Imagine boarding a plane that glides through the skies without spewing harmful emissions, leaving behind only a trail of water vapor instead of thick plumes of carbon dioxide. This isn’t a scene from a futuristic movie—it’s the promise of hydrogen-powered aircraft, a technology that’s rapidly evolving to reshape commercial aviation. As air travel booms and climate pressures mount, the aviation industry is racing toward sustainability. Traditional jet fuel, while efficient, contributes significantly to global warming, accounting for approximately 2.5% of CO2 emissions worldwide, with non-CO2 effects, such as contrails, further increasing its influence. Enter hydrogen: a clean, abundant element that could significantly reduce these impacts.

In this deep dive, we’ll explore how hydrogen propulsion works, its game-changing benefits, the roadblocks it faces, groundbreaking projects underway, and a glimpse into a greener flying future. Buckle up—this revolution is just getting off the ground.

Table of Contents

The Urgent Need for Sustainable Aviation

Aviation has connected the world like nothing else, shrinking distances and fueling economies. But this convenience comes at a steep environmental cost. Every year, planes burn millions of tons of jet fuel—a fossil-derived kerosene that releases CO2, nitrogen oxides, and soot particles high in the atmosphere. These emissions not only trap heat but also form persistent contrails, wispy clouds that amplify warming by up to four times their CO2 equivalent. By 2050, as passenger numbers could double, aviation’s share of global climate impact might soar to 22% if unchecked.

The industry isn’t ignoring the alarm bells. Major airlines and manufacturers have pledged net-zero emissions by mid-century, but solutions like sustainable aviation fuels (SAFs)—bio-based drop-in replacements—offer only partial relief. SAFs can cut lifecycle emissions by 80%, but scaling production to meet demand is a Herculean task, and they’re still tied to carbon cycles. That’s where hydrogen-powered aircraft shine as a true zero-emission contender. Produced from renewable sources like electrolysis using solar or wind power, green hydrogen combusts or reacts to produce electricity with water as the sole byproduct. No soot means fewer contrails, and minimal NOx emissions further lighten the load on the planet.

Consider a typical short-haul flight from New York to Boston: a conventional jet guzzles about 5 tons of fuel, emitting roughly 15 tons of CO2. A hydrogen equivalent? Near-zero direct CO2, with potential for 90% overall emission reductions when factoring in production. This isn’t pie-in-the-sky dreaming; it’s backed by rigorous modeling showing hydrogen’s edge in energy-per-weight efficiency, making it ideal for weight-sensitive aviation. Yet, the shift demands innovation across the board—from aircraft design to airport infrastructure. As we stand on the cusp of this transformation in 2025, the stakes couldn’t be higher: sustainable skies or stalled progress?

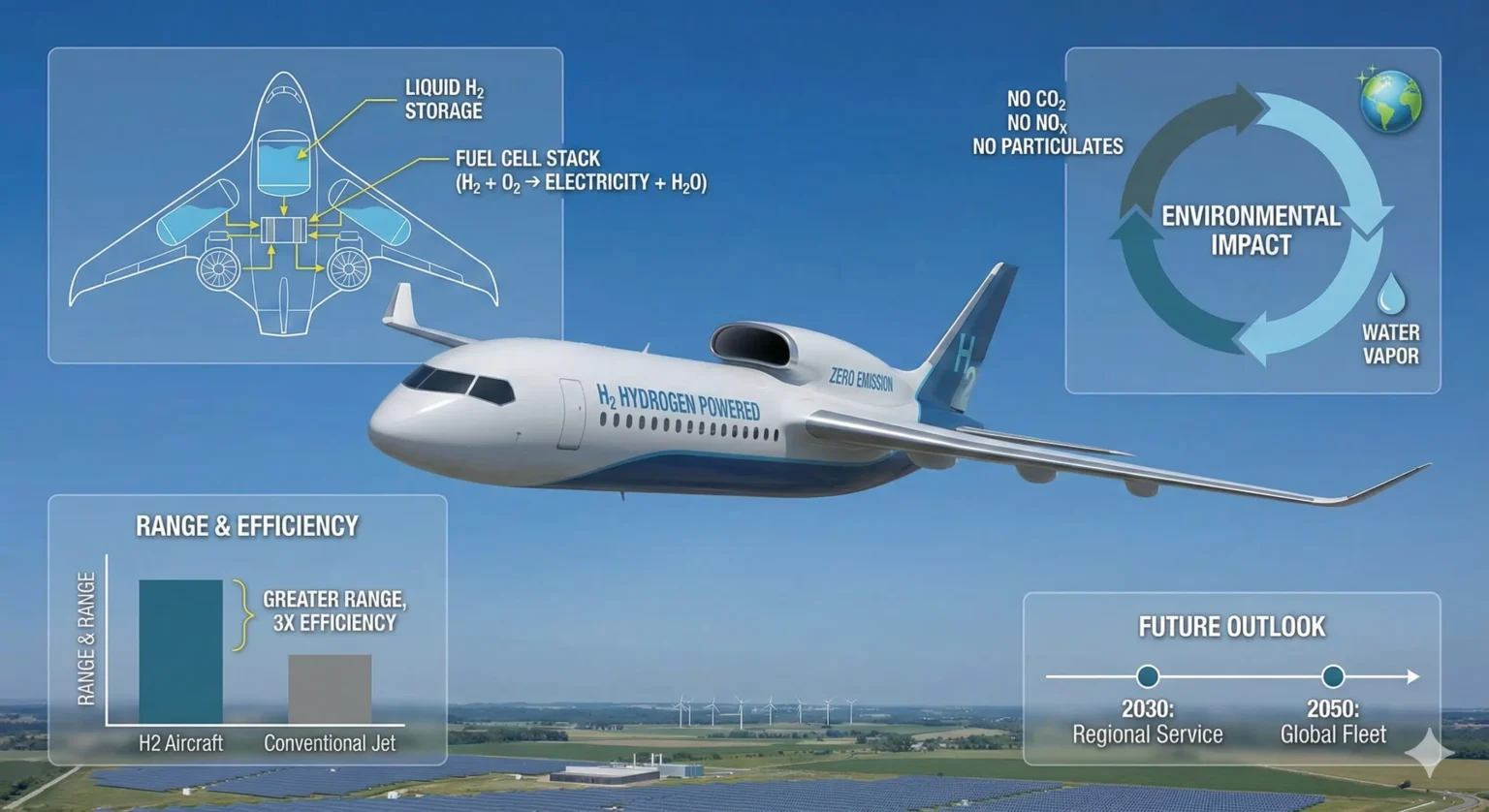

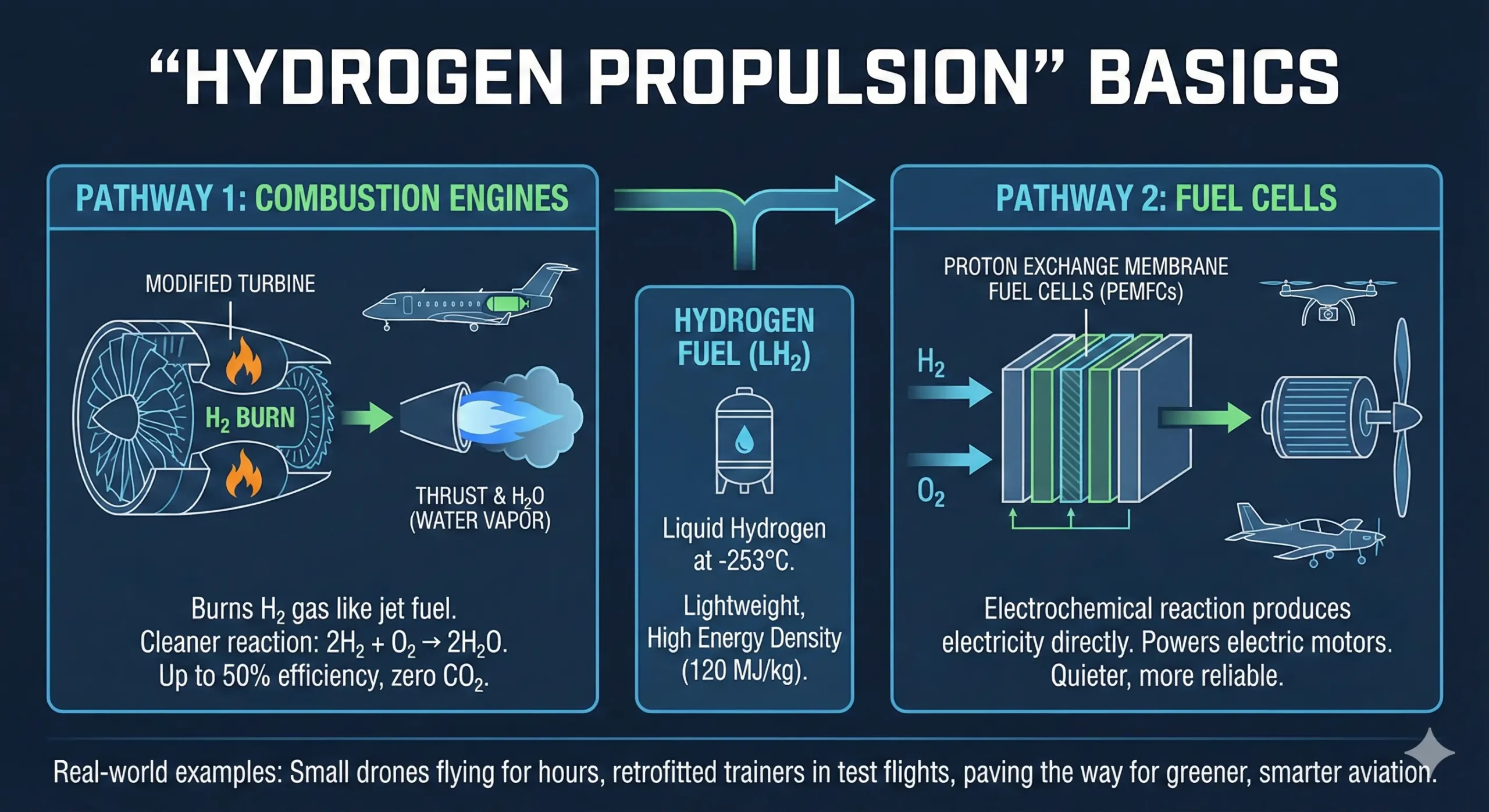

Understanding Hydrogen Propulsion Basics

Hydrogen propulsion swaps fossil fuels for the universe’s most abundant element, harnessing its energy through two primary pathways: combustion or fuel cells. In hydrogen combustion engines, the gas burns in modified turbines, much like jet fuel today, but with cleaner results. The reaction—2H2 + O2 → 2H2O—generates intense heat, which spins the turbine blades, propelling the aircraft forward. Early prototypes show that these engines can achieve efficiencies of up to 50%, rivaling kerosene burners while reducing CO2 emissions to zero.

The more revolutionary approach is hydrogen fuel cells, which electrochemically combine hydrogen with oxygen to produce electricity directly. This powers electric motors driving propellers or fans, eliminating moving parts in the engine core for quieter, more reliable operation. Proton exchange membrane fuel cells (PEMFCs) dominate here, operating at low temperatures and scaling well for aviation. Stacks of these cells can deliver megawatts of power; for instance, a 1.2-megawatt system has already powered on in test rigs, lighting the path for commercial viability.

Hydrogen’s magic lies in its properties. It’s lightweight, with an energy density of 120 megajoules per kilogram—nearly three times jet fuel’s 43 MJ/kg. This means less mass to lift, potentially trimming fuel needs by 2% on design missions. But it’s a gas at room temperature, so for aircraft, it’s liquefied at -253°C into liquid hydrogen (LH2), stored in insulated cryogenic tanks. These tanks, often rear-mounted to balance weight, resemble oversized thermos flasks, holding enough for 1,000-2,000 nautical mile ranges on regional jets.

Real-world examples illustrate the basics in action. Small drones have flown for hours on hydrogen fuel cells, sipping just grams of fuel. Scaling up, retrofits on 19-seat trainers have logged test flights, proving the tech’s reliability. As materials advance—like carbon composites for lighter tanks—hydrogen propulsion edges closer to everyday flights, promising not just greener but smarter aviation.

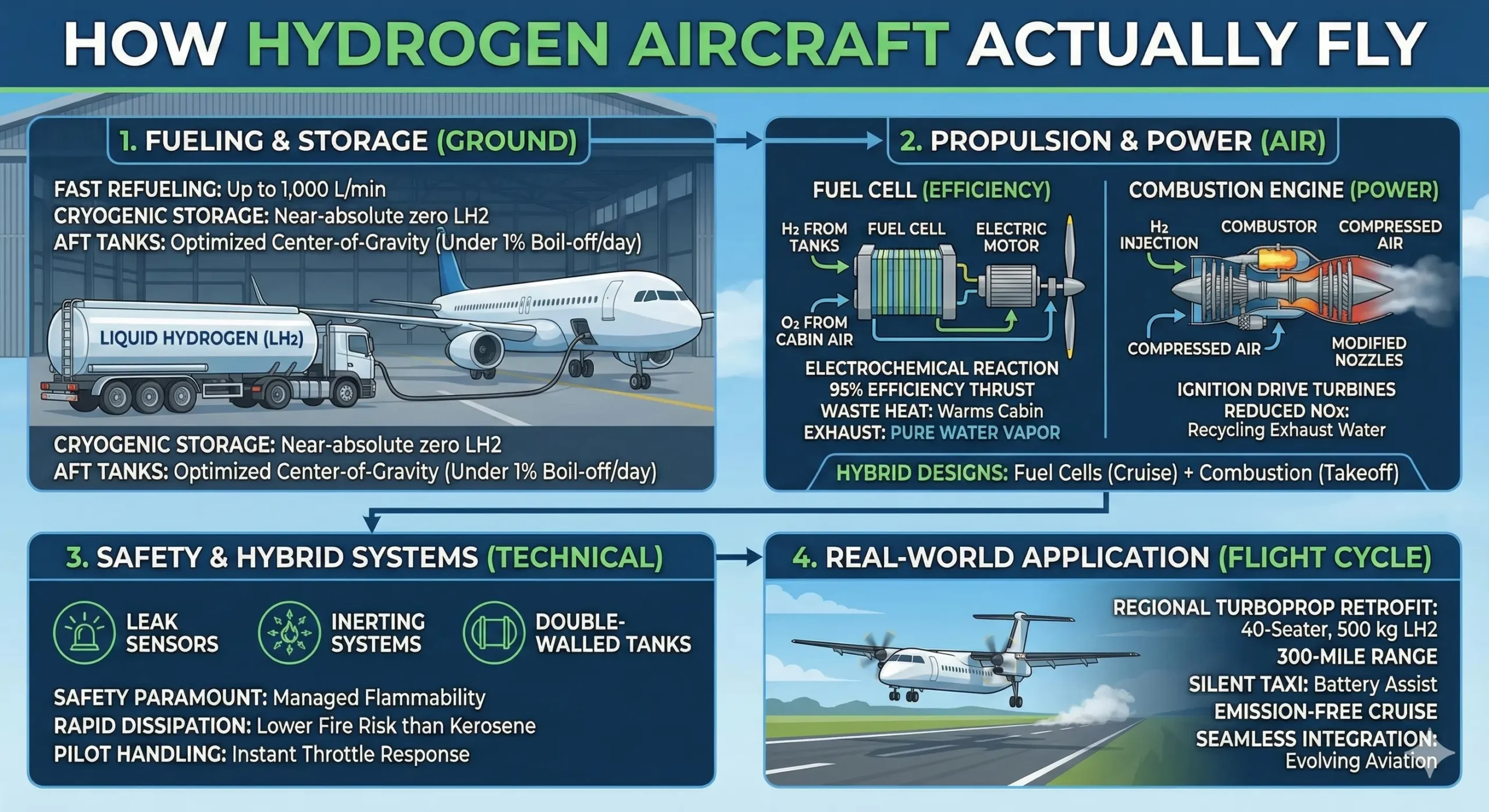

How Hydrogen Aircraft Actually Fly

Picture the lifecycle of a hydrogen flight, from fueling to touchdown. It starts at the gate with cryogenic fueling trucks pumping LH2 into the aircraft’s tanks at rates up to 1,000 liters per minute—faster than jet fuel in many cases. The fuel, stored aft to optimize center-of-gravity, chills to near-absolute zero, minimizing boil-off losses to under 1% per day.

Once airborne, propulsion kicks in. In a fuel-cell setup, hydrogen flows from tanks to the stack, where it meets oxygen from cabin air. Catalysts strip electrons, creating a current that juices electric motors. These motors spin ducted fans or open rotors, generating thrust with 95% efficiency—far above combustion engines’ 40-50%. Waste heat warms the cabin, and exhaust? Pure water, which could even hydrate passengers on long hauls.

For combustion variants, hydrogen is injected into a combustor, igniting with compressed air to drive turbines. Modified nozzles reduce NOx by recycling exhaust water, keeping emissions low. Hybrid designs blend both: fuel cells for cruise efficiency, combustion for takeoff power surges.

Safety is paramount. Hydrogen’s flammability is managed with leak sensors, inerting systems, and double-walled tanks. Crash tests show LH2 dissipates quickly, reducing fire risks compared to kerosene’s sticky pools. Pilots report handling like conventional jets, with added perks like instant throttle response from electric drives.

Take a regional turboprop retrofit: a 40-seater loads 500 kg of LH2, enough for 300 miles. It taxis silently on battery assist, climbs on hybrid boost, and cruises emission-free. Landing, it vents minimal vapor—harmless at altitude. This seamless integration hints at hydrogen’s plug-and-play potential, evolving aviation from polluter to protector.

The Compelling Advantages of Hydrogen-Powered Flight

Hydrogen isn’t just clean; it’s a Swiss Army knife for aviation woes. Foremost, zero in-flight CO2 transforms flights into climate-neutral events. When green-produced, lifecycle emissions plummet 90%, outpacing SAFs’ 80% cap. Water vapor exhaust, while a greenhouse gas, forms at lower altitudes in optimized designs, curbing contrail risks by 50%.

Efficiency steals the show. Hydrogen’s superior gravimetric energy lets aircraft shed weight—up to 80% less fuel mass for equivalent range—enabling lighter structures, smaller wings, and agile maneuvers. Operational perks abound: refueling in minutes, not hours like batteries, and lower maintenance from fewer moving parts. Fuel cells last 20,000 hours with modular swaps, slashing downtime.

Noise reduction is an urban win. Electric propulsion quiets takeoffs to library levels, easing airport expansions near cities. Economically, as green hydrogen costs dip below $2/kg by 2030, operating expenses could undercut jet fuel by 2% with carbon taxes in play. Airlines eye this for regional routes, where 50% of emissions lurk.

- Scalability for Growth: Handles rising demand without emission spikes, supporting 2x passenger volumes by 2050.

- Versatility: Suits short-haul (fuel cells) to long-haul (combustion hybrids), covering 80% of flights.

- Job Creation: Fuels a $2.5 trillion hydrogen economy, birthing 30 million roles in production and ops.

- Energy Security: Domestic renewables power it, dodging oil volatility.

Examples? A Norwegian project retrofits 15 floatplanes for fjord hops, cutting local emissions 40%. In the U.S., cargo hauls test LH2 for overnight deliveries, proving reliability. These wins underscore hydrogen’s edge: not a patch, but a paradigm shift.

Navigating the Challenges: Hurdles on the Hydrogen Horizon

No revolution rolls smoothly, and hydrogen aviation grapples with thorny issues. Chief among them: storage density. LH2’s volumetric energy is a quarter of jet fuel’s—8.5 MJ/L vs. 35 MJ/L—forcing larger tanks that gobble fuselage space. Rear placement shifts weight, demanding redesigns; early models sacrifice 20% payload for 2,500 km ranges.

Cryogenics adds complexity. Maintaining -253°C demands vacuum-insulated composites, prone to micro-leaks and boil-off. Tanks weigh 30% of fuel mass, eroding efficiency gains. Infrastructure lags too: airports need cryogenic pumps, safety zones, and pipelines, costing billions. Green hydrogen supply? Today’s 1% renewable production must explode 10-fold by 2030.

Certification daunts regulators. FAA roadmaps eye 2030 entries, but special conditions for flammability and fatigue testing stretch timelines. NOx from combustion, though low, requires afterburners. Costs sting: initial aircraft premiums hit 20-30%, though lifecycle savings recoup in a decade.

Yet, innovation chips away. Advanced cryotanks from composites cut weights 50%; modular fuel cells scale power 5x. Policy nudges help—EU grants fund Norwegian networks, FAA blueprints harmonize standards.

- Technical Tweaks Needed: Optimize tank shapes for drag reduction; integrate heat recovery for cabin use.

- Supply Chain Gaps: Ramp electrolysis via solar farms; blend blue hydrogen as a bridge.

- Equity Concerns: Ensure developing regions have access to tech, avoiding green divides.

A 2025 setback? A major manufacturer’s 2035 target slipped to 2045 amid infra woes, but it spurred collaborations. These challenges, while steep, forge resilience—hydrogen’s proving worth the climb.

Pioneering Projects: Who’s Leading the Charge?

2025 buzzes with hydrogen milestones, from test flights to patent hauls. Airbus’s ZEROe spearheads with a fully electric, four-pod concept for 100 passengers, powered by 2MW fuel cells. Down-selected from hybrids, it eyes service in the 2040s after 1.2MW ground tests. A modified glider’s Nevada hop marked aviation’s first pure-hydrogen flight, probing contrails.

ZeroAvia scales retrofits, snagging nine patents for ZA2000 engines on 40-80 seaters like ATRs. Their 19-seat Dornier logged hours, while a €21M EU grant greens Norwegian Cessnas by 2028. Investors like Alaska Airlines back their Dash-8 push for “world’s largest zero-emission” bird.

Boeing files IP for hydrogen airframes, eyeing turboprops via Canada’s HyADES. RTX’s HySIITE wrapped with liquid-optimized turbines, cutting NOx via exhaust capture; COCOLIH2T tackles storage. Honeywell’s Ballard acquisition fuels drone-to-jet leaps, targeting 120-minute shorts.

Smaller stars: Universal Hydrogen mods Dash-8s; Joby Aviation clocks nine-hour UAVs. Deutschs Dornier Demonstrator fliegt 2025. Toshiba-Airbus teams on superconducting motors for zero-emission boosts.

These efforts converge: 2024’s iron-pod power-on hit 1.2MW; 2025’s Blue Condor contrail study. Collaborative? Absolutely—MTU joins Airbus, INSAT funds HyADES. From startups to giants, the fleet’s forming, one patent at a time.

| Project | Lead Organization | Key Focus | Target Milestone | Capacity/Range |

|---|---|---|---|---|

| ZEROe | Airbus | Fuel-cell electric turbofan | Commercial entry 2040s | 100-200 pax / 2,000 nm |

| ZA2000 Retrofit | ZeroAvia | Hydrogen-electric engine for regional jets | Certification 2027 | 40-80 seats / 300-600 nm |

| HySIITE | RTX (Pratt & Whitney) | Liquid hydrogen turbine | Tech demo complete 2024 | N/A / Efficiency gains |

| HyADES | RTX Canada | Turboprop hydrogen study | Ongoing 2025 | Regional / Short-haul |

| Dornier 328 Demo | Deutsch Aircraft | Fuel-cell demonstrator | First flight 2025 | 30-40 seats / 500 nm |

| Project ODIN | ZeroAvia (EU) | Norwegian network retrofits | Ops start 2028 | 9-19 seats / Island hops |

This table spotlights synergies: retrofits bridge to clean-sheet designs, proving hydrogen’s adaptability.

Environmental Footprint: A Greener Skyline

Hydrogen’s eco-credentials dazzle, but nuance matters. Direct flight emissions? Zilch CO2, slashed soot for 50% fewer contrails, and NOx at one-third kerosene levels. High-altitude water vapor warms slightly—8-22% of impact—but optimized routing mitigates it. Lifecycle? Green hydrogen via renewables nets 74-90% CO2 cuts vs. jet fuel, per models.

Non-CO2 wins amplify: no sulfur acids, minimal particulates. A seaport study? 11.7 million tons of CO2 saved yearly from hydrogen shorts, 40% airport-level drops. Ozone tweaks? Negligible. Compared to batteries’ mining scars, hydrogen’s water byproduct refreshes.

Caveats: “Grey” hydrogen from gas spikes upstream emissions 2x jet fuel—green mandates are key. Leakage risks methane-like warming, but aviation’s sealed systems minimize it. Overall, hydrogen aviation could halve sector warming by 2050, per projections.

- Contrail Mitigation: Rear-engine designs exhaust below ice-supersaturated zones.

- Biodiversity Boost: Cleaner ops near reserves protect habitats.

- Global Equity: Lowers pollution in flight-heavy developing skies.

In essence, hydrogen doesn’t just reduce harm—it reimagines aviation as a climate ally.

Head-to-Head: Hydrogen vs. Traditional Jet Fuel

Stacking hydrogen against Jet A reveals trade-offs and triumphs. Gravimetrically, hydrogen reigns; volumetrically, it lags—demanding redesigns but enabling lighter flights.

| Metric | Jet Fuel (Kerosene) | Liquid Hydrogen (LH2) | Gaseous Hydrogen (GH2) | Implications for Aircraft |

|---|---|---|---|---|

| Energy Density (MJ/kg) | 43 | 120 | 120 | LH2/GH2: 2.8x lighter fuel mass, cuts takeoff weight 50-80% |

| Energy Density (MJ/L) | 35 | 8.5 | 5 | LH2: 0.25x volume, needs 4x larger tanks; GH2: Even bulkier |

| Emissions (per kg burned) | 3.16 kg CO2 | 0 kg CO2 (direct) | 0 kg CO2 (direct) | Hydrogen: Zero tailpipe carbon; green production key for lifecycle |

| Storage Temp (°C) | Ambient | -253 | -50 to 700 bar pressure | Cryo challenges for LH2; compression energy penalty for GH2 |

| Refuel Time | 20-30 min | 10-15 min | 30-60 min | Hydrogen edges out, but infra buildout lags |

| Cost (2030 est., $/kg) | 0.60-0.80 | 1.50-2.00 (green) | 2.00+ | Carbon taxes tip scales: H2 ops 2% cheaper by 2035 |

| Efficiency (Engine) | 40-50% | 50-60% (combustion); 55-65% (fuel cell) | Same as LH2 | 2% less energy needed for mission; quieter ops |

This comparison, drawn from engineering analyses, shows hydrogen’s payload punch despite volume woes. For a 737-class jet, LH2 swaps 20 tons of fuel for 7 tons, freeing space for 10 extra passengers—efficiency in action.

Charting the Course: A Timeline for Commercial Takeoff

Timelines flex, but momentum builds. 2025 spotlights demos: Dornier flights, Norwegian retrofits, FAA roadmaps. By 2027-2028, ZeroAvia’s ZA600 enters ops on 9-seaters; EU networks green island routes.

2030 heralds certifications: regional turboprops like ATRs go commercial, covering 50% shorts. Airbus’s fuel-cell milestones pave 2035 hybrids, though infra delays nudge full entry to 2040-2045. Long-haul? Combustion widebodies by 2040, blending with SAFs.

Projections vary: optimistic paths see 10% fleet hydrogen by 2040; cautious ones, 5%. Key drivers? Policy—EU Innovation Funds, U.S. ARPA-E grants—and supply scaling to 1,600 TWh of clean energy by 2050.

- Short-Term (2025-2030): Retrofits, small jets; 1,000+ test hours logged.

- Mid-Term (2030-2040): Regional dominance; 20% emission cuts.

- Long-Term (2040+): Global fleets; net-zero achieved.

A 2030-2050 airline sim? Hydrogen phases in 2035, slashing CO2 70% by mid-century via ZEROe-like singles and HVLMR widebodies.

| Decade | Key Milestones | Fleet Penetration | Emission Impact |

|---|---|---|---|

| 2020s | Demos, patents, grants | <1% (tests only) | Proof-of-concept reductions |

| 2030s | Certifications, regional ops | 5-15% | 20-40% CO2 drop on shorts |

| 2040s | Widebody intros, infra boom | 30-50% | 60-80% sector-wide cuts |

| 2050s | Full integration | 70%+ | Net-zero with renewables |

This roadmap, informed by industry forecasts, paints a phased ascent—steady, not supersonic.

Economic Ripples: Costs, Jobs, and Market Shifts

Hydrogen’s wallet appeal grows. Upfront? 20% pricier aircraft, but ops savings from efficiency and taxes erode that. By 2035, with $100/ton carbon pricing, hydrogen flights cost 2% less than kerosene, according to studies. Fuel drops to $1.50/kg as electrolysis scales; maintenance halves via electrics.

Markets bloom: a $2.5T hydrogen economy spawns aviation niches—cryo-factories, fuel logistics. Airlines like Alaska bet big, ordering for 2028. Cargo leads, with overnight hauls, are greening supply chains.

Challenges? Infra investments top $100B globally; subsidies bridge gaps. Returns? Massive—30M jobs, boosted GDP via connected trade.

In sum, economics align with ecology, turning green mandates into goldmines.

Envisioning the Hydrogen Era: Challenges Met, Skies Reclaimed

Hydrogen-powered aircraft aren’t a distant dream—they’re taxiing now, engines humming on test stands and runways. From ZEROe’s visionary pods to ZeroAvia’s gritty retrofits, the tech bridges today’s emissions with tomorrow’s zero-impact flights. Sure, tanks bulk up, timelines stretch, and pipes need laying, but the payoffs—crystal skies, quieter neighborhoods, equitable growth—dwarf the detours.

This green revolution demands collective lift: regulators certifying boldly, producers greening hydrogen en masse, and airlines retrofitting fleets. By 2050, picture 70% of flights hydrogen-fueled, contrails faded, warming halved. Aviation, once a climate culprit, becomes its cure. The question isn’t if, but how swiftly we soar. Ready for takeoff? The hydrogen horizon awaits.

Key Citations and References

- The Role of Renewables in Decarbonising the Aviation Sector (ICAO Environmental Report 2022, Article 47). Discusses hydrogen’s potential for zero-emission flights and its role in reducing aviation’s 2.5% global CO2 share, with projections for short-haul replacements.

- Hydrogen Power: Boldly Going to the Heart of Climate-Neutral Aviation (ICAO Environmental Report 2022, Article 32). Explores electrolysis for green hydrogen production and its net-zero pathway, highlighting Airbus and ZeroAvia’s leadership.

- Enabling a Zero-Carbon Future for Aviation (ICAO Environment Report 2025, Chapter 3). Analyzes hydrogen and battery aircraft deployment, projecting 6% CO2 reductions by 2050 from 10,000 such planes.

- ICAO Committee on Aviation Environmental Protection: Impacts and Science Group (ICAO, 2025). Covers aircraft technologies for CO2 mitigation, including stringent standards for electric and hydrogen propulsion.

- Report on the Feasibility of a Long-Term Aspirational Goal (ICAO, 2025). Examines integrated scenarios for zero CO2 via hydrogen and SAFs, noting lifecycle emissions challenges despite 100% fuel replacement.

- ICAO’s Cooperation with UN Bodies and International Organizations (ICAO Environmental Report 2022, Article 88). Details industry contributions to hydrogen R&D, including electric passenger aircraft visions.

- Assembly – 41st Session Executive Committee (ICAO Working Paper 362, 2025). Projects hydrogen planes contributing up to 5% emission reductions by 2050, with efficiency gains from operations.

- Impact of Hydrogen in Aviation (ICAO Environment Report 2025, p. 54). Investigates non-CO2 effects like contrails and NOx from hydrogen, including DLR’s Blue Condor measurements.

- Green Hydrogen for Aviation: ACT-SAF Series #9 (ICAO, 2025). Covers production and SAF integration, with speakers from Qair Energy and Power-to-X experts.

- Hydrogen-Fueled Aircraft Safety and Certification Roadmap (FAA, December 2024). Outlines mature fuel cell concepts for aviation, addressing electrical hazards and certification by 2030.

- ZEROe: Our Hydrogen-Powered Aircraft (Airbus, September 2024). Details fuel cell electric propulsion for 100-200 passengers, with 2,000 nm range targets by 2040s.

- Hydrogen Propulsion Technologies for Aviation: A Review (MDPI Aerospace, October 2025). Compares fuel cells and combustion, noting 13% SFC improvements via waste heat recovery.

- Hydrogen-Powered Aircraft (Wikipedia, November 2025). Comprehensive overview of history, including Joby’s 523-mile eVTOL flight in 2024.

- Potential of Hydrogen Fuel Cell Aircraft (MDPI Aerospace, January 2025). Studies emissions and costs for medium-long range, emphasizing green hydrogen mandates.

- Hydrogen Propulsion: The Advantages and Challenges (Modelon Blog, March 2023). Explains zero-CO2 combustion and fuel cell electricity generation for propellers.

- Hydrogen Propulsion Systems for Aircraft (ScienceDirect, October 2024). Reviews PEMFC/SOFC hybrids, addressing storage and degradation challenges.

- Hydrogen-Powered Aircraft Thrust (Clean Aviation, 2025). Details H2 combustion and FCPS development, with down-selection by 2026 for 2035 EIS.

- Liquid Hydrogen as a Potential Low-Carbon Fuel for Aviation (IATA Fact Sheet, July 2020). Compares LH2’s 2.5x energy/kg to kerosene, suitable for long-range.

- Airbus and MTU Aero Engines Advance on Hydrogen Fuel Cell Technology (Airbus Press Release, June 2025). MoU for 2MW fuel cell engines, aligning R&T roadmaps.

- Reinventing Aviation with Electrification and Digitalization (World Economic Forum, August 2025). Roadmap for hydrogen-electric by 2040-2050, with CS23 certification advantages.

- Hydrogen for Aviation: A Future Decarbonization Solution (IATA Facts, February 2025). Analyzes one-third fuel mass needs, with infrastructure challenges.

- Hydrogen (Airbus Innovation, September 2024). Focuses on fuel cells for 2040s viability, post-2025 down-selection.

- Airbus Showcases Hydrogen Aircraft Technologies During 2025 Summit (Airbus Press Release, March 2025). Revised ZEROe roadmap for 2030s single-aisle EIS.

- Hydrogen Aircraft and Sustainable Development (SSRN, April 2025). Evaluates heat exchangers for efficiency, with policy needs for scaling.

- Viewpoint: Why Hydrogen Aviation Isn’t Taking Off Yet (Aviation Week, June 2025). Discusses storage challenges and 2040s adoption timelines.

- Why Airbus Pumped the Brakes on its Hydrogen Plans (Flight Plan, April 2025). Analyzes infrastructure delays, SAF bridging to 2040s hydrogen.

- Advancing Hydrogen Aviation in 2025 (ZeroAvia Blog, January 2025). Outlines certification progress and $28.95B fuel cell market by 2028.

- Financing the Transition to Hydrogen Aircraft (Cranfield Aerospace, December 2024). Projects 40% cost savings and Islander demo by 2025 end.

- FAMU-FSU Researchers Design Cryogenic Hydrogen Storage (Florida State University News, May 2025). Details LH2 systems for zero-emission, with 3x jet fuel energy/kg.

- Airbus Showcases Hydrogen Aircraft Technologies (Airbus Press Release, March 2025). Updates ZEROe with 1.2MW demos and LH2BB handling.

Read These Articles in Detail

- Aerospace Engineering vs. Mechanical Engineering

- The Future of Aerospace Propulsion Systems

- How Aerospace Education Is Adapting to Industry Demands

- The Role of Aerospace in Combating Climate Change

- Aerospace Radar Technology: Past, Present, and Future

- The Role of Aerospace in National Security Strategies

- The Role of Nanotechnology in Aerospace Materials

- Aerospace Materials: Stronger, Lighter, And Smarter

- Aerospace Engineering Explained: A Beginner’s Guide

- Electric Aircraft vs. Hydrogen Aircraft: Which Is More Sustainable?

- Hypersonic Weapons: Aerospace’s New Arms Race

- Aerospace Defense Systems: From Drones to Hypersonic Missiles

- How Aerospace Engineers Reduce Fuel Consumption

- Computational Fluid Dynamics in Aerospace Innovation

- The Global Aerospace Market Outlook: Trends and Forecasts

- Satellite Surveillance: Aerospace’s Role in Modern Warfare

- How Aerospace Companies Are Reducing Environmental Impact

- How Airlines Use Aerospace Data Analytics to Cut Costs

- Aerospace Engineering Challenges: Innovation and Sustainability

- The Role of CFD in Aerospace Engineering

- The Role of Women in Aerospace: Breaking Barriers in the Skies

- Sustainable Aviation Fuels: The Aerospace Industry’s Green Bet

- Aerospace Cybersecurity: Protecting the Skies from Digital Threats

- Aerospace Trends Driving the Next Generation of Airliners

- The Rise of Autonomous Aerospace Systems

- How to Start a Career in Aerospace Engineering

- Can Aerospace Go Carbon Neutral by 2050?

- The Role of Aerospace in Missile Defense Systems

- How Aerospace Engineers Use AI in Design

- Top 10 Aerospace Engineering Innovations of the Decade

- Top Aerospace Careers in 2025 and Beyond

- How Aerospace Innovations Shape Global Defense Policies

- Hydrogen-Powered Aircraft: The Next Green Revolution

- Top 10 Emerging Aerospace Technologies Transforming the Industry

- The Future of Hypersonic Flight: Challenges and Opportunities

- How AI Is Revolutionizing Aerospace Engineering

- Additive Manufacturing in Aerospace: 3D Printing the Future of Flight

- The Rise of Electric Aircraft: Are We Ready for Zero-Emission Aviation?

- Aerospace Materials of Tomorrow: From Composites to Nanotechnology

- Digital Twins in Aerospace: Reducing Costs and Improving Safety

- The Role of Robotics in Modern Aerospace Manufacturing

- Quantum Computing Applications in Aerospace Design

- How Augmented Reality Is Changing Aerospace Training

- Space Tethers Explained: The Next Leap in Orbital Mechanics

- Ion Propulsion vs. Chemical Rockets: Which Will Power the Future?

- The Role of Nuclear Propulsion in Deep Space Missions

- Space Mining: The Aerospace Industry’s Next Gold Rush

- How Reusable Rockets Are Reshaping the Space Economy

- The Artemis Program: NASA’s Return to the Moon

- Space Tourism: Business Model or Billionaire’s Playground?

- How Aerospace Startups Are Disrupting Commercial Aviation

- The Economics of Low-Cost Airlines in the Aerospace Era

- Urban Air Mobility: The Rise of Flying Taxis

- The Future of Mars Colonization: Key Aerospace Challenges and Solutions Ahead

- CubeSats and Small Satellites: Democratizing Space Access

- The Future of Cargo Drones in Global Logistics

- The Role of Aerospace in Building a Lunar Economy

Frequently Asked Questions

FAQ 1: What Are Hydrogen-Powered Aircraft and How Do They Work?

Hydrogen-powered aircraft represent a groundbreaking shift in aviation, using hydrogen as a clean fuel source to drive planes without the carbon emissions tied to traditional jet fuel. At their heart, these aircraft rely on two main propulsion methods: hydrogen combustion engines or hydrogen fuel cells. In combustion systems, hydrogen gas burns with oxygen in a modified turbine, creating heat that spins blades to generate thrust, much like a conventional jet, but producing only water vapor as exhaust. This approach keeps the familiar roar of engines while slashing pollution.

Fuel cells take it further by electrochemically reacting hydrogen with oxygen to produce electricity directly, powering quiet electric motors that turn propellers or fans. This setup is especially promising for shorter flights, offering up to 95% efficiency in converting energy to motion. Storage is key here—hydrogen is cooled to -253°C into liquid form and held in insulated tanks, often at the rear of the plane to maintain balance. Recent tests, like Airbus’s 1.2-megawatt ground demonstrations in 2025, show these systems delivering reliable power for regional jets covering 300 to 2,000 nautical miles.

The beauty of this technology lies in its scalability. Small prototypes, such as ZeroAvia’s retrofitted 19-seater Dornier, have already flown hours-long test routes, proving the concept in real skies. As materials like advanced composites make tanks lighter, hydrogen aircraft could handle everything from city hops to transatlantic jaunts, all while aligning with global net-zero goals by mid-century. It’s not just cleaner flying; it’s a smarter way to connect the world.

FAQ 2: Why Is Hydrogen the Next Big Thing for Sustainable Aviation?

The aviation sector faces mounting pressure to cut its environmental footprint, which currently accounts for about 2.5% of global CO2 emissions, a figure that could double by 2050 without intervention. Hydrogen steps in as a hero because it burns or reacts to release energy with zero direct carbon output—only water vapor trails the skies. When sourced from renewables via electrolysis, the full lifecycle emissions drop by up to 90%, outpacing even sustainable aviation fuels that top out at 80% reductions.

Beyond emissions, hydrogen’s high energy density by weight—three times that of jet fuel—means planes need less mass to lift, potentially trimming overall energy use by 2% on key routes. This efficiency shines on short-haul flights, where 50% of aviation’s pollution hides, allowing quieter takeoffs and fewer contrails that trap heat. Projects like RTX’s HySIITE engine, which wrapped in 2024 with NOx cuts via water recycling, highlight how hydrogen tackles non-CO2 impacts too.

Economically, as green hydrogen prices aim for under $2 per kilogram by 2030, it could undercut fossil fuels amid rising carbon taxes. Airlines see this as a path to resilient operations, less vulnerable to oil swings, while creating jobs in a budding $2.5 trillion hydrogen economy. In short, hydrogen isn’t a band-aid; it’s the fuel to make flying truly sustainable, powering growth without the guilt.

FAQ 3: What Are the Biggest Challenges Facing Hydrogen-Powered Aircraft Development?

Developing hydrogen aircraft is an exciting frontier, but it’s not without hurdles that demand clever engineering and bold investments. One major sticking point is storage: hydrogen’s low volumetric energy density requires tanks four times larger than jet fuel ones, eating into cabin space and adding weight that offsets some efficiency gains. Cryogenic systems to keep it liquid at ultra-low temperatures also risk boil-off losses, though 2025 innovations in composite insulation are cutting these to under 1% daily.

Infrastructure lags behind too—airports need cryogenic pumps, safety zones, and pipelines, with global costs potentially hitting $100 billion. Supply chains for green hydrogen must scale tenfold by 2030, as current production is just 1% renewable. Regulatory certification adds another layer; the FAA’s 2024 roadmap eyes 2030 entries, but testing for flammability and fatigue stretches timelines, as seen in Airbus’s recent pushback of ZEROe to the 2040s.

Despite these, progress is steady. Collaborations like ZeroAvia’s EU grants for Norwegian retrofits show policy can bridge gaps, while thermal management tweaks address waste heat from fuel cells. These challenges, while daunting, are fueling a resilient tech ecosystem, ensuring hydrogen’s promise isn’t grounded.

| Challenge | Description | Current Mitigation Efforts | Projected Timeline for Resolution |

|---|---|---|---|

| Storage Density | Low volume efficiency demands bulky tanks, reducing payload. | Advanced carbon composites for lighter, shaped tanks. | Mid-2030s for commercial viability. |

| Infrastructure Buildout | Need for refueling stations and supply networks at airports. | Hydrogen Hubs at Airports initiative with 215 global partners. | 2030-2040 for widespread adoption. |

| Certification and Safety | Stringent tests for leaks and NOx; regulatory harmonization. | FAA roadmap and special conditions development. | Initial certifications by 2027-2028. |

| Green Hydrogen Supply | Scaling renewable production amid high costs ($2.28-$7.39/kg). | Electrolysis ramps via solar/wind farms; policy incentives. | Costs under $2/kg by 2030. |

| Thermal Management | Dissipating low-grade heat from fuel cells without drag. | Integrated heat recovery for cabin use; radiator innovations. | Prototypes testing in 2025-2026. |

FAQ 4: Which Companies Are Leading the Way in Hydrogen Aircraft Projects?

The race to hydrogen skies is heating up, with a mix of giants and innovators pushing boundaries through targeted projects. Airbus leads with its ZEROe initiative, unveiling a four-pod, fuel-cell electric concept in 2025 capable of 100-200 passengers over 2,000 nautical miles. Their Blue Condor glider flight in Nevada marked aviation’s first pure-hydrogen hop, studying contrails, while partnerships with Toshiba advance superconducting motors for zero-emission boosts.

ZeroAvia is scaling retrofits fast, patenting nine innovations for its ZA2000 engine on 40-80 seaters like ATRs. With €21 million in EU funding, they’re greening Norwegian Cessnas by 2028, and a $3.25 million California grant builds mobile LH2 refuelers for aviation. RTX (formerly Raytheon) wrapped HySIITE in 2024, optimizing liquid hydrogen turbines for low NOx, and now drives HyADES for Canadian turboprops.

Honeywell, post-Ballard acquisition, powers drones-to-jets with megawatt fuel cells, eyeing 120-minute shorts. Smaller players like Universal Hydrogen mod Dash-8s, and Deutsch Aircraft’s Dornier 328 demo flies in 2025. These efforts, from startups to behemoths, form a collaborative fleet, blending retrofits with clean-sheet designs for a hydrogen horizon.

FAQ 5: How Do Hydrogen-Powered Aircraft Compare to Battery-Electric Ones?

When pitting hydrogen against battery-electric aircraft, it’s like choosing between a marathon runner and a sprinter—each excels in different races, but hydrogen edges out for endurance. Battery-electric planes shine on ultra-short hops under 200 miles, leveraging 90%+ motor efficiency for whisper-quiet, low-maintenance flights. Yet, batteries’ 250 Wh/kg energy density pales against jet fuel’s 12,000 Wh/kg, imposing a weight penalty that limits range and payload; Embraer’s Energia hybrid delay to post-2035 underscores this.

Hydrogen, at 39,500 Wh/kg, powers longer legs—up to 600 nautical miles on regional jets—via fuel cells or combustion, with eight times the efficiency of synthetic fuels in electric setups. Drawbacks? Bulkier tanks and cryo-handling versus batteries’ simplicity, but no mining scars like lithium’s environmental toll. A 2025 IEEE study deems electric greener mid-flight but hydrogen superior for broader decarbonization, especially with green production.

Hybrids blend both: batteries for takeoff bursts, hydrogen for cruise. As grids strain under battery charging, hydrogen’s quick refuels (10-15 minutes) win for ops. Ultimately, batteries urbanize air travel, while hydrogen globalizes it sustainably.

| Aspect | Battery-Electric Aircraft | Hydrogen-Powered Aircraft | Best For |

|---|---|---|---|

| Energy Density (Wh/kg) | 250 (current lithium-ion) | 39,500 | Hydrogen for long-range. |

| Range Capability | Up to 200 miles | 300-2,000+ nautical miles | Hydrogen dominates mid-haul. |

| Efficiency | 90%+ in motors | 55-65% in fuel cells | Batteries for short bursts. |

| Infrastructure Needs | Charging stations | Cryo-refueling, production hubs | Batteries easier short-term. |

| Emissions Impact | Zero in-flight; mining concerns | 90% lifecycle cuts if green | Hydrogen for net-zero scale. |

| Cost (2030 est.) | Lower upfront; grid strain | $1.50-2/kg fuel; tax advantages | Hydrogen cheaper with carbon pricing. |

FAQ 6: What Is the Expected Timeline for Commercial Hydrogen Flights?

The path to everyday hydrogen flights is unfolding in phases, with 2025 as a pivotal year of demos and groundwork. Short-haul pioneers like ZeroAvia’s ZA600 on 9-seaters aim for certification in 2027, powering island hops in Norway by 2028. Regional turboprops, such as retrofitted ATRs, could enter service around 2030, covering 50% of emissions-heavy shorts and slashing CO2 by 20-40%.

Mid-decade hurdles pushed Airbus’s ZEROe to the 2040s, but hybrids might bridge with 2035 entries for 100-passenger routes. Long-haul combustion widebodies eye 2040, blending with SAFs for net-zero. Optimistic forecasts see 10% fleet penetration by 2040; cautious ones, 5%, driven by FAA roadmaps and EU funds.

Policy accelerates this: U.S. ARPA-E grants and Canada’s INSAT back studies like HyADES. By 2050, 70%+ hydrogen could halve warming, per projections. It’s a steady climb—demos today, dominance tomorrow.

FAQ 7: How Does Hydrogen Propulsion Help Reduce Aviation Emissions?

Hydrogen propulsion tackles aviation’s emission woes head-on, eliminating CO2 at the tailpipe through clean reactions that yield only water. For a New York-Boston hop, it swaps 15 tons of CO2 for near-zero, with green sourcing amplifying to 90% lifecycle savings. Contrails, amplifying warming fourfold, drop 50% sans soot, while NOx falls to a third via exhaust tweaks.

Non-CO2 perks abound: no sulfur acids or particulates harm ozone layers. A 2025 seaport analysis projects 11.7 million tons of annual CO2 cuts from short flights, plus biodiversity gains near reserves. Routed below ice zones, vapor’s warming dips to 8-22% impact.

Caveats? Grey hydrogen doubles upstream emissions—green mandates are vital. Leaks mimic methane, but sealed aviation minimizes them. Overall, hydrogen halves sector warming by 2050, turning polluters into allies.

- Direct CO2 Slash: Zero in-flight; 74-90% full cycle with renewables.

- Contrail Cuts: Optimized exhaust reduces persistent clouds by half.

- NOx and Soot Reductions: Water recycling lowers pollutants, easing urban air quality.

- Global Equity: Cleaner ops benefit developing routes most.

FAQ 8: What Infrastructure Changes Are Needed for Hydrogen Aviation at Airports?

Airports must evolve to embrace hydrogen, starting with cryogenic fueling setups that pump liquid hydrogen at 1,000 liters per minute—faster than jet fuel but requiring insulated docks and vent masts for safe boil-off. Storage tanks, often 10,000-liter mobiles like ZeroAvia’s California prototype, need safety zones to handle flammability, with sensors for leaks.

Broader shifts include land for liquefaction plants and pipelines from renewable hubs, costing billions but shared across trucking and maritime. The Hydrogen Hubs at Airports network, now at 215 sites, maps these: Gatwick’s 2024 launch tests refueling ops, while Spain’s explores ground power from excess hydrogen.

Training ramps up too—staff learn inerting and double-walled handling. By 2030, archetypes from small airfields to hubs will support gaseous or liquid flows, per UK ZEFI reports. This ecosystem not only greens skies but decarbonizes gates, a win for holistic sustainability.

FAQ 9: Are Hydrogen-Powered Aircraft Safe to Fly?

Safety sits at the core of hydrogen aviation, with designs addressing its quirks like wide flammability through rigorous testing. Unlike kerosene’s sticky fires, liquid hydrogen dissipates fast in crashes, per 1983 AIAA assessments deeming it safer than methane alternatives. Modern leak detectors, shutoff valves, and double-walled tanks prevent ignition, as outlined in the FAA’s 2024 roadmap.

A 2025 study synthesizes risks—embrittlement, reactivity—from 2015 onward, stressing mitigations like material coatings. Flammability at 4% needs low-energy ignition safeguards, but fuel cells’ no-combustion cuts fire odds. Airbus’s Blue Condor and ZeroAvia’s Dornier logs show handling matches conventional jets, with instant electric throttle.

Regulators demand performance-based rules for under-20 seaters, easing entry. While Hindenburg echoes linger, aviation’s standards ensure hydrogen’s risks are managed, paving safer, cleaner flights.

FAQ 10: What Economic Benefits Can We Expect from Hydrogen-Powered Aircraft?

Hydrogen aircraft promise a economic uplift, blending cost savings with growth sparks in a $2.5 trillion ecosystem. Upfront premiums of 20-30% recoup in a decade via 2% lower ops by 2035, per carbon-tax models—hydrogen at $1.50/kg undercuts kerosene. Maintenance halves with fewer parts, and quick refuels boost turnaround, eyeing 40% savings on regional routes.

Job booms follow: 30 million roles in production and ops, per Aerospace Technology Institute, lifting UK GDP by £37 billion by 2050. Cargo leads, greening overnight hauls for resilient chains. A 2025 DEA analysis ranks midsize concepts like FlyZero efficient, urging infrastructure investments that yield spillovers to road and sea.

Challenges like $299 billion EU fleet transitions demand incentives, but returns dazzle—hydrogen not just pays green dividends but fuels prosperity.

- Operational Savings: Efficiency and taxes make flights 2% cheaper post-2035.

- Market Expansion: Enables 2x passengers without emission hikes.

- Innovation Spillover: Tech transfers create supplier jobs and standards.

- Energy Independence: Renewables dodge oil volatility for stable costs.

FAQ 11: What Are the Latest Developments in Hydrogen-Powered Aircraft as of 2025?

As we hit the midpoint of 2025, the hydrogen aviation scene is buzzing with tangible progress that edges us closer to everyday zero-emission flights. ZeroAvia kicked things off strong by outlining four pillars for success—focusing on infrastructure, investment, regulation, and technology—while advancing their ZA2000 engine for 40-80 seaters. Their retrofitted Dornier 328 demonstrator took to the skies this year, logging crucial test hours and paving the way for certification pushes in 2027. Meanwhile, RTX wrapped up the HySIITE project in late 2024 but carried momentum into 2025 with HyADES, a Canadian-backed study optimizing turboprops for liquid hydrogen, emphasizing low NOx through exhaust water capture.

Airbus, despite scaling back ZEROe timelines to the 2040s due to infrastructure lags, isn’t standing still. Their Blue Condor glider notched aviation’s first pure-hydrogen flight over Nevada earlier this year, gathering contrail data that could refine high-altitude emissions models. A fresh partnership with Toshiba on superconducting motors promises lighter, more efficient propulsion, potentially boosting range without extra weight. Honeywell, leveraging their Ballard acquisition, is scaling fuel cells from drones to regional jets, targeting 120-minute flights by decade’s end.

These steps aren’t isolated; they’re part of a global push. The FAA’s December 2024 roadmap laid out certification paths for 2030, including special conditions for flammability and fatigue. EU grants are fueling Norwegian networks, with 9-19 seaters going green by 2028. It’s clear 2025 is a bridge year—demos proving concepts, investments flowing, and regulators aligning—for a hydrogen takeoff that’s feeling less like science fiction and more like scheduled service.

FAQ 12: How Do the Costs of Hydrogen Aircraft Stack Up Against Conventional Ones?

Diving into the numbers, hydrogen-powered planes carry a premium upfront but promise long-term savings that could flip the script on aviation economics. Initial aircraft costs hover 20-30% higher due to cryogenic tanks and fuel cell stacks, but lifecycle analyses show recoupment within a decade through efficiency gains and carbon pricing. By 2035, with green hydrogen at $1.50-2 per kilogram, operations might undercut kerosene by 2%, especially as taxes hit $100 per ton of CO2.

Fuel is the wildcard: hydrogen’s lighter weight slashes mass needs by 50-80%, but early prices ($2.28-7.39/kg for green) inflate bills—up 16% cumulatively over 2030-2050 in mixed fleets. Maintenance dips too, with modular fuel cells lasting 20,000 hours and fewer moving parts. Broader ripples? A $2.5 trillion hydrogen economy could spawn 30 million jobs, boosting GDP while dodging oil volatility.

| Cost Category | Conventional Kerosene Aircraft | Hydrogen-Powered Aircraft | Key Notes (2030-2050 Projections) |

|---|---|---|---|

| Upfront Aircraft Price | Baseline ($100M for regional jet) | +20-30% ($120-130M) | Driven by cryo-tanks; offsets via lighter structures. |

| Fuel Cost per kg | $0.60-0.80 | $1.50-2.00 (green) | Hydrogen 2.8x energy-dense by weight; taxes favor H2 by 2035. |

| Annual Operating Costs | $919M (2050 baseline fleet) | $976M (mixed fleet) | 48% DOC rise initially, but 2% cheaper post-taxes. |

| Maintenance | Higher (complex turbines) | 50% lower (electric drives) | Fuel cells modular; early hydrogen adds complexity. |

| Total Lifecycle (20 yrs) | $69B DOC for fleet | $102B (incl. $2.1B fuel premium) | Recoups via emissions savings; $299B EU transition cost. |

| Broader Economic | Oil-dependent volatility | $2.5T economy, 30M jobs | Infrastructure $1.7T capex, 90% off-airport. |

This table highlights why savvy airlines are betting on hydrogen: short-term pinch for enduring gains.

FAQ 13: What Role Does Hydrogen Play in Producing Sustainable Aviation Fuels?

Hydrogen isn’t just a direct fuel for planes—it’s a linchpin in crafting sustainable aviation fuels (SAFs), those drop-in alternatives that slash emissions without redesigning engines. In power-to-liquid processes, green hydrogen—made via electrolysis from renewables—pairs with captured CO2 to brew synthetic kerosene mimics, cutting lifecycle GHGs by up to 90% when scaled. This pathway shines for long-haul, where direct hydrogen’s bulky storage falters.

Yet, it’s energy-hungry: producing one gallon of SAF gulps 100 kWh, relying on cheap hydrogen ($5-7/kg today) and the U.S. 45V tax credit to compete. HEFA routes, using hydrogen to upgrade waste oils, yield SAF but lag in carbon efficiency—86% less than renewable diesel setups. Boeing notes renewables-boosted hydrogen could supercharge SAF output, potentially low-carbon enough for net-zero blends.

The synergy? Hydrogen bridges SAF’s supply crunch—current production meets just 0.1% demand—while SAF buys time for hydrogen planes. By 2050, this duo could decarbonize 70% of flights, with hydrogen as the efficient feedstock turning air travel’s waste into wings.

FAQ 14: How Safe Is Flying on Hydrogen-Powered Aircraft Compared to Traditional Jets?

Safety has always been aviation’s north star, and hydrogen planes are engineered to meet or exceed those gold standards, addressing unique traits like flammability through smart tech. The FAA’s 2024 roadmap stresses leak detection, shutoff valves, and double-walled tanks, ensuring risks like ignition stay low—hydrogen’s wide range (4-75%) demands vigilance, but its quick dissipation in crashes beats kerosene’s pooling fires, per 1983 AIAA tests.

Emerging strategies shine: boil-off recovery cuts losses during refueling, while advanced insulation tames cryogenic chills at -253°C. A 2025 HAZOP study flags embrittlement and reactivity but praises coatings and sensors for mitigation. Real flights, like ZeroAvia’s Dornier tests, mirror conventional handling, with electric throttles adding responsiveness.

Public jitters echo Hindenburg, but modern aviation’s rigor—performance-based rules for small jets—builds trust. Hydrogen’s no-flame fuel cells sidestep combustion odds altogether. In essence, it’s as safe as today’s skies, just cooler.

- Leak Management: Real-time sensors and inerting systems prevent buildup, far beyond jet fuel norms.

- Crash Resilience: LH2 evaporates rapidly, minimizing fire spread; FAA crash sims confirm lower hazards.

- Regulatory Backbone: Special conditions harmonize global standards, with 2030 cert targets.

- Crew Training: Enhanced protocols for cryo-handling ensure seamless ops.

FAQ 15: Why Has Airbus Delayed Its Hydrogen Aircraft Timeline, and What Does It Mean for the Industry?

Airbus’s pivot on ZEROe—from 2035 entry to 2040s—stems from stark realities: infrastructure isn’t keeping pace with tech dreams. CEO Guillaume Faury cited slow hydrogen production ramps, distribution bottlenecks, and airport mods as culprits, echoing Embraer’s Energia pushback over battery and fuel cell lags. It’s a 5-10 year slip, but not a surrender; 2025’s Summit showcased 1.2MW iron-pod power-ons and tank handling demos, keeping momentum.

For the industry, it’s a reality check that tempers hype with pragmatism. SAFs gain breathing room as bridges, while regional players like ZeroAvia hit 2027 certs for shorts. Broader? It spotlights $100B global infra needs—pipelines, liquefaction plants—urging policy like EU funds and U.S. ARPA-E grants. Delays foster resilience: collaborations with MTU and Toshiba refine motors, ensuring when hydrogen lands, it’s robust.

This isn’t stalling the revolution; it’s recalibrating for sustainable speed, reminding us net-zero by 2050 demands ecosystem sync, not solo sprints.

FAQ 16: What Are the Key Differences Between Hydrogen Fuel Cells and Combustion Engines in Aircraft?

Hydrogen propulsion splits into fuel cells for electric quietude and combustion for raw power—each suiting flight flavors. Fuel cells electrochemically zap hydrogen and oxygen into electricity, juicing motors at 55-65% efficiency with zero NOx, ideal for 300-600 nautical mile regionals. Combustion burns it in turbines like jet fuel, hitting 50-60% but needing tweaks for low emissions, better for 2,000+ nm hauls.

Trade-offs? Cells pack quieter, reliable ops but scale slower for megawatts; combustion leverages existing turbine know-how yet wrestles vapor warming. Hybrids blend them: cells cruise, combustion climbs.

| Propulsion Type | Efficiency | Emissions Profile | Best Suited For | Development Stage (2025) |

|---|---|---|---|---|

| Fuel Cells (PEMFC) | 55-65% | Zero CO2/NOx; water vapor | Short-mid haul (up to 600 nm) | Prototypes flying; 2MW tests. |

| Combustion Engines | 50-60% | Low NOx via water recycle; no soot | Long haul (2,000+ nm) | HySIITE optimized; cert by 2030. |

| Hybrids | 60%+ blended | Minimal; tunable | Versatile regional-long | Airbus down-select 2026. |

This breakdown shows a toolkit approach—cells for green efficiency, combustion for reach—uniting for full decarbonization.

FAQ 17: How Will Hydrogen Aviation Impact Global Job Markets and Energy Security?

Hydrogen’s aviation leap could supercharge economies, birthing 30 million jobs worldwide by 2050 in a $2.5 trillion sector—from electrolysis farms to cryo-tech fabs. Aviation’s slice? Thousands in retrofits and ops, per IEC estimates, with $1.2 trillion invested by 2030 scaling renewables that power it all. UK projections eye £37 billion GDP lift, spilling to suppliers and training.

Energy security sweetens the deal: renewables-fed hydrogen sidesteps oil geopolitics, stabilizing costs for airlines and nations. Domestic solar/wind hubs cut import reliance, fostering resilience amid volatility. Challenges like $10 trillion total capex demand public-private blends, but returns dazzle—cheaper flights spur tourism, trade.

It’s a virtuous cycle: jobs fuel innovation, security breeds investment, turning aviation from energy hog to green engine.

FAQ 18: What Infrastructure Investments Are Critical for Hydrogen Flights to Take Off?

Scaling hydrogen aviation hinges on a web of upgrades, from production to tarmac, demanding $1.7 trillion by 2050—90% off-airport. Electrolysis plants near renewables must balloon tenfold, pipelines snaking to hubs for cheap delivery, while liquefaction chills fuel at scale.

Airports need cryogenic pumps (1,000 L/min), vent masts, and safety buffers; Gatwick’s 2024 trials test these. Mobile refuelers bridge early gaps, like California’s for ZeroAvia.

- Production Hubs: Solar/wind farms with 1,600 TWh clean energy by 2050; $680B invested since 2021.

- Distribution Networks: Pipelines for narrowbodies; initial trucks for regionals.

- Airport Mods: Insulated docks, leak zones; $100B global tally.

- Policy Boosts: Tax credits like 45V offset $5-7/kg costs.

These pillars, per Hydrogen Council, unlock commercial viability by 2030.

FAQ 19: Can Hydrogen Aircraft Really Achieve Net-Zero Emissions by 2050?

Absolutely, hydrogen planes could spearhead net-zero aviation, halving sector warming if 70% fleet adopts by 2050—zero tailpipe CO2, 90% lifecycle cuts with green sourcing. Models show 74-98% temperature response drops versus kerosene, outpacing SAF’s 72-86% via contrail and NOx slashes.

Nuance? Upstream grey hydrogen doubles emissions—renewables are non-negotiable. Vapor’s warming (8-22%) needs routing fixes, but sealed systems curb leaks. A 2025 ICCT report flags infra as the linchpin; delays like Airbus’s underscore scale urgency.

Paired with SAF bridges, it’s feasible: 10% fleet by 2040 yields 20-40% CO2 dips, building to full zero. Aviation’s 2.5% global slice shrinks responsibly, proving flight can fuel progress, not peril.

FAQ 20: How Does Hydrogen Compare to Sustainable Aviation Fuels for Decarbonizing Long-Haul Flights?

For long-haul, SAF edges as the ready-now champ—drop-in blends cut 80% emissions sans mods, scaling to 10% supply by 2030 via waste feedstocks. Hydrogen? Zero direct CO2 but volume woes limit to hybrids by 2040, needing cryo-infra overhauls.

SAF’s appeal: existing engines, quicker rollout, but caps at carbon-cycle ties. Hydrogen unlocks true zero with 2.8x weight efficiency, though 30-69% cost hikes initially. Studies peg SAF for 2030s bridges, hydrogen dominating 2050s for 72%+ impacts.

- Emission Reductions: SAF 80% lifecycle; hydrogen 90-98% if green.

- Infrastructure Fit: SAF seamless; hydrogen $299B EU shift.

- Range Viability: SAF unlimited; hydrogen 2,500 km early limits.

- Cost Trajectory: SAF $2-3/L now; hydrogen ops cheaper post-2035 taxes.

Complementary paths: SAF buys time, hydrogen seals net-zero.