Key Trends Shaping Tomorrow’s Skies

The next generation of airliners is being redefined by a push for sustainability, where innovations such as sustainable aviation fuels (SAF) and hydrogen propulsion aim to reduce emissions by up to 80% compared to traditional jet fuel. Electric and hybrid systems are emerging for shorter routes, promising quieter flights and lower costs, while companies like Airbus target zero-emission commercial aircraft by the 2030s.

Supersonic travel is making a comeback, with designs that minimize sonic booms to enable faster transatlantic hops, potentially cutting New York to London flights to under three hours. AI integration is streamlining everything from predictive maintenance to autonomous piloting, boosting efficiency and safety. Urban air mobility, via electric vertical takeoff and landing (eVTOL) vehicles, has the potential to transform city commutes, although challenges such as infrastructure and regulations persist. Overall, these trends point to a greener, faster, and smarter aviation future, but success hinges on collaborative innovation amid economic and environmental pressures.

Why These Trends Matter Now

Aviation handles over 4.5 billion passengers yearly, contributing 2-3% of global CO2 emissions, so the urgency for change is clear. Governments and airlines are aligning on net-zero goals by 2050, driving investments into these technologies. For travelers, this means more eco-friendly options without sacrificing speed or comfort; for the industry, it’s about survival in a regulated world.

Quick Wins and Long-Term Bets

- Short-term (2025-2030): Widespread SAF adoption and hybrid-electric regional jets to meet immediate emission cuts.

- Mid-term (2030-2040): Hydrogen and full-electric airliners entering service on key routes.

- Long-term (2040+): Supersonic fleets and AI-fully autonomous flights as standard.

These shifts aren’t without hurdles—battery limitations, high costs, and supply chain issues loom large—but the momentum is building toward a resilient sector.

Table of Contents

Imagine boarding a plane that runs on nothing but water vapor, zips across continents in half the time of today, or even lifts off vertically from a city rooftop to dodge traffic jams. This isn’t science fiction; it’s the horizon of commercial aviation in the coming decades. As the world grapples with climate change and booming air travel demand, projected to double by 2040, the aerospace industry is undergoing a profound transformation. Driven by regulatory pressures, technological breakthroughs, and a collective push for sustainability, the next generation of airliners promises to be cleaner, faster, and smarter than ever before.

These evolutions are trends like advanced propulsion systems, artificial intelligence integration, and novel materials that could redefine how we fly. Major players such as Airbus, Boeing, and innovative startups are pouring billions into research, with governments like those backing NASA’s initiatives adding fuel to the fire. This article dives deep into these developments, exploring their mechanics, real-world examples, and the roadblocks ahead. Whether you’re a frequent flyer curious about greener skies or an enthusiast tracking aviation’s future, here’s a comprehensive look at what’s propelling the industry forward.

The Sustainability Imperative: Cutting Emissions Without Grounding Growth

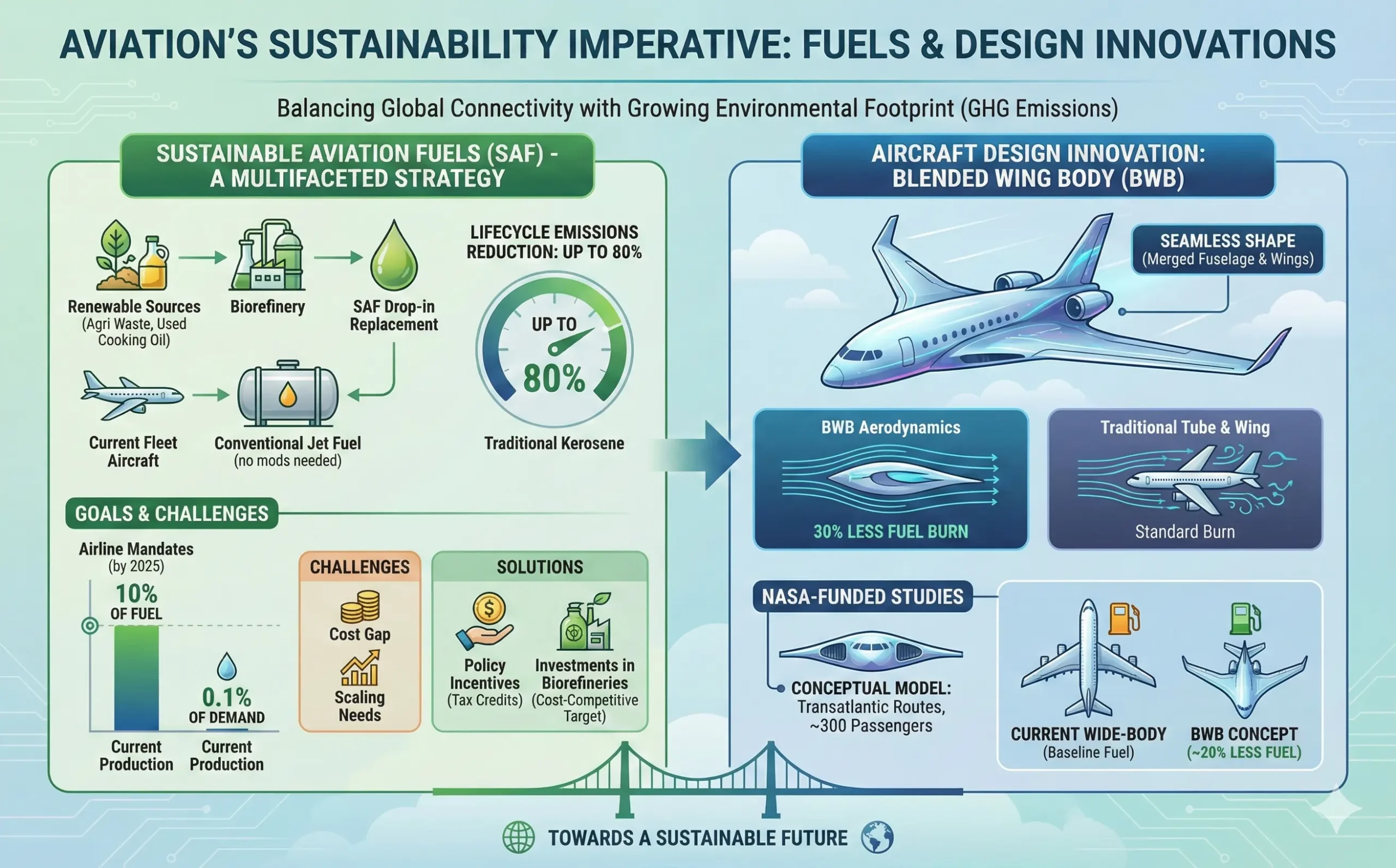

Aviation’s environmental footprint is under intense scrutiny, with the sector responsible for a growing slice of global greenhouse gases. Yet, air travel remains indispensable for connecting economies and cultures. The response? A multifaceted strategy centered on sustainable aviation fuels (SAF), which are drop-in replacements for conventional jet fuel made from renewable sources like agricultural waste and used cooking oil. Unlike traditional kerosene, SAF can reduce lifecycle emissions by up to 80%, and it’s already blending into existing fleets without needing aircraft modifications.

Take the example of major carriers committing to SAF mandates: by 2025, some airlines aim for 10% of their fuel to come from these sources, scaling up as production ramps. This isn’t just greenwashing; it’s backed by investments in biorefineries that could make SAF cost-competitive within a decade. However, challenges persist as current production meets only 0.1% of demand, and scaling requires policy incentives like tax credits to bridge the price gap.

Beyond fuels, the push for efficiency extends to aircraft design. Blended Wing Body (BWB) configurations, which merge the fuselage and wings into a seamless shape, promise 30% less fuel burn through better aerodynamics. NASA is funding studies on these, envisioning airliners that glide more efficiently while carrying the same passenger loads. In one conceptual model, a BWB could seat 300 travelers across transatlantic routes, sipping 20% less fuel than today’s wide-bodies.

| Propulsion Technology | Emission Reduction Potential | Current Status | Key Challenges | Example Projects |

|---|---|---|---|---|

| Sustainable Aviation Fuels (SAF) | Up to 80% lifecycle CO2 cut | Blending in commercial flights; 10% target by 2030 | Production scaling, higher costs (2-4x traditional fuel) | Airlines committing to 5-10% SAF use by 2025; biorefinery expansions |

| Hybrid-Electric Systems | 20-50% for short-haul | Prototypes in testing; regional jets by 2030 | Battery weight limits range to 500 miles | Airbus E-Fan X demonstrator (hybrid retrofits) |

| Hydrogen Fuel Cells | Near-zero in-flight emissions | Ground tests ongoing; entry into service 2035+ | Storage (cryogenic tanks add weight), infrastructure | Airbus ZEROe concepts: turbofan, turboprop, blended-wing variants |

| Full Electric | 100% zero-emission for short routes | Small commuter planes certified; airliners by 2040 | Energy density for long-haul (current batteries limit to 200-300 miles) | Bye Aerospace eFlyer 2 for regional ops |

This table highlights how these technologies layer onto each other, forming a roadmap from incremental gains to revolutionary shifts. For instance, hybrid systems bridge the gap, using electric motors for takeoff and climb phases that guzzle the most fuel, while relying on SAF for cruise.

Electric Propulsion: Powering Up for Shorter, Greener Hops

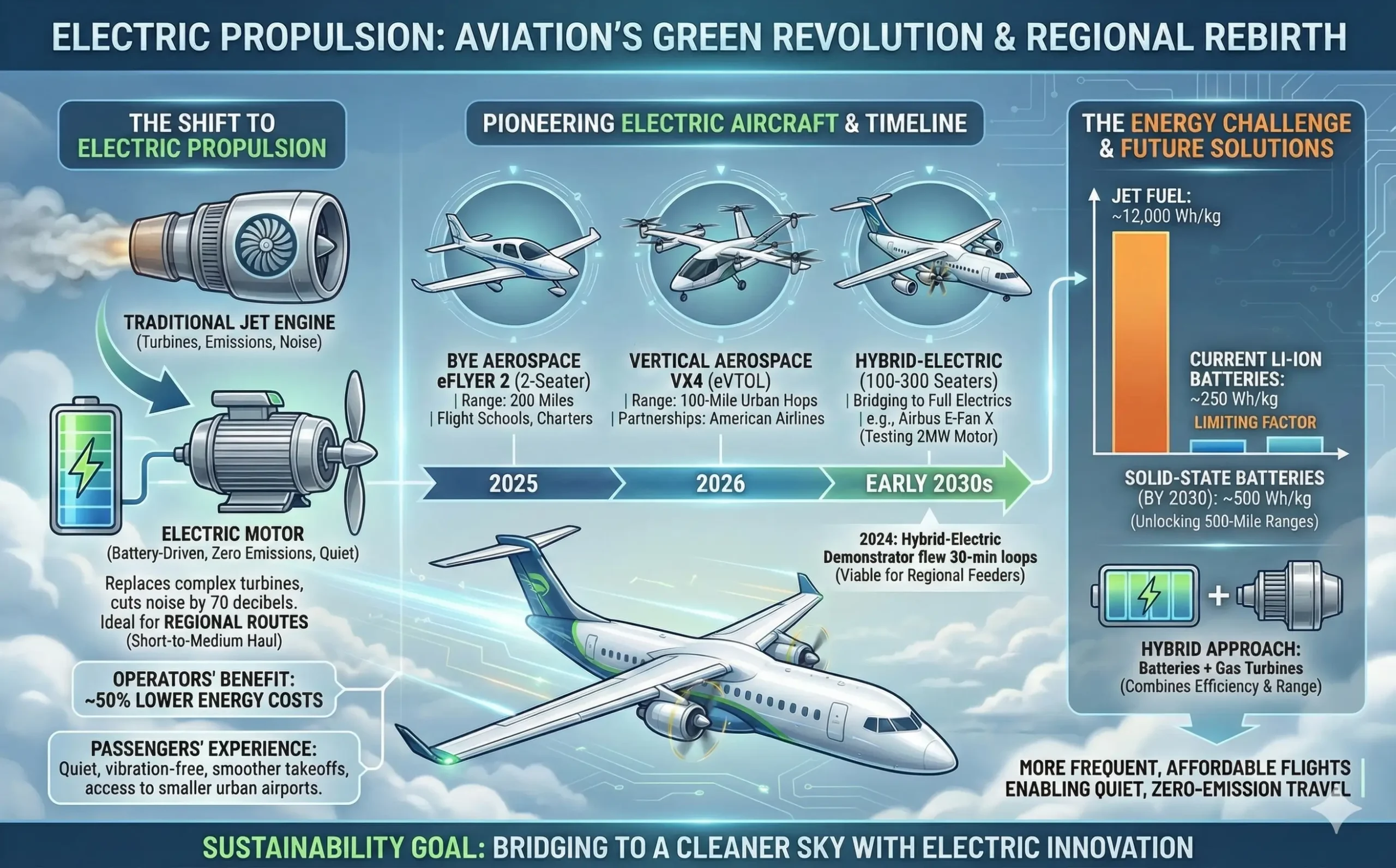

Electric aircraft are the low-hanging fruit in aviation’s green revolution, ideal for regional routes where battery limitations aren’t as crippling. Picture a quiet, vibration-free flight from Boston to New York, emitting zero tailpipe pollutants and costing operators half as much in energy. Battery-electric propulsion replaces jet engines with electric motors driven by lithium-ion packs, slashing noise by 70 decibels and enabling operations from smaller, urban-adjacent airports.

Companies are already certifying these birds: the eFlyer 2, a two-seater from Bye Aerospace, boasts a 200-mile range and is slated for delivery in 2025, targeting flight schools and charters. Scaling to airliners, Vertical Aerospace’s VX4 eVTOL aims for 100-mile urban hops, with partnerships like American Airlines backing certification by 2026. The appeal? Lower maintenance—no complex turbines means fewer parts to fail—and instant torque for smoother takeoffs.

Yet, the elephant in the room is energy density. Today’s batteries pack about 250 watt-hours per kilogram, far short of jet fuel’s 12,000. Advances in solid-state batteries could double that by 2030, unlocking 500-mile ranges. Hybrid variants smartly combine batteries with gas turbines, as seen in Airbus’s E-Fan X project, which retrofitted a BAe 146 with a 2-megawatt electric motor for testing. This hybrid approach could enter service on 100-300 seaters by the early 2030s, bridging to full electrics.

Real-world testing underscores the progress. In 2024, a hybrid-electric demonstrator flew 30-minute loops, proving the tech’s viability for regional feeders. For passengers, this means more frequent, affordable flights without the roar of jets, imagine sipping coffee in near-silence en route to a business meeting.

Hydrogen: The Clean Fuel Poised for Takeoff

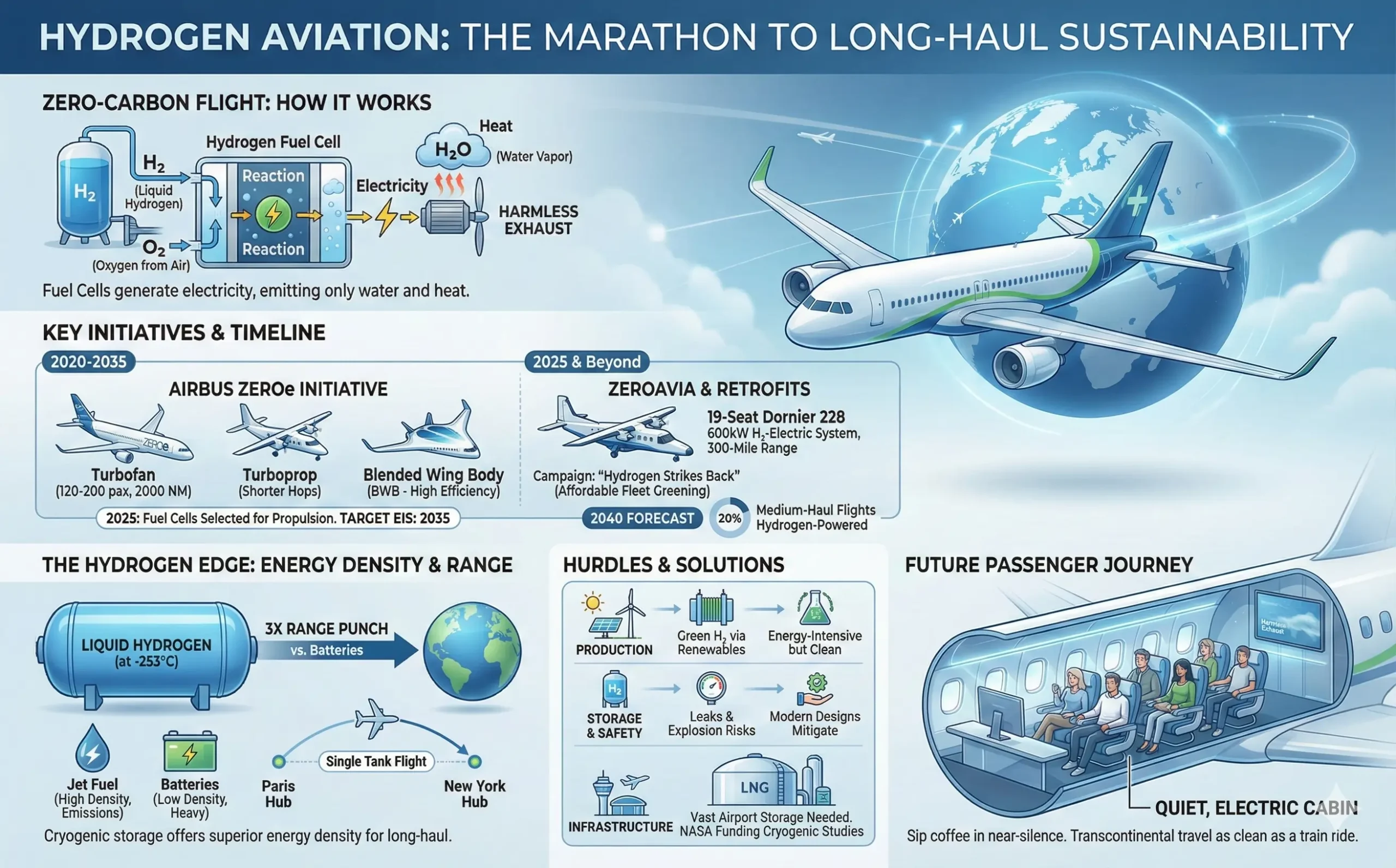

If electric is the sprint, hydrogen is the marathon for long-haul sustainability. Hydrogen fuel cells generate electricity through a reaction with oxygen, emitting only water and heat—perfect for zero-carbon flight. Airbus’s ZEROe initiative exemplifies this, unveiling three concepts in 2020: a turbofan for 120-200 passengers over 2,000 nautical miles, a turboprop for shorter hops, and a BWB for efficiency. By 2025, they’ve selected fuel cells over combustion for propulsion, targeting entry into service by 2035.

Hydrogen’s edge lies in its energy density when stored as liquid at -253°C, offering three times the range punch of batteries. A ZEROe airliner could fly Paris to New York on a single tank, refueling at dedicated cryogenic hubs. ZeroAvia is leading smaller-scale efforts, powering a 19-seat Dornier with a 600kW hydrogen-electric system, achieving a 300-mile range in tests. Their “Hydrogen Strikes Back” campaign highlights how retrofits could green existing fleets affordably.

Challenges abound: producing green hydrogen (via electrolysis with renewables) is energy-intensive, and leaks pose explosion risks, though modern designs mitigate this. Infrastructure lags too; airports need vast storage for liquid hydrogen, akin to LNG terminals. Despite delays, like Airbus pushing back timelines due to supply chain woes, momentum builds. NASA’s funding for cryogenic hydrogen studies with JetZero signals a U.S. commitment, aiming for 30% fuel savings in blended designs.

Envision the passenger experience: a flight where your exhaust is harmless mist, and the cabin hums with the whisper of electric props. By 2040, hydrogen could power 20% of medium-haul flights, per industry forecasts, making transcontinental travel as clean as a train ride.

Reviving Speed: Supersonic and Hypersonic Horizons

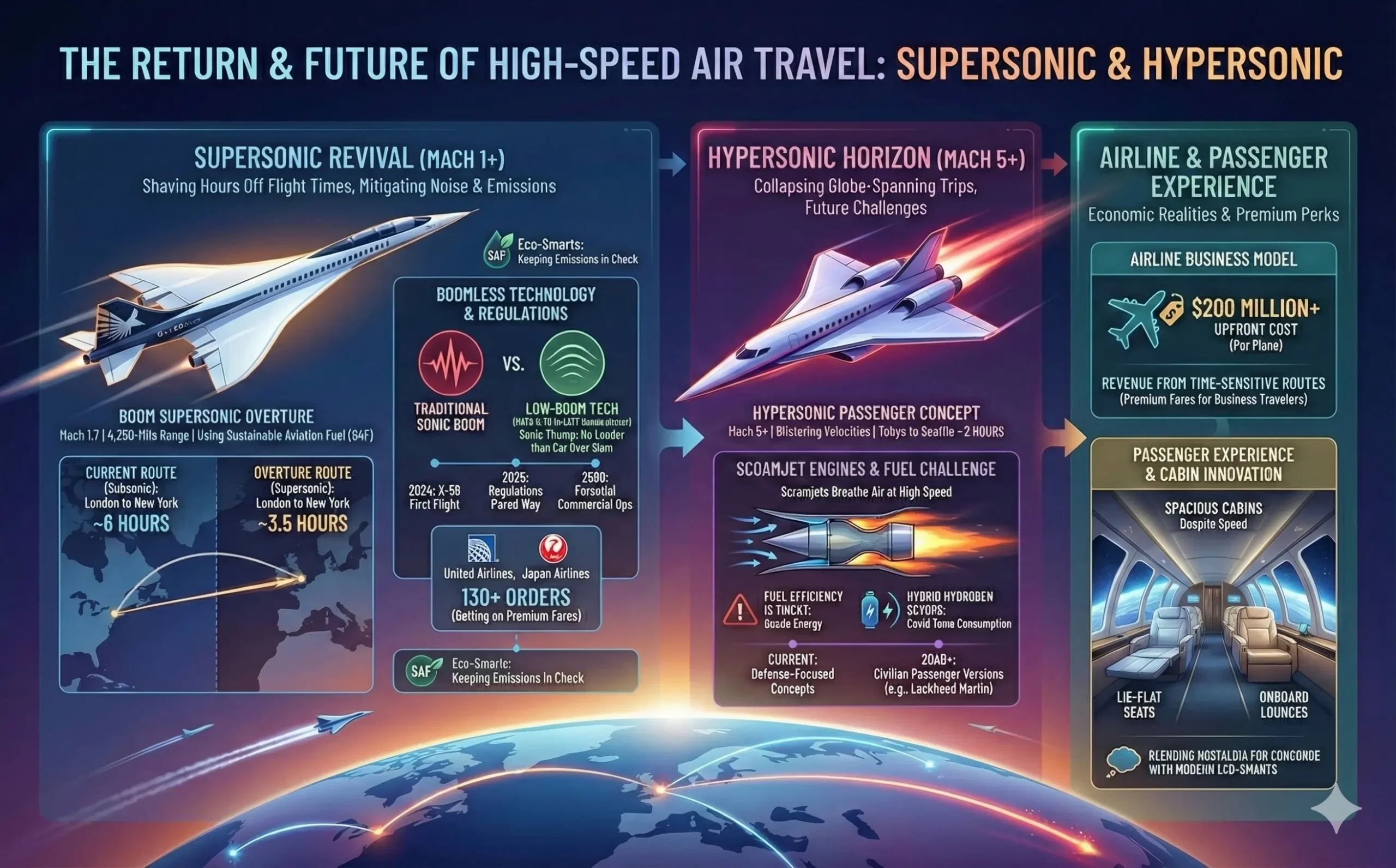

Who wouldn’t want to shave hours off a flight? Supersonic travel, clocking Mach 1+ speeds, is roaring back after decades grounded by noise bans. Boom Supersonic’s Overture jet promises 4,250-mile ranges at Mach 1.7, linking London to New York in 3.5 hours—versus six today—using SAF to keep emissions in check. Their “boomless” design, shaped to soften shockwaves, could lift overland flight restrictions, opening domestic supersonic routes.

NASA’s X-59 QueSST demonstrator tests this low-boom tech, aiming for sonic thumps no louder than a car door slam. First flight in 2024 paved the way for 2025 regulations, potentially greenlighting commercial ops by 2030. Boom has 130+ orders, including from United Airlines, betting on premium fares for business travelers.

Pushing further, hypersonic speeds (Mach 5+) could collapse globe-spanning trips: Tokyo to Seattle in two hours. While defense-focused now, civilian concepts from Lockheed Martin envision passenger versions by 2040, using scramjet engines that breathe air at blistering velocities. Fuel efficiency here is tricky—hypersonics guzzle energy—but hybrid hydrogen setups could tame that.

For airlines, supersonic means revenue from time-sensitive routes, but upfront costs top $200 million per plane. Passenger perks? Spacious cabins despite speed, with Boom’s rendering showing lie-flat seats and onboard lounges. As regulations evolve, expect a supersonic renaissance, blending nostalgia for Concorde with modern eco-smarts.

| Timeline of Supersonic Milestones | Description | Key Players | Expected Impact |

|---|---|---|---|

| 2025: Low-Boom Flight Tests | NASA X-59 validates quiet supersonic over land | NASA, Lockheed Martin | Regulatory approval for overland routes |

| 2029: First Commercial Supersonic Flight | Boom Overture certification and debut | Boom Supersonic, United Airlines | 50% faster transoceanic travel |

| 2035: Hypersonic Prototypes | Scramjet demos for passenger viability | Boeing, Hermeus | Sub-3-hour intercontinental flights |

| 2040+: Fleet Integration | 10% of long-haul market supersonic/hypersonic | Multiple OEMs | $100B+ market; reduced jet lag economics |

This roadmap shows how incremental tests build to transformative fleets, potentially reshaping global connectivity.

AI and Automation: The Brains Behind Smarter Skies

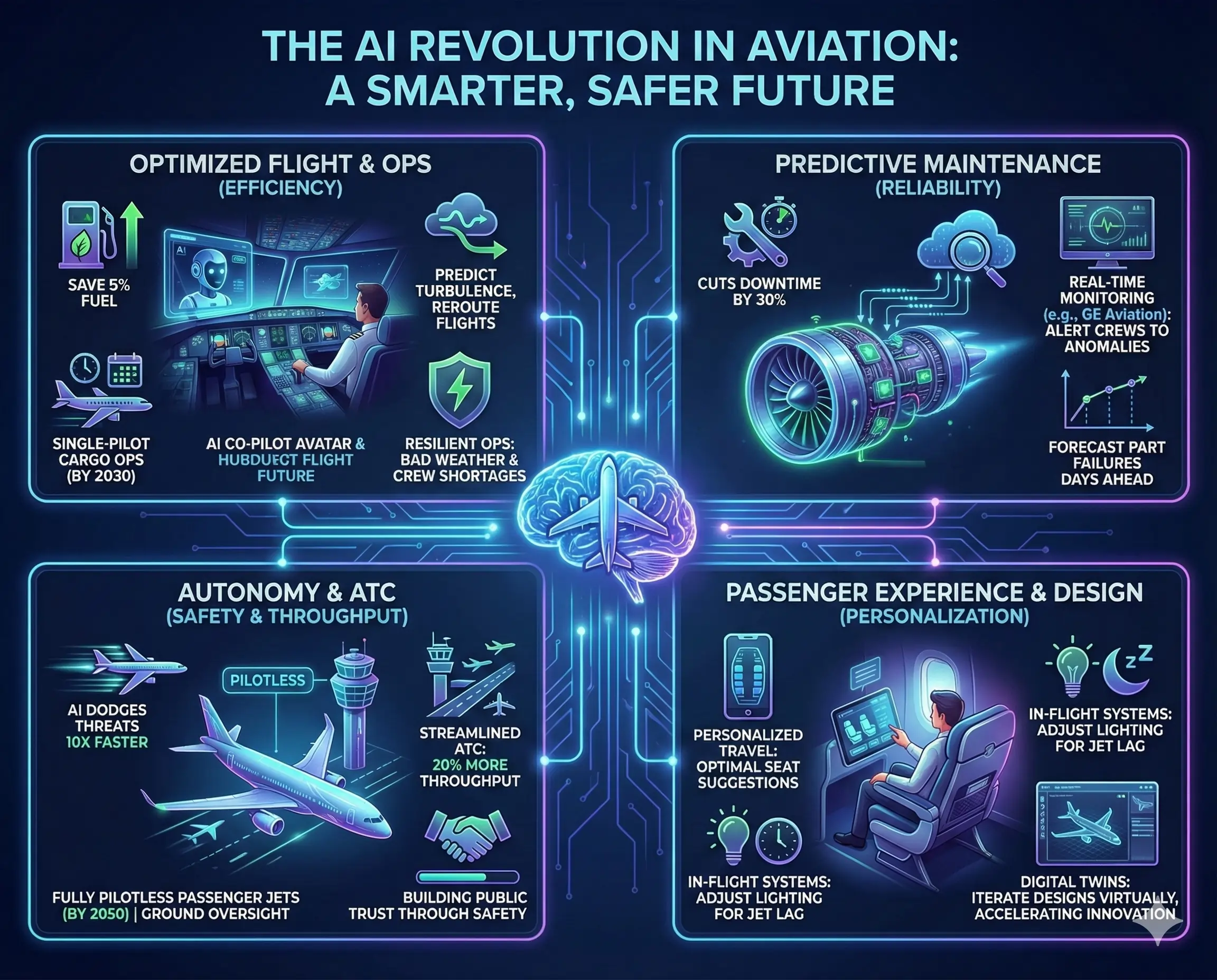

No trend is more pervasive than artificial intelligence (AI), weaving into every facet of aviation. From design to dispatch, AI optimizes for efficiency: machine learning algorithms predict turbulence, rerouting flights to save 5% fuel. In cockpits, AI co-pilots handle routine tasks, freeing humans for complex decisions—single-pilot ops for cargo could roll out by 2030.

Predictive maintenance is a game-changer: sensors feed data to AI models that forecast part failures days, cutting downtime by 30%. GE Aviation’s systems, for example, monitor engines in real-time, alerting crews to anomalies before they escalate. On the ground, AI streamlines air traffic control, packing runways tighter for 20% more throughput.

Autonomy takes it further: fully pilotless passenger jets by 2050, starting with regional routes under ground oversight. Public trust builds slowly—safety records must outshine humans’—but simulations show AI dodging mid-air threats 10 times faster. For airliners, this means resilient ops in bad weather or crew shortages.

Engagingly, AI personalizes travel: apps suggesting optimal seats based on preferences, or in-flight systems adjusting lighting to combat jet lag. As digital twins—virtual replicas of aircraft—evolve, engineers iterate designs virtually, accelerating innovation cycles.

Urban Air Mobility: From Roads to Skies in Megacities

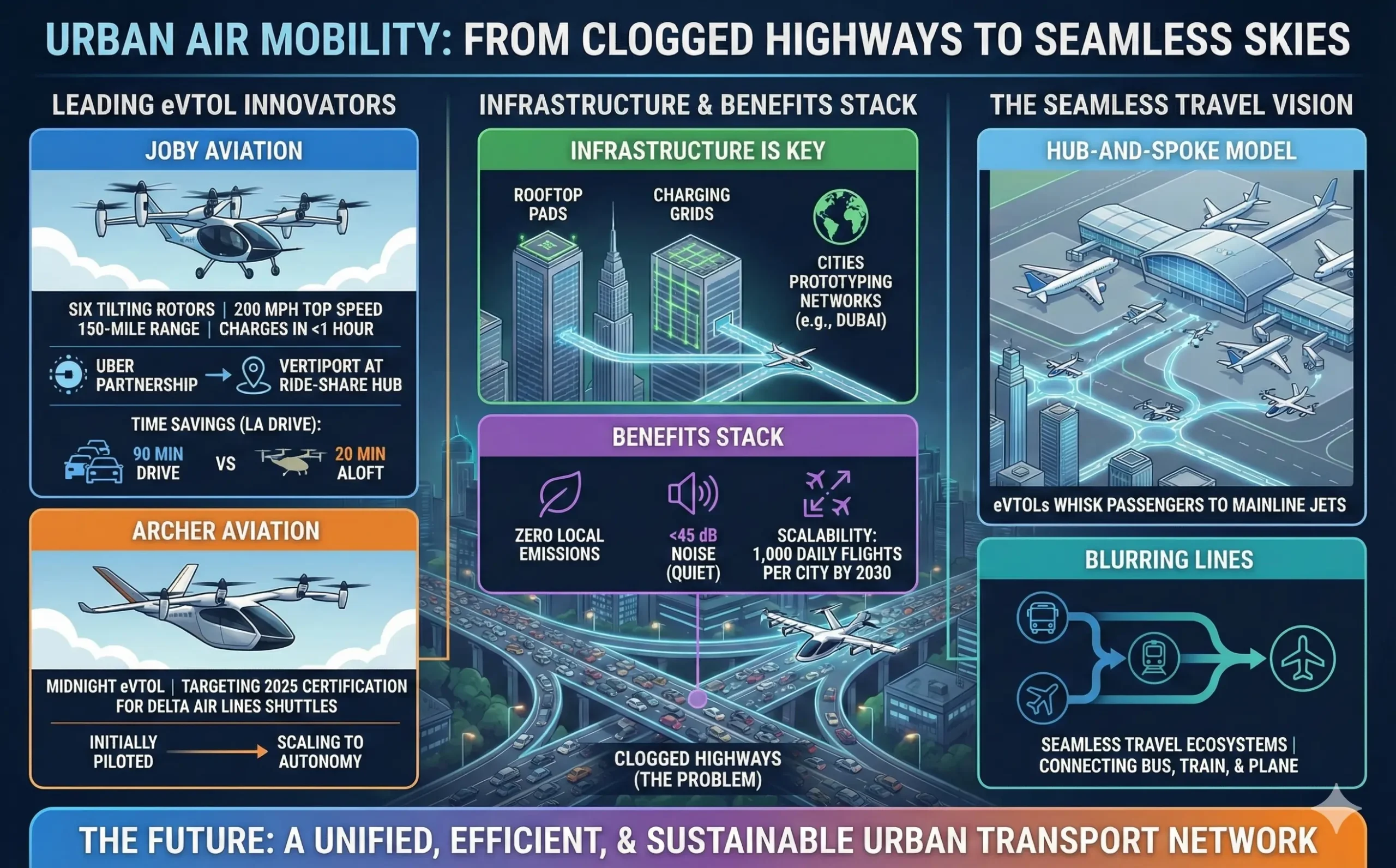

Clogged highways? Enter urban air mobility (UAM), where eVTOLs ferry passengers above the fray. Joby Aviation’s air taxi, with six tilting rotors, hits 200 mph for 150-mile trips, charging in under an hour. Partnerships with Uber envision vertiports at ride-share hubs, turning a 90-minute LA drive into 20 minutes aloft.

Archer Aviation targets a similar goal, with Midnight eVTOLs certifying in 2025 for Delta Air Lines shuttles. These aren’t toys; they’re piloted initially, scaling to autonomy. Benefits stack: zero local emissions, noise under 45 dB, and scalability for 1,000 daily flights per city by 2030.

Infrastructure is key—rooftop pads and charging grids—but cities like Dubai are prototyping networks. For airliners, UAM feeds into “hub-and-spoke” models, where eVTOLs whisk you to mainline jets. The vision? Seamless travel ecosystems, blurring lines between bus, train, and plane.

| UAM Vehicle Comparison | Range (miles) | Passenger Capacity | Top Speed (mph) | Entry Year | Lead Developer |

|---|---|---|---|---|---|

| Joby S4 | 150 | 4 + pilot | 200 | 2025 | Joby Aviation |

| Archer Midnight | 100 | 4 + pilot | 150 | 2025 | Archer Aviation |

| Lilium Jet | 155 | 6 | 175 | 2026 | Lilium |

| Volocopter VoloCity | 22 | 2 | 63 | 2024 (urban trials) | Volocopter |

These specs illustrate UAM’s focus on short, frequent hops, complementing traditional airliners.

Advanced Materials and Manufacturing: Building Lighter, Stronger

Underpinning all trends are advanced materials such as carbon composites and alloys, which shave 20% off airframe weight for greater efficiency. Additive manufacturing—3D printing—speeds prototyping, crafting complex parts in days versus months. Boeing’s use of laser-sintered titanium for engine brackets cuts waste by 90%.

These enable bolder designs: flexible wings that morph mid-flight for optimal lift, or self-healing polymers that patch micro-cracks. Supply chains are digitizing too, with blockchain helping ensure the ethical sourcing of rare earths for batteries.

Navigating Challenges: Regulations, Costs, and Collaboration

No revolution is smooth. Battery fires, hydrogen leaks, and AI biases demand rigorous testing. Costs—$10-15 billion per new airliner program—strain budgets, exacerbated by 2025’s supply disruptions. Regulations lag tech; FAA approvals for eVTOLs could take years.

Yet, collaboration shines: Airbus-Boeing pacts on SAF standards, NASA’s $11.5 million grants for sustainable concepts. Public buy-in grows via demos, like Boom’s supersonic flyovers.

A Soaring Future: What Lies Ahead

By 2050, airliners could be 70% more efficient, with hydrogen dominating long-haul and electrics regional skies. Supersonic options cater to elites, while UAM democratizes short trips. AI ensures it’s all safer, greener. The next generation isn’t just about planes—it’s reimagining mobility for a connected planet. As these trends converge, buckle up: the skies are about to get a whole lot more exciting.

Key Citations And References

- Top Trends Shaping the Aerospace Industry in 2025

- Top 10 Aerospace and Defense Industry Trends

- The Future of Aerospace: Trends and Predictions

- The Future of Commercial Aviation: A 20-50 Year Outlook

- ZEROe: our hydrogen-powered aircraft – Airbus

- NASA Funds New Studies Looking at Future of Sustainable Aircraft

- Future Of Aviation – Dubai Airshow 2025

- Leeham News and Analysis Evaluates Next Generation Airliner

- NASA’s AACES program funds future concepts for sustainable airliners

- Sustainable Aviation Fuels and Advanced Propulsion Tech Will Help Industry Achieve Net Zero Goals by 2050

Read These Articles in Detail

- Aerospace Engineering vs. Mechanical Engineering

- The Future of Aerospace Propulsion Systems

- How Aerospace Education Is Adapting to Industry Demands

- The Role of Aerospace in Combating Climate Change

- Aerospace Radar Technology: Past, Present, and Future

- The Role of Aerospace in National Security Strategies

- The Role of Nanotechnology in Aerospace Materials

- Aerospace Materials: Stronger, Lighter, And Smarter

- Aerospace Engineering Explained: A Beginner’s Guide

- Electric Aircraft vs. Hydrogen Aircraft: Which Is More Sustainable?

- Hypersonic Weapons: Aerospace’s New Arms Race

- Aerospace Defense Systems: From Drones to Hypersonic Missiles

- How Aerospace Engineers Reduce Fuel Consumption

- Computational Fluid Dynamics in Aerospace Innovation

- The Global Aerospace Market Outlook: Trends and Forecasts

- Satellite Surveillance: Aerospace’s Role in Modern Warfare

- How Aerospace Companies Are Reducing Environmental Impact

- How Airlines Use Aerospace Data Analytics to Cut Costs

- Aerospace Engineering Challenges: Innovation and Sustainability

- The Role of CFD in Aerospace Engineering

- The Role of Women in Aerospace: Breaking Barriers in the Skies

- Sustainable Aviation Fuels: The Aerospace Industry’s Green Bet

- Aerospace Cybersecurity: Protecting the Skies from Digital Threats

- Aerospace Trends Driving the Next Generation of Airliners

- The Rise of Autonomous Aerospace Systems

- How to Start a Career in Aerospace Engineering

- Can Aerospace Go Carbon Neutral by 2050?

- The Role of Aerospace in Missile Defense Systems

- How Aerospace Engineers Use AI in Design

- Top 10 Aerospace Engineering Innovations of the Decade

- Top Aerospace Careers in 2025 and Beyond

- How Aerospace Innovations Shape Global Defense Policies

- Hydrogen-Powered Aircraft: The Next Green Revolution

- Top 10 Emerging Aerospace Technologies Transforming the Industry

- The Future of Hypersonic Flight: Challenges and Opportunities

- How AI Is Revolutionizing Aerospace Engineering

- Additive Manufacturing in Aerospace: 3D Printing the Future of Flight

- The Rise of Electric Aircraft: Are We Ready for Zero-Emission Aviation?

- Aerospace Materials of Tomorrow: From Composites to Nanotechnology

- Digital Twins in Aerospace: Reducing Costs and Improving Safety

- The Role of Robotics in Modern Aerospace Manufacturing

- Quantum Computing Applications in Aerospace Design

- How Augmented Reality Is Changing Aerospace Training

- Space Tethers Explained: The Next Leap in Orbital Mechanics

- Ion Propulsion vs. Chemical Rockets: Which Will Power the Future?

- The Role of Nuclear Propulsion in Deep Space Missions

- Space Mining: The Aerospace Industry’s Next Gold Rush

- How Reusable Rockets Are Reshaping the Space Economy

- The Artemis Program: NASA’s Return to the Moon

- Space Tourism: Business Model or Billionaire’s Playground?

- How Aerospace Startups Are Disrupting Commercial Aviation

- The Economics of Low-Cost Airlines in the Aerospace Era

- Urban Air Mobility: The Rise of Flying Taxis

- The Future of Mars Colonization: Key Aerospace Challenges and Solutions Ahead

- CubeSats and Small Satellites: Democratizing Space Access

- The Future of Cargo Drones in Global Logistics

- The Role of Aerospace in Building a Lunar Economy

Frequently Asked Questions

FAQ 1: What Are the Top Aerospace Trends Shaping Airliners in 2025?

The aerospace industry in 2025 is buzzing with innovations that promise to make flying more efficient, eco-friendly, and accessible. At the forefront, sustainable aviation is no longer a buzzword but a core driver, with airlines and manufacturers ramping up efforts to meet global net-zero targets by 2050. This year has seen a surge in investments into clean technologies, fueled by regulatory pressures and consumer demand for greener travel. From fuel alternatives to smart systems, these trends are transforming how we think about air travel.

One major shift is toward hybrid-electric propulsion, which combines traditional engines with electric motors to cut fuel use by up to 30% on short routes. Companies are testing prototypes that could enter service soon, offering quieter cabins and lower operating costs. Another exciting development is the integration of artificial intelligence for everything from route optimization to real-time safety checks, potentially boosting on-time performance by 15%. Meanwhile, urban air mobility is gaining traction, with electric vertical takeoff and landing vehicles poised to ease city congestion.

To break it down further, here are some standout trends with their potential impacts:

- Hydrogen Propulsion: Advances in fuel cell tech could enable zero-emission long-haul flights by the early 2030s, with ongoing ground tests showing promising efficiency gains.

- Supersonic Revival: Low-boom designs are clearing regulatory hurdles, aiming to halve transatlantic flight times while using sustainable fuels.

- Advanced Manufacturing: 3D printing and composites are speeding up production, reducing aircraft weight and assembly times by 20-40%.

These trends aren’t isolated; they’re converging to create a more resilient aviation ecosystem. For instance, AI is optimizing hydrogen storage designs, while eVTOLs feed into larger networks of efficient airliners. As 2025 wraps up, expect even more prototypes in the sky, signaling a pivotal year for sustainable skies.

FAQ 2: How Does Sustainable Aviation Fuel Work and Why Is It Gaining Momentum in 2025?

Sustainable aviation fuel, or SAF, is essentially a drop-in alternative to conventional jet fuel, produced from renewable sources like plant oils, agricultural waste, and even municipal garbage. Unlike traditional kerosene derived from fossil fuels, SAF is created through processes such as hydrotreated esters and fatty acids, which convert these feedstocks into hydrocarbons that burn cleanly in existing engines. This means no need for costly aircraft retrofits, making it a practical first step toward decarbonization. In 2025, production has scaled up significantly, with global capacity hitting over 1 billion liters, driven by mandates requiring airlines to blend at least 5-10% SAF in their fuel mixes.

The appeal of SAF lies in its lifecycle emissions reduction, which can slash carbon output by 80% compared to fossil fuels, depending on the feedstock. For example, a flight from New York to London using SAF could avoid emitting thousands of tons of CO2 equivalent, contributing to broader climate goals. This year, airlines have committed to billions in off-take agreements, spurred by incentives like tax credits and carbon pricing. However, challenges remain: SAF still costs 2-4 times more than regular fuel, and supply chains are stretched thin, prompting calls for more biorefineries worldwide.

As adoption grows, SAF is evolving beyond blends into full-drop solutions for new aircraft designs. It’s not just about emissions; it enhances energy security by diversifying away from oil imports. By mid-2025, major hubs like Amsterdam and San Francisco reported 20% SAF usage in departures, setting a precedent for global rollout. For passengers, this translates to guilt-free getaways, with airlines transparently tracking and reporting SAF contributions on tickets. Looking ahead, SAF could power 10% of aviation fuel by 2030, bridging the gap to revolutionary tech like hydrogen.

FAQ 3: What Is the Current Status of Hydrogen-Powered Aircraft Development in 2025?

Hydrogen propulsion represents a game-changer for aviation, offering near-zero in-flight emissions by converting the gas into electricity via fuel cells or burning it directly in modified engines. In 2025, projects like Airbus’s ZEROe have made strides, focusing on cryogenic storage and efficient powertrains to enable commercial viability. These efforts build on years of R&D, with recent milestones including advanced fuel cell tests that boost energy density for longer ranges.

To illustrate the progress, here’s a timeline of key developments for major hydrogen aircraft initiatives:

| Project | Key Milestone in 2025 | Range Target | Expected Entry into Service | Lead Developer |

|---|---|---|---|---|

| ZEROe Turbofan | Fuel cell integration tests completed in November, achieving 2,000 nautical miles | 2,000+ nm | 2035 | Airbus |

| ZEROe Blended Wing Body | Heat exchanger prototypes for thermal management validated with partners | 1,500 nm | 2037 | Airbus with Conflux Technology |

| Hydrogen-Electric Regional Jet | Ground demos of 600kW systems on 19-seater, expanding to 50 passengers | 300-500 nm | 2030 | ZeroAvia |

| NASA CRYO | Cryogenic hydrogen tank studies funded, aiming for 30% fuel savings in hybrids | N/A (research) | Mid-2030s | NASA with JetZero |

This table highlights how 2025 has been a year of validation rather than full flights, with collaborations accelerating component maturity. Airbus, for instance, showcased updated roadmaps at industry summits, reaffirming hydrogen’s role despite supply chain tweaks. Challenges like infrastructure for liquid hydrogen refueling persist, but investments are pouring in, positioning hydrogen as a cornerstone for medium- to long-haul flights by decade’s end.

FAQ 4: When Can We Expect Commercial Electric Airliners and What Benefits Do They Offer?

Electric airliners are on the cusp of reality, particularly for regional routes under 500 miles, where battery limitations are less of an issue. By late 2025, the commercial electric aircraft market has grown to nearly $7 billion, with prototypes logging thousands of flight hours and certifications advancing rapidly. Full commercial ops for small 10-20 seaters could start as early as 2026-2027, while larger hybrids for 100+ passengers might follow by 2030, thanks to breakthroughs in solid-state batteries doubling energy density.

The benefits are compelling, starting with environmental gains: zero direct emissions mean cleaner air around airports and reduced noise pollution, ideal for urban-adjacent operations. Operators save big too, with electricity costs 50-70% lower than jet fuel, and maintenance simplified by fewer moving parts. Passengers enjoy smoother, quieter rides without the roar of turbines.

Consider these practical advantages in action:

- Cost Efficiency: A regional electric flight might run operators $200 per hour versus $1,000 for traditional jets, enabling more frequent schedules.

- Sustainability Boost: Aligns with 2025’s push for 20% emission cuts, supporting airline net-zero pledges.

- Accessibility: Enables service to smaller airstrips, connecting remote areas without big infrastructure.

As batteries improve, expect electric tech to hybridize with SAF for extended ranges. Early adopters like flight schools are already flying certified models, paving the way for airliners that make short-haul travel as routine as driving.

FAQ 5: What Progress Has Boom Supersonic Made on the Overture Jet in 2025?

Boom Supersonic’s Overture jet is reigniting the dream of routine supersonic travel, designed to cruise at Mach 1.7 with capacity for 64-80 passengers over 4,250 miles. Throughout 2025, the company has notched significant wins, from regulatory breakthroughs to manufacturing ramps, positioning Overture for first flights by 2029 and service in 2030. A pivotal moment came in June when a U.S. executive order lifted the long-standing ban on overland supersonic flights, directing the FAA to craft new noise rules based on low-boom tech.

Vertically integrating production has been key, with Boom fabricating its own Symphony engine components in-house to control timelines and costs. By October, they advanced from design to metal machining for engine parts, while wind tunnel tests refined the delta-wing shape for optimal aerodynamics and sustainability using SAF. Orders now exceed 130 from carriers like United, signaling strong market confidence despite premium ticket prices.

This progress isn’t without hurdles—supply chain tweaks delayed some milestones—but Boom’s Mojave facility is humming, with subscale models proving fuel efficiency gains of 20% over predecessors like Concorde. For travelers, Overture promises halved flight times, like New York to London in 3.5 hours, in spacious cabins with modern amenities. As 2025 closes, Boom’s momentum suggests supersonic could claim 5-10% of long-haul premium routes by mid-decade.

FAQ 6: How Is AI Transforming Predictive Maintenance in Aviation by 2025?

Artificial intelligence is quietly revolutionizing aviation maintenance, shifting from reactive fixes to proactive predictions that keep planes flying longer and safer. In 2025, AI systems analyze sensor data in real-time to forecast failures, reducing unplanned downtime by 15-20% and cutting costs by 12-18%. Tools like machine learning models process vast datasets from engines and airframes, spotting anomalies humans might miss.

The global AI aviation market is valued at $7.4 billion this year, with predictive maintenance as a top application. Here’s a breakdown of its impacts:

| AI Application | Key Benefit | 2025 Adoption Example | Projected Savings |

|---|---|---|---|

| Engine Monitoring | Predicts wear 10x faster than manual checks | GE’s real-time alerts on 1,000+ fleets | 25% reduction in overhaul frequency |

| Structural Health | Detects micro-cracks via vibration data | Boeing’s digital twins for 787s | 30% less downtime |

| Fleet Optimization | Schedules parts based on usage patterns | Airlines using AI for 20% more uptime | $500M annual industry-wide |

| Supply Chain Forecasting | Anticipates part needs to avoid delays | Integrated with ERP systems | 15% lower inventory costs |

These advancements mean fewer delays for passengers and greener ops through optimized fuel use. As AI evolves, expect full integration with autonomous diagnostics by 2030.

FAQ 7: What Are eVTOL Vehicles and What’s Their Certification Progress in 2025?

Electric vertical takeoff and landing (eVTOL) vehicles are compact, battery-powered aircraft designed for short urban hops, blending helicopter agility with airplane efficiency. Think silent air taxis zipping you from downtown to the airport in 15 minutes, emitting no exhaust and costing a fraction of a cab ride. In 2025, the sector is exploding, with market projections soaring as cities pilot vertiport networks.

Certification is the big story this year, with FAA approvals accelerating under new streamlined rules. Joby Aviation and Archer Aviation lead the pack, both joining White House pilot programs for supervised trials starting in 2026. Joby completed structural load tests and began FAA-piloted flights, targeting Dubai ops via qualification paths that bypass full certification initially. Archer, meanwhile, inked deals for UAE air taxi services, racing Joby amid IP disputes but advancing Midnight eVTOL prototypes.

Key highlights include:

- Joby S4: 150-mile range, FAA Type Inspection Authorization in progress for 2026 commercial launch.

- Archer Midnight: 100-mile hops, partnerships with Delta for U.S. trials post-2025 certification.

- Global Rollout: Dubai Airshow demos showcased integrated networks, with Europe following via EASA nods.

While legal tussles like Joby’s November lawsuit against Archer add drama, the focus remains on safety and scalability. By year’s end, eVTOLs could transform commutes, making air travel as everyday as ridesharing.

FAQ 8: How Are Advanced Materials Like Carbon Composites Revolutionizing Aerospace in 2025?

Advanced materials are the unsung heroes of modern airliners, enabling lighter, stronger, and more fuel-efficient designs without compromising safety. Carbon fiber reinforced polymers (CFRPs) stand out, offering a strength-to-weight ratio five times better than steel, which translates to 20-40% weight reductions in fuselages and wings. In 2025, the aerospace composites market is booming at a 10.4% CAGR, reaching $35 billion as manufacturers like Boeing and Airbus integrate them into 70% of new builds.

These materials aren’t just lighter; they’re smarter, with innovations like self-healing resins that mend cracks autonomously and high-thermal-conductivity variants up to 15 W/mK for heat management in electric systems. At events like the Paris Air Show, Toray showcased next-gen fibers for hypersonic apps, reinforcing aerospace’s pivot to sustainability. Production via automated layup and 3D printing cuts waste by 90%, speeding timelines from years to months.

The ripple effects are profound: lighter planes burn less fuel, slashing emissions and extending ranges for hybrid designs. For passengers, this means roomier cabins and smoother flights. As supply chains stabilize post-2024 disruptions, expect composites to underpin 80% of airframes by 2030, driving a greener, faster aviation era.

FAQ 9: What Challenges Are Next-Generation Airliners Facing in 2025?

The road to next-gen airliners is paved with promise but littered with obstacles, from tech hurdles to economic pressures. In 2025, supply chain snarls continue to delay prototypes, with raw material shortages inflating costs by 15-20% across programs. Regulatory alignment is another bottleneck, as agencies like the FAA grapple with certifying novel fuels and autonomy features.

Here’s a structured overview of primary challenges and mitigation strategies:

| Challenge | Description | 2025 Impact | Strategies in Play |

|---|---|---|---|

| Battery and Hydrogen Storage | Energy density limits range; cryogenic needs add weight | Delays electric/hydrogen entries to 2030+ | Solid-state R&D, NASA-funded cryo tanks |

| High Development Costs | $10-15B per program amid inflation | Fewer startups viable; reliance on subsidies | Public-private partnerships, e.g., EU green deals |

| Infrastructure Gaps | Few SAF refineries or vertiports | Caps adoption at 5% for SAF | $2B global investments in hubs |

| Regulatory Delays | Harmonizing global standards for supersonic/eVTOL | Pushes certifications to 2026-2027 | FAA-EASA collaborations, pilot programs |

| Skilled Workforce Shortage | Need for 1M+ engineers by 2030 | Slows manufacturing ramps | Training initiatives, AI-assisted design |

Despite these, optimism prevails with $50B+ in sector funding. Collaborative forums are fostering solutions, ensuring these trends don’t stall but soar.

FAQ 10: What Does the Future Timeline Look Like for Supersonic and Hypersonic Air Travel?

Supersonic travel is set for a renaissance, with 2025 marking regulatory and tech turning points that fast-track faster flights. Boom’s Overture leads, with low-boom certifications enabling overland routes by 2029, potentially serving 500 daily passengers across oceans at Mach 1.7. Hypersonics, at Mach 5+, remain defense-oriented but inch toward civilians, with concepts promising Tokyo-LA in two hours by 2040.

Short-term, expect supersonic premiums for business routes, blending speed with SAF for eco-balance. Mid-term, fleets could integrate by 2035, capturing 10% of long-haul. Long-term visions include hypersonic hubs revolutionizing global logistics.

Notable milestones include:

- 2026-2028: Overture test flights, FAA noise approvals.

- 2030-2035: Commercial supersonic ops, hypersonic prototypes.

- 2040+: Widespread adoption, AI-piloted hypersonics.

This timeline hinges on sustained investment, but it heralds an era where distance shrinks, making the world feel smaller and more connected.

FAQ 11: What Is a Blended Wing Body Aircraft and Why Is It Gaining Traction in 2025?

The blended wing body (BWB) aircraft represents a bold departure from traditional tube-and-wing designs, merging the fuselage seamlessly into the wings to create a more aerodynamic, flying-wing shape. This configuration distributes lift more evenly across the structure, reducing drag and improving fuel efficiency by up to 50% compared to conventional airliners. In 2025, BWBs are moving from concept to prototype, driven by the urgent need for sustainable aviation amid rising emissions pressures. Companies like JetZero are leading the charge, with their Z4 model showcasing how this design could carry 250 passengers over 5,000 miles while slashing operational costs.

What makes BWBs particularly appealing now is their versatility for green technologies. The wider body allows for larger fuel tanks suited to hydrogen or sustainable aviation fuels, and the structure supports hybrid-electric systems without compromising range. A small V-shaped remote-controlled BWB took to the skies in March 2025, validating stability and control systems that had puzzled engineers for decades. This test flight marked a milestone, proving the design’s feasibility for commercial use and sparking interest from airlines seeking to meet net-zero goals by 2050.

Beyond efficiency, BWBs promise structural advantages, using advanced composites to keep weight down while enhancing cabin space. Passengers could enjoy panoramic views and quieter rides, as the engines mount higher on the body, away from windows. However, challenges like evacuation protocols and manufacturing complexity remain, though partnerships with NASA are addressing these through wind tunnel simulations.

To highlight the potential, consider this comparison of BWB concepts versus traditional airliners:

| Aspect | Traditional Tube-and-Wing | Blended Wing Body (e.g., JetZero Z4) | Projected Impact by 2030 |

|---|---|---|---|

| Fuel Efficiency | Baseline (100%) | Up to 50% improvement | $10B+ annual savings for fleets |

| Passenger Capacity | 200-300 seats | 250-450 seats with wider cabin | Enhanced comfort on long-haul routes |

| Emission Reduction | Relies on SAF/hybrids | Optimized for hydrogen/electrics | 30-40% CO2 cut per flight |

| Development Status (2025) | Mature, in service | Full-scale demo by 2027 | Certification targeted for 2035 |

As 2025 progresses, BWBs are poised to redefine air travel, blending innovation with practicality for a more sustainable future.

FAQ 12: How Is NASA Driving Sustainable Aviation Innovations in 2025?

NASA’s role in sustainable aviation has never been more critical, especially as the industry races toward net-zero emissions. In 2025, the agency is channeling billions into research that bridges lab concepts to real-world flights, focusing on everything from ultra-efficient designs to advanced propulsion. Through programs like the Sustainable Flight National Partnership, NASA collaborates with industry giants to test technologies that could cut fuel use by 30% by the 2030s. Their work isn’t just about greener skies; it’s about making aviation safer, quieter, and more accessible globally.

One standout initiative is the Advanced Air Transport Technology project, which in November 2025 funded partnerships for liquid hydrogen integration in blended-wing bodies. Universities and startups are prototyping systems that store and distribute hydrogen efficiently, addressing key hurdles like cryogenic cooling. NASA’s wind tunnels and flight simulators have logged thousands of hours this year, refining models that predict performance under real conditions. These efforts extend to urban air mobility, where NASA supports eVTOL testing to ensure seamless integration into busy airspace.

The ripple effects are felt worldwide. NASA’s data-sharing platforms enable international teams to iterate faster, accelerating certifications and reducing development costs. For instance, their collaboration with Electra.aero explores hybrid-electric regional planes that could enter service by 2030, promising shorter, emission-free hops for commuters.

Key contributions from NASA in 2025 include:

- Computational Modeling: Advanced simulations that optimize wing shapes for 20% drag reduction, shared freely with manufacturers.

- Material Testing: Development of lightweight composites for hydrogen tanks, tested in extreme conditions to ensure durability.

- Noise Reduction Tech: Active flow control systems that quiet engines by 50%, vital for community acceptance of new routes.

- Workforce Development: Grants training over 10,000 engineers in sustainable tech, building a skilled pipeline for the industry.

By fostering these innovations, NASA isn’t just funding the future—it’s engineering it, one flight at a time.

FAQ 13: What Key Advancements in AI for Air Traffic Control Are Happening in 2025?

Artificial intelligence is reshaping air traffic control (ATC) in 2025, tackling chronic issues like controller shortages and rising flight volumes with smarter, faster decision-making. The FAA’s upgraded systems now use AI to predict conflicts up to 30 minutes ahead, allowing for smoother rerouting and 10% fewer delays. This year has seen a surge in deployments, with AI analyzing trajectories in real-time to optimize spacing, especially in congested hubs like Atlanta and London Heathrow.

Globally, ICAO guidelines emphasize AI’s role in reducing emissions through efficient routing, potentially saving airlines billions in fuel. Eurocontrol’s trials have integrated AI for surveillance, cutting communication errors by 25%. Yet, human oversight remains central, with AI acting as a co-pilot rather than a replacement to build trust.

Here’s a snapshot of major AI advancements in ATC for 2025:

| Advancement | Description | Key Benefit | Leading Implementer |

|---|---|---|---|

| Trajectory Prediction | AI models forecast paths using weather and traffic data | 15% fuel savings per flight | FAA NextGen System |

| Conflict Detection | Real-time alerts for potential collisions | Reduces incidents by 20% | Eurocontrol AI4ATM |

| Automation Tools | Handles routine clearances, freeing controllers | Boosts throughput by 25% | SESAR Joint Undertaking |

| Dynamic Airspace Management | Adjusts sectors based on demand | Cuts delays by 12% | NASA Airspace Technology Demonstration |

| Integration with Drones/eVTOLs | Manages mixed traffic flows | Enables urban ops scalability | ICAO Global Framework |

These tools are proving their worth, with early adopters reporting safer, greener skies as AI evolves from helper to essential partner.

FAQ 14: What Are the Latest Regulatory Updates for Supersonic Travel in 2025?

The landscape for supersonic travel has shifted dramatically in 2025, with long-standing bans lifting to unleash innovation while prioritizing noise and environmental concerns. In June, a landmark executive order directed the FAA to repeal outdated prohibitions on overland supersonic flights, effective by year’s end. This move, aimed at reclaiming U.S. leadership in high-speed aviation, sets noise thresholds based on operational testing, allowing “boomless” designs to operate domestically for the first time since 1973.

Building on this, the FAA issued special flight authorizations for test programs, enabling companies like Boom Supersonic to conduct low-altitude trials over select corridors. Regulations now require certification for en-route noise below 75 decibels—comparable to a car door slam—pushing developers toward advanced shaping and engine tech. Internationally, ICAO is harmonizing standards, with Europe eyeing similar reforms by 2026 to avoid fragmented rules.

These updates aren’t without debate. Environmental groups advocate for stricter emission caps, given supersonic’s higher fuel burn, but proponents highlight sustainable fuels as a mitigator. By December 2026, full noise rules should be in place, potentially greenlighting commercial routes like New York to Los Angeles in under three hours.

For airlines, this means new revenue streams from premium speed services, but compliance costs could top $50 million per type. As 2025 closes, the regulatory thaw signals a supersonic revival, balancing excitement with accountability for quieter, cleaner fast flights.

FAQ 15: How Do Leading eVTOL Companies Stack Up in 2025?

The eVTOL market is heating up in 2025, with a handful of frontrunners vying for dominance in urban air mobility. Joby Aviation leads with FAA certification progress and partnerships like Toyota, while Archer Aviation pushes aggressive timelines for Delta shuttles. These electric air taxis promise to slash commute times, but differences in range, speed, and funding set them apart.

Investors are eyeing pure-play stocks, as the sector’s value climbs toward $28 billion by 2030. EHang’s autonomous focus shines in Asia, contrasting Lilium’s high-speed European ambitions. Safety and infrastructure remain key differentiators, with all facing battery and regulatory hurdles.

A quick comparison of top players:

| Company | Range (miles) | Top Speed (mph) | Capacity | Certification Status (2025) | Key Partnerships |

|---|---|---|---|---|---|

| Joby Aviation | 150 | 200 | 4 passengers + pilot | FAA Type Inspection underway | Toyota, Uber |

| Archer Aviation | 100 | 150 | 4 passengers + pilot | FAA trials starting 2026 | Delta, United |

| Lilium | 155 | 175 | 6 passengers | EASA validation flights | Lufthansa |

| EHang | 22 | 81 | 2 passengers | CAAC certified for ops | Asian regulators |

| Volocopter | 22 | 63 | 2 passengers | Urban trials in Europe | Munich Airport |

Standout strengths include:

- Joby’s Edge: Proven flight hours and vertical integration for faster scaling.

- Archer’s Hustle: Massive order book and U.S. focus for quick market entry.

- Lilium’s Reach: Longer hops suit regional networks, with jet-like efficiency.

As vertiports sprout in cities like Dubai, these companies are set to transform daily travel by late decade.

FAQ 16: How Is 3D Printing Revolutionizing Aerospace Manufacturing in 2025?

3D printing, or additive manufacturing, is no longer experimental in aerospace—it’s a cornerstone for building lighter, more complex parts that traditional methods can’t touch. In 2025, the sector’s adoption has surged, with printers churning out engine components and brackets that reduce weight by 40% and assembly time by months. This shift supports sustainability goals, as it minimizes waste and enables on-demand production for remote repairs.

Major players like Boeing and GE are printing titanium fuel nozzles that withstand extreme heat, cutting costs by 55% over forging. NASA’s contracts for metal systems highlight how 3D tech accelerates prototypes, from drone wings to satellite housings. The market is booming at 10% annually, driven by high-temperature alloys for hypersonics.

Yet, scalability is key: automated systems now handle large-scale runs, integrating with AI for design optimization.

Notable applications in 2025:

- Engine Parts: QuesTek’s printable alloys for hotter, efficient turbines.

- Structural Elements: Lightweight lattices that boost fuel savings on airliners.

- Custom Interiors: Rapid prototyping of cabin fixtures for personalized fleets.

- Supply Chain Fixes: On-site printing to dodge global disruptions.

By empowering intricate designs, 3D printing is fueling the next wave of efficient, resilient aircraft.

FAQ 17: What Economic Impacts Are Green Aviation Trends Having in 2025?

Green aviation is reshaping economics in 2025, balancing trillion-dollar revenues with sustainability investments. Airlines project $1 trillion in total income, up slightly despite fuel volatility, thanks to efficiency gains from hybrids and SAF. Yet, the push for net-zero adds pressures, with SAF mandates hiking costs but unlocking subsidies.

The sector’s 2.5% share of global CO2 drives $250 billion in potential savings from tech like BWBs. Job creation surges, with 1 million roles in green manufacturing by decade’s end.

| Trend | Economic Benefit | 2025 Cost/Investment | Projected ROI by 2030 |

|---|---|---|---|

| SAF Adoption | $66B market by 2030 | $248B fuel spend (down 5%) | 80% emission cuts, $100B savings |

| Electric/Hybrid Fleets | 50% lower ops costs | $12.5B FAA overhaul | $250B airline savings |

| AI Optimization | 10% fuel reduction | $7.4B AI market | 15% delay cuts, $50B efficiency |

| BWB Designs | 30% fuel savings | $235M prototypes | $10B fleet-wide annually |

These trends signal a resilient industry, where green bets yield long-term prosperity.

FAQ 18: How Will Passenger Experiences Evolve in Next-Generation Airliners?

Next-gen airliners are set to elevate the journey from stressful chore to seamless delight, with tech and design prioritizing comfort and connectivity. Imagine voice-activated booking that flows into boarding, where AI personalizes everything from seat lighting to meal prefs. In 2025, airlines are rolling out Wi-Fi that’s as fast as home broadband, ensuring lag-free streaming even at 35,000 feet.

Cabins in BWBs offer expansive, hotel-like spaces with lie-flat pods and mood-adaptive lighting to fight jet lag. Hybrid-electric quietude means deeper sleep, while AR windows project scenic views on cloudy days. Sustainability shines through: recycled materials and air purification rival luxury spas.

For urban hops, eVTOLs promise door-to-door ease, with apps tracking your ride in real-time. Overall, these evolutions make flying inclusive, reducing anxiety for the 60% who dread it today and turning flights into highlights of trips.

FAQ 19: What Is the Global Status of Sustainable Aviation Fuel Adoption in 2025?

Sustainable aviation fuel (SAF) adoption hit strides in 2025, with production doubling to 2 million tonnes amid mandates kicking in worldwide. Europe leads with 2% blends required, while the U.S. eyes similar via incentives, pushing airlines toward 0.7% usage. This drop-in fuel, from waste and crops, cuts lifecycle CO2 by 80%, but supply lags demand at just 0.1% of jet needs.

Offtake deals surged, with hubs like Amsterdam hitting 20% SAF departures. Challenges persist—prices 2-4x conventional—but $25 billion market projections fuel optimism. By 2030, mandates could mandate 10%, bridging to hydrogen.

Progress highlights:

- Policy Wins: UK/EU ramps to 6-10% by 2030.

- Feedstock Growth: Landfill/waste sources for scalable supply.

- Airline Pledges: Commitments for 5.5 billion gallons demand.

SAF’s momentum in 2025 underscores a pivotal shift toward cleaner skies.

FAQ 20: What Progress Has Been Made on Autonomous Airliners in 2025?

Autonomous airliners edged closer to reality in 2025, with demos proving pilotless ops in controlled settings. BETA Technologies partnered for uncrewed Alia flights by mid-2026, focusing on cargo and regional routes. Joby’s REFORPAC exercise showcased AI handling takeoffs amid fighters, earning DoD praise and $9.4 billion funding requests.

Sikorsky’s MATRIX system flew fully autonomous missions, targeting 2025 expansions for risky scenarios. Public trust builds via simulations, with IATA forecasting $1 trillion revenues enabling investments. Hurdles like redundancy and ethics loom, but hybrids—AI assisting pilots—could debut by 2030.

A timeline of key developments:

| Milestone | Description | Timeline | Impact |

|---|---|---|---|

| BETA-Near Earth Partnership | Autonomous hybrid-electric tests | H1 2026 | Cargo autonomy in 18-36 months |

| Joby DoD Exercise | Pilotless integration with manned ops | Sept 2025 | $9.4B FY26 budget boost |

| Sikorsky MATRIX Demos | Full uncrewed flights | Ongoing 2025 | Support for high-risk missions |

| AFWERX Showcases | eVTOL autonomy in exercises | Sept 2025 | Scalable urban networks |

This year’s advances signal autonomy as a safety enhancer, not replacer, for aviation’s future.