Navigating the complexities of tax filing can be daunting, especially when it involves reporting supplemental income from sources like rental properties, S corporations, partnerships, royalties, trusts, or real estate mortgage investment conduits (REMICs). IRS Form 1040 Schedule E is a critical document for taxpayers who need to report such income or losses.

This extensive guide will walk you through everything you need to know about Schedule E, including who needs to file it, how to complete it, and key considerations for 2025 and future years. Whether you’re a landlord, a shareholder in an S corporation, or a beneficiary of a trust, this article will provide detailed insights, practical examples, and step-by-step instructions to ensure accurate and timely filing.

Table of Contents

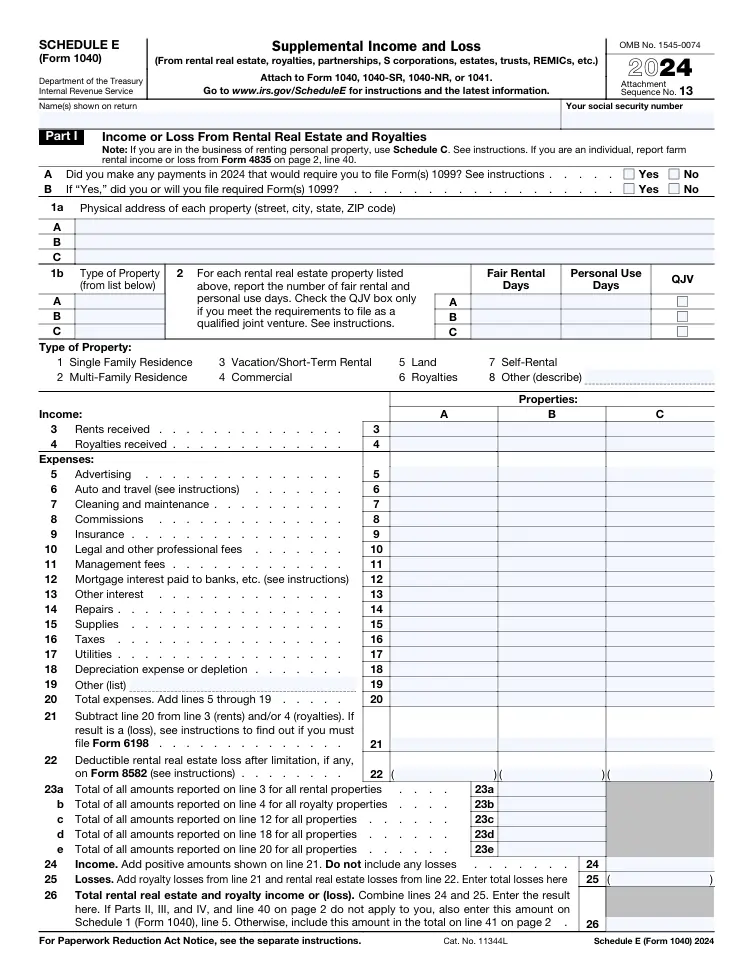

What Is IRS Form 1040 Schedule E?

Schedule E is an IRS form used to report supplemental income and loss alongside Form 1040, the standard individual income tax return. It is designed for taxpayers who earn income from non-employment sources, such as rental real estate, royalties, partnerships, S corporations, estates, trusts, or REMICs. Unlike income from wages or salaries, which is reported on Form W-2, supplemental income often involves pass-through entities or passive income streams, making Schedule E essential for accurate tax reporting.

The form is divided into several parts, each dedicated to a specific type of income or loss:

- Part I: Rental real estate and royalty income or losses

- Part II: Income or losses from partnerships and S corporations

- Part III: Income or losses from estates and trusts

- Part IV: Income or losses from REMICs

- Part V: Summary of totals to be transferred to Form 1040

By organizing income and losses into these categories, Schedule E ensures that taxpayers report their earnings accurately and in compliance with IRS regulations. For example, a taxpayer who owns a rental property and is a shareholder in an S corporation would use both Part I and Part II to report their respective income streams.

Who Needs to File Schedule E?

Schedule E is required for individuals who receive income or incur losses from specific sources. Understanding whether you need to file this form is crucial to avoid penalties or missed deductions. Below are the primary scenarios where filing Schedule E is necessary:

- Rental Real Estate: If you own rental properties and earn income from tenants, you must report this on Schedule E, provided you do not operate the rental activity as a business. For example, renting out a single-family home or a vacation property typically qualifies for Schedule E.

- Royalties: Individuals receiving royalty payments, such as from intellectual property (e.g., books, music, or patents), report this income on Schedule E unless they are self-employed in a related trade or business.

- S Corporations and Partnerships: Shareholders or partners in pass-through entities like S corporations or partnerships receive a Schedule K-1, which details their share of income, losses, deductions, and credits. This information is reported in Part II of Schedule E.

- Estates and Trusts: Beneficiaries of estates or trusts that pass income or losses to them must report these amounts in Part III.

- REMICs: Investors in real estate mortgage investment conduits report income or losses in Part IV.

Exceptions and Alternative Forms

Not all income from these sources is reported on Schedule E. The IRS has specific rules about when other forms, such as Schedule C or Schedule D, are more appropriate:

- Schedule C: If you actively manage multiple rental properties as a business or are self-employed (e.g., as an author or songwriter holding copyrights), you may need to file Schedule C instead of Schedule E. This distinction is critical because Schedule C filers are subject to self-employment tax (15.3% in 2025, covering Social Security and Medicare).

- Schedule D: Capital gains or losses from the sale of assets, including those passed through from an S corporation or partnership, are reported on Schedule D.

- Schedule B: Interest and dividend income from pass-through entities are reported on Schedule B.

For example, suppose you’re an author who earns royalties from a book you wrote. If you actively engage in writing as a business, you would report your royalty income on Schedule C and pay self-employment tax. However, if you receive royalties from a one-time project and do not consider yourself self-employed, you would report this income on Schedule E.

Understanding Key Components of Schedule E

To file Schedule E correctly, it’s essential to understand its structure and the types of income or losses it covers. Below is a detailed breakdown of each part of the form, along with examples to illustrate their application.

Part I: Rental Real Estate and Royalties

Part I is used to report income and expenses from rental properties and royalties. This section is particularly relevant for landlords and individuals receiving royalty payments who are not self-employed.

Rental Income

If you own a rental property, you must report all income received, such as rent payments, security deposits (if not refundable), and tenant-paid expenses (e.g., utilities). You can also deduct allowable expenses, such as:

- Mortgage interest

- Property taxes

- Insurance

- Repairs and maintenance

- Depreciation

Example: Sarah owns a single-family home she rents out for $2,000 per month. In 2025, she collects $24,000 in rent. Her expenses include $8,000 in mortgage interest, $3,000 in property taxes, $1,200 in insurance, and $2,000 in repairs. She also claims $4,000 in depreciation. On Schedule E, Part I, Sarah reports her total rental income of $24,000 and deducts $18,200 in expenses, resulting in a net rental income of $5,800.

Royalties

Royalty income includes payments for the use of intellectual property, such as books, music, or patents. Deductible expenses may include costs associated with maintaining the property generating the royalties (e.g., legal fees for copyright protection).

Example: John receives $10,000 in royalties from a patent he licensed to a company. He incurs $1,500 in legal fees to maintain the patent. On Schedule E, Part I, he reports $10,000 in royalty income and deducts $1,500, resulting in a net royalty income of $8,500.

Passive Activity Loss Limitations

Rental activities are generally considered passive activities by the IRS, meaning losses may be limited. You can only deduct losses up to the amount you are at risk, which typically includes your investment in the property (e.g., down payment, improvements) and any loans for which you are personally liable. If your losses exceed your at-risk amount, you may need to carry forward the excess to future years.

| Activity Type | Small Size (Single Property) | Medium Size (2-3 Properties) | Large Size (4-10 Properties) | Huge Size (10+ Properties) |

|---|---|---|---|---|

| Management Level | Minimal (e.g., single home) | Moderate (e.g., small portfolio) | Active (e.g., multiple units) | Professional (e.g., real estate business) |

| Form Used | Schedule E | Schedule E | Schedule E or C | Schedule C |

| Tax Implications | Passive activity rules apply | Passive activity rules apply | May qualify as real estate professional | Subject to self-employment tax |

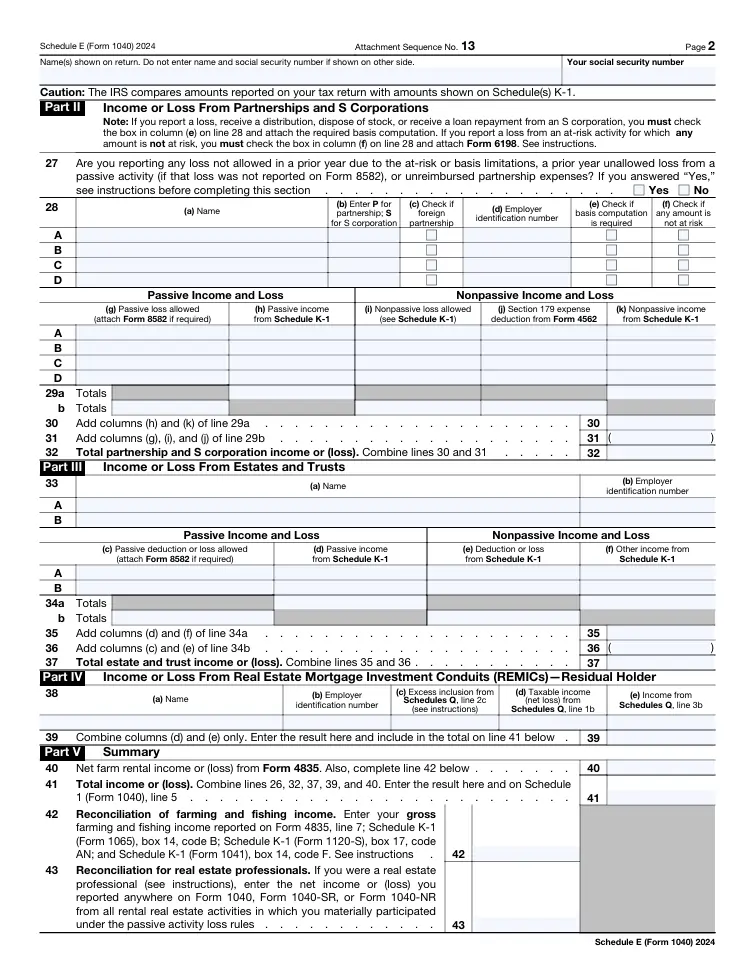

Part II: Partnerships and S Corporations

Part II is used to report income or losses from pass-through entities like partnerships and S corporations. These entities do not pay taxes themselves; instead, they issue Schedule K-1 forms to their partners or shareholders, detailing each individual’s share of income, losses, deductions, and credits.

How It Works

- S Corporations: An S corporation files Form 1120S to report its income and expenses. Each shareholder receives a Schedule K-1 (Form 1120S), which they use to report their share of the corporation’s income or loss on Schedule E, Part II.

- Partnerships: Similarly, partnerships file Form 1065 and issue Schedule K-1 (Form 1065) to partners, who report their share on Schedule E.

Example: Emily is a 50% shareholder in an S corporation that earns $100,000 in net income in 2025. Her Schedule K-1 shows her share as $50,000. She reports this amount in Part II of Schedule E, which flows to her Form 1040 to calculate her taxable income.

At-Risk and Basis Limitations

Like rental losses, losses from partnerships and S corporations are subject to at-risk rules and basis limitations. You can only deduct losses up to the amount you have invested in the entity (your basis) and for which you are personally liable. If your losses exceed your basis, you may need to carry them forward.

Part III: Estates and Trusts

Part III is used to report income or losses from estates or trusts. If you are a beneficiary, you receive a Schedule K-1 (Form 1041) from the estate or trust, detailing your share of income, deductions, or credits.

Example: Michael is a beneficiary of a trust that distributes $15,000 in income to him in 2025. His Schedule K-1 from the trust shows this amount, which he reports in Part III of Schedule E.

Part IV: REMICs

Part IV is reserved for income or losses from real estate mortgage investment conduits (REMICs), which are less common for most taxpayers. REMICs are investment vehicles that hold pools of mortgages and issue interests to investors. If you hold an interest in a REMIC, you receive a Schedule Q to report on Schedule E, Part IV.

Part V: Summary

Part V totals the income or losses from Parts I through IV and transfers the net amount to Form 1040, Line 17. This ensures that your supplemental income is included in your overall taxable income.

How to Obtain and File Schedule E

Where to Get Schedule E

You can obtain Schedule E in several ways:

- IRS Website: Download a printable PDF from the IRS website (irs.gov) and complete it manually if filing by mail.

- Tax Software: Programs like TurboTax, H&R Block, or TaxAct automatically include Schedule E if you enter relevant income or loss information.

- Tax Professional: A CPA or tax preparer can provide and complete the form for you.

Filing Options

Schedule E can be filed either electronically or by mail with your Form 1040:

- E-Filing: Most tax software supports e-filing for Schedule E, which is faster and reduces errors. Free options, like IRS Free File, are available for taxpayers with adjusted gross income (AGI) below a certain threshold (e.g., $79,000 in 2025, subject to change).

- Mailing: If filing by mail, send your completed Form 1040 and Schedule E to the IRS processing center for your state. Check the IRS website for the correct address, as it varies by location.

Filing Deadlines

The standard deadline for filing Form 1040 and Schedule E is April 15 of the following year (e.g., April 15, 2026, for the 2025 tax year). If April 15 falls on a weekend or holiday, the deadline shifts to the next business day. You can request an automatic six-month extension by filing Form 4868, extending the filing deadline to October 15. However, this extension does not apply to tax payments, which are still due by April 15 to avoid penalties and interest.

Special Extensions in 2025

In 2025, certain taxpayers may qualify for automatic extensions due to natural disasters or other IRS-designated events. For example, in 2021, taxpayers in Texas, Louisiana, and Oklahoma affected by winter storms received an extension until June 15. Check the IRS website for any 2025 disaster-related extensions.

S Corporation and Partnership Extensions

S corporations and partnerships face earlier deadlines for their returns:

- S Corporations: Form 1120S is due by March 15 (e.g., March 17, 2025, due to March 15 being a Saturday). They can file Form 7004 for an automatic six-month extension to September 15.

- Partnerships: Form 1065 is also due by March 15, with a similar extension option.

Since shareholders and partners rely on Schedule K-1 to complete Schedule E, delays in corporate or partnership filings often necessitate personal extensions to October 15.

Step-by-Step Guide to Completing Schedule E

Filling out Schedule E requires careful attention to detail. Below is a step-by-step guide for each relevant part, assuming you’re using tax software or a paper form.

Step 1: Gather Necessary Documents

Before starting, collect all relevant documents:

- Schedule K-1 forms from S corporations, partnerships, estates, or trusts

- Schedule Q for REMIC income

- Rental income and expense records (e.g., receipts, bank statements)

- Royalty income and expense records

- Prior year’s tax return for carryover losses or depreciation schedules

Step 2: Complete Part I (Rental Real Estate and Royalties)

- List Properties: In Part I, list each rental property separately (e.g., Property A, Property B). Include the address and type (e.g., single-family home, apartment).

- Report Income: Enter total rental or royalty income received for the year.

- Deduct Expenses: List allowable expenses, such as mortgage interest, property taxes, insurance, repairs, and depreciation. Use IRS Publication 527 for guidance on deductible expenses.

- Calculate Net Income or Loss: Subtract expenses from income for each property. Apply passive activity loss limitations if applicable.

- Apply At-Risk Rules: Ensure losses do not exceed your at-risk amount. Carry forward any excess losses.

Step 3: Complete Part II (Partnerships and S Corporations)

- Enter K-1 Information: For each Schedule K-1 received, enter the entity’s name, EIN, and your share of income, losses, or credits as reported on the K-1.

- Separate Income Types: Report ordinary income or loss in Part II. Other items, like capital gains or interest, go to Schedule D or Schedule B.

- Check Basis and At-Risk Limits: Verify that losses do not exceed your basis or at-risk amount. Consult a tax professional if unsure.

Step 4: Complete Part III (Estates and Trusts)

- Enter K-1 Information: Use Schedule K-1 (Form 1041) to report income or losses from estates or trusts.

- Include Deductions and Credits: Report any deductions or credits passed through to you.

Step 5: Complete Part IV (REMICs)

- Enter Schedule Q Information: Report income or losses from Schedule Q for REMIC investments.

- Verify Calculations: Ensure accuracy, as REMIC reporting can be complex.

Step 6: Summarize in Part V

- Total Income or Losses: Sum the net amounts from Parts I through IV.

- Transfer to Form 1040: Enter the total on Form 1040, Line 17.

Step 7: Review and File

- Double-Check Entries: Ensure all income, expenses, and K-1 information are accurate.

- E-File or Mail: Submit Schedule E with your Form 1040 by the deadline.

- Keep Records: Retain all documentation for at least three years in case of an IRS audit.

Common Mistakes to Avoid

Filing Schedule E incorrectly can lead to penalties, audits, or missed deductions. Here are common pitfalls and how to avoid them:

- Misclassifying Income: Ensure rental or royalty income is reported on Schedule E rather than Schedule C unless you’re self-employed. Consult IRS Publication 925 for passive activity rules.

- Ignoring At-Risk Rules: Verify your at-risk amount before claiming losses. Use IRS Form 6198 to calculate at-risk limitations.

- Incomplete K-1 Reporting: Double-check that all Schedule K-1 amounts are accurately transferred to Schedule E.

- Missing Deadlines: File by April 15 or request an extension by filing Form 4868. Pay any taxes owed by April 15 to avoid penalties.

- Not Claiming Deductions: Ensure you claim all allowable expenses, such as depreciation, which can significantly reduce taxable income.

Additional Considerations for 2025 and Beyond

Tax Law Changes

Tax laws evolve, and 2025 may bring changes affecting Schedule E filers. For example, the Tax Cuts and Jobs Act (TCJA) of 2017, set to expire in 2025, may be extended or modified, impacting deductions like mortgage interest or depreciation. Stay updated via the IRS website or consult a tax professional.

Technology and E-Filing

In 2025, e-filing remains the most efficient way to submit Schedule E. Tax software like TurboTax or H&R Block simplifies the process by automatically populating fields based on your input. The IRS Free File program, available for lower-income taxpayers, supports Schedule E e-filing.

Cryptocurrency and Digital Assets

If you receive rental income or royalties in cryptocurrency, report the fair market value in U.S. dollars on Schedule E. The IRS requires reporting of digital asset transactions, so maintain detailed records of crypto payments.

Energy Efficiency Deductions

For rental properties, you may qualify for energy efficiency deductions or credits in 2025, such as for installing solar panels or energy-efficient windows. Check IRS Publication 527 for details.

Practical Examples

Example 1: Rental Property Portfolio

Lisa owns three rental properties in 2025:

- Property A: A single-family home generating $30,000 in rent and $15,000 in expenses (net $15,000).

- Property B: A duplex generating $40,000 in rent and $20,000 in expenses (net $20,000).

- Property C: A vacation home rented part-time, generating $10,000 in rent and $8,000 in expenses (net $2,000).

Lisa reports these on Schedule E, Part I, calculating a total net rental income of $37,000, which she transfers to Form 1040.

Example 2: S Corporation Shareholder

Mark is a 25% shareholder in an S corporation that earns $200,000 in net income in 2025. His Schedule K-1 shows $50,000 in ordinary income and $5,000 in capital gains. He reports the $50,000 in Schedule E, Part II and the $5,000 in Schedule D.

Example 3: Trust Beneficiary

Jennifer is a beneficiary of a trust that distributes $20,000 in income and $2,000 in deductions in 2025. Her Schedule K-1 (Form 1041) details these amounts, which she reports in Schedule E, Part III, resulting in a net income of $18,000.

Conclusion

Filing IRS Form 1040 Schedule E is a critical task for taxpayers with supplemental income from rental properties, royalties, S corporations, partnerships, estates, trusts, or REMICs. By understanding the form’s structure, gathering necessary documents, and following IRS guidelines, you can accurately report your income and losses while maximizing deductions. In 2025, leverage tax software for efficient e-filing, stay informed about potential tax law changes, and consult a tax professional if your situation is complex. With careful preparation, you can navigate Schedule E confidently and ensure compliance with IRS requirements for years to come.

Disclaimer

The information provided in “A Comprehensive Guide to Filing IRS Form 1040 Schedule E in 2025 and Beyond,” is intended for general informational purposes only and does not constitute professional tax, financial, or legal advice. Tax laws and IRS regulations are subject to change, and the information presented may not reflect the most current legal or regulatory requirements.

Readers are strongly encouraged to consult with a qualified tax professional, certified public accountant (CPA), or attorney to address their specific tax situations and ensure compliance with all applicable laws. The authors and publishers of this website (Manishchanda.net) are not responsible for any errors, omissions, or consequences arising from the use of this information.

Acknowledgements

The creation of “A Comprehensive Guide to Filing IRS Form 1040 Schedule E in 2025 and Beyond,” was made possible through the extensive resources and insights provided by numerous reputable websites. I sincerely express my gratitude to the following organizations for their valuable information, which helped shape this detailed guide. Their expertise in tax regulations, financial planning, and IRS procedures ensured the accuracy and comprehensiveness of the article. Below is a list of key sources that contributed to the research and development of this guide:

- IRS: For providing official tax forms, instructions, and publications, including detailed guidance on Schedule E and related tax rules.

- TurboTax: For offering practical insights on e-filing and navigating tax software for Schedule E reporting.

- H&R Block: For clarifying rental income and royalty reporting requirements for individual taxpayers.

- TaxAct: For providing user-friendly explanations of pass-through income and Schedule K-1 reporting.

- Nolo: For legal insights on rental property management and distinctions between Schedule E and Schedule C.

- Investopedia: For comprehensive articles on S corporations, partnerships, and passive activity loss limitations.

- Forbes: For updates on tax law changes and their potential impact on Schedule E filers in 2025.

- Kiplinger: For practical tax tips and examples relevant to rental real estate and royalty income.

- The Balance: For clear explanations of at-risk rules and basis limitations for partnerships and S corporations.

- NerdWallet: For guidance on tax deductions and energy efficiency credits for rental properties.

- CPA Practice Advisor: For professional insights into tax preparation and compliance for small business owners.

- Tax Foundation: For analysis of tax policy changes, including potential updates to the Tax Cuts and Jobs Act.

- Bloomberg Tax: For in-depth coverage of IRS regulations and REMIC reporting requirements.

- Accounting Today: For updates on tax filing deadlines and extensions for S corporations and partnerships.

- Journal of Accountancy: For detailed explanations of trust and estate income reporting on Schedule E.

Frequently Asked Questions (FAQs)

FAQ 1: What Is IRS Form 1040 Schedule E and Who Needs to File It?

IRS Form 1040 Schedule E is a critical tax document used to report supplemental income and loss from various non-employment sources, filed alongside Form 1040 during the annual tax season. This form is essential for taxpayers who earn income from sources such as rental real estate, royalties, S corporations, partnerships, estates, trusts, or real estate mortgage investment conduits (REMICs). Understanding who needs to file Schedule E is key to ensuring compliance with IRS regulations and avoiding penalties.

For rental real estate, Schedule E is used by individuals who own properties and collect rent, provided they do not manage these properties as a business. For example, if you rent out a single-family home or a vacation property, you would report this income on Schedule E. However, if you actively manage multiple properties as a primary source of income, you may need to file Schedule C instead, as this could classify you as self-employed. Similarly, royalties from intellectual property, like books or patents, are reported on Schedule E unless you’re self-employed in a related trade, in which case Schedule C applies.

Individuals involved in S corporations or partnerships receive a Schedule K-1, which details their share of income, losses, deductions, or credits from these pass-through entities. This information is reported in Part II of Schedule E. Beneficiaries of estates or trusts report distributions in Part III, while investors in REMICs use Part IV. For instance, if Jane is a 30% partner in a business that earns $100,000, her Schedule K-1 would show $30,000, which she reports on Schedule E. Taxpayers with any of these income types must file Schedule E to accurately report their earnings and comply with IRS rules.

FAQ 2: What Types of Income Are Reported on Schedule E?

Schedule E is designed to capture supplemental income from a variety of sources, each reported in specific sections of the form. These include rental income, royalties, pass-through income from S corporations and partnerships, estate and trust distributions, and REMIC income. Each type has unique reporting requirements, making it essential to understand what qualifies for Schedule E versus other forms.

Rental income includes payments from tenants for properties like homes, apartments, or commercial spaces, as well as non-refunded security deposits or tenant-paid expenses (e.g., utilities). For example, if Tom rents out a duplex for $2,500 monthly, he reports $30,000 annually in Part I of Schedule E, along with deductible expenses like mortgage interest or repairs. Royalties, such as payments for a book or patent, are also reported in Part I, but only if you’re not self-employed. If you’re an author actively writing as a business, royalties go on Schedule C.

Pass-through income from S corporations or partnerships is reported in Part II, using data from Schedule K-1. For example, if a partnership distributes $50,000 in income to a partner, this is reported on Schedule E, while capital gains or interest from the same entity may go on Schedule D or Schedule B. Estate and trust income (reported in Part III) comes from distributions to beneficiaries, and REMIC income (reported in Part IV) involves specialized mortgage investments. Knowing where to report each income type ensures accurate tax filing.

FAQ 3: How Do I Report Rental Income and Expenses on Schedule E?

Reporting rental income on Schedule E, Part I involves documenting all income received from rental properties and deducting allowable expenses to calculate net income or loss. This process is straightforward but requires meticulous record-keeping to maximize deductions and comply with IRS rules.

Start by listing each rental property separately, including its address and type (e.g., single-family home). Report all income, such as rent payments, non-refunded security deposits, or tenant-paid utilities. Next, list deductible expenses, which may include:

- Mortgage interest: Interest paid on loans for the property.

- Property taxes: Local taxes assessed on the property.

- Insurance: Premiums for property insurance.

- Repairs and maintenance: Costs for fixing or maintaining the property.

- Depreciation: A non-cash expense for the property’s wear and tear, calculated using IRS guidelines.

For example, suppose Lisa owns a rental condo generating $24,000 in annual rent. Her expenses include $8,000 in mortgage interest, $3,000 in property taxes, $1,500 in insurance, $2,000 in repairs, and $4,000 in depreciation. She reports the $24,000 income and $18,500 in expenses on Schedule E, resulting in a net income of $5,500. However, passive activity loss limitations may restrict deductions if the property incurs a loss. If Lisa’s expenses were $26,000, resulting in a $2,000 loss, she must ensure she is at risk for that amount (e.g., her investment in the property) to claim the loss, or else carry it forward.

FAQ 4: What Are Passive Activity Loss Limitations on Schedule E?

Passive activity loss limitations are IRS rules that restrict the amount of losses you can deduct from rental real estate or other passive activities reported on Schedule E. These rules aim to prevent taxpayers from offsetting non-passive income (e.g., wages) with losses from activities in which they do not materially participate.

A passive activity is one where you do not actively manage the operations, such as renting out a single property. Losses from passive activities can only offset income from other passive activities, and any excess losses are carried forward to future years. Additionally, losses are limited to the amount you are at risk, meaning your personal investment in the activity (e.g., down payment, improvements) plus any loans for which you’re liable. For example, if your rental property incurs a $10,000 loss but your at-risk amount is only $6,000, you can deduct only $6,000, carrying forward the remaining $4,000.

There are exceptions for real estate professionals who spend significant time managing properties (at least 750 hours annually and more than half their working hours). They may be exempt from passive loss rules, allowing full deduction of losses. For instance, if Mark, a real estate professional, incurs a $20,000 loss on a rental property, he can deduct the full amount against other income, provided he meets IRS criteria. Use IRS Form 8582 to calculate and report passive activity losses.

FAQ 5: How Do I Report S Corporation or Partnership Income on Schedule E?

Income from S corporations and partnerships is reported in Schedule E, Part II, using information from Schedule K-1 forms issued by these entities. These pass-through entities do not pay taxes themselves; instead, they distribute income, losses, deductions, and credits to shareholders or partners, who report them on their personal tax returns.

For S corporations, the entity files Form 1120S and issues a Schedule K-1 (Form 1120S) to each shareholder, detailing their share of income, losses, or credits. For partnerships, Form 1065 is filed, and partners receive a Schedule K-1 (Form 1065). You enter the ordinary income or loss from the K-1 in Part II, while other items, like capital gains or interest, are reported on Schedule D or Schedule B. For example, if Sarah owns 40% of an S corporation that earns $100,000 in net income, her K-1 shows $40,000, which she reports on Schedule E.

Be mindful of basis and at-risk limitations. You can only deduct losses up to your basis in the entity (e.g., your investment plus undistributed income) and the amount you’re personally liable for. If your K-1 shows a $15,000 loss but your basis is $10,000, you can deduct only $10,000, carrying forward the rest. Use IRS Form 6198 to calculate at-risk amounts. Consulting a tax professional can help ensure accurate reporting, especially with multiple K-1s.

FAQ 6: What Is the Difference Between Schedule E and Schedule C for Rental Income and Royalties?

The distinction between Schedule E and Schedule C for reporting rental income and royalties hinges on whether the activity constitutes a business, impacting tax obligations like self-employment tax. Understanding this difference is crucial for accurate filing.

Schedule E is used for passive rental income or royalties, such as renting out a single property or receiving payments for a patent without actively managing a related business. For example, if John rents out a vacation home for $15,000 annually, he reports this on Schedule E, Part I, deducting expenses like repairs or depreciation. Similarly, royalties from a one-time book deal are reported on Schedule E if John isn’t a professional author. Schedule E filers are not subject to self-employment tax, but losses are subject to passive activity loss limitations.

Schedule C, however, is for self-employed individuals who actively manage rental properties or earn royalties as part of a trade or business. For instance, if Jane manages a portfolio of 10 rental properties as her primary livelihood, she files Schedule C, reporting income and expenses and paying self-employment tax (15.3% in 2025). Similarly, an author who actively writes and markets books reports royalties on Schedule C. Schedule C allows broader expense deductions but requires meticulous record-keeping. If unsure, consult IRS Publication 925 or a tax professional to determine the correct form.

FAQ 7: How Do I File Schedule E and What Are the Deadlines for 2025?

Filing Schedule E involves submitting it with Form 1040 either electronically or by mail, adhering to IRS deadlines. The process is straightforward with proper preparation, but missing deadlines can result in penalties.

To file, gather necessary documents, including Schedule K-1 forms, rental income records, and expense receipts. Use tax software like TurboTax for e-filing, which automatically populates Schedule E based on your input, or download the form from the IRS website for manual filing. Complete the relevant parts (Part I for rentals/royalties, Part II for partnerships/S corporations, etc.), calculate the net income or loss, and transfer the total to Form 1040, Line 17. E-filing is recommended for speed and accuracy, with free options like IRS Free File available for eligible taxpayers (e.g., AGI under $79,000 in 2025).

The standard deadline for Form 1040 and Schedule E is April 15, 2026, for the 2025 tax year, shifting to the next business day if it falls on a weekend or holiday. You can request a six-month extension by filing Form 4868, moving the filing deadline to October 15, 2026, but taxes owed must be paid by April 15 to avoid penalties. S corporations and partnerships file Form 1120S or Form 1065 by March 17, 2025, with extensions to September 15, 2025, via Form 7004. Since Schedule K-1 delays are common, shareholders/partners may need personal extensions.

FAQ 8: Can I Deduct Losses on Schedule E, and What Are the Limitations?

Deducting losses on Schedule E is possible but subject to strict IRS rules, including passive activity loss limitations and at-risk rules, which can restrict the amount you can claim in a given year.

For rental real estate (reported in Part I), losses are considered passive unless you’re a real estate professional. You can only offset passive losses against passive income (e.g., rental income or royalties). If losses exceed passive income, the excess is carried forward. For example, if Mike’s rental property generates $10,000 in income but $15,000 in expenses, resulting in a $5,000 loss, he can carry forward the loss unless he has other passive income to offset it. At-risk rules further limit losses to the amount you’ve invested or are personally liable for. If Mike’s at-risk amount is $3,000, he can deduct only $3,000, carrying forward $2,000.

For S corporations and partnerships (Part II), losses are limited by your basis (your investment in the entity) and at-risk amount. For instance, if your K-1 shows a $20,000 loss but your basis is $12,000, you can deduct only $12,000. Use IRS Form 8582 for passive losses and Form 6198 for at-risk calculations. Real estate professionals or active participants in partnerships may have fewer restrictions but must meet specific IRS criteria.

FAQ 9: What Are Common Mistakes to Avoid When Filing Schedule E?

Filing Schedule E correctly requires attention to detail, as errors can lead to IRS audits, penalties, or missed deductions. Common mistakes include misclassifying income, ignoring limitations, and missing deadlines.

One frequent error is reporting rental income or royalties on Schedule E when Schedule C is appropriate. For example, if you actively manage multiple rental properties as a business, you should file Schedule C to account for self-employment tax. Another mistake is failing to apply passive activity loss limitations or at-risk rules, which can result in overstated deductions. For instance, claiming a $10,000 rental loss without verifying your at-risk amount could trigger an audit.

Incomplete or incorrect Schedule K-1 reporting is also common, especially with multiple K-1s from partnerships or S corporations. Ensure all amounts are accurately transferred to Part II. Missing the April 15 deadline (or October 15 with an extension) or failing to pay taxes owed by April 15 can incur penalties. Finally, overlooking deductions like depreciation or mortgage interest reduces your tax savings. Keep detailed records and consult IRS publications or a tax professional to avoid these pitfalls.

FAQ 10: How Can Tax Software or Professionals Help with Schedule E Filing?

Tax software and tax professionals play a vital role in simplifying and ensuring the accuracy of Schedule E filing, especially for complex income sources like rentals, S corporations, or trusts. They help navigate IRS rules and maximize deductions.

Tax software like TurboTax, H&R Block, or TaxAct streamlines the process by guiding you through data entry for rental income, royalties, or Schedule K-1 information. The software automatically populates Schedule E and transfers totals to Form 1040, reducing errors. For example, entering rental income and expenses prompts the software to calculate depreciation and apply passive activity loss rules. Free options like IRS Free File are available for eligible taxpayers, making e-filing accessible. Software also stays updated with 2025 tax law changes, such as potential adjustments to the Tax Cuts and Jobs Act.

Tax professionals, such as CPAs or enrolled agents, offer expertise for complex scenarios, like managing multiple K-1s or determining whether to file Schedule E or Schedule C. For instance, if you’re a real estate professional with a rental portfolio, a CPA can verify your eligibility to bypass passive loss rules. Professionals also provide personalized advice on deductions, like energy efficiency credits for rental properties. While software is cost-effective for straightforward cases, a professional is invaluable for intricate tax situations or audit preparation.

FAQ 11: How Do I Report Royalties on Schedule E, and When Should I Use Schedule C Instead?

Reporting royalties on IRS Form 1040 Schedule E is required for individuals who receive income from intellectual property, such as books, music, patents, or mineral rights, but only if they are not self-employed in a related trade or business. Royalties are typically considered passive income and are reported in Part I of Schedule E, alongside rental income. The process involves documenting royalty payments received and deducting allowable expenses, but understanding when to use Schedule C instead is critical to avoid misfiling and potential IRS penalties.

To report royalties on Schedule E, list the source of the royalty income (e.g., a book or patent) in Part I, along with the total payments received during the tax year. Deductible expenses may include costs directly related to maintaining the royalty-generating asset, such as legal fees for copyright protection or licensing fees.

For example, if Emma receives $12,000 in royalties from a novel she wrote years ago and incurs $2,000 in legal fees to renew her copyright, she reports $12,000 in income and deducts $2,000, resulting in a net royalty income of $10,000 on Schedule E. However, passive activity loss limitations apply, meaning any losses (if expenses exceed income) can only offset other passive income, with excess losses carried forward.

If you actively engage in a trade or business related to the royalties, such as being a professional author or songwriter, you must file Schedule C instead. This distinction hinges on whether you hold the copyright and if creating or managing the royalty-generating asset is an ongoing business activity.

For instance, if Emma actively writes and markets multiple books, her royalties are reported on Schedule C, and she is subject to self-employment tax (15.3% in 2025). Schedule C allows broader expense deductions, like marketing or office costs, but requires meticulous record-keeping. If unsure, consult IRS Publication 525 or a tax professional to determine the correct form based on your level of involvement.

FAQ 12: What Are the At-Risk Rules for Schedule E, and How Do They Affect Deductions?

At-risk rules are IRS regulations that limit the amount of losses you can deduct on Schedule E to the amount you have personally invested or are liable for in the activity, such as rental real estate, partnerships, or S corporations. These rules prevent taxpayers from claiming losses beyond their financial stake, ensuring deductions reflect actual economic risk. Understanding how these rules apply is essential for accurate tax reporting and maximizing allowable deductions.

For rental real estate (reported in Part I), your at-risk amount includes your cash investment (e.g., down payment, improvements) and any loans for which you are personally liable. For example, if Tom invests $20,000 in a rental property and incurs a $25,000 loss, he can only deduct $20,000 in 2025, carrying forward the remaining $5,000 to future years when he has additional at-risk basis or passive income. Similarly, for S corporations or partnerships (Part II), losses are limited to your basis (your investment plus undistributed income) and at-risk amount. If your Schedule K-1 shows a $15,000 loss but your at-risk amount is $10,000, you can deduct only $10,000.

To calculate your at-risk amount, use IRS Form 6198, which requires you to list your investment, income, and liabilities for the activity. Non-recourse loans (where you’re not personally liable) generally do not count toward your at-risk amount, except in specific cases like qualified real estate financing.

For instance, if Sarah’s rental property is financed with a $100,000 recourse loan and she’s invested $30,000, her at-risk amount is $130,000, allowing her to deduct losses up to that amount. Failing to apply at-risk rules correctly can lead to disallowed deductions, so consult a tax professional for complex scenarios or multiple activities.

FAQ 13: How Do I Handle Schedule K-1 Forms When Filing Schedule E?

Schedule K-1 forms are issued by S corporations, partnerships, estates, or trusts to report an individual’s share of income, losses, deductions, and credits, which are then reported on Schedule E. These forms are critical for pass-through entities, as they transfer tax liability to owners or beneficiaries. Properly handling K-1s ensures accurate reporting on Schedule E and avoids IRS scrutiny.

For S corporations (Form 1120S) and partnerships (Form 1065), the K-1 details your share of ordinary income, losses, capital gains, or other items. Report ordinary income or loss in Schedule E, Part II, while other items, like capital gains or interest, go to Schedule D or Schedule B. For example, if Mike receives a K-1 from an S corporation showing $40,000 in ordinary income and $5,000 in dividends, he reports the $40,000 in Part II and the $5,000 on Schedule B. For estates or trusts (Form 1041), the K-1 reports distributions, which are entered in Schedule E, Part III. If Lisa, a trust beneficiary, receives a K-1 showing $10,000 in income and $1,000 in deductions, she reports a net of $9,000 in Part III.

Key steps for handling K-1s include:

- Verify Accuracy: Ensure the K-1 matches your records and the entity’s filings.

- Separate Income Types: Report each K-1 item on the correct form or schedule.

- Check Basis and At-Risk Limits: Confirm losses do not exceed your basis or at-risk amount using Form 6198.

- Retain Records: Keep K-1s and related documents for at least three years for audit purposes.

Delays in receiving K-1s are common, as S corporations and partnerships have a March 15 deadline (extendable to September 15). Request a personal extension (Form 4868) to October 15 if needed. Multiple or complex K-1s may warrant professional assistance to ensure compliance.

FAQ 14: Can I E-File Schedule E, and What Are the Benefits of Doing So?

Yes, Schedule E can be e-filed with Form 1040 using tax software or a tax preparation service, offering significant advantages over paper filing. E-filing is increasingly popular due to its efficiency, accuracy, and accessibility, especially for taxpayers with supplemental income from rentals, royalties, or pass-through entities. In 2025, e-filing remains a preferred method for submitting Schedule E.

E-filing through software like TurboTax, H&R Block, or TaxAct simplifies the process by guiding you through data entry for rental income, royalties, or Schedule K-1 information. The software automatically populates Schedule E, applies passive activity loss and at-risk rules, and transfers totals to Form 1040, reducing manual errors. For example, if John enters $30,000 in rental income and $15,000 in expenses, the software calculates his net income and flags any limitations. Free e-filing options, like IRS Free File, are available for taxpayers with adjusted gross income (AGI) below a threshold (e.g., $79,000 in 2025, subject to change).

Benefits of e-filing include:

- Speed: E-filed returns are processed faster, often within 21 days, compared to 6-8 weeks for paper returns.

- Accuracy: Built-in error checks reduce mistakes, such as incorrect K-1 entries.

- Convenience: File from home, 24/7, without mailing.

- Security: Electronic submissions are encrypted, reducing the risk of lost mail.

- Confirmation: Receive immediate confirmation of IRS receipt.

Paper filing is still an option, but it requires mailing to the correct IRS processing center based on your state. E-filing is generally recommended for its efficiency, especially for complex Schedule E filings involving multiple properties or K-1s.

FAQ 15: What Are the Tax Implications of Filing Schedule E in 2025?

Filing Schedule E in 2025 has significant tax implications, as it reports supplemental income that contributes to your overall taxable income on Form 1040. Understanding these implications helps you plan for tax liabilities, deductions, and potential law changes, especially with the Tax Cuts and Jobs Act (TCJA) set to expire in 2025.

Income reported on Schedule E, such as rental income, royalties, or pass-through income, is taxed at your ordinary income tax rate (ranging from 10% to 37% in 2025, depending on your income bracket). Unlike Schedule C filers, Schedule E filers are not subject to self-employment tax (15.3% for Social Security and Medicare), making it advantageous for passive income earners. For example, if Sarah reports $50,000 in net rental income on Schedule E, it’s taxed at her marginal rate (e.g., 24%), resulting in a $12,000 tax liability, without additional self-employment tax.

Deductions play a key role in reducing taxable income. Allowable expenses for rentals include mortgage interest, property taxes, insurance, and depreciation, which can significantly lower your tax bill.

For instance, if Tom’s rental property generates $40,000 in income but has $25,000 in deductible expenses, his taxable income is only $15,000. However, passive activity loss limitations may restrict loss deductions, and at-risk rules limit losses to your investment. Potential 2025 TCJA changes could affect deductions like mortgage interest caps or depreciation schedules, so monitor IRS updates. Additional considerations, like energy efficiency credits for rental properties or cryptocurrency income reporting, may also apply. Consulting a tax professional ensures you navigate these complexities and optimize your tax strategy.