Excel, a powerhouse in the Microsoft Office suite, is more than just a spreadsheet tool—it’s a game-changer for small business owners looking to streamline their accounting processes. Whether you’re tracking daily transactions or preparing complex financial reports, Excel’s robust features make it an ideal choice for managing finances with precision and ease.

This article dives deep into how small businesses can harness Excel for cash basis and accrual basis accounting, offering step-by-step guidance, practical examples, and unique tips to elevate your bookkeeping game. From setting up a chart of accounts to leveraging Excel’s formulas and formats, we’ll cover everything you need to know to make accounting accessible, efficient, and accurate.

Table of Contents

Why Choose Excel for Small Business Accounting?

Excel’s versatility makes it a go-to tool for small businesses that may not have the budget for expensive accounting software. Its ability to calculate, store, and visualize data allows business owners to customize their bookkeeping processes to fit their unique needs. Whether you’re a sole proprietor managing a freelance gig or a small retailer tracking inventory, Excel can handle it all. The program’s flexibility means you can start with basic spreadsheets and scale up to sophisticated financial models as your business grows.

Beyond affordability, Excel offers formulas, pivot tables, and charting tools that simplify complex calculations and provide visual insights into your financial health. For small businesses, where every penny counts, these features help you stay organized, make informed decisions, and prepare for tax season without breaking a sweat. Plus, Excel’s widespread use means you can easily share files with accountants or collaborators, ensuring seamless communication.

Getting Started: Setting Up Your Excel Workbook

Before diving into transactions, you need to set up your Excel workbook to ensure it’s organized and functional. A well-structured workbook is the foundation of effective accounting. Here’s how to get started:

Create a Chart of Accounts

A chart of accounts is the backbone of your accounting system, categorizing all financial transactions into specific accounts like assets, liabilities, equity, revenue, and expenses. This structure helps you track where money is coming from and where it’s going. For small businesses, keeping this chart simple yet comprehensive is key.

Start by creating a new worksheet in your Excel workbook and label it “Chart of Accounts.” List each account, assign it a unique number, and specify its type and how to increase it (debit or credit). Below is an example of a chart of accounts tailored for a small business:

| Account Number | Account Title | Type | How to Increase |

|---|---|---|---|

| 101 | Cash | Asset | Debit |

| 102 | Accounts Receivable | Asset | Debit |

| 103 | Inventory | Asset | Debit |

| 201 | Accounts Payable | Liability | Credit |

| 301 | Owner’s Equity | Equity | Credit |

| 401 | Sales Revenue | Revenue | Credit |

| 501 | Rent Expense | Expense | Debit |

| 502 | Advertising Expense | Expense | Debit |

This table organizes your accounts systematically, making it easier to record transactions accurately. For example, a retail store might add accounts like “Store Equipment” or “Utilities Expense” to reflect their specific operations.

Organize Your Workbook with Multiple Sheets

To keep your accounting tidy, use separate worksheets for different purposes. For instance, dedicate one sheet to your chart of accounts, another for cash transactions, and additional sheets for accounts like inventory or accounts receivable. You can also create monthly sheets to track transactions over time or a single sheet for the entire year, depending on your preference. Naming each sheet clearly (e.g., “January 2025 Transactions” or “Accounts Payable”) ensures you can navigate your workbook effortlessly.

Cash Basis Accounting in Excel: Simple and Effective

For many small businesses, cash basis accounting is the preferred method because it’s straightforward. In this approach, you record revenue and expenses only when cash changes hands. Think of it like a checkbook: you log income when a customer pays you and expenses when you pay a vendor. Excel makes this process intuitive with its spreadsheet layout.

Setting Up a Cash Basis Worksheet

Create a new worksheet and add column headers to track your transactions. A typical setup includes:

| Number | Date | Description | Income | Expense | Account Balance |

|---|---|---|---|---|---|

| 001 | 08/10/2025 | Flo’s Plastics Sale | $300.00 | $1,500.00 | |

| 002 | 08/10/2025 | Joe’s Parts Purchase | $50.00 | $1,450.00 |

Here’s how to use this setup:

- Number: Assign a unique transaction number for easy reference.

- Date: Record the transaction date to maintain a chronological order.

- Description: Note the transaction details, such as the customer or vendor name.

- Income: Enter any money received, like sales revenue.

- Expense: Record payments made, such as supplies or utilities.

- Account Balance: Calculate the running balance by adding income and subtracting expenses from the previous balance.

For example, if your starting balance is $1,500, a $300 sale increases it to $1,800, and a $50 expense reduces it to $1,750. Use Excel’s SUM function to automate balance calculations. For instance, if your income and expense are in cells D2 and E2, enter =F1+D2-E2 in the Account Balance column (F2) to update the balance dynamically.

Tips for Cash Basis Accounting

- Use Conditional Formatting: Highlight negative balances in red to spot potential cash flow issues. Select the Account Balance column, go to “Conditional Formatting,” and set a rule to format cells less than zero.

- Monthly Summaries: At the end of each month, use Excel’s AutoSum feature to total your income and expenses, giving you a snapshot of your financial performance.

- Backup Regularly: Save your workbook frequently and consider using cloud storage to prevent data loss.

Accrual Basis Accounting in Excel: Capturing the Full Picture

For businesses that extend or receive credit, accrual basis accounting is more appropriate. This method records revenue when it’s earned and expenses when they’re incurred, regardless of when cash is exchanged. It follows the accounting equation: Assets = Liabilities + Equity. Excel’s structure is perfect for managing the complexity of accrual accounting.

Building Your Accrual Basis Worksheets

After creating your chart of accounts, set up individual worksheets for key accounts like Cash, Accounts Receivable, Accounts Payable, and Inventory. Each worksheet should track debits, credits, and balances. Here’s how to record a transaction where you sell $100 of inventory for cash:

Cash Worksheet

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 08/10/2025 | Inventory Sale | $100 | $1,100 |

Inventory Worksheet

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 08/10/2025 | Inventory Sale | $100 | $9,900 |

In this example, you debit Cash (an asset) to increase its value and credit Inventory (another asset) to decrease its value. The key is to ensure every transaction has a corresponding entry to maintain the balance of the accounting equation.

Handling Credit Transactions

Accrual accounting shines when dealing with credit. Suppose you allow a customer, Joe’s Parts, to purchase $100 of goods on credit. You’d record this in two worksheets:

Accounts Receivable (Joe’s Parts) Worksheet

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 08/10/2025 | Sale on Credit | $100 | $100 |

Inventory Worksheet

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 08/10/2025 | Sale on Credit | $100 | $9,800 |

Here, you debit Accounts Receivable to reflect the amount owed and credit Inventory to show the reduction in stock. When Joe’s Parts pays later, you’d debit Cash and credit Accounts Receivable to clear the balance.

Balancing the Accounting Equation

To verify your accrual accounting, regularly check that Assets = Liabilities + Equity. Create a summary worksheet with formulas to sum your asset accounts (e.g., Cash, Accounts Receivable, Inventory) and compare them to the sum of liability and equity accounts. Use Excel’s SUM function, like =SUM(Sheet1!F2, Sheet2!F2), to aggregate balances across sheets. If the totals don’t match, review your entries for errors.

Leveraging Excel’s Formulas and Formats

Excel’s built-in tools can simplify your accounting tasks and reduce errors. Here are some ways to make the most of them:

Formatting for Clarity

To make your numbers easier to read, apply the Accounting format. Highlight your data, right-click, select “Format Cells,” and choose “Accounting” under the Number tab. This adds dollar signs and formats negative numbers in parentheses, enhancing readability. For example, a $50 expense might appear as ($50.00), clearly indicating a deduction.

Automating Calculations

Excel’s formulas are a lifesaver for accounting. Use the SUM function to calculate totals, such as =SUM(A2:B2) to add debits and credits. For running balances, use a formula like =C1+A2-B2, where C1 is the previous balance, A2 is the debit, and B2 is the credit. To calculate monthly revenue, use =SUMIF(D2:D100, ">0", D2:D100) to sum only positive values in the Income column.

Creating Visuals with Charts

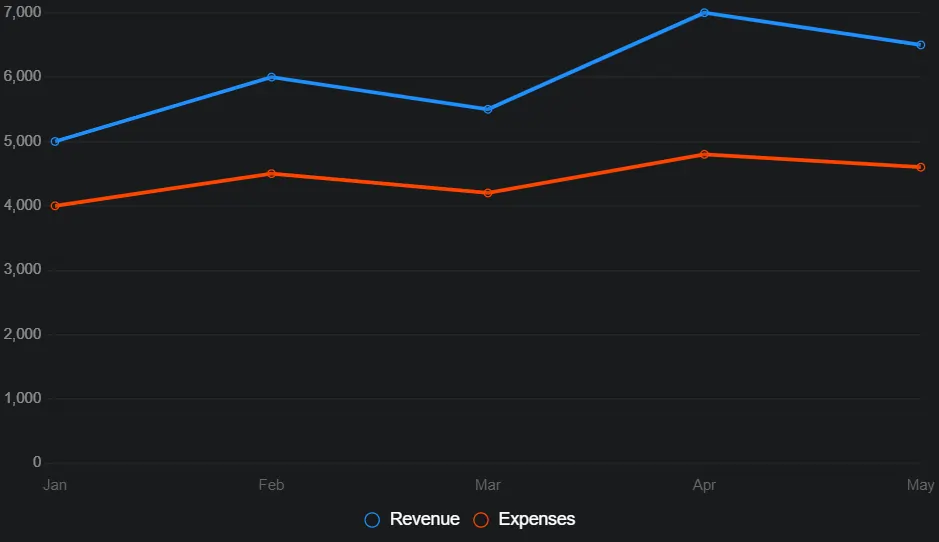

Visualizing your financial data can reveal trends and insights. For example, to track monthly revenue and expenses, create a line chart to compare them over time:

This chart helps you see whether your revenue consistently outpaces expenses, guiding your financial decisions.

Advanced Excel Features for Accounting

As you grow more comfortable with Excel, explore advanced features to enhance your accounting:

- Pivot Tables: Summarize large datasets to analyze revenue by product or expense by category. For example, a pivot table can show total sales per customer in seconds.

- VLOOKUP: Use this function to pull account details from your chart of accounts into transaction sheets, reducing manual entry errors.

- Macros: Automate repetitive tasks, like formatting new monthly sheets, by recording a macro and running it as needed.

Practical Example: Running a Small Retail Business

Imagine you run a small boutique selling handmade jewelry. You start with $5,000 in cash and $2,000 in inventory. In August 2025, you make a $300 sale in cash and purchase $100 of materials on credit from a supplier, Crafty Co. Here’s how you’d record these in Excel using accrual accounting:

Cash Worksheet

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 08/10/2025 | Jewelry Sale | $300 | $5,300 |

Inventory Worksheet

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 08/10/2025 | Jewelry Sale | $300 | $1,700 | |

| 08/10/2025 | Materials Purchase | $100 | $1,800 |

Accounts Payable (Crafty Co.) Worksheet

| Date | Description | Debit | Credit | Balance |

|---|---|---|---|---|

| 08/10/2025 | Materials Purchase | $100 | $100 |

When you pay Crafty Co. later, you’d debit Accounts Payable and credit Cash, reducing both balances accordingly. This setup ensures you track all financial activity accurately, even when cash hasn’t yet changed hands.

Common Pitfalls and How to Avoid Them

Accounting in Excel is powerful but not foolproof. Here are some common mistakes and how to sidestep them:

- Data Entry Errors: Double-check entries and use Excel’s Data Validation feature to restrict input types (e.g., only numbers in amount columns).

- Disorganized Workbooks: Label sheets clearly and use a consistent structure to avoid confusion.

- Ignoring Backups: Save your workbook to a cloud service like OneDrive or Google Drive to protect against data loss.

- Overcomplicating Formulas: Start with simple formulas and test them before building complex ones to ensure accuracy.

Expanding Your Excel Skills

As your business grows, so will your accounting needs. Excel offers endless possibilities for customization. You can create profit and loss statements by summarizing revenue and expenses, forecast cash flow using trendlines, or build dashboards to visualize key metrics. Online tutorials and templates can help you explore these advanced features, but start with the basics outlined here to build a solid foundation.

Final Thoughts

Excel is a versatile, cost-effective tool that empowers small business owners to take control of their accounting. Whether you’re using cash basis or accrual basis accounting, Excel’s flexibility allows you to tailor your bookkeeping to your business’s unique needs. By setting up a clear chart of accounts, leveraging formulas, and creating insightful charts, you can manage your finances with confidence. With practice, you’ll unlock Excel’s full potential, transforming raw data into actionable insights that drive your business forward. Start small, stay organized, and let Excel simplify your journey to financial success.

Frequently Asked Questions

FAQ 1: How can small businesses use Excel for accounting?

Excel is a powerful tool for small businesses looking to manage their finances without investing in expensive accounting software. Its ability to calculate, organize, and visualize data makes it ideal for handling tasks like tracking income, expenses, and inventory. Small business owners can use Excel to create customized spreadsheets tailored to their specific needs, whether they’re running a freelance operation or a small retail store. The program’s flexibility allows users to start with simple setups and scale up as their business grows.

To get started, create a workbook with multiple worksheets for different purposes, such as a chart of accounts, transaction logs, and financial summaries. For cash basis accounting, you can set up a sheet with columns for dates, descriptions, income, expenses, and balances, much like a digital checkbook. For accrual basis accounting, you’ll need separate sheets for accounts like cash, accounts receivable, and inventory to track debits and credits. Excel’s formulas and formatting tools help automate calculations and ensure your data is easy to read. For example, applying the Accounting format adds dollar signs and places negative numbers in parentheses, improving clarity.

Excel also supports visualization tools like charts and pivot tables, which help business owners spot trends, such as rising expenses or seasonal sales spikes. By using features like SUM and VLOOKUP, you can streamline repetitive tasks and reduce errors. With regular backups and organized worksheets, Excel becomes a cost-effective, reliable solution for small business accounting.

FAQ 2: What is a chart of accounts, and how do I create one in Excel?

A chart of accounts is a structured list of all financial accounts used by a business, such as assets, liabilities, equity, revenue, and expenses. It serves as the foundation for organizing transactions, making it easier to track money flow and prepare financial reports. For small businesses, a well-designed chart of accounts ensures clarity and consistency in bookkeeping.

To create one in Excel, start by opening a new worksheet and labeling it “Chart of Accounts.” Create columns for Account Number, Account Title, Type, and How to Increase (debit or credit). For example, you might assign “101” to Cash (an asset increased by debit) and “201” to Accounts Payable (a liability increased by credit). List accounts relevant to your business, such as inventory for a retail store or consulting fees for a service-based business. Keep it simple but comprehensive to cover all financial activities.

This setup helps you categorize transactions accurately. For instance, when recording a sale, you’d reference the chart to debit Cash and credit Sales Revenue. Use Excel’s sorting and filtering features to organize the chart by account type, making it easier to navigate. Regularly update the chart as your business evolves, adding new accounts like equipment or utilities to reflect growth.

FAQ 3: What’s the difference between cash basis and accrual basis accounting in Excel?

Cash basis accounting and accrual basis accounting are two methods small businesses can use to track finances in Excel, each suited to different needs. Cash basis records transactions only when cash changes hands, making it simpler for businesses with straightforward operations, like freelancers or small retailers. Accrual basis, however, records revenue when earned and expenses when incurred, even if payment hasn’t been made, which is ideal for businesses dealing with credit.

In Excel, cash basis accounting involves a single worksheet with columns for date, description, income, expense, and account balance. For example, if you receive $500 from a customer, you log it as income and update the balance. This method mimics a checkbook and is easy to manage with Excel’s SUM function for calculating running totals. It’s perfect for businesses that don’t deal with credit or delayed payments.

For accrual basis accounting, you’ll need multiple worksheets to track accounts like cash, accounts receivable, and accounts payable. Each transaction requires a debit and credit entry to maintain the accounting equation: Assets = Liabilities + Equity. For instance, selling $200 of goods on credit would involve debiting Accounts Receivable and crediting Inventory. Excel’s ability to handle multiple sheets and formulas, like =SUM(A2:B2), makes it easier to balance these entries and ensure accuracy. Choose the method that aligns with your business’s complexity and legal requirements.

FAQ 4: How do I set up a cash basis accounting worksheet in Excel?

Setting up a cash basis accounting worksheet in Excel is straightforward and ideal for small businesses with simple cash transactions. This method tracks money only when it’s received or paid, making it easy to manage in a single spreadsheet. It’s perfect for businesses like food trucks or freelance services that don’t deal with credit.

Start by creating a new worksheet and adding column headers: Number, Date, Description, Income, Expense, and Account Balance. Number each transaction for reference, record the date, and describe the transaction (e.g., “Customer Payment” or “Supply Purchase”). Enter income or expense amounts and calculate the balance by adding income and subtracting expenses from the previous balance. For example, if your starting balance is $2,000, a $300 sale increases it to $2,300, and a $100 expense reduces it to $2,200.

Use Excel’s SUM function to automate balance calculations. For instance, in the Account Balance column, enter =F1+D2-E2 (where F1 is the previous balance, D2 is income, and E2 is expense). Apply the Accounting format to display dollar signs and format negative numbers clearly. You can create separate sheets for each month or use one sheet for the year, depending on your preference. Regularly review your totals using AutoSum to monitor cash flow and ensure accuracy.

FAQ 5: How do I manage accrual basis accounting in Excel?

Accrual basis accounting in Excel is more complex than cash basis but essential for businesses that handle credit or delayed payments. It records revenue when earned and expenses when incurred, following the accounting equation: Assets = Liabilities + Equity. Excel’s multi-sheet functionality makes it well-suited for managing these transactions.

First, create a chart of accounts in one worksheet, listing accounts like Cash, Accounts Receivable, Accounts Payable, and Inventory, along with their account numbers and debit/credit rules. Then, set up separate worksheets for each account. For example, a Cash worksheet would have columns for Date, Description, Debit, Credit, and Balance. If you sell $200 of inventory on credit, debit Accounts Receivable $200 and credit Inventory $200 in their respective sheets. When the customer pays, debit Cash and credit Accounts Receivable.

Excel’s formulas help maintain accuracy. Use =C1+A2-B2 to calculate running balances in each sheet. To ensure your books balance, create a summary sheet that sums all asset accounts and compares them to liabilities plus equity using the SUM function. Regularly check for discrepancies and use conditional formatting to highlight errors, like negative balances. This method provides a complete financial picture, crucial for businesses with complex transactions.

FAQ 6: What Excel formulas are most useful for small business accounting?

Excel’s formulas simplify accounting tasks by automating calculations and reducing errors. For small businesses, a few key formulas can make bookkeeping faster and more accurate, whether you’re using cash basis or accrual basis accounting.

The SUM function is essential for totaling income, expenses, or account balances. For example, =SUM(D2:D100) adds all values in the Income column, giving you a quick revenue snapshot. For running balances, use a formula like =F1+D2-E2 to add income and subtract expenses from the previous balance. The SUMIF function is great for selective calculations, such as =SUMIF(D2:D100, ">0", D2:D100), which sums only positive values (e.g., income).

For accrual accounting, VLOOKUP helps pull account details from your chart of accounts into transaction sheets, reducing manual entry errors. For instance, =VLOOKUP(A2, Sheet1!A2:D100, 2, FALSE) retrieves the account name for a given account number. The IF function can flag issues, like =IF(F2<0, "Check Balance", "OK"), to alert you to negative balances. Combine these with Excel’s Accounting format and conditional formatting to keep your data clear and actionable, saving time and improving accuracy.

FAQ 7: How can I use Excel to track inventory for my small business?

Tracking inventory in Excel is a practical way for small businesses to monitor stock levels, manage costs, and ensure smooth operations. Whether you’re running a retail store or a manufacturing business, Excel’s spreadsheet capabilities make it easy to record and analyze inventory movements.

Create a dedicated Inventory worksheet with columns for Date, Description, Debit, Credit, and Balance. For cash basis accounting, simply record inventory purchases as expenses when paid. For accrual basis accounting, track inventory as an asset. For example, if you purchase $500 of materials, debit Inventory $500 and credit Cash or Accounts Payable. When you sell $200 of goods, credit Inventory $200 and debit Accounts Receivable or Cash.

Use Excel’s SUM function to calculate total inventory value and conditional formatting to highlight low stock levels (e.g., format cells red if balance falls below a threshold). You can also create a pivot table to summarize inventory by category, such as raw materials or finished goods. For advanced tracking, add columns for item codes, quantities, and unit costs to calculate cost of goods sold (COGS). Regularly reconcile your inventory sheet with physical counts to ensure accuracy and avoid discrepancies.

FAQ 8: How do I create financial reports in Excel for my small business?

Excel is a versatile tool for generating financial reports like profit and loss statements, balance sheets, and cash flow summaries. These reports provide insights into your business’s financial health, helping you make informed decisions and prepare for tax season.

For a profit and loss statement, create a worksheet with columns for Revenue and Expenses. Use the SUM function to total each category monthly or annually. For example, =SUM(D2:D100) calculates total revenue, while =SUM(E2:E100) totals expenses. Subtract expenses from revenue to find net profit: =D101-E101. Format the sheet with the Accounting format for clarity and add a line chart to visualize trends over time.

For a balance sheet, create a summary worksheet that pulls data from your asset, liability, and equity accounts using formulas like =SUM(Sheet1!F2, Sheet2!F2). Ensure Assets = Liabilities + Equity to verify accuracy. Use pivot tables to analyze specific accounts, such as breaking down expenses by category. Regularly update these reports and use conditional formatting to highlight key metrics, like negative profits, to stay on top of your finances.

FAQ 9: What are common mistakes to avoid when using Excel for accounting?

Using Excel for accounting is powerful but can lead to errors if not managed carefully. Small businesses can avoid pitfalls by adopting best practices to ensure accuracy and efficiency.

One common mistake is data entry errors. Mistyping amounts or account numbers can throw off your books. Use Excel’s Data Validation feature to restrict inputs (e.g., only numbers in amount columns) and double-check entries. Another issue is disorganized workbooks. Without clear labels or consistent structures, finding data becomes time-consuming. Name sheets clearly (e.g., “Cash 2025”) and use a chart of accounts to standardize entries.

Failing to back up is another risk. A computer crash could wipe out your financial records, so save your workbook to a cloud service like OneDrive regularly. Overcomplicating formulas can also cause problems—start with simple ones like SUM and test them before building complex calculations. Finally, neglecting to reconcile accounts, like comparing your Cash sheet to bank statements, can hide errors. Schedule monthly reviews to catch discrepancies early and keep your books accurate.

FAQ 10: How can I use Excel’s advanced features to improve my small business accounting?

Excel offers advanced features that can take your small business accounting to the next level, saving time and providing deeper insights. As you grow more comfortable with the basics, these tools can enhance efficiency and accuracy.

Pivot tables are excellent for summarizing large datasets. For example, you can create a pivot table to analyze total sales by product or expenses by category, helping you identify top performers or cost-saving opportunities. VLOOKUP or INDEX-MATCH functions streamline data entry by pulling account details from your chart of accounts into transaction sheets, reducing errors. For instance, =VLOOKUP(A2, Sheet1!A2:D100, 3, FALSE) retrieves the account type for a given transaction.

Macros automate repetitive tasks, like formatting new monthly sheets or generating reports. Record a macro for common actions and run it with a click. Conditional formatting highlights issues, such as formatting negative balances in red or flagging overdue accounts receivable. Finally, use charts like bar or line graphs to visualize financial trends, making it easier to spot patterns like seasonal sales spikes. By mastering these features, you can transform Excel into a robust accounting tool tailored to your business’s needs.

FAQ 11: How can I use Excel to track expenses for my small business?

Tracking expenses in Excel is a straightforward way for small business owners to monitor spending and maintain control over their finances. Whether you’re paying for supplies, rent, or utilities, Excel’s spreadsheet capabilities allow you to organize and analyze expenses efficiently. This is particularly useful for businesses using cash basis accounting, where expenses are recorded when paid, or accrual basis accounting, where expenses are logged when incurred.

Start by creating a dedicated Expenses worksheet in your Excel workbook. Include columns for Date, Transaction Number, Description, Category (e.g., Supplies, Rent, Utilities), Amount, and Notes. For example, a $200 payment for office supplies on August 10, 2025, would be entered with a description like “Office Depot Supplies” and categorized as “Supplies.” Use the SUM function, such as =SUM(E2:E100), to calculate total expenses for a specific period. For accrual accounting, if you owe $500 for utilities but haven’t paid yet, record it in an Accounts Payable worksheet and credit it when paid.

To enhance tracking, use pivot tables to summarize expenses by category, helping you identify areas where you might cut costs. Apply conditional formatting to highlight unusually high expenses (e.g., amounts over $1,000 in red) to catch anomalies quickly. You can also create a bar chart to visualize monthly spending trends, making it easier to spot patterns. Regularly reconcile your expense records with bank statements to ensure accuracy and use cloud storage to back up your workbook, protecting your data from loss.

FAQ 12: What are the benefits of using Excel for small business accounting?

Excel offers numerous advantages for small businesses managing their accounting, making it a cost-effective alternative to specialized software. Its flexibility, accessibility, and robust features allow business owners to customize their bookkeeping processes, whether they’re tracking simple cash transactions or complex accrual-based accounts. For small businesses with limited budgets, Excel’s affordability is a major draw, as it’s often already part of Microsoft Office suites.

One key benefit is Excel’s ability to handle both cash basis and accrual basis accounting. For cash basis, you can create a single sheet to track income and expenses, while accrual accounting is supported through multiple worksheets for accounts like Cash, Accounts Receivable, and Inventory. Excel’s formulas, such as SUM and VLOOKUP, automate calculations, saving time and reducing errors. For example, a formula like =F1+D2-E2 updates your account balance instantly, while pivot tables summarize data for quick insights into revenue or expenses.

Additionally, Excel’s charting tools help visualize financial trends, such as sales growth or expense patterns, aiding decision-making. Its widespread use ensures compatibility with accountants or collaborators, and features like conditional formatting highlight critical data, like low cash balances. By leveraging these tools, small businesses can maintain accurate records, generate reports, and plan for growth without investing in costly software.

FAQ 13: How do I create a profit and loss statement in Excel?

A profit and loss (P&L) statement is a critical financial report that shows your business’s revenue, expenses, and net profit over a specific period. Excel’s ability to organize data and perform calculations makes it an excellent tool for creating a P&L statement tailored to your small business’s needs.

Begin by setting up a new worksheet labeled “Profit and Loss.” Create sections for Revenue, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, and Net Profit. Under Revenue, list income sources like sales or services, and use the SUM function (e.g., =SUM(D2:D10)) to total them. For COGS, include costs directly tied to production, such as inventory or materials. Calculate Gross Profit with a formula like =D11-E11, subtracting COGS from revenue. List Operating Expenses (e.g., rent, utilities, advertising) in another section and sum them similarly. Finally, calculate Net Profit by subtracting total expenses from gross profit.

To make the P&L statement more insightful, use conditional formatting to highlight negative profits in red or create a line chart to track profit trends over months. For example, a chart comparing revenue and expenses can reveal seasonal patterns. Regularly update the statement and cross-check it with your transaction sheets to ensure accuracy. This report not only helps you understand your business’s performance but also prepares you for tax season or investor discussions.

FAQ 14: How can Excel help with budgeting for a small business?

Excel is an excellent tool for creating and managing a budget, helping small businesses plan their finances and stay on track. A well-structured budget in Excel allows you to forecast revenue, allocate funds for expenses, and monitor cash flow, ensuring you don’t overspend.

Start by creating a Budget worksheet with columns for Category (e.g., Rent, Supplies, Marketing), Projected Amount, Actual Amount, and Difference. List all expected income and expense categories based on your chart of accounts. For each category, enter projected amounts based on historical data or estimates. As the month progresses, input actual amounts from your transaction sheets and calculate the difference with a formula like =B2-C2. Use conditional formatting to highlight overspending (e.g., negative differences in red) to address issues quickly.

To enhance your budget, use pivot tables to analyze spending by category or create a pie chart to visualize how funds are allocated. For example, a pie chart can show that 40% of your budget goes to inventory, prompting cost-saving measures. Update your budget monthly and compare it to your profit and loss statement to refine projections. Excel’s flexibility lets you adjust your budget as your business evolves, ensuring you’re prepared for unexpected expenses or growth opportunities.

FAQ 15: How do I reconcile accounts in Excel for accurate bookkeeping?

Reconciling accounts in Excel ensures your financial records match external statements, like bank or credit card statements, preventing errors and maintaining accuracy. This process is crucial for both cash basis and accrual basis accounting, as it verifies that your Excel data reflects real-world transactions.

Create a Reconciliation worksheet with columns for Date, Description, Excel Amount, Statement Amount, and Difference. Import your bank statement data (manually or via CSV import) and compare it to your Cash or Accounts Payable worksheet. For each transaction, ensure the amounts match; if they don’t, calculate the difference with a formula like =C2-D2. Investigate discrepancies, which could stem from missing entries, typos, or bank fees. For example, a $50 difference might reveal an unrecorded service charge.

Use filters to sort unmatched transactions and conditional formatting to highlight non-zero differences in red. For accrual accounting, reconcile Accounts Receivable and Accounts Payable by comparing invoices or bills to your sheets. Perform reconciliations monthly to catch errors early and maintain accurate books. Back up your reconciled data to a cloud service to ensure you have a reliable record for audits or tax preparation.

FAQ 16: Can Excel be used to track accounts receivable and accounts payable?

Yes, Excel is highly effective for tracking accounts receivable (money owed to you) and accounts payable (money you owe) in accrual basis accounting. These accounts are critical for businesses that deal with credit, ensuring you monitor outstanding payments and obligations accurately.

For Accounts Receivable, create a worksheet for each customer or a single sheet with a Customer Name column. Include columns for Date, Invoice Number, Description, Debit, Credit, and Balance. When you issue a $1,000 invoice to a client, debit Accounts Receivable $1,000 and credit Sales Revenue or Inventory. When the client pays, debit Cash and credit Accounts Receivable. Use =C1+A2-B2 to calculate the running balance. For Accounts Payable, set up a similar worksheet for vendors, recording purchases on credit as debits to Inventory and credits to Accounts Payable.

Use pivot tables to summarize outstanding balances by customer or vendor, and apply conditional formatting to flag overdue invoices (e.g., balances older than 30 days). Create a bar chart to visualize total receivables or payables over time, helping you manage cash flow. Regularly update these sheets and reconcile them with invoices or vendor statements to ensure accuracy and timely payments.

FAQ 17: How do I use Excel to forecast cash flow for my small business?

Cash flow forecasting in Excel helps small businesses predict future cash availability, ensuring they can cover expenses and plan for growth. By analyzing historical data and projecting future transactions, Excel provides a clear picture of your financial health.

Create a Cash Flow Forecast worksheet with columns for Date, Category (e.g., Sales, Expenses, Loan Payments), Projected Inflow, Projected Outflow, and Net Cash Flow. Use historical data from your Cash or Profit and Loss sheets to estimate monthly revenue and expenses. For example, if past sales average $5,000 monthly, project similar amounts, adjusting for seasonal trends. Enter expected expenses like rent or payroll, and calculate net cash flow with =C2-D2. Use the SUM function to total inflows and outflows for the period.

Enhance your forecast with trendlines in a line chart to visualize cash flow patterns, helping you anticipate shortfalls. For instance, a chart might show a dip in December due to holiday slowdowns, prompting you to save cash in November. Update your forecast monthly and compare it to actuals to refine accuracy. Use scenario analysis by creating multiple versions of the worksheet (e.g., best-case and worst-case scenarios) to prepare for uncertainties.

FAQ 18: How can I ensure data accuracy when using Excel for accounting?

Ensuring data accuracy in Excel is critical for reliable accounting, as errors can lead to incorrect financial decisions or tax issues. Small businesses can implement several strategies to maintain precise records in their Excel workbooks.

Start with a clear structure, using a chart of accounts to standardize entries and separate worksheets for accounts like Cash, Accounts Receivable, and Expenses. Use Data Validation to restrict inputs, such as allowing only numbers in amount columns or specific account names from a dropdown list. For example, set a rule to ensure Account Number entries match your chart of accounts. Apply formulas like =SUM(A2:B2) for calculations to avoid manual errors, and test complex formulas on small datasets first.

Regularly reconcile your Excel data with bank statements or invoices to catch discrepancies. Use conditional formatting to highlight errors, such as negative balances or mismatched totals. For instance, format cells red if Assets don’t equal Liabilities + Equity in accrual accounting. Back up your workbook to a cloud service and maintain version control to recover from mistakes. Schedule weekly or monthly reviews to verify data, ensuring your books remain accurate and audit-ready.

FAQ 19: How do I use Excel to prepare for tax season as a small business?

Excel simplifies tax preparation for small businesses by organizing financial data and generating reports needed for tax filings. From tracking deductible expenses to summarizing income, Excel helps ensure you’re ready for tax season without stress.

Create worksheets for Income, Expenses, and Profit and Loss to compile data required for tax forms like Schedule C (for sole proprietors). In your Expenses sheet, categorize deductible expenses (e.g., rent, supplies, marketing) and use pivot tables to summarize them by category. For example, =SUMIF(D2:D100, "Supplies", E2:E100) totals all supply expenses. Your Profit and Loss sheet, built with SUM functions, provides net profit, a key figure for tax calculations.

Track mileage or home office expenses in separate sheets if applicable, using templates with columns for Date, Purpose, and Amount. Use conditional formatting to flag missing receipts or incomplete entries to ensure compliance. Export your data to CSV files for easy sharing with your accountant, and back up your workbook to avoid data loss. By maintaining organized records and reconciling them with bank statements monthly, Excel helps you stay prepared and minimizes last-minute tax season scrambling.

FAQ 20: How can I scale my Excel accounting system as my small business grows?

As your small business grows, your accounting needs will become more complex, but Excel’s flexibility allows you to scale your system effectively. By expanding your workbook’s structure and leveraging advanced features, you can handle increased transactions, new accounts, and more detailed reporting.

Start by refining your chart of accounts to include new categories, such as Equipment for capital investments or Payroll Expenses for new employees. Add worksheets for specific accounts, like Accounts Receivable for multiple clients or Inventory by product type, to manage growing complexity. Use pivot tables to analyze data, such as sales by region or expenses by department, providing insights for strategic decisions.

Incorporate macros to automate repetitive tasks, like generating monthly reports or formatting new sheets, saving time as transaction volumes increase. For example, a macro can copy a template sheet and rename it for the current month. Use charts to visualize key metrics, such as a bar chart comparing revenue across product lines. If your business outgrows Excel, you can export data to accounting software, as Excel’s CSV format is widely compatible. Regularly back up your workbook and train team members on its structure to ensure smooth scaling.

Also, Read these Articles in Detail

- A Guide to Creating a Track Spending Spreadsheet for Home Business

- Understanding SEC Form D: A Comprehensive Guide to Exempt Securities Offerings

- Understanding Quotes, Estimates, and Bids: A Comprehensive Guide for Businesses

- Mastering Accruals: A Guide to Understanding and Managing Accrued Accounts

- Building a Robust Emergency Fund for Your Small Business: A Guide to Financial Security

- How to Determine Your Business Valuation: A Comprehensive Guide for Sellers

- Mastering Business Cost Categorization: A Guide to Tracking and Managing Expenses

- Why Every Small Business Owner Needs an Accountant: Your Guide to Financial Success

- Inventory Management: A Comprehensive Guide to Streamlining Your Business Operations

- Mastering Cash Flow: Effective Strategies to Conserve Cash and Maximize Profits

- Inventory Management: A Comprehensive Guide to Streamlining Your Business Operations

- Mastering Cash Flow: Effective Strategies to Conserve Cash and Maximize Profits

- Financial Statements: What Investors Really Want to Know About Your Business

- Return on Ad Spend (ROAS): Your Ultimate Guide to Measuring Advertising Success

- Innovative Small Business Marketing Ideas to Skyrocket Your Success

- Market and Marketing Research: The Key to Unlocking Business Success

- Target Audience: A Comprehensive Guide to Building Effective Marketing Strategies

- SWOT Analysis: A Comprehensive Guide for Small Business Success

- Market Feasibility Study: Your Blueprint for Business Success

- Mastering the Art of Selling Yourself and Your Business with Confidence and Authenticity

- 10 Powerful Ways Collaboration Can Transform Your Small Business

- The Network Marketing Business Model: Is It the Right Path for You?

- Crafting a Memorable Business Card: 10 Essential Rules for Small Business Owners

- Bootstrap Marketing Mastery: Skyrocketing Your Small Business on a Shoestring Budget

- Mastering Digital Marketing: The Ultimate Guide to Small Business Owner’s

- Crafting a Stellar Press Release: Your Ultimate Guide to Free Publicity

- Reciprocity: Building Stronger Business Relationships Through Give and Take

- Business Cards: A Comprehensive Guide to Designing and Printing at Home

- The Ultimate Guide to Marketing Firms: How to Choose the Perfect One

- Direct Marketing: A Comprehensive Guide to Building Strong Customer Connections

- Mastering Marketing for Your Business: A Comprehensive Guide

- Crafting a Winning Elevator Pitch: Your Guide to Captivating Conversations

- A Complete Guide to Brand Valuation: Unlocking Your Brand’s True Worth

- B2B Marketing vs. B2C Marketing: A Comprehensive Guide to Winning Your Audience

- Pay-Per-Click Advertising: A Comprehensive Guide to Driving Traffic and Maximizing ROI

- Multi-Level Marketing: A Comprehensive Guide to MLMs, Their Promises, and Pitfalls

- Traditional Marketing vs. Internet Marketing for Small Businesses

- Branding: Building Trust, Loyalty, and Success in Modern Marketing

- How to Craft a Winning Marketing Plan for Your Home Business

- The Synergy of Sales and Marketing: A Comprehensive Guide

- Mastering the Marketing Mix: A Comprehensive Guide to Building a Winning Strategy

- Return on Investment (ROI): Your Guide to Smarter Business Decisions

- How to Create a Winning Website Plan: A Comprehensive Guide

Acknowledgement

The creation of the article “Excel for Small Business Accounting: Step-by-Step Guide for Beginners” was made possible through insights and information gathered from several reputable online resources. These sources provided valuable guidance on using Excel for accounting, ensuring the article is both comprehensive and practical for small business owners.

Below are the key resources that contributed to the development of this guide:

- Investopedia (www.investopedia.com) offered detailed explanations of accounting concepts like cash basis and accrual basis accounting, helping to clarify complex terms in simple language.

- Microsoft Support (support.microsoft.com) provided technical guidance on Excel’s features, such as formulas, pivot tables, and conditional formatting, ensuring accurate instructions for users.

- Small Business Administration (www.sba.gov) contributed practical advice on small business financial management, which informed the article’s tips for budgeting and tax preparation.

- AccountingCoach (www.accountingcoach.com) supplied foundational knowledge on creating charts of accounts and understanding debits and credits, enhancing the article’s depth.

Disclaimer

The information provided in “Excel for Small Business Accounting: Step-by-Step Guide for Beginners” is intended for general informational purposes only and should not be considered professional financial or accounting advice. While the article offers practical guidance on using Excel for small business accounting, it is not a substitute for consulting with a qualified accountant or financial advisor. Every business has unique financial needs, and accounting practices may vary based on legal, regulatory, or industry-specific requirements.

The author and publisher of this website are not responsible for any errors, omissions, or financial outcomes resulting from the application of the information in this guide. Readers are encouraged to verify all information and seek professional advice tailored to their specific circumstances before making financial decisions.