Navigating the complexities of corporate taxation can be daunting, especially for small businesses and entrepreneurs aiming to optimize their tax strategy. For S corporations, IRS Form 1120S serves as the cornerstone of tax compliance, offering a pathway to avoid the double taxation that burdens traditional C corporations.

This comprehensive guide article provides an in-depth, forward-looking exploration of IRS Form 1120S, covering its purpose, eligibility requirements, preparation process, filing obligations, and practical insights for businesses in 2025 and beyond. Whether you’re a small business owner, a shareholder, or a tax professional, this guide will equip you with the knowledge to confidently manage S corporation tax filings.

Table of Contents

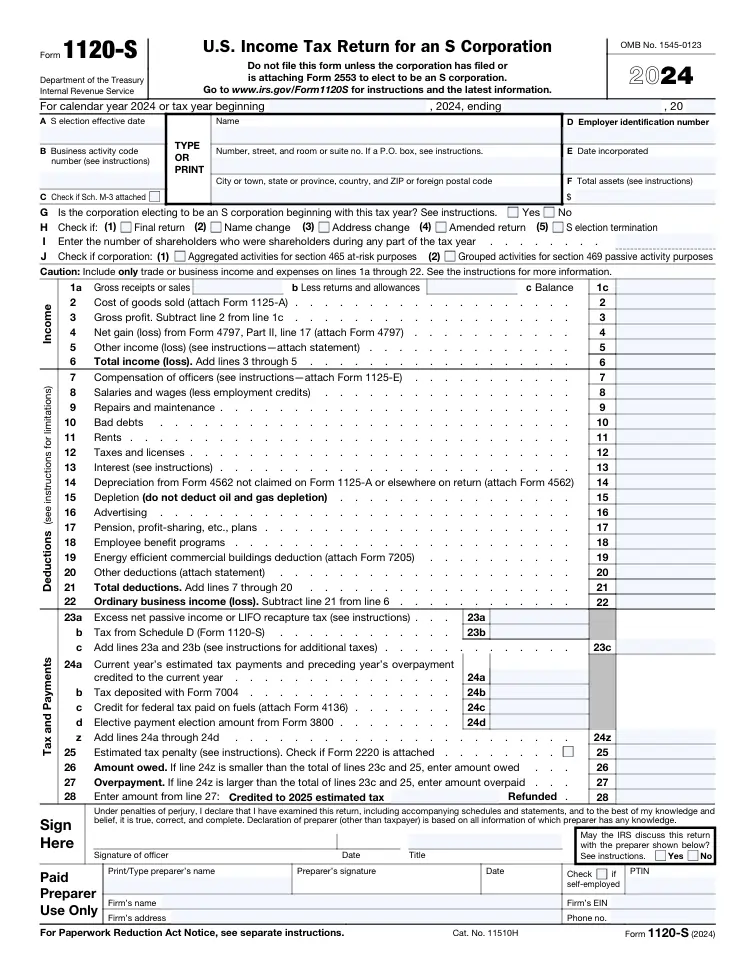

What Is IRS Form 1120S?

IRS Form 1120S, officially titled U.S. Income Tax Return for an S Corporation, is the tax form used by domestic corporations that have elected S corporation status to report their financial activities for a given tax year. Unlike C corporations, which face double taxation—once at the corporate level and again on dividends distributed to shareholders—S corporations are pass-through entities. This means that the corporation itself does not pay federal income tax on its profits. Instead, income, losses, deductions, and credits “pass through” to shareholders, who report these items on their personal income tax returns (typically Form 1040) and pay taxes at their individual tax rates.

The pass-through taxation model is a defining feature of S corporations, making them an attractive option for small to medium-sized businesses seeking tax efficiency. By filing Form 1120S, S corporations provide the IRS with a detailed account of their financial performance, including income, gains, losses, credits, and deductions. This information is then allocated to shareholders via Schedule K-1 (Form 1120S), which outlines each shareholder’s share of the corporation’s tax items.

For 2025, Form 1120S remains a critical tool for S corporations to maintain compliance with IRS regulations while leveraging the benefits of pass-through taxation. As tax laws evolve, staying informed about updates to the form, filing requirements, and eligibility criteria is essential for businesses aiming to maximize their financial strategy.

Why Choose S Corporation Status?

The decision to elect S corporation status is driven by the desire to avoid the double taxation inherent in C corporation structures. C corporations are taxed on their profits at the corporate level (currently at a flat federal rate of 21% as of 2025), and shareholders are taxed again on dividends or distributions they receive. This dual taxation can significantly erode profits, particularly for smaller businesses.

By contrast, S corporations filing Form 1120S bypass corporate-level taxation. The corporation’s net income is distributed to shareholders, who report it on their personal tax returns. This structure often results in lower overall tax liability, especially for shareholders in lower tax brackets. Additionally, S corporations can offer other benefits, such as:

- Simplified Tax Reporting: Shareholders receive a Schedule K-1, which streamlines the process of reporting their share of the corporation’s income or losses.

- Flexibility in Income Allocation: S corporations can allocate income and losses based on ownership percentages, providing clarity for shareholders.

- Potential Tax Savings on Self-Employment Taxes: Unlike sole proprietorships or partnerships, S corporation shareholders who work for the business can receive a reasonable salary, with the remaining income treated as distributions, which are not subject to self-employment taxes (though this requires careful compliance with IRS guidelines).

- Asset Protection: Like C corporations, S corporations provide limited liability protection, shielding shareholders’ personal assets from business debts and liabilities.

However, S corporations come with restrictions, such as limits on the number and type of shareholders, which we’ll explore in detail below. For businesses planning for 2025 and beyond, consulting with a tax professional to evaluate whether S corporation status aligns with long-term goals is a prudent step.

Eligibility Requirements for S Corporation Status

Not every corporation qualifies for S corporation status. The IRS imposes strict criteria to ensure that only certain businesses can take advantage of pass-through taxation. To elect S corporation status and file Form 1120S, a corporation must meet the following requirements:

- Domestic Corporation: The business must be incorporated in the United States and operate as a domestic entity.

- Eligible Shareholders: Shareholders must be individuals, certain trusts, or estates. Partnerships, corporations, and nonresident aliens (non-U.S. citizens who do not reside in the U.S.) are not permitted to be shareholders.

- Shareholder Limit: The corporation can have no more than 100 shareholders. For this purpose, spouses and certain family members may be counted as a single shareholder.

- Single Class of Stock: The S corporation must have only one class of stock, meaning all shares must confer identical rights to distributions and liquidation proceeds. However, differences in voting rights are allowed.

- Ineligible Entities: Certain types of businesses, such as financial institutions (e.g., banks using the reserve method of accounting) and insurance companies, are not eligible for S corporation status.

These requirements ensure that S corporations remain small to medium-sized businesses with straightforward ownership structures. For example, a tech startup with 50 individual shareholders, all U.S. residents, could qualify for S corporation status, while a multinational corporation with 150 shareholders, including foreign entities, would not.

Table: S Corporation Eligibility Criteria

| Criteria | Requirement |

|---|---|

| Small Size | Domestic corporation only |

| Medium Size | Shareholders must be individuals, trusts, or estates; no partnerships or corporations |

| Large Size | Maximum of 100 shareholders |

| Huge Size | Only one class of stock; certain businesses (e.g., banks, insurers) ineligible |

To elect S corporation status, a corporation must file IRS Form 2553 (Election by a Small Business Corporation), typically within 75 days of the corporation’s formation or the start of the tax year. For 2025, businesses should ensure timely filing to avoid missing the deadline, which could delay S corporation benefits.

Key Components of IRS Form 1120S

Form 1120S is a multi-page document that requires detailed financial and operational information about the S corporation. Understanding its components is critical for accurate preparation and compliance. Below is a breakdown of the key sections of the form:

1. General Information

The first section of Form 1120S collects basic details about the corporation, including:

- Name, address, and Employer Identification Number (EIN).

- Date of incorporation and the effective date of the S corporation election.

- Total assets at the end of the tax year.

- Business activity code (based on the North American Industry Classification System, or NAICS).

This section establishes the corporation’s identity and provides context for the IRS to process the return.

2. Income and Deductions

This section requires the corporation to report its gross income, including revenue from sales, services, and other sources, as well as deductions such as salaries, rent, and depreciation. The net income (or loss) is calculated here and then allocated to shareholders.

For example, a small consulting firm with $500,000 in revenue and $300,000 in deductible expenses (e.g., office rent, employee salaries, and marketing costs) would report a net income of $200,000, which is then distributed to shareholders via Schedule K-1.

3. Schedule K: Shareholders’ Pro Rata Share Items

Schedule K summarizes the corporation’s income, deductions, credits, and other tax items, which are then allocated to shareholders based on their ownership percentages. Each shareholder receives a Schedule K-1, which details their share of these items for reporting on their personal tax returns.

For instance, if a corporation has two shareholders with equal 50% ownership, and the corporation reports $100,000 in net income, each shareholder’s Schedule K-1 would reflect $50,000 in income.

4. Schedule L: Balance Sheet

Schedule L provides a snapshot of the corporation’s financial position at the end of the tax year, including assets, liabilities, and shareholders’ equity. A comparative balance sheet (showing the prior year’s figures) is often required for accuracy.

5. Schedule M-1 and M-2

- Schedule M-1: Reconciles the corporation’s book income (as per financial accounting records) with its taxable income.

- Schedule M-2: Tracks changes in the corporation’s Accumulated Adjustments Account (AAA), which reflects the corporation’s undistributed earnings.

6. Additional Schedules and Forms

Depending on the corporation’s activities, additional forms may be required, such as:

- Form 1125-A: Cost of Goods Sold, for businesses that manufacture or sell products.

- Form 1125-E: Compensation of Officers, detailing salaries paid to corporate officers.

- Form 4562: Depreciation and Amortization, for reporting asset depreciation.

For 2025, businesses should ensure they have the latest versions of these schedules, as the IRS may update forms to reflect changes in tax law or reporting requirements.

How to Prepare IRS Form 1120S

Preparing Form 1120S requires careful attention to detail and a comprehensive understanding of the corporation’s financial activities. While the form is designed to be user-friendly, with clear instructions for each line, the complexity of S corporation taxation often necessitates the expertise of a tax professional. Below is a step-by-step guide to preparing Form 1120S:

Step 1: Gather Necessary Documents

To complete Form 1120S, you’ll need the following documents and information:

- Income Statement (Profit and Loss Statement): Summarizes revenue, expenses, and net income for the tax year.

- Balance Sheet: Details assets, liabilities, and equity, ideally with a comparison to the prior year.

- Fixed Asset List: Includes details of depreciable assets for calculating depreciation deductions.

- Shareholder Transactions: Records of capital contributions, distributions, dividends, and loans to or from shareholders.

- Shareholder Information: Names, addresses, Social Security numbers, ownership percentages, and any changes in ownership during the year.

- Officer Compensation: A breakdown of salaries paid to corporate officers versus other employees.

- Tax Payments: Records of estimated tax payments, extension payments, and state tax payments.

- Responses to Form Questions: Answers to the informational questions on page 2 of Form 1120S, such as whether the corporation changed its accounting method.

Step 2: Complete the Form

Using the gathered data, fill out each section of Form 1120S, ensuring accuracy in calculations and adherence to IRS instructions. Key areas to focus on include:

- Income and Deductions: Accurately report all revenue sources and allowable deductions, such as rent, utilities, and employee benefits.

- Schedule K-1 Preparation: Ensure that shareholder allocations are correctly calculated and reported.

- Balance Sheet and Schedules: Verify that financial statements align with the corporation’s accounting records.

Step 3: Review for Accuracy

Errors on Form 1120S can lead to penalties, audits, or delays in processing. Double-check calculations, shareholder information, and compliance with S corporation eligibility rules. A tax professional can provide an additional layer of review to catch potential issues.

Step 4: Determine Filing Method

S corporations have the option to file Form 1120S electronically or by mail, though e-filing is mandatory in certain cases (see below). Ensure that the filing method complies with IRS requirements and deadlines.

Example: Preparing Form 1120S for a Small Business

Consider a hypothetical S corporation, ABC Consulting Inc., with three shareholders and $1 million in revenue for 2025. The corporation incurs $600,000 in expenses, including $200,000 in officer salaries and $50,000 in rent. The net income of $400,000 is allocated to shareholders based on their ownership percentages (50%, 30%, and 20%). The corporation’s accountant gathers financial statements, prepares Schedule K-1 for each shareholder, and e-files Form 1120S to meet the IRS deadline of March 15, 2026 (for calendar-year corporations). This process ensures compliance and accurate reporting of pass-through income.

Filing Requirements and Deadlines for 2025

Form 1120S must be filed by the 15th day of the third month following the end of the corporation’s tax year. For calendar-year S corporations (those whose tax year ends on December 31), the deadline is March 15 of the following year (e.g., March 15, 2026, for the 2025 tax year). If the deadline falls on a weekend or holiday, it is typically extended to the next business day.

If additional time is needed, S corporations can request a six-month extension by filing Form 7004 (Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns). However, an extension to file does not extend the deadline to pay any taxes owed, so estimated tax payments should be made by the original due date to avoid penalties.

E-Filing Requirements

Certain S corporations are required to e-file Form 1120S:

- Corporations with $10 million or more in total assets at the end of the tax year.

- Corporations that file 250 or more tax returns annually, including Form W-2, Form 1099, employment tax returns, and excise tax returns.

E-filing is facilitated through IRS-approved software or tax professionals, offering a secure and efficient way to submit returns. Even for corporations not required to e-file, electronic submission is encouraged for faster processing and reduced risk of errors.

Mailing Form 1120S

For corporations eligible to file by mail, the IRS provides specific mailing addresses based on the corporation’s principal business location and total assets. These addresses are listed in the IRS instructions for Form 1120S and vary by state and asset size. For example:

- Corporations with total assets under $10 million may mail their returns to a regional IRS processing center.

- Corporations with higher assets may have a different mailing address.

Always verify the correct address in the latest IRS instructions to avoid delays.

Common Challenges and Best Practices

Filing Form 1120S can present challenges, particularly for businesses with complex financial structures or those new to S corporation status. Below are common issues and best practices to address them:

Common Challenges

- Maintaining S Corporation Eligibility: Failing to meet eligibility criteria (e.g., adding a nonresident alien shareholder) can result in the revocation of S corporation status, triggering C corporation taxation.

- Accurate Schedule K-1 Reporting: Errors in allocating income or deductions to shareholders can lead to discrepancies on personal tax returns.

- Reasonable Compensation: S corporation shareholders who work for the business must receive a reasonable salary for their services, subject to payroll taxes. The IRS scrutinizes distributions to ensure they are not used to avoid payroll taxes.

- Depreciation and Asset Tracking: Incorrectly calculating depreciation or failing to maintain accurate asset records can lead to audit risks.

Best Practices

- Engage a Tax Professional: A certified public accountant (CPA) or tax advisor with S corporation expertise can ensure compliance and optimize tax outcomes.

- Maintain Detailed Records: Keep organized records of financial statements, shareholder transactions, and tax payments to streamline preparation.

- Use Accounting Software: Tools like QuickBooks or Xero can simplify financial tracking and integration with tax preparation software.

- Monitor Tax Law Changes: Stay informed about updates to tax laws, such as changes to deduction limits or credits, that may affect Form 1120S for 2025 and beyond.

- Plan for Estimated Taxes: Shareholders should make quarterly estimated tax payments to cover their share of S corporation income, avoiding penalties for underpayment.

Looking Ahead: S Corporations in 2025 and Beyond

As businesses plan for 2025 and future years, several trends and considerations will shape the use of Form 1120S and S corporation status:

- Tax Policy Changes: Potential changes to federal tax rates, deductions, or credits could impact the benefits of S corporation status. For example, proposed increases in individual tax rates could affect shareholders’ tax liabilities, while new deductions could enhance pass-through benefits.

- Technology and E-Filing: The IRS continues to emphasize electronic filing, with potential expansions to mandatory e-filing thresholds. Businesses should invest in reliable tax software to stay compliant.

- Remote Work and Shareholder Residency: The rise of remote work may complicate shareholder eligibility, as businesses must ensure that shareholders remain U.S. residents to maintain S corporation status.

- Sustainability and Tax Incentives: S corporations may benefit from emerging tax credits for sustainability initiatives, such as energy-efficient investments, which can be reported on Form 1120S.

By staying proactive and informed, S corporations can leverage Form 1120S to maintain tax efficiency and compliance in an evolving economic landscape.

Conclusion

IRS Form 1120S is a vital tool for S corporations, enabling them to report financial activities, allocate income to shareholders, and avoid the double taxation faced by C corporations. By meeting strict eligibility criteria, gathering comprehensive financial data, and adhering to IRS filing requirements, S corporations can navigate the complexities of tax compliance with confidence. For 2025 and beyond, businesses should prioritize accurate preparation, consider e-filing options, and consult tax professionals to optimize their tax strategy. With careful planning and attention to detail, Form 1120S empowers S corporations to thrive in a competitive business environment while maximizing the benefits of pass-through taxation.

For the latest version of Form 1120S and detailed instructions, visit the IRS website. For personalized guidance, consult a tax professional to ensure your S corporation remains compliant and financially sound.

Disclaimer

The information provided in “IRS Form 1120S: The Comprehensive Guide to S Corporation Tax Filing for 2025 and Beyond,” is intended for general informational purposes only and should not be construed as legal, tax, or financial advice. Tax laws and regulations are complex and subject to change, and the content of this article may not reflect the most current IRS guidelines or requirements. Businesses and individuals should consult with a qualified tax professional or certified public accountant (CPA) to ensure compliance with all applicable tax laws and to address their specific tax situations. The authors and publishers of this article (Website Name: Manishchanda.net) are not responsible for any errors, omissions, or outcomes resulting from the use of this information.

Acknowledgements

The creation of the article “IRS Form 1120S: The Comprehensive Guide to S Corporation Tax Filing for 2025 and Beyond,” was made possible through the extensive research and valuable insights drawn from a variety of reputable online resources. These sources provided critical information on IRS regulations, S corporation requirements, and tax filing procedures, ensuring the article’s accuracy and comprehensiveness. I sincerely express my gratitude to the following websites for their authoritative content, which informed the development of this guide:

- IRS: For official tax forms, instructions, and guidelines related to Form 1120S and S corporation eligibility.

- SBA: For insights into small business structures and tax considerations.

- Tax Foundation: For analysis of tax policies affecting S corporations.

- Nolo: For accessible explanations of S corporation tax benefits and requirements.

- Forbes: For articles on business taxation and S corporation strategies.

- Investopedia: For detailed definitions and examples of pass-through taxation.

- QuickBooks: For practical guidance on accounting and tax preparation for S corporations.

- H&R Block: For insights into tax filing processes and common challenges.

- TurboTax: For user-friendly explanations of Form 1120S and e-filing requirements.

- Wolters Kluwer: For professional resources on corporate tax compliance.

- Accounting Today: For updates on tax law changes and their impact on S corporations.

- Journal of Accountancy: For in-depth articles on S corporation taxation.

- CPA Practice Advisor: For practical tips for tax professionals preparing Form 1120S.

- Entrepreneur: For business-focused advice on S corporation benefits.

- Bench: For guidance on bookkeeping and financial reporting for S corporations.

- The Balance: For clear explanations of S corporation eligibility and filing.

- LegalZoom: For information on business formation and S corporation election.

- BNA Bloomberg: For detailed tax policy and regulatory updates.

- Tax Policy Center: For research on pass-through taxation trends.

- AICPA: For professional standards and resources for tax practitioners.

These resources collectively ensured that the article provides a well-rounded, accurate, and forward-looking guide to navigating IRS Form 1120S for 2025 and beyond.

Frequently Asked Questions (FAQs)

FAQ 1: What Is IRS Form 1120S and Why Is It Important for S Corporations?

IRS Form 1120S, officially known as the U.S. Income Tax Return for an S Corporation, is the tax form used by domestic corporations that have elected S corporation status to report their financial activities for a specific tax year. This form is crucial because it allows S corporations to operate as pass-through entities, meaning they do not pay federal income tax at the corporate level. Instead, the corporation’s income, losses, deductions, and credits are passed through to shareholders, who report these items on their personal tax returns, typically via Form 1040. This structure helps S corporations avoid the double taxation faced by C corporations, where profits are taxed at both the corporate and shareholder levels.

The importance of Form 1120S lies in its role in ensuring compliance with IRS regulations while providing a clear mechanism to allocate financial outcomes to shareholders. The form captures detailed information, including gross income, deductions, credits, and shareholder distributions, which are summarized in Schedule K and distributed to shareholders via Schedule K-1. For example, a small retail business with $1 million in revenue and $600,000 in expenses would use Form 1120S to report a net income of $400,000, which is then allocated to shareholders based on their ownership percentages.

For 2025 and beyond, Form 1120S remains essential for S corporations to maintain tax efficiency. It ensures that shareholders accurately report their share of the corporation’s financial activities, avoiding penalties or audits. Businesses must stay updated on IRS guidelines, as tax laws may evolve, impacting deductions, credits, or filing requirements. Consulting a tax professional is advisable to navigate the complexities of Form 1120S and optimize tax outcomes.

FAQ 2: Who Is Eligible to File IRS Form 1120S?

To file IRS Form 1120S, a corporation must first qualify for S corporation status by meeting specific IRS criteria. These requirements ensure that only certain small to medium-sized businesses can benefit from pass-through taxation. The eligibility rules are strict, and failure to comply can result in the loss of S corporation status, reverting the business to C corporation taxation.

The key eligibility requirements include:

- Domestic Corporation: The business must be incorporated in the United States.

- Eligible Shareholders: Shareholders must be individuals, certain trusts, or estates. Partnerships, corporations, and nonresident aliens (non-U.S. citizens not residing in the U.S.) are not permitted.

- Shareholder Limit: The corporation can have no more than 100 shareholders. Spouses and certain family members may be counted as a single shareholder.

- Single Class of Stock: The corporation must have only one class of stock, though differences in voting rights are allowed.

- Ineligible Entities: Certain businesses, such as banks using the reserve method of accounting or insurance companies, cannot elect S corporation status.

For example, a family-owned consulting firm with 50 U.S. resident shareholders and a single class of stock would qualify to file Form 1120S, while a multinational corporation with 150 shareholders, including foreign entities, would not. To elect S corporation status, businesses must file Form 2553 (Election by a Small Business Corporation) within 75 days of incorporation or the start of the tax year. For 2025, ensuring compliance with these criteria is critical to maintain the tax advantages of S corporation status.

FAQ 3: How Does Pass-Through Taxation Work for S Corporations?

Pass-through taxation is the hallmark of S corporations, distinguishing them from C corporations. Under this model, the corporation itself does not pay federal income tax on its profits. Instead, income, losses, deductions, and credits are “passed through” to shareholders, who report these items on their personal tax returns and pay taxes at their individual tax rates. This avoids the double taxation faced by C corporations, where profits are taxed at the corporate level (currently 21% in 2025) and again as shareholder dividends.

The process begins with the S corporation filing IRS Form 1120S, which details its financial performance, including gross income, expenses, and net income. The corporation then prepares Schedule K-1 for each shareholder, outlining their share of the income, losses, deductions, and credits based on their ownership percentage. For instance, if an S corporation earns $500,000 in net income and has two shareholders with 60% and 40% ownership, the first shareholder would report $300,000 and the second $200,000 on their personal tax returns.

This structure offers significant tax savings, particularly for shareholders in lower tax brackets. Additionally, shareholders who work for the corporation must receive a reasonable salary, subject to payroll taxes, while remaining profits can be distributed as dividends, which are not subject to self-employment taxes. However, the IRS closely monitors salary arrangements to prevent tax avoidance. For 2025, pass-through taxation remains a key advantage for S corporations, but shareholders must plan for quarterly estimated tax payments to avoid penalties.

FAQ 4: What Documents Are Needed to Prepare IRS Form 1120S?

Preparing IRS Form 1120S requires a comprehensive set of financial and operational documents to ensure accurate reporting. Gathering these documents in advance streamlines the process and reduces the risk of errors, which could trigger IRS scrutiny. While the form includes clear instructions, the complexity of S corporation taxation often necessitates the expertise of a tax professional.

Key documents needed include:

- Income Statement (Profit and Loss Statement): Summarizes the corporation’s revenue, expenses, and net income for the tax year.

- Balance Sheet: Details assets, liabilities, and shareholders’ equity, ideally with a comparison to the previous year’s figures.

- Fixed Asset List: Includes details of depreciable assets, such as equipment or vehicles, for calculating depreciation deductions.

- Shareholder Transactions: Records of capital contributions, distributions, dividends, and loans to or from shareholders.

- Shareholder Information: Names, addresses, Social Security numbers, ownership percentages, and any changes in ownership during the year.

- Officer Compensation: A breakdown of salaries paid to corporate officers versus other employees, reported on Form 1125-E.

- Tax Payments: Records of estimated tax payments, extension payments, and state tax payments.

- Responses to Form Questions: Answers to informational questions on page 2 of Form 1120S, such as changes in accounting methods.

For example, a manufacturing S corporation would need to provide its accountant with a profit and loss statement showing $2 million in revenue and $1.5 million in expenses, a balance sheet with $500,000 in assets, and a list of shareholder distributions totaling $200,000. For 2025, businesses should maintain organized records, ideally using accounting software, to ensure all required data is readily available for Form 1120S preparation.

FAQ 5: When Is the Deadline for Filing IRS Form 1120S in 2025?

The deadline for filing IRS Form 1120S is the 15th day of the third month following the end of the corporation’s tax year. For S corporations operating on a calendar year (ending December 31), the deadline is March 15, 2026, for the 2025 tax year. If this date falls on a weekend or holiday, the deadline typically shifts to the next business day. Timely filing is critical to avoid penalties, which can include late-filing fees or loss of S corporation status in severe cases.

If additional time is needed, S corporations can request a six-month extension by filing Form 7004 (Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns). However, this extension applies only to filing the return, not to paying any taxes owed. Shareholders must make estimated tax payments by the original deadline to avoid interest and penalties. For example, if an S corporation expects $300,000 in pass-through income for 2025, shareholders should calculate and pay their share of taxes by March 15, 2026, even if the corporation files for an extension.

For 2025, businesses should plan ahead to meet deadlines, especially if e-filing is required (see FAQ 6). Using tax software or engaging a professional can help ensure compliance with IRS timelines and requirements.

FAQ 6: Is E-Filing Mandatory for IRS Form 1120S?

E-filing IRS Form 1120S is mandatory for certain S corporations, based on their size and filing volume, but it is also an option for others seeking efficiency and accuracy. The IRS encourages electronic filing for faster processing, reduced errors, and secure submission. For 2025, the e-filing requirements are as follows:

- Mandatory E-Filing: S corporations with $10 million or more in total assets at the end of the tax year and those filing 250 or more tax returns annually (including Form W-2, Form 1099, employment tax returns, and excise tax returns) must e-file Form 1120S.

- Optional E-Filing: Smaller S corporations can choose to e-file using IRS-approved software or through a tax professional, or they may mail a paper return to the appropriate IRS address based on their principal business location and asset size.

E-filing offers several advantages, including immediate confirmation of receipt, automated error checks, and integration with accounting software. For example, a tech startup with $12 million in assets and 300 tax forms filed annually would be required to e-file Form 1120S using software like TurboTax or through a CPA. Smaller businesses, such as a local bakery with $2 million in assets, may opt for e-filing for convenience or mail their return to the IRS processing center designated for their state.

For 2025, the trend toward e-filing is expected to grow, with potential expansions to mandatory thresholds. Businesses should verify their filing obligations and consider e-filing to streamline compliance.

FAQ 7: What Are the Key Schedules Included in IRS Form 1120S?

IRS Form 1120S comprises several schedules that provide detailed financial and shareholder information, ensuring accurate reporting of the S corporation’s activities. These schedules are integral to the form and must be completed with precision to comply with IRS requirements. Below are the key schedules and their purposes:

- Schedule K (Shareholders’ Pro Rata Share Items): Summarizes the corporation’s income, deductions, credits, and other tax items, which are allocated to shareholders based on ownership percentages. Each shareholder receives a Schedule K-1 to report their share on their personal tax return.

- Schedule L (Balance Sheet): Provides a snapshot of the corporation’s assets, liabilities, and shareholders’ equity at the end of the tax year, often including a comparison to the prior year.

- Schedule M-1 (Reconciliation of Income): Reconciles the corporation’s book income (per financial accounting records) with its taxable income reported on Form 1120S.

- Schedule M-2 (Accumulated Adjustments Account): Tracks changes in the corporation’s undistributed earnings, reflecting distributions, income, and losses.

Additional forms, such as Form 1125-A (Cost of Goods Sold) for businesses with inventory or Form 1125-E (Compensation of Officers) for officer salaries, may also be required depending on the corporation’s activities. For example, a manufacturing S corporation would complete Form 1125-A to report $500,000 in inventory costs, while a service-based S corporation would focus on Form 1125-E for $200,000 in officer compensation. For 2025, businesses should ensure they use the latest versions of these schedules, as updates may reflect changes in tax law.

FAQ 8: How Can S Corporations Avoid Common Mistakes When Filing Form 1120S?

Filing IRS Form 1120S accurately is critical to avoid penalties, audits, or the loss of S corporation status. Common mistakes can arise from oversight, misunderstanding IRS rules, or inadequate record-keeping. Below are frequent errors and strategies to avoid them:

- Inaccurate Shareholder Allocations: Errors in Schedule K-1 calculations can lead to discrepancies on shareholders’ personal tax returns. To avoid this, double-check ownership percentages and use accounting software to ensure precise allocations.

- Failure to Pay Reasonable Compensation: Shareholders who work for the corporation must receive a reasonable salary subject to payroll taxes. The IRS may reclassify excessive distributions as salary if compensation is deemed too low, so consult industry benchmarks to determine appropriate salaries.

- Noncompliance with Eligibility Rules: Adding ineligible shareholders, such as nonresident aliens, can revoke S corporation status. Regularly review shareholder agreements to ensure compliance.

- Incorrect Depreciation Calculations: Mistakes in reporting depreciation on Form 4562 can trigger audits. Maintain detailed asset records and verify calculations with a tax professional.

- Missing Deadlines: Late filing of Form 1120S incurs penalties. Use calendar reminders or tax software to track deadlines, and file Form 7004 if an extension is needed.

For example, an S corporation that incorrectly allocates $100,000 in income equally among three shareholders, despite unequal ownership (50%, 30%, 20%), could face IRS penalties. To mitigate risks in 2025, businesses should engage a CPA, maintain organized records, and stay informed about tax law changes to ensure compliance with Form 1120S requirements.

FAQ 9: What Are the Benefits of S Corporation Status Compared to Other Business Structures?

Electing S corporation status offers distinct advantages over other business structures, such as C corporations, partnerships, or sole proprietorships, particularly for small to medium-sized businesses. These benefits make Form 1120S an attractive filing option for eligible corporations.

Key benefits include:

- Avoidance of Double Taxation: Unlike C corporations, S corporations avoid corporate-level taxation, passing income directly to shareholders, who pay taxes at their individual rates. For example, a C corporation with $500,000 in profits pays 21% ($105,000) in federal taxes, and shareholders pay additional taxes on dividends, while an S corporation’s shareholders pay only once on their share of the $500,000.

- Self-Employment Tax Savings: Shareholders who work for the S corporation receive a reasonable salary subject to payroll taxes, but additional profits distributed as dividends are exempt from self-employment taxes, unlike partnerships or sole proprietorships.

- Limited Liability Protection: Like C corporations, S corporations shield shareholders’ personal assets from business debts and liabilities.

- Simplified Tax Reporting: Schedule K-1 streamlines the reporting of pass-through income, reducing complexity compared to partnership tax returns.

However, S corporations face restrictions, such as the 100-shareholder limit and single class of stock requirement, which may not suit businesses with complex ownership structures. For 2025, businesses should weigh these benefits against their growth plans and consult a tax professional to determine if S corporation status aligns with their goals.

FAQ 10: How Will Tax Policy Changes in 2025 Affect IRS Form 1120S Filings?

Tax policy changes can significantly impact IRS Form 1120S filings, as S corporations and their shareholders are sensitive to shifts in federal tax rates, deductions, and credits. While specific changes for 2025 are subject to legislative developments, several trends and potential updates are worth monitoring.

Potential impacts include:

- Changes in Individual Tax Rates: Since S corporation income is taxed at shareholders’ personal tax rates, proposed increases in individual rates could raise tax liabilities. For example, if top individual tax rates rise from 37% to 39.6%, shareholders with high pass-through income may face higher taxes.

- New Deductions or Credits: Emerging tax incentives, such as credits for energy-efficient investments or research and development, could be reported on Form 1120S, reducing shareholders’ taxable income. Businesses should track updates to forms like Form 4562 for depreciation-related credits.

- E-Filing Mandates: The IRS may expand mandatory e-filing thresholds, requiring more S corporations to file Form 1120S electronically. This could affect businesses with assets approaching $10 million or those filing numerous tax forms.

- Reasonable Compensation Scrutiny: The IRS continues to monitor S corporation salaries to prevent tax avoidance, potentially issuing updated guidelines for reasonable compensation in 2025.

To prepare, businesses should stay informed about tax law changes through IRS updates or professional advisors. For example, an S corporation anticipating a new energy credit could adjust its Form 1120S to claim the deduction, reducing shareholders’ tax burdens. For 2025 and beyond, proactive planning and consultation with a tax professional will ensure compliance and optimization of Form 1120S filings.