Navigating the complexities of tax forms can be daunting, especially for independent contractors, freelancers, or self-employed individuals. One form that frequently arises in these scenarios is IRS Form W-9, a critical document for reporting income paid to non-employees.

This extensive guide will walk you through every aspect of Form W-9, from its purpose and who needs to complete it to step-by-step instructions on filling it out, potential pitfalls, and additional considerations to ensure compliance with IRS regulations. Whether you’re a freelancer, a small business owner, or a company hiring independent contractors, this article provides a thorough understanding of Form W-9 and its role in the U.S. tax system.

Table of Contents

What Is IRS Form W-9?

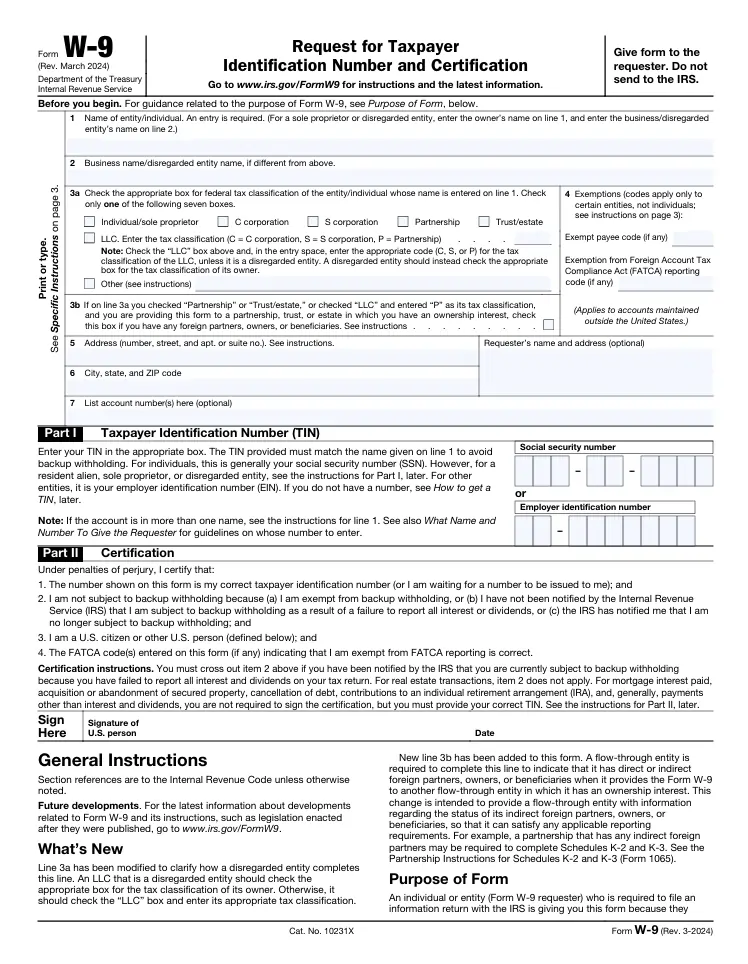

IRS Form W-9, officially titled “Request for Taxpayer Identification Number and Certification,” is a document used to collect a taxpayer’s identification information, primarily their Taxpayer Identification Number (TIN). The TIN can be a Social Security Number (SSN), Employer Identification Number (EIN), or another type of identifier, depending on the entity. Unlike many tax forms, Form W-9 is not filed with the Internal Revenue Service (IRS); instead, it is provided to the entity or individual requesting it, typically a company or organization for whom you provide services.

The primary purpose of Form W-9 is to enable businesses to report payments made to non-employees, such as independent contractors, consultants, or freelancers, to the IRS. For payments exceeding $600 in a tax year, companies are required to report this income using Form 1099-NEC (Nonemployee Compensation) for tax years 2020 and beyond, or Form 1099-MISC for earlier years or specific types of payments. Form W-9 ensures that the company has accurate information to complete these reports, helping the IRS track income and ensure proper tax reporting.

For example, imagine you’re a freelance graphic designer hired by a marketing agency to create a logo for $1,000. Since your compensation exceeds $600, the agency will request a completed Form W-9 to obtain your TIN and other details. This allows them to issue a 1099-NEC to report the payment to the IRS, ensuring transparency in income reporting.

Who Needs to Complete Form W-9?

Form W-9 is typically required for individuals or entities classified as non-employees by the IRS. This includes:

- Independent contractors: Freelancers, consultants, or gig workers who provide services without being on a company’s payroll.

- Sole proprietors: Individuals running their own businesses without a formal business entity.

- Limited Liability Companies (LLCs): Single-member LLCs or multi-member LLCs, depending on their tax classification.

- Partnerships, corporations, or trusts: Entities that provide services and are not subject to employee tax withholding.

- Specific professionals: Attorneys or individuals involved in certain industries (e.g., commercial fishing) may be required to provide a W-9, even for smaller payments, as mandated by IRS rules.

Companies or organizations that hire non-employees are responsible for requesting Form W-9 from these individuals or entities. If you’re paid $600 or less in a tax year by a company, you generally won’t need to provide a W-9 for that specific client, though it’s good practice to confirm with the payer.

For instance, if you’re a freelance writer who earns $500 from a small business for a one-time project, the business may not request a W-9 because the payment falls below the $600 threshold. However, if you earn $700 from the same business over the year, a W-9 will likely be required.

| Size of Payment | W-9 Requirement |

|---|---|

| Small Size ($600 or less) | Not typically required |

| Medium Size ($601-$1,000) | Required for 1099-NEC reporting |

| Large Size ($1,001-$5,000) | Required for 1099-NEC reporting |

| Huge Size (Over $5,000) | Required for 1099-NEC reporting |

Why Is Form W-9 Important?

Form W-9 serves several critical purposes in the U.S. tax system:

- Accurate Income Reporting: It ensures that businesses report payments to non-employees accurately to the IRS, preventing discrepancies in income reporting.

- Taxpayer Identification: The form provides the payer with your TIN, which is essential for matching income reported on 1099 forms with your tax return.

- Compliance with IRS Regulations: By providing a W-9, you certify that you are not subject to backup withholding (unless otherwise noted) and that you are a U.S. person (e.g., a U.S. citizen, resident alien, or U.S.-based entity).

- Avoiding Penalties: Failing to provide a W-9 or providing incorrect information can lead to penalties, such as backup withholding at a rate of 24% of your payments, which the payer must withhold and send to the IRS.

For example, a small business owner who hires a web developer for a $2,000 project needs the developer’s W-9 to issue a 1099-NEC. Without the form, the business risks IRS penalties for failing to report the payment, and the developer may face backup withholding if their TIN is not provided.

How to Obtain Form W-9

In most cases, the company or individual hiring you will provide a blank Form W-9 for you to complete. This is typically sent via email, as part of a contractor agreement, or through a secure online portal. If you don’t receive a W-9 from the payer, you can easily download the form directly from the IRS website (irs.gov). The form is available in PDF format and can be filled out electronically or printed and completed by hand.

If you’re a business owner needing to issue W-9s to contractors, you can also download the form from the IRS website or create a substitute W-9 that meets IRS requirements. A substitute form must include all the certifications and information required by the official W-9, such as the contractor’s name, TIN, and certifications regarding backup withholding and FATCA.

| Source | Availability |

|---|---|

| Small Size (Individual Payer) | Provided by the hiring company via email or in-person |

| Medium Size (Online Platforms) | Available through contractor management platforms (e.g., Upwork, PayPal) |

| Large Size (IRS Website) | Downloadable PDF from irs.gov |

| Huge Size (Custom Forms) | Substitute W-9 created by businesses, compliant with IRS rules |

Step-by-Step Guide to Filling Out Form W-9

Completing Form W-9 is relatively straightforward, but attention to detail is crucial to avoid errors that could lead to issues with the IRS. Below is a detailed guide to filling out each section of the form:

Step 1: Provide Your Name and Business Name

- Enter your full legal name as it appears on your federal income tax return.

- If you operate under a business name (e.g., “Jane Doe Designs” instead of “Jane Doe”), enter that in the business name field.

- Example: If you’re a freelancer named John Smith but operate as “Smith Consulting,” enter “John Smith” in the name field and “Smith Consulting” in the business name field.

Step 2: Select Your Federal Tax Classification

- Check the appropriate box for your federal tax classification. Options include:

- Individual/sole proprietor or single-member LLC

- C corporation

- S corporation

- Partnership

- Trust/estate

- LLC (with additional instructions for multi-member LLCs or those electing specific tax treatments)

- If you’re unsure of your classification, consult a tax professional. For example, most freelancers are classified as sole proprietors unless they’ve formed a formal business entity like an LLC or corporation.

Step 3: Enter Exemption Codes (If Applicable)

- If you are exempt from backup withholding or FATCA reporting, enter the appropriate exemption codes in the designated fields.

- Backup withholding: Most sole proprietors are not exempt, but corporations (e.g., C corporations) are typically exempt from backup withholding for certain payments, such as interest or dividends.

- FATCA: This applies to foreign financial institutions and is unlikely to apply to most U.S.-based contractors. Refer to pages 3 and 4 of the Form W-9 instructions for specific codes.

Step 4: Provide Your Address

- Enter your business or personal address where you receive tax-related correspondence. This should match the address on your tax return to ensure consistency.

Step 5: Provide Your TIN

- In Part I, enter your TIN, which is typically your SSN for individuals or EIN for businesses. If you’re a single-member LLC, you may use your SSN unless you’ve obtained an EIN for your business.

- Double-check your TIN to avoid errors, as an incorrect TIN can trigger backup withholding or IRS penalties.

Step 6: Certify and Sign

- In Part II, sign and date the form to certify the following:

- The TIN you provided is correct.

- You are a U.S. person (e.g., U.S. citizen, resident alien, or U.S.-based entity).

- You are not subject to backup withholding, unless you’ve been notified by the IRS that you are (in which case, cross out item 2 under Certification).

- Any exemption codes you entered are accurate.

- Your signature is legally binding, so ensure all information is correct before signing.

Example Scenario

Suppose you’re a freelance photographer named Emily Johnson, operating as a sole proprietor. You’re hired by a local business for a $1,200 project. Here’s how you’d fill out the W-9:

- Name: Emily Johnson

- Business Name: (Leave blank if you don’t use a separate business name)

- Federal Tax Classification: Individual/sole proprietor

- Exemption Codes: (Leave blank unless you’re exempt from backup withholding or FATCA)

- Address: Your home or business address

- TIN: Your SSN (e.g., 123-45-6789)

- Certification: Sign and date to confirm the information is accurate.

| Form Section | Details Required |

|---|---|

| Small Size (Name) | Full legal name as on tax return |

| Medium Size (Tax Classification) | Select appropriate entity type (e.g., sole proprietor, LLC) |

| Large Size (TIN) | SSN, EIN, or other TIN |

| Huge Size (Certification) | Signature and date confirming accuracy |

Potential Problems and Red Flags

While Form W-9 is a standard tax document, there are several potential issues to watch for to protect your personal information and ensure compliance:

- Unknown Requesters: Be cautious if you receive a W-9 request from an unfamiliar person or business. Verify their legitimacy before providing sensitive information like your TIN. Scammers may pose as legitimate businesses to steal personal data.

- Tip: Contact the requester directly using verified contact information to confirm their identity.

- Secure Transmission: Never send a completed W-9 via unsecured email or unencrypted methods. Use secure delivery methods, such as:

- Hand delivery

- U.S. mail

- Encrypted email attachments or secure file-sharing platforms

- Example: If a client asks you to email your W-9, use a service like Google Drive or Dropbox with password protection to share the file.

- Confusion with Form W-4: If you’re starting a new job and receive a W-9 instead of a Form W-4, clarify your employment status. Form W-4 is for employees to set tax withholdings, while W-9 is for independent contractors. If your employer controls your work hours, location, and methods, you may be an employee, not a contractor.

- Example: If a company provides you with a W-9 but also offers health insurance and a fixed schedule, you may need to discuss whether you’re an employee and should complete a W-4 instead.

- Incorrect TIN: Providing an incorrect TIN can lead to backup withholding at 24% or IRS penalties. Always double-check your SSN or EIN before submitting the form.

- Tip: If you’ve been notified by the IRS that you’re subject to backup withholding, cross out item 2 in the Certification section and address the issue promptly with the IRS.

- Outdated Information: If your name, address, or TIN changes (e.g., due to marriage, relocation, or forming a new business entity), submit a new W-9 to the requester to ensure their records are up to date.

Backup Withholding and FATCA: What You Need to Know

Backup Withholding

Backup withholding is a mechanism where a payer withholds 24% of your payment as federal income tax, even though independent contractors are typically responsible for paying their own taxes. You may be subject to backup withholding if:

- You provided an incorrect TIN on a previous W-9.

- You failed to report or underreported interest or dividend income on your tax return.

- The IRS has notified you of backup withholding due to tax compliance issues.

If you’re subject to backup withholding, you’ll receive a notice from the IRS, and you should cross out item 2 in the Certification section of the W-9. To resolve this, contact the IRS to correct your TIN or pay any owed taxes.

FATCA

The Foreign Account Tax Compliance Act (FATCA) applies primarily to foreign financial institutions and is unlikely to affect most U.S.-based contractors. However, if you’re exempt from FATCA reporting, you may need to enter specific codes on the W-9. Consult a tax professional if you’re unsure whether FATCA applies to you.

How Often Should You Update Form W-9?

You should submit a new Form W-9 whenever any of the following information changes:

- Name: Due to marriage, divorce, or other legal name changes.

- Business Name: If you rebrand or form a new business entity.

- Address: If you move to a new location.

- TIN: If you obtain a new SSN or EIN (e.g., after forming an LLC).

- Tax Classification: If your business structure changes (e.g., from sole proprietor to LLC).

For example, if you’re a freelancer who recently formed an LLC and obtained an EIN, you’ll need to provide a new W-9 to all clients reflecting the updated business name, TIN, and tax classification.

Additional Considerations for Businesses and Contractors

For Businesses Issuing W-9s

If you’re a business owner hiring independent contractors, you’re responsible for:

- Requesting a W-9 from any contractor paid $600 or more in a tax year.

- Using the information to issue Form 1099-NEC (or 1099-MISC for pre-2020 payments) by January 31 of the following year.

- Ensuring compliance with IRS rules to avoid penalties for non-reporting.

You may also consider creating a substitute W-9 if you have a streamlined process for collecting contractor information, but it must meet IRS requirements.

For Contractors Completing W-9s

As a contractor, keep the following in mind:

- Track Your Income: Since you’re responsible for paying your own taxes, maintain accurate records of payments received and 1099 forms issued.

- Quarterly Estimated Taxes: Independent contractors typically pay estimated taxes quarterly to avoid penalties for underpayment. Use Form 1040-ES to calculate and submit these payments.

- Tax Deductions: Keep records of business expenses (e.g., equipment, travel, home office costs) to reduce your taxable income. Consult a tax professional to maximize deductions.

| Responsibility | Contractor | Business |

|---|---|---|

| Small Size (W-9 Completion) | Provide accurate W-9 to payer | Request W-9 from contractors |

| Medium Size (Income Reporting) | Track income and 1099s | Issue 1099-NEC by January 31 |

| Large Size (Tax Payments) | Pay quarterly estimated taxes | Withhold taxes if required (backup withholding) |

| Huge Size (Compliance) | Maintain expense records | Ensure IRS compliance to avoid penalties |

Common Misconceptions About Form W-9

- Myth: Form W-9 is filed with the IRS.

- Fact: Form W-9 is sent to the payer, not the IRS. The payer uses it to prepare 1099 forms, which are filed with the IRS.

- Myth: Only freelancers need to complete a W-9.

- Fact: Any non-employee, including LLCs, corporations, or trusts, may need to provide a W-9 if paid over $600.

- Myth: You only need to submit a W-9 once to a client.

- Fact: You must provide a new W-9 if your information changes (e.g., name, address, TIN).

- Myth: Completing a W-9 means taxes are automatically withheld.

- Fact: Independent contractors are responsible for their own taxes unless subject to backup withholding.

Tips for Staying Compliant and Protecting Your Information

- Verify the Requester: Always confirm the legitimacy of the business or individual requesting your W-9. Check their website, contact information, or contract details.

- Use Secure Methods: Protect your TIN by using encrypted file-sharing or physical delivery methods.

- Keep Copies: Retain a copy of every W-9 you submit for your records, along with any 1099 forms you receive.

- Consult a Professional: If you’re unsure about your tax classification, exemptions, or backup withholding status, consult a tax professional or accountant.

- Stay Updated: Monitor IRS updates for changes to Form W-9 or 1099 reporting requirements, as tax laws can change frequently.

Key Takeaways

IRS Form W-9 is a vital tool for ensuring accurate income reporting for non-employees, such as independent contractors, freelancers, and other self-employed individuals. By providing your TIN, name, and tax classification, you enable businesses to report payments to the IRS using Form 1099-NEC or 1099-MISC. Completing the form accurately and securely is essential to avoid issues like backup withholding or IRS penalties. Whether you’re a contractor providing a W-9 or a business requesting one, understanding the form’s purpose, requirements, and potential pitfalls is crucial for tax compliance.

For current tax or legal advice, consult with an accountant or attorney, as state and federal laws may change, and individual circumstances vary. By staying informed and proactive, you can navigate the world of Form W-9 with confidence and ensure your tax obligations are met efficiently.

Disclaimer

The information provided in “A Comprehensive Guide to IRS Form W-9: Everything You Need to Know”, is for general informational purposes only and does not constitute tax, legal, or financial advice. Tax laws and regulations are subject to change, and the information in this article may not reflect the most recent updates or your specific circumstances. For personalized tax or legal advice, please consult a qualified accountant, tax professional, or attorney. The author and publisher of this website (Manishchanda.net) are not responsible for any errors, omissions, or actions taken based on the information provided in this article. Always verify details with the IRS or relevant authorities to ensure compliance with current tax requirements.

Acknowledgements

The creation of “A Comprehensive Guide to IRS Form W-9: Everything You Need to Know”, was made possible through the extensive resources and insights provided by numerous reputable websites. These sources offered valuable information on IRS regulations, tax form requirements, and best practices for independent contractors and businesses. I sincerely express my gratitude to the following organizations and platforms for their authoritative content, which helped shape this comprehensive guide:

- IRS: For official guidance on Form W-9 and related tax forms.

- Investopedia: For clear explanations of tax concepts and terminology.

- TurboTax: For practical advice on tax obligations for freelancers and contractors.

- H&R Block: For insights into tax compliance and form completion.

- Nolo: For legal and tax resources tailored to small businesses and self-employed individuals.

- QuickBooks: For guidance on managing contractor payments and 1099 reporting.

- TaxAct: For detailed information on tax forms and filing requirements.

- Forbes: For articles on tax strategies for freelancers and small businesses.

- The Balance: For comprehensive overviews of tax forms and processes.

- LegalZoom: For insights into business structures and tax classifications.

- Bench: For bookkeeping and tax advice for small businesses and freelancers.

- Small Business Administration (SBA): For resources on tax compliance for small businesses.

- AccountingTools: For detailed explanations of accounting and tax processes.

- Wolters Kluwer: For professional insights into tax regulations and compliance.

- Paychex: For payroll and tax guidance for businesses hiring contractors.

These sources provided a robust foundation for ensuring the accuracy and depth of the information presented in the article.

Frequently Asked Questions (FAQs)

FAQ 1: What Is IRS Form W-9 and Why Is It Needed?

IRS Form W-9, officially known as the “Request for Taxpayer Identification Number and Certification,” is a critical document used to collect essential taxpayer information, such as the Taxpayer Identification Number (TIN), which could be a Social Security Number (SSN), Employer Identification Number (EIN), or another identifier. This form is primarily used by individuals or entities classified as non-employees, such as independent contractors, freelancers, or consultants, to provide their tax details to the entity paying them for services. Unlike other tax forms, Form W-9 is not submitted to the Internal Revenue Service (IRS) but is instead sent to the requesting business or individual, who uses the information to prepare Form 1099-NEC or Form 1099-MISC for reporting payments to the IRS.

The primary purpose of Form W-9 is to ensure accurate income reporting for non-employee compensation. When a company pays a non-employee more than $600 in a tax year, they are required to report this income to the IRS, typically using Form 1099-NEC for tax years 2020 and beyond. The information provided on Form W-9, such as the contractor’s name, address, and TIN, enables the payer to correctly report these payments, helping the IRS track income and ensure tax compliance. Additionally, the form includes certifications that confirm the TIN is correct, the individual or entity is a U.S. person, and they are not subject to backup withholding unless specified.

For example, consider a freelance web developer hired by a small business to build a website for $2,000. The business requests a W-9 from the developer to obtain their TIN and other details. This allows the business to issue a 1099-NEC at the end of the year, reporting the payment to the IRS. Without the W-9, the business might face penalties for failing to report the income, and the developer could be subject to backup withholding. Form W-9 is thus essential for both parties to maintain compliance and avoid tax-related issues.

FAQ 2: Who Needs to Complete IRS Form W-9?

Form W-9 is required for individuals and entities who provide services as non-employees and receive payments exceeding $600 in a tax year from a single payer. This includes independent contractors, freelancers, consultants, sole proprietors, and certain business entities like Limited Liability Companies (LLCs), partnerships, corporations, or trusts. Specific professionals, such as attorneys or individuals in industries like commercial fishing, may also need to provide a W-9, even for smaller payments, due to IRS requirements.

Businesses or organizations that hire non-employees are responsible for requesting Form W-9 from these individuals or entities. The form ensures that the payer has the necessary information to report non-employee compensation accurately to the IRS. If a contractor earns $600 or less from a payer in a tax year, a W-9 is typically not required, though some businesses may request one for record-keeping purposes. Additionally, companies may create a substitute W-9 that mirrors the IRS form, provided it includes all required certifications and information.

For instance, a freelance graphic designer working for multiple clients would need to provide a W-9 to each client paying more than $600 annually. If the designer earns $500 from one client and $1,000 from another, only the client paying $1,000 would typically request a W-9. However, if the designer forms an LLC and obtains an EIN, they must ensure the W-9 reflects the correct business name and tax classification to avoid discrepancies.

FAQ 3: How Do I Obtain a Blank Form W-9?

Obtaining a blank Form W-9 is straightforward, as it is readily available from multiple sources. In most cases, the business or individual hiring you as a non-employee will provide a blank W-9, often sent via email, included in a contractor agreement, or accessible through a secure online portal. If you don’t receive one, you can easily download the form in PDF format from the IRS website, where it can be filled out electronically or printed for manual completion.

For businesses hiring contractors, providing a W-9 to each non-employee paid over $600 is a standard practice. If a business prefers, they can create a substitute W-9 that complies with IRS requirements, ensuring it captures the same information and certifications as the official form. Contractors should ensure they receive the form from a legitimate source to avoid sharing sensitive information, such as their TIN, with unauthorized parties.

For example, a freelance writer hired by a marketing agency might receive a W-9 via the agency’s contractor management platform. If the agency fails to provide one, the writer can download the form from the IRS website, complete it, and send it securely to the agency. Businesses, on the other hand, might download multiple W-9s to distribute to their contractors or use accounting software that generates substitute forms.

FAQ 4: How Do I Fill Out IRS Form W-9 Correctly?

Filling out Form W-9 is relatively simple, but accuracy is crucial to avoid tax complications. Here’s a step-by-step guide to completing the form:

- Name and Business Name: Enter your full legal name as it appears on your federal income tax return. If you operate under a business name (e.g., “Jane Doe Consulting”), include it in the business name field.

- Federal Tax Classification: Select your tax classification, such as individual/sole proprietor, single-member LLC, C corporation, S corporation, partnership, or trust/estate. For LLCs, specify if you’re taxed as a corporation, partnership, or disregarded entity.

- Exemptions: Enter codes if you’re exempt from backup withholding (e.g., corporations for certain payments) or FATCA reporting (rare for U.S. persons). Most sole proprietors leave these fields blank.

- Address: Provide your current address for tax correspondence, ensuring it matches your tax return.

- TIN: Enter your SSN, EIN, or other TIN in Part I. Double-check for accuracy to prevent backup withholding.

- Certification: Sign and date Part II to certify that your TIN is correct, you’re a U.S. person, and you’re not subject to backup withholding (unless notified by the IRS).

For example, a freelance photographer operating as a sole proprietor would enter their legal name, check “individual/sole proprietor,” provide their home address, enter their SSN, and sign the certification. If they’ve been notified of backup withholding, they would cross out item 2 in the certification section. Errors, such as an incorrect TIN, could lead to 24% backup withholding or IRS penalties, so careful completion is essential.

FAQ 5: What Is Backup Withholding and How Does It Affect Form W-9?

Backup withholding is a process where a payer withholds 24% of a contractor’s payment as federal income tax, even though independent contractors are typically responsible for paying their own taxes. This occurs if the contractor provides an incorrect TIN, fails to report or underreports interest or dividend income on their tax return, or receives an IRS notice mandating backup withholding. Form W-9 requires you to certify whether you’re subject to backup withholding in Part II.

If you’re subject to backup withholding, you must cross out item 2 in the certification section before signing the W-9. The IRS will notify you if this applies, often due to issues like an incorrect TIN or unreported income. To resolve backup withholding, contact the IRS to correct your TIN or address any tax discrepancies promptly.

For example, a consultant who provided an incorrect EIN on a previous W-9 might receive an IRS notice requiring backup withholding. When completing a new W-9 for a client, they would cross out item 2 and work with the IRS to resolve the issue, ensuring future payments are not withheld. Contractors should maintain accurate records and respond quickly to IRS notices to avoid unnecessary withholding.

FAQ 6: What Are the Risks of Providing Sensitive Information on Form W-9?

Form W-9 requires sensitive information, such as your TIN, which can be a target for identity theft if mishandled. Key risks include:

- Unverified Requesters: Sharing your W-9 with an unknown or unverified business could lead to fraud. Always confirm the legitimacy of the requester before providing your TIN.

- Unsecure Transmission: Sending a W-9 via unsecured email or unencrypted methods risks exposing your personal data. Use secure delivery methods like encrypted email, secure file-sharing platforms, or physical delivery.

- Misuse of Information: If a requester mishandles your W-9, your TIN could be compromised, leading to potential identity theft or unauthorized tax filings.

To mitigate these risks, verify the requester’s identity, use secure transmission methods (e.g., password-protected files or U.S. mail), and keep copies of all W-9s you submit. For example, a freelancer receiving a W-9 request from a new client should confirm the client’s identity through a verified email or contract before sending the form via a secure platform like Dropbox. Monitoring your tax accounts and credit reports can also help detect any misuse of your information.

FAQ 7: How Often Should I Update Form W-9?

You should submit a new Form W-9 whenever key information changes, such as your name, business name, address, TIN, or tax classification. Common scenarios requiring an update include:

- Name Change: Due to marriage, divorce, or legal name changes.

- Business Name Change: If you rebrand or form a new business entity, like transitioning from a sole proprietorship to an LLC.

- Address Change: If you relocate and update your tax correspondence address.

- TIN Change: If you obtain a new SSN or EIN, such as after forming a business entity.

- Tax Classification Change: If your business structure changes, like converting from a sole proprietor to a corporation.

For example, a freelancer who marries and changes their last name must submit a new W-9 to all clients reflecting the updated name and, if applicable, a new TIN. Similarly, a contractor who forms an LLC and obtains an EIN should provide an updated W-9 to ensure accurate 1099 reporting. Proactively updating your W-9 helps prevent mismatches with IRS records and avoids issues like backup withholding.

FAQ 8: What’s the Difference Between Form W-9 and Form W-4?

Form W-9 and Form W-4 serve distinct purposes in the tax system. Form W-9 is used by non-employees, such as independent contractors, to provide their TIN and certify their tax status for 1099 reporting. It is sent to the payer, not the IRS, and does not involve tax withholding unless backup withholding applies. In contrast, Form W-4, titled “Employee’s Withholding Certificate,” is completed by employees to specify their tax withholding preferences, determining how much federal income tax is withheld from their paychecks.

The key difference lies in employment status. Independent contractors have more control over their work, set their own schedules, and are responsible for paying their own taxes, often through quarterly estimated taxes. Employees, however, work under the employer’s direction, receive benefits like health insurance, and have taxes withheld by the employer. If you’re starting a new job and receive a W-9 instead of a W-4, clarify your employment status with the employer, as you may be misclassified.

For example, a software developer hired as a contractor would complete a W-9 for a client paying $5,000 for a project, while a developer hired as a full-time employee would complete a W-4 to set withholding for their salary. Misclassification can lead to tax issues, so understanding your role is critical.

FAQ 9: What Happens If I Don’t Provide a Form W-9?

Failing to provide a Form W-9 when requested by a payer can lead to several consequences. The payer may be required to implement backup withholding at a rate of 24% on your payments, reducing the amount you receive and sending the withheld amount to the IRS. Additionally, the payer may face IRS penalties for failing to report your income accurately on Form 1099-NEC or 1099-MISC if they lack your TIN. For the contractor, not providing a W-9 could delay payments, as some businesses withhold payment until the form is received.

If you provide an incorrect TIN or incomplete information, the IRS may flag the discrepancy, triggering backup withholding or penalties. To avoid these issues, ensure you provide a W-9 promptly and accurately. If you’re concerned about sharing sensitive information, verify the requester’s legitimacy and use secure transmission methods.

For example, a freelance editor who refuses to provide a W-9 to a client paying $1,500 might receive only $1,140 after 24% backup withholding. To resolve this, the editor should submit a correct W-9 and address any IRS notices to stop the withholding and recover the withheld amount.

FAQ 10: How Does Form W-9 Relate to Form 1099-NEC and 1099-MISC?

Form W-9 is directly linked to Form 1099-NEC and Form 1099-MISC, as it provides the information needed to prepare these forms for IRS reporting. Form 1099-NEC, used for tax years 2020 and beyond, reports non-employee compensation paid to independent contractors, freelancers, or other non-employees exceeding $600 in a tax year. Form 1099-MISC, used for earlier years or specific payments (e.g., rent, royalties), also relies on W-9 data for accurate reporting. The payer uses the contractor’s TIN, name, and address from the W-9 to complete these forms, which are sent to both the IRS and the contractor by January 31 of the following year.

The W-9 ensures that the IRS can match the reported income with the contractor’s tax return, preventing underreporting. Contractors should compare the 1099 forms they receive with their own income records to ensure accuracy and report any discrepancies to the payer or IRS. For example, a consultant paid $10,000 by a company would provide a W-9, enabling the company to issue a 1099-NEC. The consultant uses the 1099-NEC to report their income on their tax return, ensuring compliance and avoiding penalties.