The U.S. Small Business Administration (SBA) offers a lifeline to small businesses through its 7(a) loan program, one of the most popular and accessible financing options for entrepreneurs. If you’re a small business owner seeking an SBA 7(a) loan, you’ll encounter a variety of forms, including SBA Form 1919, which you complete, and SBA Form 1920, which your lender fills out. While the responsibility of completing Form 1920 falls on the lender, understanding its purpose, components, and importance can make the loan application process smoother for you.

This detailed guide dives deep into SBA Form 1920, explaining its significance, breaking down its sections, and offering practical tips to ensure you and your lender are well-prepared. By the end, you’ll have a clear roadmap to navigate this critical piece of the SBA loan puzzle.

Table of Contents

Why SBA Form 1920 Matters

SBA Form 1920 is a cornerstone of the 7(a) loan application process. It serves as a detailed snapshot that the SBA uses to evaluate the eligibility of the borrower, the lender’s compliance with program requirements, and the loan’s structure. Unlike Form 1919, which captures your personal and business details, Form 1920 focuses on the lender’s perspective, outlining key information about the loan terms, the borrower’s business, and how the funds will be used. This form ensures that both the lender and the SBA are aligned in their understanding of the loan’s purpose and the business’s ability to repay.

For borrowers, understanding Form 1920 is crucial because you’ll need to provide much of the information your lender will use to complete it. For lenders, the form is a critical tool to demonstrate compliance with SBA guidelines and secure the agency’s guaranty, which reduces the risk of lending to small businesses. Think of Form 1920 as a bridge between you, your lender, and the SBA—a document that ensures everyone is on the same page.

For example, imagine you’re a small business owner running a family-owned bakery looking to expand with a new location. You apply for a 7(a) loan to cover the costs of leasing a space and purchasing equipment. While you’ll provide personal and financial details on Form 1919, your lender will use Form 1920 to detail the loan amount, repayment terms, and how your bakery meets the SBA’s eligibility criteria, such as being a for-profit business operating in the U.S. Understanding what your lender needs for Form 1920 can help you prepare the right documentation, speeding up the process.

Who Completes SBA Form 1920?

The responsibility for completing SBA Form 1920 lies with the lender, not the borrower. However, as a borrower, you play a significant role in the process by supplying the necessary information. The SBA does not typically lend money directly; instead, it partners with approved lenders, such as banks or credit unions, to facilitate loans. These lenders use Form 1920 to provide the SBA with a comprehensive overview of the loan application, ensuring it aligns with the agency’s standards.

As a business owner, you’ll need to work closely with your lender to provide details about your business’s operations, financial health, and plans for the loan proceeds. For instance, if you’re seeking funds to purchase inventory for a retail store, your lender will need specifics about the inventory costs, your business’s revenue history, and your repayment capacity. Familiarizing yourself with Form 1920’s requirements allows you to anticipate what your lender will ask for, making the process more efficient.

Lenders are categorized as delegated or non-delegated. Delegated lenders, who have authority from the SBA to approve loans independently, complete Form 1920 and keep it in their loan file. Non-delegated lenders must submit the form electronically to the SBA’s Loan Guaranty Processing Center (LGPC) for approval. Understanding your lender’s status can help you gauge the timeline and steps involved in your application.

Breaking Down SBA Form 1920: Key Sections Explained

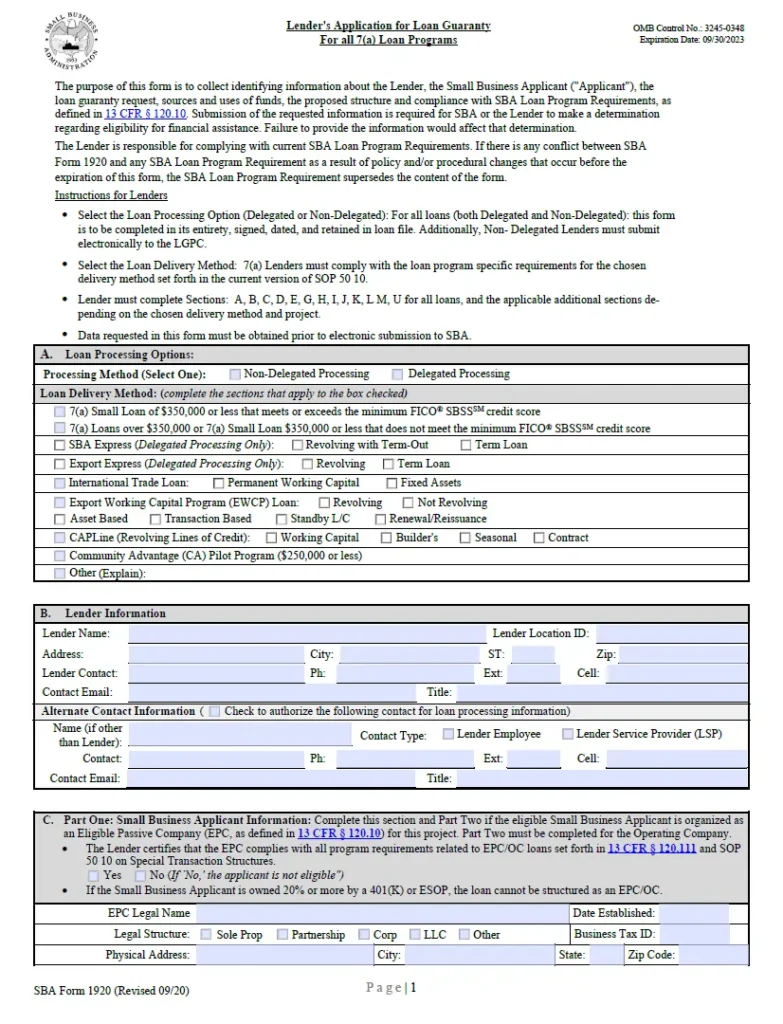

SBA Form 1920 is a detailed document with multiple sections, each serving a specific purpose in the loan evaluation process. Below, we explore the key sections (A, B, C, D, E, G, H, I, J, K, L, M, and U) that all lenders must complete, along with insights into their significance. Additional sections may apply depending on the loan type or project, but these core components are universal.

Part A: Loan Processing Options

This section identifies whether the lender is using a delegated or non-delegated processing method and specifies the type of 7(a) loan being applied for, such as a Standard 7(a), SBA Express, or Community Advantage loan. Each loan type has unique features, such as varying loan amounts, guaranty percentages, or eligibility criteria tailored to specific business needs.

For example, a Community Advantage loan, designed for underserved communities, caps at $250,000 and focuses on businesses in low-income areas. By contrast, a Standard 7(a) loan can go up to $5 million for larger projects like real estate purchases. Knowing the loan type helps the SBA ensure the application aligns with the program’s goals.

Part B: Lender Information

Part B captures basic details about the lender, including their name, address, and contact information. This section ensures the SBA can verify the lender’s credentials and communicate effectively during the review process. For borrowers, this section is straightforward but underscores the importance of choosing an SBA-approved lender with experience in 7(a) loans to ensure a smooth application process.

Part C: Small Business Applicant Information

Part C is divided into two subsections:

- Eligible Passive Company (EPC): If your business operates as an EPC, such as a holding company that leases property to an operating business, this section requires details about the arrangement. For example, a real estate investor using an EPC to lease a commercial property to their retail business would need to clarify the relationship between the entities.

- Business Details: This part collects information about your business’s legal structure (e.g., LLC, corporation), establishment date, length of operation, and job creation or retention impact. For instance, if your loan will help hire five new employees for a manufacturing business, this section highlights that economic benefit, which strengthens your application.

Part D: Structure Information

Part D outlines the financial structure of the loan, including the loan amount, guaranty percentage, repayment terms, payment frequency, and interest rate structure. It accommodates different rates for guaranteed and unguaranteed portions of the loan, which is critical since the SBA typically guarantees 75-90% of the loan, reducing the lender’s risk.

For example, if you’re borrowing $500,000 with an 85% SBA guaranty, the lender will note that $425,000 is guaranteed, with specific terms for both portions. This section ensures transparency in how the loan is structured and repaid.

Part E: Complete Project Information

This section details how the loan proceeds will be used and the sources of funding for the project. It categorizes expenses, such as land acquisition, construction, equipment purchases, inventory, or working capital, and specifies the contribution from the SBA loan, other financing, and the borrower’s equity injection.

Here’s an example in table form to illustrate how funds might be allocated for a hypothetical coffee shop expansion:

| Use of Funds | SBA Loan | Other Financing | Equity Injection | Total |

|---|---|---|---|---|

| Leasehold Improvements | $50,000 | $0 | $10,000 | $60,000 |

| Equipment Purchase | $30,000 | $20,000 | $5,000 | $55,000 |

| Working Capital | $20,000 | $0 | $5,000 | $25,000 |

| Total | $100,000 | $20,000 | $20,000 | $140,000 |

This table helps the SBA and lender verify that the funds are being used for eligible purposes and that the borrower has sufficient skin in the game.

Part G: General Eligibility

Part G confirms that the business meets the SBA’s eligibility criteria, including being a for-profit entity, operating in the U.S., meeting size standards, and demonstrating a need for the loan. The lender must also verify that the business’s goods or services are available to the public. For instance, a consulting firm offering services to private clients would qualify, but a nonprofit organization would not.

Part H: Credit Not Reasonably Available Elsewhere

This section requires the lender to confirm that the borrower cannot obtain credit from non-federal, non-state, or non-local government sources at reasonable terms. The lender provides a credit memo and analysis to support this claim, ensuring the SBA loan is a necessary resource. For example, if a borrower was denied a conventional loan due to insufficient collateral, this section would document that scenario.

Part I: Required Guarantors

Part I verifies that all owners with a 20% or greater stake in the business will personally guarantee the loan. This requirement protects the SBA and lender by ensuring key stakeholders are committed to repayment. For instance, if two partners own 60% and 40% of a business, both must guarantee the loan.

Part J: Character Determination

This section investigates the character of the business’s owners, asking about any criminal history or legal issues. The SBA wants to ensure that the business is operated by individuals with integrity. For example, a past misdemeanor unrelated to financial misconduct might not disqualify an applicant, but a history of fraud could.

Part K: Citizenship

Part K confirms that the business is at least 51% owned and controlled by U.S. citizens or lawful permanent residents, verified through the U.S. Citizenship and Immigration Services (USCIS). This ensures the loan supports domestic businesses.

Part L: Prior Loss to Government/Delinquent Federal Debt

This section checks for any past defaults on federal loans or delinquent nontax debts to the government. For example, if a business owner previously defaulted on a federal student loan, this could impact eligibility unless resolved.

Part M: Size Analysis

Part M determines if the business qualifies as “small” under SBA size standards, based on factors like average annual receipts, number of employees, and tangible net worth. For instance, a restaurant with $2 million in annual revenue and 30 employees might qualify as small, depending on its industry.

Part U: 7(a) Small Loan

For loans under the 7(a) Small Loan program (typically $350,000 or less), this section includes the borrower’s credit score, details from the lender’s credit memo, and specifics about collateral and loan terms. For Community Advantage loans, additional details focus on supporting underserved communities.

How to Submit SBA Form 1920

Lenders must complete, sign, and date Form 1920, keeping it in the loan file. Non-delegated lenders must also submit it electronically to the SBA’s Loan Guaranty Processing Center (LGPC). The SBA estimates that completing the form takes about 25 minutes, including gathering data, reviewing instructions, and finalizing the document. However, this timeline depends on the complexity of the loan and the borrower’s readiness with information.

For borrowers, ensuring your lender has all necessary documents—such as financial statements, tax returns, and business plans—can streamline the process. For example, a tech startup seeking a $200,000 loan for software development should provide detailed projections of revenue and expenses to help the lender complete Part E accurately.

Tips for Borrowers to Prepare for Form 1920

While the lender handles Form 1920, your preparation can make a significant difference. Here are practical tips to ensure a smooth process:

- Organize Financial Documents: Gather tax returns, profit and loss statements, balance sheets, and cash flow projections. These help your lender complete sections like Part D and Part M.

- Clarify Loan Purpose: Be specific about how you’ll use the funds. For example, if you’re buying equipment, provide vendor quotes or invoices to support Part E.

- Verify Eligibility: Confirm that your business meets SBA criteria, such as being for-profit and U.S.-based. Review size standards for your industry to ensure compliance with Part M.

- Communicate with Your Lender: Maintain open communication to provide any additional details promptly. For instance, if your lender needs clarification on your business’s legal structure for Part C, respond quickly to avoid delays.

- Understand Guaranty Requirements: Be prepared to personally guarantee the loan if you own 20% or more of the business, as outlined in Part I.

Common Challenges and How to Overcome Them

Navigating Form 1920 can present challenges, especially for first-time borrowers. Here are common issues and solutions:

- Incomplete Information: If you fail to provide all required data, your lender may delay completing the form. Solution: Create a checklist of required documents based on Form 1920’s sections and submit them upfront.

- Eligibility Concerns: Businesses with complex ownership structures or past financial issues may face scrutiny. Solution: Work with your lender to address potential red flags, such as resolving delinquent debts before applying.

- Time Constraints: The SBA loan process can be time-consuming, especially for non-delegated lenders. Solution: Choose a delegated lender if possible, as they can approve loans faster.

The Bigger Picture: Why Form 1920 Benefits Both Parties

For borrowers, Form 1920 ensures that your loan application is thoroughly evaluated, increasing the likelihood of approval by aligning with SBA standards. For lenders, it provides a structured way to present the loan to the SBA, securing the guaranty that mitigates their risk. Ultimately, the form fosters transparency and accountability, ensuring that SBA loans support viable businesses that contribute to economic growth.

For example, a small construction company using a 7(a) loan to purchase heavy machinery can create jobs and stimulate the local economy. Form 1920 helps the SBA verify that the loan aligns with such goals, benefiting both the business and the community.

Additional Resources for Success

To maximize your chances of a successful 7(a) loan application, consider these resources:

- SBA Local Assistance: Connect with an SBA district office or Small Business Development Center (SBDC) for personalized guidance.

- Loan Calculators: Use online tools to estimate loan payments and ensure the terms fit your budget.

- Professional Advisors: Consult an accountant or financial advisor to prepare accurate financial documents and strengthen your application.

Conclusion

SBA Form 1920 is more than just paperwork—it’s a critical tool that ensures your 7(a) loan application aligns with the SBA’s mission to support small businesses. By understanding its components and preparing thoroughly, you can work seamlessly with your lender to complete the form and secure the funding your business needs. Whether you’re expanding a retail store, launching a tech startup, or upgrading equipment, mastering Form 1920 is a key step toward turning your entrepreneurial dreams into reality. Stay proactive, communicate clearly with your lender, and leverage the SBA’s resources to navigate the process with confidence.

Also, Read these Articles in Detail

- How to Address Small Business Insolvency Before It Leads to Bankruptcy

- The Ultimate Guide to Cash Flow Loans: Unlocking Business Growth

- Petty Cash: A Comprehensive Guide for Small Businesses

- Repaying SBA Loans: A Comprehensive Guide for Small Business Owners

- Microloans for Small Businesses: Unlocking Big Opportunities for Small Ventures

- Swingline Loans: Unlocking Quick Capital Solutions for Businesses and Individuals

- A Comprehensive Guide to Getting Business Loans Without a Credit Check

- Secured vs. Unsecured Business Loans: A Comprehensive Guide for Small Business Owners

- SBA Express Loan: How to Qualify and Apply Successfully

- 1099 Forms: A Comprehensive Guide for Businesses and Individuals

- How to Obtain and File W-2 and 1099 Forms for Your Business: A Comprehensive Guide

- 2025 Guide to W-2 and 1099-NEC Tax Reporting Deadlines and Online Filing Options

- Navigating the World of 1099 Employee Benefits: A Comprehensive Guide for Freelancers

- Comprehensive Guide to Understanding and Filing Form 1099-NEC

- Bank Reconciliation: A Guide to Balancing Your Business’s Books

- How Low Interest Rates Shape the Future of Small Businesses

Frequently Asked Questions (FAQs)

FAQ 1: What is SBA Form 1920, and why is it important for a 7(a) loan application?

SBA Form 1920 is a critical document that lenders must complete as part of the U.S. Small Business Administration’s 7(a) loan program application process. This form provides the SBA with a detailed overview of the loan, including information about the lender, the borrower, and how the loan aligns with SBA requirements. It ensures that the loan meets eligibility criteria, the funds are used appropriately, and the lender complies with program guidelines. While borrowers fill out SBA Form 1919, Form 1920 is the lender’s responsibility, but borrowers play a key role by supplying much of the required information.

The importance of Form 1920 lies in its role as a bridge between the lender, borrower, and SBA. It helps the SBA evaluate whether the loan supports a viable small business and contributes to economic goals, such as job creation. For example, if a small retail store applies for a loan to purchase inventory, Form 1920 details how the funds will be used and confirms the business’s eligibility. For lenders, the form secures the SBA’s guaranty, which reduces their risk by covering a portion of the loan (typically 75-90%) if the borrower defaults. By ensuring transparency, Form 1920 protects all parties and streamlines the approval process.

Key points about Form 1920’s importance:

- It verifies the borrower’s eligibility, such as being a for-profit business operating in the U.S.

- It outlines the loan structure, including amount, terms, and interest rates.

- It confirms the loan’s purpose, such as funding equipment or working capital.

- It ensures compliance with SBA rules, reducing the risk of application rejection.

FAQ 2: Who is responsible for completing SBA Form 1920?

The lender is responsible for completing SBA Form 1920 as part of the 7(a) loan application process. Unlike SBA Form 1919, which is filled out by the borrower, Form 1920 is handled by the SBA-approved lender, such as a bank or credit union, that facilitates the loan. However, borrowers are deeply involved because they must provide the lender with detailed information about their business, finances, and loan purpose to complete the form accurately.

Lenders use Form 1920 to present the loan application to the SBA, ensuring it meets all program requirements. For example, if a small manufacturing business seeks a loan to expand its facility, the borrower supplies financial statements and project details, which the lender uses to fill out sections like Part E (Complete Project Information) and Part M (Size Analysis). The lender’s role is to compile this information, verify its accuracy, and submit the form (if required) to the SBA’s Loan Guaranty Processing Center (LGPC) for non-delegated lenders. Delegated lenders, who have authority to approve loans independently, keep the form in their loan file.

Key responsibilities:

- Lenders complete and sign Form 1920.

- Borrowers provide essential data, such as business financials and loan use plans.

- Non-delegated lenders submit the form electronically to the SBA.

- Both parties collaborate to ensure the form is accurate and complete.

FAQ 3: What information is included in SBA Form 1920?

SBA Form 1920 is a comprehensive document with multiple sections that capture details about the lender, borrower, and loan. All lenders must complete sections A, B, C, D, E, G, H, I, J, K, L, M, and U, with additional sections required depending on the loan type or project. These sections ensure the SBA has a clear picture of the loan’s purpose, the business’s eligibility, and the lender’s compliance with 7(a) loan program guidelines.

For example, Part A specifies whether the loan is processed under a delegated or non-delegated method and identifies the loan type, such as a Standard 7(a) or Community Advantage loan. Part C includes details about the borrower’s business, such as its legal structure and job creation impact, while Part D outlines the loan’s financial terms, like the amount and repayment schedule. Part E breaks down how the funds will be used, such as for equipment or working capital, and Part G confirms eligibility criteria, like operating as a for-profit business in the U.S. Other sections cover guarantors, citizenship, credit availability, and past federal debt.

Key information included:

- Lender details (name, contact information).

- Borrower’s business profile (legal structure, years in operation).

- Loan structure (amount, terms, interest rates).

- Fund usage (e.g., inventory, construction).

- Eligibility verification (size standards, U.S. operation).

- Guarantor and citizenship requirements.

FAQ 4: How does SBA Form 1920 differ from SBA Form 1919?

SBA Form 1920 and SBA Form 1919 are both essential for 7(a) loan applications, but they serve different purposes and are completed by different parties. Form 1919 is filled out by the borrower and focuses on personal and business information, such as the owner’s financial standing, business history, and loan specifics. In contrast, Form 1920 is completed by the lender and provides the SBA with a broader overview of the loan, including eligibility, loan terms, and compliance with program requirements.

For instance, a borrower applying for a loan to open a coffee shop would use Form 1919 to report their personal credit history, business revenue, and intended loan use. The lender, using Form 1920, would detail the loan’s structure (e.g., $100,000 with an 85% guaranty), verify that the business meets SBA size standards, and confirm that credit is not available elsewhere. While Form 1919 is about the borrower’s perspective, Form 1920 reflects the lender’s analysis and ensures the loan aligns with SBA goals, such as supporting small businesses that contribute to economic growth.

Key differences:

- Form 1919: Completed by the borrower; focuses on personal and business details.

- Form 1920: Completed by the lender; focuses on loan structure and eligibility.

- Form 1919 is submitted to the lender, while Form 1920 may go to the SBA (for non-delegated lenders).

- Both require borrower input, but Form 1920 emphasizes lender verification.

FAQ 5: What are the key sections of SBA Form 1920 that borrowers should understand?

While SBA Form 1920 is completed by the lender, borrowers should familiarize themselves with its key sections to provide accurate information and streamline the 7(a) loan application process. The form includes sections A, B, C, D, E, G, H, I, J, K, L, M, and U, each addressing a specific aspect of the loan and business. Understanding these sections helps borrowers anticipate what their lender will need.

For example, Part C requires details about the business’s legal structure, years of operation, and job creation impact, which the borrower must supply. Part E outlines how the loan funds will be used, such as for purchasing equipment or covering working capital, requiring detailed cost breakdowns from the borrower. Part I confirms that owners with a 20% or greater stake will guarantee the loan, so borrowers must be prepared to commit personally. Part M verifies that the business meets SBA size standards, which may require financial statements or employee counts. By preparing this information in advance, borrowers can avoid delays and strengthen their application.

Key sections to understand:

- Part C: Business details (structure, job impact).

- Part D: Loan terms (amount, repayment schedule).

- Part E: Fund usage (e.g., inventory, construction).

- Part G: Eligibility (for-profit, U.S.-based).

- Part I: Guarantor requirements (20%+ owners).

- Part M: Size standards (receipts, employees).

FAQ 6: How can borrowers prepare to help their lender complete SBA Form 1920?

Borrowers play a crucial role in helping their lender complete SBA Form 1920 by providing accurate and organized information. Since the form requires details about the business, loan purpose, and financial standing, preparation is key to avoiding delays in the 7(a) loan application process. By anticipating the lender’s needs, borrowers can ensure the form is completed efficiently and accurately.

Start by gathering essential documents, such as tax returns, financial statements, and a business plan, which support sections like Part M (Size Analysis) and Part H (Credit Not Reasonably Available Elsewhere). Be specific about how the loan funds will be used—for example, provide vendor quotes for equipment purchases to help complete Part E (Complete Project Information). Verify your business’s eligibility, such as being a for-profit entity in the U.S., to align with Part G (General Eligibility). Maintain open communication with your lender to address any questions promptly, and ensure owners with a 20% or greater stake are ready to guarantee the loan (Part I).

Preparation tips:

- Compile financial records (tax returns, profit and loss statements).

- Provide detailed plans for loan fund usage.

- Confirm eligibility criteria (U.S.-based, for-profit).

- Communicate regularly with the lender.

- Prepare guarantors for personal commitments.

FAQ 7: What happens after SBA Form 1920 is completed?

Once the lender completes SBA Form 1920, the next steps depend on whether the lender is delegated or non-delegated in the 7(a) loan program. Delegated lenders, who have authority to approve loans independently, sign and date the form and keep it in their loan file for SBA review if needed. Non-delegated lenders must submit Form 1920 electronically to the SBA’s Loan Guaranty Processing Center (LGPC) for approval, along with other application documents.

After submission, the SBA reviews Form 1920 to ensure the loan meets program requirements, such as borrower eligibility, proper fund usage, and compliance with size standards. For example, if a small bakery applies for a $150,000 loan to renovate its storefront, the SBA checks that the business is U.S.-based, for-profit, and that the funds are allocated appropriately (Part E). If approved, the lender finalizes the loan terms, and funds are disbursed to the borrower. If revisions are needed, the lender may request additional information from the borrower. The process typically takes a few weeks, depending on the loan’s complexity and lender status.

Post-completion steps:

- Delegated lenders retain the form; non-delegated lenders submit it to the LGPC.

- SBA reviews the form for compliance and eligibility.

- Approved loans move to funding; revisions may require more data.

- Borrowers should stay in touch with lenders for updates.

FAQ 8: What are common challenges when completing SBA Form 1920, and how can they be avoided?

Completing SBA Form 1920 can present challenges for lenders and borrowers in the 7(a) loan application process, but proactive preparation can minimize issues. Common problems include incomplete information, eligibility concerns, and delays due to complex business structures or past financial issues. Addressing these challenges upfront ensures a smoother application process.

One frequent issue is incomplete information, such as missing financial statements or unclear fund usage plans, which delays sections like Part E (Complete Project Information) or Part M (Size Analysis). Borrowers can avoid this by creating a checklist of required documents, including tax returns and vendor quotes. Eligibility concerns, such as businesses with non-standard ownership or past federal debt (Part L), can be resolved by consulting with the lender early to address red flags. Delays often occur with non-delegated lenders, who require SBA approval. Choosing a delegated lender, if possible, can speed up the process. Clear communication between the borrower and lender is essential to resolve issues quickly.

Common challenges and solutions:

- Incomplete information: Provide all documents upfront (financials, plans).

- Eligibility issues: Review SBA criteria and resolve debts early.

- Delays: Opt for a delegated lender or submit promptly.

- Complex structures: Clarify ownership details for Part C.

FAQ 9: How does SBA Form 1920 support the goals of the 7(a) loan program?

SBA Form 1920 plays a vital role in supporting the 7(a) loan program’s mission to provide financial assistance to small businesses that struggle to access conventional credit. By capturing detailed information about the loan, borrower, and lender, the form ensures that funds are allocated to eligible businesses that contribute to economic growth, such as through job creation or community development. It aligns the loan with the SBA’s goal of fostering entrepreneurship and reducing lender risk through a guaranty.

For example, Part C (Small Business Applicant Information) highlights a business’s job creation impact, such as a construction company hiring new workers with loan funds, which supports local economies. Part E (Complete Project Information) ensures funds are used for eligible purposes, like equipment or working capital, maximizing the loan’s impact. Part G (General Eligibility) verifies that the business is a for-profit entity operating in the U.S., aligning with the program’s focus on domestic small businesses. By facilitating transparency and compliance, Form 1920 helps the SBA achieve its mission while protecting lenders and borrowers.

How Form 1920 supports 7(a) goals:

- Verifies eligibility for small, U.S.-based businesses.

- Ensures funds support economic goals (job creation, growth).

- Secures lender guaranty, reducing risk.

- Promotes transparency in loan usage and terms.

FAQ 10: What types of 7(a) loans require SBA Form 1920, and how do they differ?

SBA Form 1920 is required for all loans under the 7(a) loan program, which includes several loan types designed to meet diverse small business needs. These types include Standard 7(a), SBA Express, Community Advantage, and others, each with unique features like loan amounts, guaranty percentages, or eligibility criteria. Form 1920’s Part A (Loan Processing Options) identifies the specific loan type, ensuring the application aligns with its requirements.

For example, a Standard 7(a) loan, with a maximum of $5 million, is ideal for large projects like real estate purchases and offers a guaranty of up to 85%. SBA Express loans, capped at $500,000, provide faster processing for smaller needs, like working capital, with a 50% guaranty. Community Advantage loans, limited to $250,000, target underserved communities, such as businesses in low-income areas, and emphasize economic impact in Part U (7(a) Small Loan). Each type requires Form 1920 to verify eligibility and fund usage, but the details vary based on the loan’s purpose and structure.

Key 7(a) loan types:

- Standard 7(a): Up to $5 million, 75-85% guaranty, for major projects.

- SBA Express: Up to $500,000, 50% guaranty, faster approval.

- Community Advantage: Up to $250,000, focuses on underserved areas.

- All require Form 1920, tailored to their specific terms.

FAQ 11: Why does the SBA require Form 1920 for 7(a) loans?

SBA Form 1920 is a critical component of the 7(a) loan program because it provides the U.S. Small Business Administration with a comprehensive overview of the loan application, ensuring alignment with the program’s objectives. The form collects essential details about the lender, borrower, and loan terms, allowing the SBA to verify that the loan supports a viable small business and complies with eligibility criteria. This process helps the SBA fulfill its mission of fostering entrepreneurship while minimizing risk for lenders through the SBA guaranty.

For instance, a small business owner applying for a loan to purchase new equipment for a bakery would provide financial data and business plans, which the lender uses to complete Form 1920. The form’s sections, such as Part E (Complete Project Information), ensure the funds are used for approved purposes, while Part G (General Eligibility) confirms the business operates as a for-profit entity in the U.S. By requiring Form 1920, the SBA ensures transparency, reduces the risk of misuse, and supports economic growth through job creation or retention.

Key reasons for requiring Form 1920:

- Verifies borrower eligibility and compliance with SBA standards.

- Details loan structure and fund usage for transparency.

- Secures the SBA guaranty, protecting lenders from default risks.

- Supports the SBA’s mission to aid small businesses and economic development.

FAQ 12: How does Part E of SBA Form 1920 help determine loan fund usage?

Part E (Complete Project Information) of SBA Form 1920 is crucial because it outlines how the 7(a) loan funds will be used and identifies the sources of financing for the project. This section categorizes expenses, such as land acquisition, equipment purchases, inventory, or working capital, and specifies how much comes from the SBA loan, other financing, and the borrower’s equity injection. By providing this breakdown, Part E ensures the funds are used for eligible purposes that align with the SBA’s goals.

For example, a small retail business seeking a $200,000 loan to renovate its storefront might allocate $100,000 for construction, $50,000 for equipment, and $50,000 for working capital. The borrower would provide cost estimates or vendor quotes, which the lender uses to complete Part E. This section also requires details on other funding sources, such as a bank loan or personal savings, ensuring the borrower has sufficient investment in the project. This transparency helps the SBA confirm that the loan supports legitimate business needs and contributes to economic impact.

Key aspects of Part E:

- Categorizes fund usage (e.g., construction, inventory).

- Specifies SBA loan, other financing, and equity contributions.

- Requires detailed cost breakdowns from the borrower.

- Ensures alignment with SBA-approved purposes.

FAQ 13: What role does Part G play in ensuring eligibility for a 7(a) loan?

Part G (General Eligibility) of SBA Form 1920 is designed to confirm that the borrower meets the 7(a) loan program’s eligibility requirements. This section verifies that the business is a for-profit entity, operates in the U.S. or its territories, meets SBA size standards, and demonstrates a need for the loan. It also ensures that the business’s goods or services are available to the public, aligning with the SBA’s mission to support viable small businesses that contribute to the economy.

For instance, a small consulting firm applying for a loan to hire additional staff would need to show it operates for profit and is based in the U.S. The lender uses Part G to confirm these criteria, often relying on the borrower’s financial statements and business registration documents. If the firm employs 10 people and generates $1 million annually, Part G ensures it meets size standards for its industry. This section is critical to prevent ineligible businesses, such as nonprofits or speculative ventures, from receiving SBA support.

Key roles of Part G:

- Confirms the business is for-profit and U.S.-based.

- Verifies compliance with SBA size standards.

- Ensures goods or services are publicly available.

- Validates the need for SBA financing.

FAQ 14: How does Part I of SBA Form 1920 affect business owners?

Part I (Required Guarantors) of SBA Form 1920 requires that all owners with a 20% or greater stake in the business personally guarantee the 7(a) loan. This means these owners are legally responsible for repaying the loan if the business cannot, protecting the SBA and lender from financial loss. For business owners, this section underscores the personal commitment required when seeking SBA financing, as it ties their personal finances to the loan’s success.

For example, if two partners own a small construction company with 60% and 40% shares, both must guarantee a $300,000 loan used to purchase heavy machinery. The lender verifies this in Part I, ensuring all major stakeholders are committed. Owners should be prepared to provide personal financial statements and understand the risks, as defaulting could impact their personal assets. This requirement encourages responsible borrowing and ensures the business is managed with care to avoid financial strain.

Key impacts of Part I:

- Requires personal guarantees from 20%+ owners.

- Ties owners’ personal finances to loan repayment.

- Encourages responsible business management.

- Protects the SBA and lender from default risks.

FAQ 15: What is the significance of Part H in SBA Form 1920?

Part H (Credit Not Reasonably Available Elsewhere) of SBA Form 1920 ensures that the borrower cannot obtain credit from non-federal, non-state, or non-local government sources at reasonable terms without SBA assistance. This section is critical because the 7(a) loan program is designed to help small businesses that lack access to conventional financing, such as those with limited collateral or credit history. The lender provides a credit memo and analysis to demonstrate this need, supporting the loan’s necessity.

For instance, a startup restaurant with strong revenue potential but insufficient collateral might be denied a bank loan. The lender would document this in Part H, showing that the SBA loan is essential for the business to expand. This section ensures that SBA funds are directed to businesses genuinely in need, maximizing the program’s impact. Borrowers should provide evidence of prior loan denials or unfavorable terms to help the lender complete this section accurately.

Significance of Part H:

- Confirms the borrower’s lack of access to other credit.

- Requires a lender’s credit memo and analysis.

- Ensures SBA loans support businesses in need.

- Aligns with the program’s mission to bridge financing gaps.

FAQ 16: How does Part M of SBA Form 1920 determine if a business is “small”?

Part M (Size Analysis) of SBA Form 1920 determines whether the applicant and its affiliates qualify as a “small” business under SBA size standards, a key eligibility requirement for the 7(a) loan program. This section collects data on the business’s average annual receipts, number of employees, and tangible net worth, which vary by industry. The SBA uses these metrics to ensure loans support small businesses rather than larger enterprises.

For example, a retail clothing store with $2 million in annual revenue and 15 employees might qualify as “small” if its industry’s size standard allows up to $41.5 million in receipts or 250 employees. The borrower provides financial statements and employee counts, which the lender uses to complete Part M. This section prevents larger businesses from accessing SBA loans, ensuring funds are reserved for those most in need of support. Borrowers should review their industry’s size standards to confirm eligibility before applying.

Key aspects of Part M:

- Assesses business size based on receipts, employees, or net worth.

- Uses industry-specific SBA size standards.

- Requires financial and operational data from the borrower.

- Ensures loans target small businesses.

FAQ 17: What types of businesses need to provide information for Part C of SBA Form 1920?

Part C (Small Business Applicant Information) of SBA Form 1920 applies to all businesses applying for a 7(a) loan, with additional requirements for those structured as an Eligible Passive Company (EPC). This section collects details about the business’s legal structure, establishment date, years of operation, and job creation or retention impact. For EPCs, such as holding companies that lease property to an operating business, Part C requires specific information about the relationship between the entities.

For instance, a small manufacturing business applying for a loan to upgrade equipment would provide its LLC status, founding date, and data on hiring new employees, which the lender uses to complete Part C. If the business operates as an EPC leasing a facility to a retail store, the lender needs details on both entities’ operations and ownership. All applicants must supply this information to demonstrate their business’s viability and economic impact, making Part C a foundational part of the form.

Businesses affected by Part C:

- All 7(a) loan applicants (e.g., LLCs, corporations).

- EPCs with leasing or holding arrangements.

- Businesses reporting job creation or retention.

- Those providing legal and operational details.

FAQ 18: How long does it take to complete SBA Form 1920, and what factors affect the timeline?

The SBA estimates that completing SBA Form 1920 takes about 25 minutes per response, including reviewing instructions, gathering data, filling out the form, and finalizing it. However, the actual time can vary depending on the complexity of the loan, the borrower’s preparedness, and the lender’s experience with 7(a) loans. For straightforward loans, such as a small business seeking $50,000 for inventory, the process may be quick if all documents are ready. Complex projects, like a $2 million loan for real estate, may take longer due to detailed financial analyses.

Factors affecting the timeline include the availability of borrower information, such as financial statements or cost estimates, and the lender’s status as delegated or non-delegated. Delegated lenders can complete the form faster since they don’t require immediate SBA submission. Borrowers can speed up the process by providing organized documents, like tax returns and vendor quotes, upfront. Clear communication between the borrower and lender also minimizes delays.

Factors affecting completion time:

- Loan complexity (simple vs. large projects).

- Borrower’s readiness with documents.

- Lender’s delegated or non-delegated status.

- Communication efficiency between parties.

FAQ 19: What is the role of Part U in SBA Form 1920 for small loans?

Part U (7(a) Small Loan) of SBA Form 1920 applies specifically to loans under the 7(a) Small Loan program, typically $350,000 or less, including Community Advantage loans aimed at underserved communities. This section collects the borrower’s credit score, details from the lender’s credit memo, and information about collateral and loan terms. For Community Advantage loans, it emphasizes supporting businesses in low-income areas, ensuring alignment with the program’s focus on economic equity.

For example, a small daycare in an underserved neighborhood applying for a $100,000 Community Advantage loan would provide credit information and collateral details, such as equipment value, for Part U. The lender’s credit memo might summarize the business’s history and repayment ability. This section ensures that smaller loans are thoroughly evaluated, balancing risk and impact. Borrowers should prepare accurate financial data and collateral valuations to help the lender complete Part U efficiently.

Key roles of Part U:

- Collects credit scores and credit memo details.

- Focuses on collateral and loan terms for small loans.

- Supports Community Advantage loans for underserved areas.

- Ensures thorough evaluation of smaller loan applications.

FAQ 20: How can borrowers avoid delays in the SBA Form 1920 process?

Avoiding delays in the SBA Form 1920 process is essential for a smooth 7(a) loan application, and borrowers play a key role by being proactive and organized. Since the lender relies on borrower-provided information to complete the form, delays often occur when data is incomplete or unclear. By preparing thoroughly and maintaining open communication, borrowers can help ensure the form is completed and submitted efficiently.

Start by compiling all required documents, such as tax returns, financial statements, and a detailed business plan, to support sections like Part M (Size Analysis) and Part E (Complete Project Information). For example, a borrower seeking a loan for equipment should provide vendor quotes to clarify costs. Choosing a delegated lender, who can approve loans faster, also reduces delays compared to non-delegated lenders who submit to the SBA’s Loan Guaranty Processing Center. Regularly check in with the lender to address questions or provide additional data promptly, ensuring the process stays on track.

Tips to avoid delays:

- Gather all financial and business documents upfront.

- Provide specific cost breakdowns for loan usage.

- Work with a delegated lender for faster processing.

- Maintain clear, frequent communication with the lender.

Acknowledgement

The creation of the article “SBA Form 1920: A Comprehensive Guide for Small Business Owners and Lenders” was made possible through the valuable insights and information provided by a variety of reputable sources. I sincerely express my humble gratitude to these organizations for their comprehensive resources, which helped ensure the accuracy and depth of the content. Their expertise in small business financing, SBA loan programs, and regulatory guidelines was instrumental in shaping this guide.

Below is a list of the key sources referenced:

- U.S. Small Business Administration for detailed information on the 7(a) loan program and SBA Form 1920 requirements.

- Bankrate for insights into loan application processes and financial tips for small businesses.

- NerdWallet for clear explanations of SBA loan eligibility and documentation.

- Forbes for expert advice on small business financing and loan structures.

- Investopedia for in-depth definitions and analyses of SBA loan terms.

- Business News Daily for practical guidance on navigating SBA loan applications.

- Entrepreneur for actionable tips for small business owners seeking financing.

- The Balance for detailed breakdowns of SBA loan processes and forms.

- Fundera for comparisons of SBA loan types and lender requirements.

- Nav for insights into credit requirements and loan preparation.

- LendingTree for information on lender perspectives and loan terms.

- Inc. for strategies to optimize SBA loan applications.

- Fit Small Business for step-by-step guides on SBA loan documentation.

- SCORE for mentorship-driven advice on small business financing.

- U.S. Chamber of Commerce for resources on small business growth and SBA programs.

Disclaimer

The information provided in the article “SBA Form 1920: A Comprehensive Guide for Small Business Owners and Lenders” is intended for general informational purposes only and should not be considered as legal, financial, or professional advice. While every effort has been made to ensure the accuracy and completeness of the content, the U.S. Small Business Administration (SBA) regulations, policies, and loan requirements are subject to change, and individual circumstances may vary.

Readers are encouraged to consult with qualified professionals, such as financial advisors, accountants, or SBA-approved lenders, before making decisions related to SBA loan applications or completing SBA Form 1920. The author and publisher of this article, and the website Manishchanda.net are not responsible for any errors, omissions, or outcomes resulting from the use of this information.