The world of securities offerings can feel like navigating a labyrinth, with complex regulations and paperwork at every turn. For businesses looking to raise capital without the burden of a full-blown securities registration, SEC Form D offers a streamlined path. This form is a critical tool for companies seeking to notify the Securities and Exchange Commission (SEC) about exempt offerings—sales of securities like stocks, bonds, or other investments that bypass the rigorous registration process. In this article, we’ll dive deep into what SEC Form D is, who uses it, how to file it, and why it matters, while sprinkling in practical examples and insights to make this topic crystal clear.

Table of Contents

What Is SEC Form D?

SEC Form D is a notice filed with the SEC by companies that have sold securities without registering them, as permitted under Regulation D (Reg D) of the Securities Act of 1933. The Securities Act is a cornerstone of U.S. financial regulation, designed to protect investors by ensuring transparency and accountability in securities offerings. However, the registration process can be a daunting, time-consuming, and costly endeavor, often requiring months of preparation and the expertise of legal and financial professionals. For smaller businesses or startups, this can be a significant barrier to raising capital.

This is where SEC Form D comes in. It serves as a notification to the SEC that a company has conducted an exempt offering, meaning they’ve sold securities without going through the full registration process. The form is not an application for approval but a report filed after the securities have been offered. By filing Form D, companies comply with federal regulations while taking advantage of exemptions that make fundraising more accessible.

For example, imagine a tech startup aiming to raise $2 million to develop a new app. Instead of navigating the costly registration process, the company could sell shares to a select group of investors under Reg D and file Form D to inform the SEC. This approach saves time and resources while still ensuring regulatory oversight.

Why Does SEC Form D Exist?

The SEC’s mission is to protect investors, maintain fair markets, and facilitate capital formation. The registration process ensures that companies provide detailed disclosures about their financial health, operations, and risks, giving investors the information they need to make informed decisions. However, for certain types of offerings, particularly those involving sophisticated or wealthy investors, the SEC allows exemptions to streamline the process.

Regulation D provides a framework for these exemptions, balancing investor protection with the needs of businesses. Form D is a key part of this framework, requiring companies to disclose essential details about the offering, such as the type of securities sold, the amount raised, and the identities of key individuals involved. This ensures that the SEC can monitor exempt offerings and protect investors from fraud, even in the absence of a full registration.

Consider a small biotech firm developing a groundbreaking medical device. By targeting accredited investors—individuals or entities with significant financial resources—the firm can raise funds quickly under Reg D, file Form D, and focus on innovation rather than regulatory hurdles. The SEC still gets the information it needs to oversee the transaction, creating a win-win scenario.

Who Uses SEC Form D?

SEC Form D is primarily used by businesses and entrepreneurs conducting exempt offerings under specific SEC rules, including:

- Rule 506(b): Allows private placements to accredited investors and up to 35 non-accredited but sophisticated investors, with no general solicitation (e.g., public advertising).

- Rule 506(c): Permits general solicitation, but all investors must be accredited, and the company must verify their accreditation status.

- Rule 504: Permits offerings up to $10 million (as of recent updates) to a broader range of investors, often used by smaller companies.

Eligible entities include corporations, limited liability companies (LLCs), partnerships, and trusts. These organizations use Form D to notify the SEC about their offerings, ensuring compliance with Reg D’s requirements.

A critical aspect of Form D is the focus on accredited investors. The SEC defines these as individuals with an annual income exceeding $200,000 (or $300,000 jointly with a spouse) for the past two years, or a net worth over $1 million (excluding their primary residence). Entities like trusts or LLCs qualify if all equity owners are accredited or if the entity has assets exceeding $5 million. The SEC requires companies to verify the accreditation status of investors to ensure they have the financial sophistication to understand and bear the risks of unregistered securities.

Additionally, Form D requires disclosure of Related Persons—executive officers, directors, and promoters involved in the offering. This allows the SEC to check for any “bad actors” (individuals with disqualifying events like criminal convictions or regulatory violations) who might pose a risk to investors.

For instance, a real estate development company might use Rule 506(b) to raise $5 million from accredited investors to fund a new project. By filing Form D, the company informs the SEC about the offering, lists its directors and officers, and confirms that all investors meet the accreditation criteria.

| SEC Rule | Key Features | Investor Requirements | Offering Limit |

|---|---|---|---|

| Rule 506(b) | Private placements, no general solicitation | Accredited investors; up to 35 sophisticated non-accredited investors | Unlimited |

| Rule 506(c) | General solicitation allowed | Only accredited investors, with verification | Unlimited |

| Rule 504 | Smaller offerings, more flexible | No specific investor requirements | Up to $10 million |

How to File SEC Form D

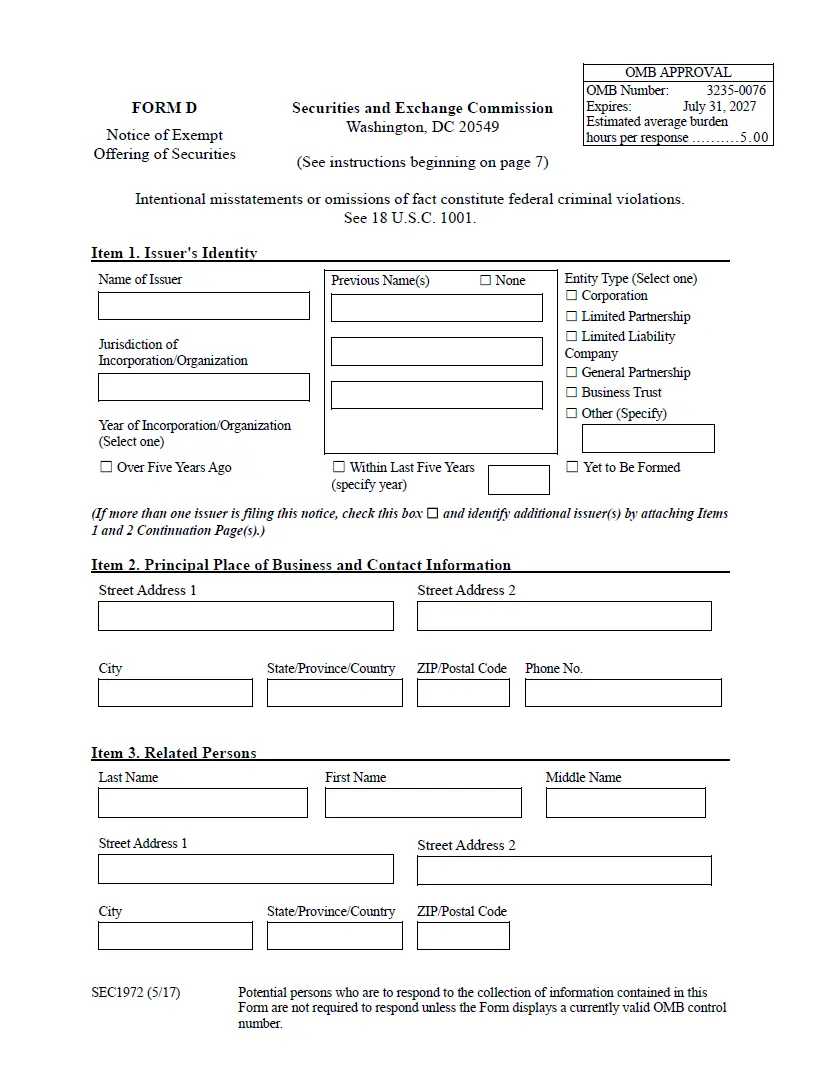

Filing SEC Form D is a straightforward but precise process that requires careful attention to detail. The form must be filed within 15 days of the date of first sale, defined as the moment an investor is irrevocably committed to the investment. Here’s a step-by-step guide to the process:

- Access the EDGAR System: The SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system is the platform for filing Form D. Companies must first obtain a Central Index Key (CIK) number and access codes by registering with EDGAR. This ensures secure submission and tracking.

- Complete the Form: Form D is available as a fillable PDF with detailed instructions. It requires information such as:

- The issuer’s name, address, and legal structure.

- Details of the offering, including the amount raised and the type of securities (e.g., equity, debt).

- Information about Related Persons, including their roles and any disqualifying events.

- The specific Reg D rule under which the exemption is claimed.

- Verify Investor Accreditation: Companies must confirm that investors meet the accredited investor criteria, often through documentation like tax returns, bank statements, or third-party verification.

- Submit the Form: Once completed, the form is submitted electronically via EDGAR. The SEC does not charge a filing fee, making Form D a cost-effective option for compliance.

- State Filings: Many states require a copy of Form D to be filed, often with a fee. Some states accept paper filings, while others use the Electronic Filing Depository (EFD) for online submissions. Check with your state’s securities regulator for specific requirements.

For example, a fintech startup raising $3 million under Rule 506(c) would gather investor documentation, complete Form D with details of the offering, and submit it via EDGAR within 15 days of the first investor’s commitment. If operating in California, the company might also file Form D with the state’s Department of Financial Protection and Innovation, paying a modest fee.

State Filing Requirements

In addition to federal filing, most states require companies to file Form D or a similar notice for offerings conducted within their jurisdiction. State regulations vary widely, with some states requiring online filings through the EFD, while others accept paper submissions. Fees also differ, ranging from nominal amounts to several hundred dollars, depending on the state and the size of the offering.

For instance, a company raising funds in New York must file Form D with the New York Attorney General’s Investor Protection Bureau and pay a fee based on the offering amount. In contrast, a state like Texas might require only an online filing through the EFD with a flat fee. Checking with the North American Securities Administrators Association (NASAA) can help companies identify state-specific requirements.

| State | Filing Method | Fee Structure | Additional Notes |

|---|---|---|---|

| California | Online (EFD) or paper | $200-$800, based on offering size | Requires detailed investor information |

| New York | Paper or online | $300-$1,200, based on offering size | Strict deadlines for filing |

| Texas | Online (EFD) | $500 flat fee | Simplified process for Reg D filings |

What Happens After Filing?

Once Form D is filed, the SEC reviews the submission to ensure compliance with Reg D. The agency authenticates the filing and communicates the outcome via email. If the filing is accepted, no further action is typically required unless amendments are needed (e.g., if the offering amount changes).

However, a filing can be rejected due to issues like incomplete information or a bad actor disqualification. This occurs if a Related Person has a disqualifying event, such as a criminal conviction or SEC enforcement action, that occurred after September 23, 2013, when updated rules took effect. Companies can apply for a waiver in some cases, but this requires legal assistance to navigate.

For example, a startup might discover that one of its promoters has a recent regulatory violation. The SEC could reject the Form D filing unless the company removes the individual or secures a waiver demonstrating good cause.

Common Challenges and Best Practices

Filing SEC Form D may seem straightforward, but mistakes can lead to delays or penalties. Common challenges include:

- Incorrect Investor Verification: Failing to properly verify accredited investor status can invalidate the exemption.

- Missed Deadlines: Filing after the 15-day window can trigger SEC scrutiny or state penalties.

- Incomplete Related Person Disclosures: Omitting key individuals or failing to disclose disqualifying events can lead to rejection.

To avoid these pitfalls, consider these best practices:

- Engage a Securities Attorney: Legal experts can ensure compliance with federal and state regulations, reducing the risk of errors.

- Maintain Detailed Records: Document investor accreditation and offering details meticulously to support the filing.

- Check State Requirements Early: Research state filing obligations before launching the offering to avoid surprises.

- Use EDGAR Efficiently: Save drafts in EDGAR to streamline revisions and ensure timely submission.

Why Form D Matters for Businesses and Investors

For businesses, SEC Form D is a lifeline, enabling faster and more cost-effective fundraising. By leveraging Reg D exemptions, companies can access capital from accredited investors without the burden of full registration, which can cost hundreds of thousands of dollars and take months to complete. This is particularly valuable for startups and small businesses with limited resources.

For investors, Form D filings provide transparency. Although exempt offerings carry higher risks due to limited disclosures, the SEC’s oversight ensures that companies meet certain standards, such as verifying investor accreditation and disclosing Related Persons. Investors can also access Form D filings through EDGAR to research the offering and the company’s leadership.

Take the case of a renewable energy startup raising $8 million to build a solar farm. By filing Form D under Rule 506(b), the company can target high-net-worth individuals who understand the risks of investing in a new venture. The Form D filing ensures the SEC is aware of the transaction, protecting both the company and its investors.

Additional Insights: The Broader Impact of Form D

Beyond its immediate function, SEC Form D plays a broader role in the financial ecosystem. It supports capital formation by enabling smaller companies to compete with larger firms for investment dollars. This democratization of fundraising fosters innovation, as startups in industries like technology, healthcare, and clean energy can secure funding without navigating prohibitive regulatory barriers.

Moreover, Form D filings contribute to market transparency. The SEC uses the data to monitor trends in exempt offerings, identify potential risks, and refine regulations. For example, the SEC might analyze Form D filings to assess the growth of private placements in a specific sector, informing future policy decisions.

From an investor’s perspective, the requirement to verify accreditation ensures that only those with sufficient financial resources participate in high-risk offerings. This protects less experienced investors from ventures they may not fully understand, while still allowing sophisticated investors to support innovative companies.

Conclusion: Navigating Form D with Confidence

SEC Form D is a powerful tool for businesses seeking to raise capital efficiently while complying with federal and state regulations. By understanding its purpose, eligibility requirements, and filing process, companies can leverage Reg D exemptions to access funding from accredited investors without the burden of full securities registration. For investors, Form D offers a layer of transparency and oversight, balancing the risks of exempt offerings with the opportunities they present.

Whether you’re a startup founder, an entrepreneur, or an investor, mastering Form D is essential for navigating the world of exempt securities offerings. By following best practices, engaging legal expertise, and staying informed about state requirements, you can use Form D to unlock new opportunities while staying on the right side of the law. In a financial landscape where agility and compliance go hand in hand, Form D is a bridge to success for businesses and investors alike.

Frequently Asked Questions

FAQ 1: What is SEC Form D and why is it important?

SEC Form D is a notice that companies file with the Securities and Exchange Commission (SEC) when they sell securities, like stocks or bonds, without registering them under the Securities Act of 1933. This form is critical for businesses using Regulation D (Reg D) exemptions, which allow them to raise capital more quickly and with less cost than a full registration process. Filing Form D informs the SEC about the exempt offering, ensuring oversight while helping companies comply with federal regulations.

The importance of Form D lies in its role in balancing investor protection with business flexibility. The SEC’s mission is to safeguard investors by ensuring transparency, but registering securities can take months and require expensive legal and financial expertise. Form D allows eligible businesses to bypass this process, provided they meet specific requirements, such as selling to accredited investors. For example, a startup raising $1 million for a new product can file Form D to notify the SEC of its private offering, avoiding the lengthy registration process while still adhering to regulatory standards.

By filing Form D, companies also provide transparency for investors. The form includes details about the offering, such as the amount raised and the identities of key individuals involved, which the SEC can review to prevent fraud. This makes Form D a vital tool for startups, small businesses, and investors navigating the world of exempt securities offerings.

FAQ 2: Who needs to file SEC Form D?

SEC Form D is required for businesses and entrepreneurs conducting exempt offerings under Regulation D rules, such as Rule 506(b), Rule 506(c), or Rule 504. These entities include corporations, limited liability companies (LLCs), partnerships, and trusts that sell securities like equity or debt without registering them with the SEC. The form serves as a notice filed after the securities are sold, ensuring the SEC is informed of the transaction.

Eligible businesses typically include startups, small companies, or real estate ventures looking to raise capital efficiently. For instance, a tech startup might use Rule 506(b) to sell shares to a small group of wealthy investors, while a real estate firm could use Rule 504 for a smaller offering under $10 million. The key requirement is that the investors are often accredited investors, meaning they have significant income or net worth, ensuring they can handle the risks of unregistered securities.

Additionally, Form D requires disclosure of Related Persons, such as executive officers, directors, or promoters, to allow the SEC to check for any disqualifying events, like criminal convictions. This ensures that only credible individuals are involved in the offering, protecting investors and maintaining market integrity.

FAQ 3: What are the key rules under Regulation D for SEC Form D filings?

Regulation D includes several rules that allow businesses to conduct exempt offerings without registering securities, and SEC Form D is used to notify the SEC about these offerings. The main rules are Rule 506(b), Rule 506(c), and Rule 504, each with distinct features tailored to different types of offerings.

- Rule 506(b) allows private placements to accredited investors and up to 35 non-accredited but sophisticated investors, with no public advertising permitted. There’s no limit on the amount raised, making it ideal for large fundraising efforts.

- Rule 506(c) permits general solicitation, like advertising to the public, but all investors must be accredited, and the company must verify their status through documentation, such as tax returns or bank statements.

- Rule 504 is designed for smaller offerings, allowing up to $10 million to be raised with fewer restrictions on investor types, suitable for small businesses or startups.

For example, a biotech company might use Rule 506(b) to raise $20 million from accredited investors in a private deal, while a local business might use Rule 504 to raise $2 million for expansion. Filing Form D under these rules ensures the SEC is aware of the offering and can monitor compliance, protecting investors while allowing businesses flexibility.

FAQ 4: How do you file SEC Form D?

Filing SEC Form D is a structured process that requires careful attention to detail and must be completed within 15 days of the date of first sale, when an investor is irrevocably committed to the investment. The filing is done electronically through the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system, and there’s no federal filing fee, making it cost-effective.

To file, a company must first register with EDGAR to obtain a Central Index Key (CIK) number and access codes. Then, they complete the Form D PDF, which asks for details like the issuer’s name, the amount raised, the type of securities, and information about Related Persons (e.g., executives or promoters). The form also requires confirmation that investors meet accredited investor criteria, often verified through financial documents. Once completed, the form is submitted via EDGAR, where it can also be saved as a draft or amended later if needed.

State filings may also be required, often through the Electronic Filing Depository (EFD) or paper submissions, depending on the state. For instance, a startup raising $5 million in California would file Form D with the SEC via EDGAR and submit a copy to the state, possibly paying a fee. Consulting a securities attorney can help ensure accuracy and compliance with both federal and state requirements.

FAQ 5: What are accredited investors, and why are they important for Form D?

Accredited investors are individuals or entities with significant financial resources, as defined by the SEC, who can participate in exempt offerings under Regulation D. They are crucial for SEC Form D filings because Reg D rules, particularly Rule 506(b) and Rule 506(c), often require that investors meet accreditation standards to ensure they can handle the risks of unregistered securities.

An individual qualifies as an accredited investor if they have an annual income over $200,000 (or $300,000 jointly with a spouse) for the past two years, or a net worth exceeding $1 million (excluding their primary residence). Entities like trusts or LLCs qualify if they have assets over $5 million or if all equity owners are accredited. Companies must verify this status, often through documents like tax returns, bank statements, or third-party certifications.

For example, a startup raising funds under Rule 506(c) might ask investors to provide financial statements to confirm their accreditation before accepting their investment. This protects both the company and investors by ensuring only financially sophisticated individuals participate, reducing the risk of fraud or misunderstanding. Form D requires companies to confirm investor accreditation, making it a key component of regulatory compliance.

FAQ 6: What happens if SEC Form D is filed incorrectly?

Filing SEC Form D incorrectly can lead to serious consequences, including rejection by the SEC or penalties for non-compliance. Common errors include missing the 15-day filing deadline, failing to verify accredited investor status, or omitting details about Related Persons, such as executives or promoters with disqualifying events like criminal convictions.

If the SEC rejects a Form D filing, they will notify the company via email, explaining the issue and how to resolve it. For instance, a rejection might occur due to a bad actor disqualification, where a Related Person has a regulatory violation or criminal record after September 23, 2013. In such cases, the company might need to remove the individual, amend the filing, or apply for a waiver, which requires legal assistance to navigate.

Incorrect filings can also trigger state-level penalties, as many states require their own Form D submissions. For example, a company in New York that misses the state filing deadline might face fines or delays in their offering. To avoid these issues, businesses should work with a securities attorney, maintain detailed records, and double-check all information before submitting Form D through the EDGAR system.

FAQ 7: Do you need to file SEC Form D with states as well?

Yes, in addition to filing SEC Form D with the SEC, many states require companies to file a copy of Form D or a similar notice for exempt offerings conducted within their jurisdiction. State requirements vary, with some accepting online filings through the Electronic Filing Depository (EFD), while others allow or require paper submissions. Most states also charge a filing fee, which can range from $100 to over $1,000, depending on the offering size and state regulations.

For example, a company raising $3 million in Texas might file Form D online via the EFD and pay a flat $500 fee, while in California, the same company might need to submit additional investor details and pay a fee based on the offering amount. Failing to file with the state can result in penalties or restrictions on the offering, so it’s critical to check requirements with the state’s securities regulator, often accessible through resources like the North American Securities Administrators Association (NASAA).

Businesses should plan for state filings early in the process, as deadlines and requirements differ. Consulting a securities attorney can help navigate these variations, ensuring compliance with both federal and state regulations while avoiding costly mistakes.

FAQ 8: What are the benefits of using SEC Form D for businesses?

SEC Form D offers significant benefits for businesses seeking to raise capital through exempt offerings under Regulation D. By filing Form D, companies can bypass the costly and time-consuming process of registering securities with the SEC, which can take months and require substantial legal and financial expertise. This makes fundraising more accessible for startups, small businesses, and entrepreneurs.

Key benefits include:

- Cost Savings: There’s no federal filing fee for Form D, and the process is simpler than full registration, reducing legal and administrative costs.

- Speed: Filing Form D after the first sale allows companies to raise funds quickly, often within weeks, compared to months for registered offerings.

- Flexibility: Rules like Rule 506(b) and Rule 506(c) allow companies to target accredited investors, while Rule 504 supports smaller offerings up to $10 million.

- Investor Access: Companies can reach wealthy or sophisticated investors who understand the risks, fostering innovation in industries like tech or healthcare.

For example, a clean energy startup might use Form D to raise $5 million from accredited investors for a new solar project, avoiding the expense of registration while complying with SEC oversight. This efficiency makes Form D a powerful tool for businesses looking to grow without regulatory burdens.

FAQ 9: What are the risks of filing SEC Form D?

While SEC Form D simplifies fundraising, it comes with risks that businesses must manage carefully. Filing incorrectly or failing to comply with Regulation D requirements can lead to regulatory scrutiny, penalties, or the loss of the exemption, potentially forcing the company to halt the offering or refund investors.

Common risks include:

- Non-Compliance: Missing the 15-day filing deadline or failing to verify accredited investor status can invalidate the exemption, exposing the company to SEC enforcement actions.

- Bad Actor Disqualifications: If a Related Person has a disqualifying event, like a recent fraud conviction, the SEC may reject the filing, requiring costly corrections or waivers.

- State Violations: Failing to file Form D with states or meet their requirements can result in fines or restrictions on future offerings.

- Investor Risks: Unregistered securities carry higher risks for investors, and companies must ensure transparency to avoid disputes or legal challenges.

For instance, a company that overlooks a promoter’s regulatory violation might face a rejected Form D, delaying their fundraising. To mitigate these risks, businesses should engage securities attorneys, verify investor credentials, and maintain meticulous records to ensure compliance with both federal and state regulations.

FAQ 10: How does SEC Form D protect investors?

SEC Form D plays a key role in protecting investors by ensuring transparency and oversight in exempt offerings under Regulation D. While these offerings don’t require the detailed disclosures of registered securities, Form D provides the SEC with critical information about the offering, the company, and its key individuals, helping to prevent fraud and ensure investor confidence.

The form requires companies to disclose details like the amount raised, the type of securities, and the identities of Related Persons, such as executives or promoters. This allows the SEC to check for bad actor disqualifications, ensuring that individuals with criminal or regulatory issues aren’t involved. Additionally, companies must verify that investors are accredited investors, meaning they have the financial sophistication to understand the risks of unregistered securities.

For example, an investor considering a $100,000 investment in a startup’s private offering can review the Form D filing on the EDGAR system to confirm the company’s legitimacy and the offering’s details. This transparency, combined with the SEC’s oversight, helps protect investors while allowing businesses to raise capital efficiently, creating a balanced system for both parties.

FAQ 11: What types of securities can be offered using SEC Form D?

SEC Form D is used to notify the Securities and Exchange Commission (SEC) about the sale of various types of securities in exempt offerings under Regulation D (Reg D). These securities include equity (such as stocks or shares in a company), debt (like bonds or notes), and other investment instruments, such as partnership interests or units in a limited liability company (LLC). The flexibility of Reg D allows businesses to offer a wide range of financial instruments to raise capital without the need for full registration, provided they meet specific requirements.

For instance, a tech startup might issue common stock to accredited investors under Rule 506(b) to fund product development, while a real estate firm could offer promissory notes under Rule 504 to finance a new property project. Other securities, such as convertible notes (which can later convert into equity) or preferred shares, are also commonly used in exempt offerings. The key is that these securities must comply with Reg D’s rules, such as targeting accredited investors or adhering to offering limits.

The diversity of securities covered by Form D makes it a versatile tool for businesses across industries. However, companies must clearly specify the type of security in the Form D filing to ensure transparency for the SEC and investors. This helps the SEC monitor the offering and ensures that investors understand what they’re purchasing, reducing the risk of confusion or fraud.

FAQ 12: How does SEC Form D differ from a full securities registration?

SEC Form D is a notice filed for exempt offerings under Regulation D, while a full securities registration is a comprehensive process required for public offerings under the Securities Act of 1933. The primary difference lies in the level of regulatory scrutiny, cost, and time involved. Filing Form D is a simpler, faster, and less expensive way to raise capital, but it comes with restrictions, such as limiting sales to accredited investors or specific offering amounts.

A full securities registration involves submitting detailed documents, like a prospectus, that disclose the company’s financials, operations, and risks. This process can take months, requires extensive legal and accounting support, and incurs significant costs, often hundreds of thousands of dollars. For example, a large corporation planning an initial public offering (IPO) must register with the SEC, providing exhaustive disclosures to protect public investors. In contrast, a small business raising $2 million from private investors can file Form D after the sale, avoiding these burdens.

Form D filings are ideal for private placements or smaller offerings, but they offer less investor protection due to limited disclosures. Investors rely on the company’s transparency and the SEC’s oversight of Related Persons and investor accreditation. Understanding this distinction helps businesses choose the right path for their fundraising goals, balancing cost, speed, and regulatory requirements.

FAQ 13: Can startups benefit from filing SEC Form D?

Startups are among the primary beneficiaries of SEC Form D, as it allows them to raise capital efficiently through exempt offerings under Regulation D. For early-stage companies with limited resources, the cost and complexity of a full securities registration can be prohibitive. Form D provides a streamlined alternative, enabling startups to access funding from accredited investors without the need for extensive disclosures or prolonged regulatory reviews.

For example, a biotech startup developing a new medical device might use Rule 506(c) to raise $5 million by advertising to accredited investors, filing Form D to notify the SEC afterward. This approach saves time and money, allowing the startup to focus on innovation rather than regulatory hurdles. Additionally, Rule 504 is particularly useful for smaller startups, as it allows offerings up to $10 million with fewer restrictions, ideal for seed funding or early growth stages.

The flexibility of Form D also helps startups attract high-net-worth individuals or venture capital firms, who are often accredited investors. However, startups must ensure compliance by verifying investor accreditation and disclosing Related Persons, as errors can lead to SEC penalties or investor disputes. By leveraging Form D, startups can fuel growth while maintaining regulatory compliance, making it a cornerstone of entrepreneurial fundraising.

FAQ 14: What is the role of the EDGAR system in filing SEC Form D?

The Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system is the SEC’s online platform for filing SEC Form D and other regulatory documents. It’s a secure, centralized system that ensures companies can submit, save, and amend filings electronically, making the process efficient and accessible. All Form D filings must be submitted through EDGAR, and there’s no federal filing fee, which reduces costs for businesses.

To use EDGAR, a company must first register to obtain a Central Index Key (CIK) number and access codes, which serve as a unique identifier and login credentials. Once registered, the company can complete the Form D PDF, which includes details about the offering, such as the amount raised, the type of securities, and information about Related Persons. The form is then uploaded to EDGAR, where it can be saved as a draft or amended if needed, such as when the offering amount changes.

For example, a real estate LLC raising $3 million under Rule 506(b) would use EDGAR to submit Form D within 15 days of the first sale. The system’s transparency allows investors to access filings, fostering trust, while the SEC uses EDGAR data to monitor exempt offerings and detect potential fraud. Understanding EDGAR’s role is crucial for companies to ensure timely and accurate filings.

FAQ 15: What are the consequences of missing the SEC Form D filing deadline?

SEC Form D must be filed within 15 days of the date of first sale, defined as the moment an investor is irrevocably committed to the investment. Missing this deadline can have serious consequences, including the loss of the Regulation D exemption, SEC enforcement actions, or penalties. Non-compliance can also erode investor confidence and complicate future fundraising efforts.

If a company fails to file Form D on time, the SEC may deem the offering non-exempt, requiring the company to register the securities retroactively—a costly and time-consuming process. For instance, a startup that misses the deadline for a $1 million offering might face fines or be forced to refund investors, disrupting its operations. Additionally, states with their own filing requirements may impose penalties or restrict the company from offering securities in their jurisdiction.

To avoid these issues, companies should track the date of first sale carefully and work with a securities attorney to ensure timely submission through the EDGAR system. For example, a company that closes its first investment on January 1 must file Form D by January 16. Proactive planning and accurate record-keeping are essential to meet this critical deadline and maintain compliance.

FAQ 16: How does SEC Form D support investor transparency?

SEC Form D enhances investor transparency by requiring companies to disclose key details about exempt offerings under Regulation D. While exempt offerings involve less disclosure than registered securities, Form D provides the SEC and investors with essential information, such as the amount raised, the type of securities, and the identities of Related Persons, like executives or promoters. This helps ensure accountability and reduces the risk of fraud.

Investors can access Form D filings through the EDGAR system, allowing them to review the offering’s details and assess the company’s credibility. For example, an accredited investor considering a $200,000 investment in a startup can check the Form D filing to confirm the offering’s size and the backgrounds of key individuals. The requirement to verify accredited investor status also protects investors by ensuring only those with financial sophistication participate in these high-risk offerings.

By mandating these disclosures, Form D strikes a balance between business flexibility and investor protection. The SEC uses the data to monitor trends and identify potential issues, such as bad actor disqualifications, ensuring that exempt offerings remain a safe and viable option for both companies and investors.

FAQ 17: Can foreign companies file SEC Form D?

Yes, foreign companies can file SEC Form D for exempt offerings under Regulation D, provided they are selling securities to U.S. investors or conducting offerings in the United States. This allows international businesses to access U.S. capital markets without the burden of full securities registration, making Form D an attractive option for global startups and firms seeking American investment.

However, foreign companies must comply with the same Reg D requirements as U.S. companies, including targeting accredited investors for Rule 506(b) or Rule 506(c) offerings and verifying their status. They must also file Form D through the EDGAR system within 15 days of the first sale and disclose Related Persons to ensure no disqualifying events, such as regulatory violations. For example, a Canadian tech company raising $4 million from U.S. accredited investors would file Form D to notify the SEC of the offering.

Foreign companies may face additional challenges, such as navigating U.S. state filing requirements or ensuring compliance with their home country’s regulations. Consulting a securities attorney familiar with cross-border offerings is crucial to avoid pitfalls and ensure compliance with both U.S. and international laws.

FAQ 18: What is a bad actor disqualification in SEC Form D?

A bad actor disqualification occurs when an individual or entity involved in an exempt offering, such as a Related Person (e.g., executive, director, or promoter), has a disqualifying event that prevents the company from using a Regulation D exemption. These events include criminal convictions, SEC enforcement actions, or other regulatory violations occurring on or after September 23, 2013, when updated SEC rules took effect. SEC Form D requires disclosure of these individuals to ensure transparency and protect investors.

For example, if a company’s promoter has a recent fraud conviction, the SEC may reject the Form D filing, invalidating the exemption. This could force the company to halt the offering or seek a waiver, which requires demonstrating good cause and often involves legal assistance. The disqualification applies to events like court orders, suspensions, or bans from the securities industry, ensuring that only credible individuals are involved in exempt offerings.

Companies can mitigate this risk by thoroughly vetting Related Persons before filing Form D. For instance, a startup raising $2 million under Rule 506(b) should confirm that all directors and officers are free of disqualifying events. This due diligence protects the offering’s validity and maintains investor trust, as the SEC uses these disclosures to monitor potential risks.

FAQ 19: How does SEC Form D impact small businesses?

SEC Form D is a game-changer for small businesses, enabling them to raise capital through exempt offerings under Regulation D without the high costs and complexity of full securities registration. Small businesses often lack the resources for a public offering, which requires extensive disclosures and legal fees. Form D allows them to access funding from accredited investors or through smaller offerings under Rule 504, which caps at $10 million.

For example, a local coffee shop chain seeking $500,000 to open new locations could use Rule 504 to sell securities to investors, filing Form D to notify the SEC. This process is faster and more affordable than registration, allowing the business to focus on growth. Similarly, Rule 506(b) enables small tech firms to raise unlimited funds from accredited investors, fostering innovation in competitive industries.

However, small businesses must navigate challenges like verifying investor accreditation and complying with state filing requirements. Errors, such as missing the 15-day filing deadline, can lead to penalties or loss of the exemption. By working with a securities attorney and maintaining accurate records, small businesses can leverage Form D to fuel expansion while staying compliant with SEC and state regulations.

FAQ 20: What role does a securities attorney play in filing SEC Form D?

A securities attorney is invaluable when filing SEC Form D, as the process involves complex legal and regulatory requirements that can trip up even experienced businesses. Attorneys ensure compliance with Regulation D, help avoid costly mistakes, and guide companies through both federal and state filing obligations. Their expertise is particularly critical for startups or small businesses unfamiliar with securities laws.

Key roles of a securities attorney include:

- Preparing the Filing: Attorneys help complete Form D accurately, ensuring all required details, such as Related Persons and offering specifics, are correct.

- Verifying Investor Accreditation: They assist in confirming that investors meet accredited investor criteria, reducing the risk of non-compliance.

- Navigating State Requirements: Attorneys identify state-specific filing rules and fees, ensuring compliance with jurisdictions where the offering occurs.

- Addressing Disqualifications: If a bad actor disqualification arises, attorneys can help secure waivers or restructure the offering to maintain eligibility.

For example, a real estate firm raising $6 million under Rule 506(c) might hire an attorney to verify investor documents, file Form D through the EDGAR system, and submit state filings in multiple jurisdictions. This professional guidance ensures a smooth process, minimizes risks, and allows the company to focus on its fundraising goals.

Also, Read these Articles in Detail

- Return on Ad Spend (ROAS): Your Ultimate Guide to Measuring Advertising Success

- Innovative Small Business Marketing Ideas to Skyrocket Your Success

- Market and Marketing Research: The Key to Unlocking Business Success

- Target Audience: A Comprehensive Guide to Building Effective Marketing Strategies

- SWOT Analysis: A Comprehensive Guide for Small Business Success

- Market Feasibility Study: Your Blueprint for Business Success

- Mastering the Art of Selling Yourself and Your Business with Confidence and Authenticity

- 10 Powerful Ways Collaboration Can Transform Your Small Business

- The Network Marketing Business Model: Is It the Right Path for You?

- Crafting a Memorable Business Card: 10 Essential Rules for Small Business Owners

- Bootstrap Marketing Mastery: Skyrocketing Your Small Business on a Shoestring Budget

- Mastering Digital Marketing: The Ultimate Guide to Small Business Owner’s

- Crafting a Stellar Press Release: Your Ultimate Guide to Free Publicity

- Reciprocity: Building Stronger Business Relationships Through Give and Take

- Business Cards: A Comprehensive Guide to Designing and Printing at Home

- The Ultimate Guide to Marketing Firms: How to Choose the Perfect One

- Direct Marketing: A Comprehensive Guide to Building Strong Customer Connections

- Mastering Marketing for Your Business: A Comprehensive Guide

- Crafting a Winning Elevator Pitch: Your Guide to Captivating Conversations

- A Complete Guide to Brand Valuation: Unlocking Your Brand’s True Worth

- B2B Marketing vs. B2C Marketing: A Comprehensive Guide to Winning Your Audience

- Pay-Per-Click Advertising: A Comprehensive Guide to Driving Traffic and Maximizing ROI

- Multi-Level Marketing: A Comprehensive Guide to MLMs, Their Promises, and Pitfalls

- Traditional Marketing vs. Internet Marketing for Small Businesses

- Branding: Building Trust, Loyalty, and Success in Modern Marketing

- How to Craft a Winning Marketing Plan for Your Home Business

- The Synergy of Sales and Marketing: A Comprehensive Guide

- Mastering the Marketing Mix: A Comprehensive Guide to Building a Winning Strategy

- Return on Investment (ROI): Your Guide to Smarter Business Decisions

- How to Create a Winning Website Plan: A Comprehensive Guide

- Top Sources of Capital: A Comprehensive Guide to Funding Your Business

- Why Do Businesses Go Bankrupt? Understanding the Causes and Solutions

- Inventory Management: The Ultimate Guide to Optimizing Your Business Inventory

- Implied Contracts: A Comprehensive Guide to Avoiding Unintended Obligations

- Business Contracts Through Change: What Happens When a Company Transforms?

- Principal Place of Business for Tax Deductions: A Comprehensive Guide

- Mastering the 5 Ps of Marketing to Skyrocket Your Home Business Success

- A Comprehensive Guide to Spotting Red Flags in Your Financial Statements

- Income Payments on Form 1099: A Guide for Businesses and Individuals

- The Challenges of Forming a Corporation: Is It Worth the Leap?

- Socially and Economically Disadvantaged Businesses: Pathways to Opportunity

- Business Viability: A Comprehensive Guide to Building a Thriving Enterprise

- The Art of Achieving Business Goals: A Comprehensive Guide to Success

- The Art & Science of Raising Your Business Rates: A Guide for Entrepreneurs

- Crafting a Winning Business Proposal: Your Ultimate Guide to Securing Clients

- The Art of the Business Letter: A Guide to Professional Communication

- 7 Key Components of a Business Proposal: Your Ultimate Guide to Securing Contracts

- Calculating Costs for Leasing a Retail Store: A Comprehensive Guide

- Understanding Gross Margin vs. Gross Profit: A Comprehensive Guide

- Mastering Initial Markup (IMU): The Key to Retail Profitability

- Understanding Retailers: The Heart of Consumer Commerce

- Stock Keeping Units (SKUs): The Backbone of Retail Inventory Management

- Why Your Business Must Embrace an Online Presence in Today’s World

- Finding the Perfect Wholesale Distributor for Your Small Business

- The Art of Building a Thriving Online Business

- A Guide to Buying a Great, Affordable Domain Name

- The Art of Writing an RFP: A Comprehensive Guide

- Don’t Try to Boil the Ocean: Mastering Focus in Business Strategy

- Mastering Project Management: Your Ultimate Guide to Success

- A Comprehensive Guide to Critical Success Factors and Indicators in Business

Acknowledgement

I would like to express my gratitude to the reputable sources that provided valuable insights and information for the article “Understanding SEC Form D: A Comprehensive Guide to Exempt Securities Offerings.” The comprehensive details and regulatory guidance from these sources were instrumental in crafting an accurate and informative piece. Specifically, I acknowledge the following:

- U.S. Securities and Exchange Commission for its detailed regulatory guidelines and official resources on SEC Form D and Regulation D requirements.

- North American Securities Administrators Association for providing clarity on state-specific filing requirements and resources for securities compliance.

- Investopedia for its accessible explanations of securities laws and financial concepts that enriched the article’s clarity.

These sources ensured the article’s accuracy, depth, and relevance, offering readers a reliable guide to navigating exempt securities offerings.

Disclaimer

The information provided in the article “Understanding SEC Form D: A Comprehensive Guide to Exempt Securities Offerings” is intended for general informational purposes only and does not constitute legal, financial, or investment advice. While every effort has been made to ensure the accuracy and completeness of the content, securities laws and regulations are complex and subject to change.

Readers should consult with qualified legal or financial professionals before making decisions related to SEC Form D filings, exempt offerings, or any securities-related activities. The author and publisher of this website are not responsible for any errors, omissions, or outcomes resulting from the use of this information.