these steps affirm 100% SAF as aviation’s bridge to zero-emission eras, balancing ambition with achievability.

FAQ 18: How Do International Trade Policies Influence SAF Availability and Costs in 2025?

International trade policies are shaping sustainable aviation fuel (SAF) dynamics in 2025, balancing mandates with cross-border flows to prevent shortages and price spikes. The EU’s ReFuelEU, enforcing 2% blends, pulls 81% of global UCO-based SAF, prompting U.S. exporters to seek new markets via agreements with Japan and Indonesia that boost ethanol and SAF shipments. This harmonization, under ICAO guidelines, avoids distortions but highlights tensions—European duties on imports could add 10-15% to costs for non-EU producers.

Asia-Pacific’s emerging frameworks, like China’s 50,000-tonne target, foster intra-regional trade, with Australia’s ethanol plants eyeing exports. Globally, policies like U.S. tax credits ($1.75/gallon) incentivize domestic buildout, reducing reliance on imports and stabilizing prices at 4.2 times jet fuel averages.

Trade’s dual edge: It expands access—projected 18-20 million tonnes by 2030—but risks feedstock competition, as seen in UCO price surges. Fines for non-compliance in the EU underscore enforcement, while voluntary CORSIA credits encourage equitable sharing. As policies align, trade becomes a tailwind, ensuring SAF’s equitable global rollout without inflating costs unduly.

FAQ 19: What Are Some Common Myths Surrounding Sustainable Aviation Fuel, and How Can They Be Debunked?

Misconceptions about sustainable aviation fuel (SAF) often stall progress, but unpacking them reveals its true potential. One persistent myth is that SAF is just a rebranded biofuel that competes with food production; in reality, 98% derives from wastes like used oils, avoiding arable land and delivering 70-90% emission cuts per lifecycle analyses.

Another fallacy claims SAF combustion releases as much CO2 as jet fuel—false, as its renewable origins recycle recent carbon, not ancient fossils, slashing net GHG by up to 80%. Critics also argue it’s too inefficient, but pathways like ATJ match fossil energy yields while cutting water use.

Debunking key myths:

- Myth: SAF is too expensive forever. Fact: Premiums drop with scale; subsidies already halve costs at hubs.

- Myth: It requires new planes. Fact: Drop-in design fits existing fleets up to 100% blends.

- Myth: Supply can’t meet demand. Fact: Feedstock potential covers 2050 needs; innovations expand options.

- Myth: Certifications are lax. Fact: ISCC/RSB audits ensure no deforestation or social harms.

- Myth: It’s a distraction from electrification. Fact: Complements hydrogen/electric for long-haul gaps.

- Myth: No real emission wins. Fact: Avoids 10,000+ tonnes quarterly in EU trials.

By grounding claims in data, these clarifications empower informed advocacy for SAF’s role in cleaner aviation.

FAQ 20: How Can Businesses Outside the Airline Industry Contribute to SAF Growth?

Businesses beyond airlines can amplify sustainable aviation fuel (SAF) momentum by integrating it into supply chains and advocacy, turning corporate travel into a force for change. Start with procurement: Companies like those in the Eco-Skies Alliance commit to SAF-powered flights for executives, using certificates to claim reductions without physical blending—over 240,000 tonnes traded in 2025 alone.

Next, invest in ecosystems: Tech firms fund R&D via grants, while logistics giants recycle UCO to feed plants, closing loops. Advocacy matters too—joining coalitions pushes for policies like extended tax credits, as seen in U.S. rural revitalization efforts.

Practical steps include auditing emissions, piloting SAF surcharges on business trips, and partnering with producers for custom blends. This not only cuts scopes 3 footprints but yields PR wins, with 70% of consumers favoring green brands. As SAF scales, such involvement accelerates the industry’s green bet, proving collective action lifts all toward net-zero horizons.