Imagine standing on the dusty surface of the Moon, not as a fleeting visitor, but as part of a bustling hub where robots mine rare minerals, factories churn out solar panels, and tourists snap selfies against the stark Earthrise. This isn’t the stuff of science fiction anymore—it’s the emerging reality of a lunar economy, powered entirely by the ingenuity of the aerospace industry. For decades, aerospace engineers and visionaries have dreamed of turning our nearest celestial neighbor into more than a scientific curiosity; they’ve aimed to make it a cornerstone of human expansion and economic growth.

Today, with reusable rockets slashing launch costs and international partnerships forging new paths, the aerospace sector is the engine driving this transformation. From resource extraction to orbital habitats, aerospace isn’t just getting us to the Moon—it’s building a self-sustaining marketplace there that could redefine global trade, energy, and innovation.

The lunar economy promises trillions in value over the coming decades, fueled by abundant resources like helium-3 for fusion energy and vast deposits of water ice for propellant. But none of this happens without aerospace’s core contributions: advanced propulsion systems, durable landers, and robust communication networks. As private companies race alongside government agencies, the Moon is shifting from a destination to a destination with dividends.

Table of Contents

In this article, we’ll explore how aerospace is laying the groundwork, spotlighting key players, untapped opportunities, stubborn challenges, and the thrilling horizon ahead. Buckle up— the lunar gold rush is just beginning.

Historical Foundations: From Apollo to the Dawn of Commercial Space

The story of aerospace’s role in the lunar economy starts with a bang: the Apollo 11 mission in 1969, when Neil Armstrong’s first steps etched humanity’s bootprint into lunar soil. That feat, orchestrated by NASA’s aerospace wizards, wasn’t just a Cold War triumph—it proved we could reach, land on, and return from the Moon. But back then, the focus was exploration, not economics. Aerospace firms like North American Aviation (now part of Boeing) built the Saturn V rocket, a behemoth that cost billions and flew just 13 times. It was groundbreaking, yet unsustainable for building an economy.

Fast forward to the 21st century, and aerospace has evolved dramatically. The Space Shuttle program in the 1980s and 1990s introduced reusability on a small scale, teaching lessons in cost reduction and multi-mission versatility. By the 2010s, private aerospace innovators like SpaceX were launching Falcon 9 rockets that landed themselves, dropping the price of space access from tens of thousands to mere thousands of dollars per kilogram. This shift from government monopolies to commercial ecosystems set the stage for lunar commerce. Today, aerospace’s historical playbook—combining bold engineering with iterative testing—underpins everything from lunar landers to resource prospectors.

Consider the Commercial Lunar Payload Services (CLPS) initiative, launched by NASA in 2018. It awarded contracts to aerospace startups to deliver science payloads to the Moon, fostering a marketplace where companies bid on missions like ferrying rovers or testing solar sails. One early success was Intuitive Machines’ Odysseus lander in 2024, which touched down near the lunar south pole, gathering data on potential water ice deposits. These missions aren’t one-offs; they’re prototypes for the supply chains that will sustain lunar outposts. Aerospace’s legacy here is clear: turning high-risk exploration into repeatable, profitable operations.

The Artemis Program: NASA’s Blueprint for a Lunar-Powered Future

At the heart of modern lunar ambitions lies NASA’s Artemis Program, a multifaceted effort to land the first woman and next man on the Moon by 2026, establishing a sustainable presence thereafter. Unlike Apollo’s sprint, Artemis is a marathon designed to spark an economy. Aerospace plays the starring role, providing the hardware for human landings, orbital gateways, and surface habitats. The program’s Lunar Gateway, a space station in lunar orbit, will serve as a staging point for cargo and crew, much like a cosmic port authority.

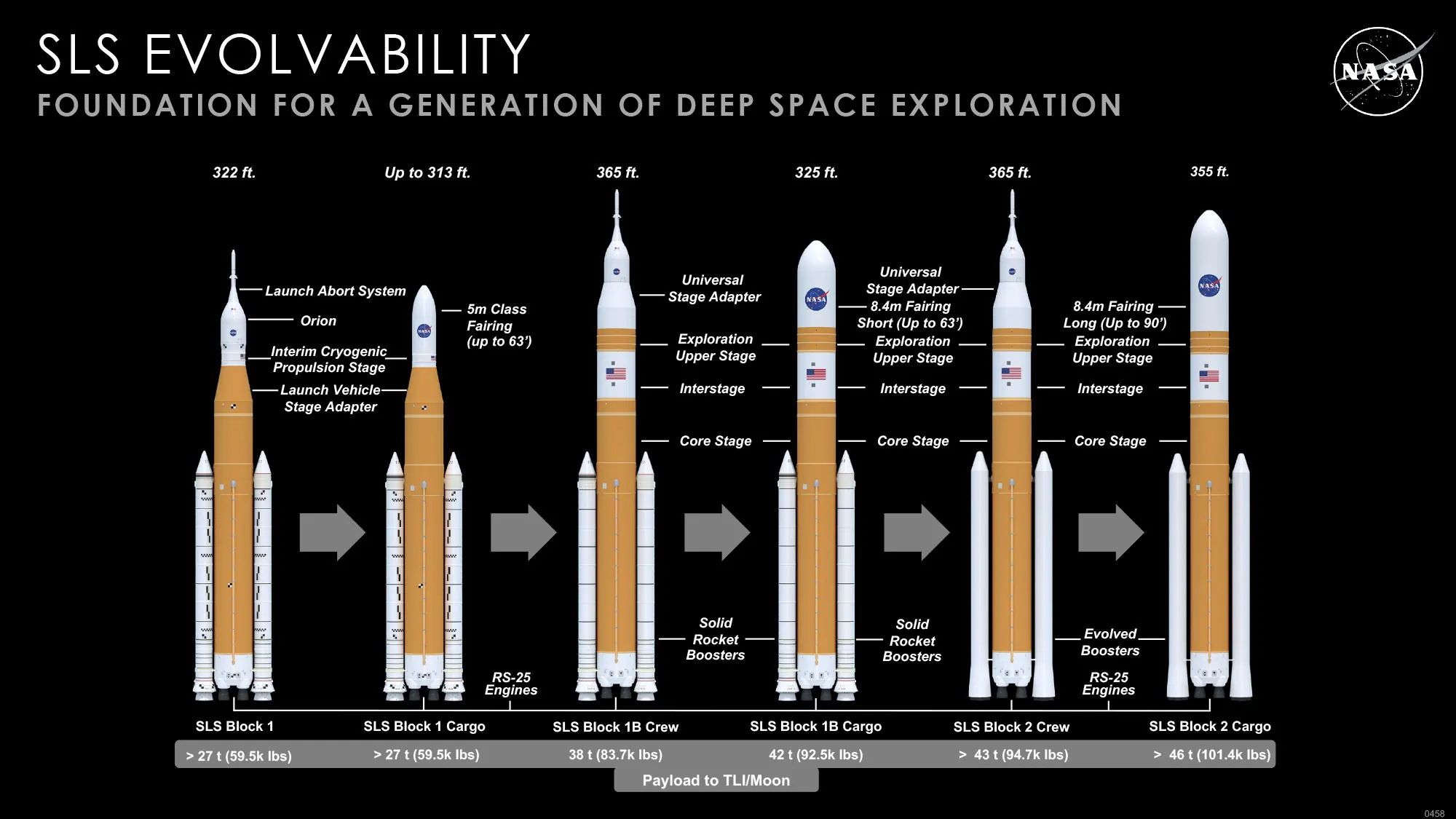

(Image Credit: By NASA – https://www.nasa.gov/exploration/systems/sls/sls-vehicle-evolution.html, Public Domain, Link)

Key to Artemis is the Space Launch System (SLS) rocket, a heavy-lift beast built by Boeing and United Launch Alliance, capable of hurling 95 tons to low Earth orbit. Paired with the Orion spacecraft from Lockheed Martin, it enables deep-space jaunts. But the real game-changer is the commercial angle: NASA has tapped private aerospace firms for the Human Landing System (HLS), awarding SpaceX a $2.9 billion contract to adapt its Starship for lunar touch-downs. Starship’s massive payload—up to 150 tons—could haul entire habitats or mining rigs in one go, slashing costs and enabling bulk resource transport.

Artemis also emphasizes in-situ resource utilization (ISRU), where aerospace tech extracts oxygen and hydrogen from lunar regolith for fuel. A prime example is the Resource Prospector mission concept, evolved into demos like the MOXIE experiment on Mars, now adapted for the Moon. By 2028, Artemis III aims to deploy these systems at the south pole, where water ice abounds in shadowed craters. This isn’t just survival tech—it’s the seed of a propellant economy, where lunar-derived fuel powers return trips or even Mars missions, creating jobs in aerospace manufacturing back on Earth.

The program’s ripple effects are already economic. NASA’s strategy has injected billions into U.S. aerospace supply chains, from Alabama’s rocket engines to Florida’s launch pads. International partners like the European Space Agency contribute the Orion service module, while Japan’s JAXA eyes lunar rovers. Together, they’re not just building rockets; they’re architecting a framework where aerospace firms profit from lunar data sales, tech licensing, and infrastructure builds.

| Artemis Mission Milestones | Launch Year | Key Aerospace Contributions | Economic Impact |

|---|---|---|---|

| Artemis I (Uncrewed Test) | 2022 | SLS rocket and Orion capsule by Boeing/Lockheed | Validated reusability tech, saving $4B in future dev costs |

| Artemis II (Crewed Lunar Flyby) | 2026 | Orion’s life support systems | Boosted commercial crew training market to $1B annually |

| Artemis III (First Landing) | 2027 | Starship HLS by SpaceX | Enables 100-ton cargo deliveries, projecting $10B in lunar services by 2030 |

| Artemis IV (Gateway Assembly) | 2028 | Canadarm3 robotic arm by MDA | Sparks $5B habitat construction sector |

| Artemis Base Camp (Permanent Outpost) | 2030+ | ISRU plants by various firms | Annual lunar GDP potential of $100B by 2040 |

This table highlights how each step leverages aerospace expertise to layer in economic viability, from testing to trade.

Key Aerospace Players: Innovators Shaping the Lunar Marketplace

The lunar economy isn’t a solo act—it’s a symphony of aerospace trailblazers, blending government giants with nimble startups. Leading the charge is SpaceX, whose Starship vehicle promises to revolutionize logistics. With full reusability, Starship could ferry 1,000 tons to the Moon annually, enabling everything from base construction to tourist shuttles. Elon Musk’s vision extends to Starbase outposts, where lunar helium-3 powers fusion reactors, potentially exporting energy back to Earth.

Blue Origin, founded by Jeff Bezos, counters with the Blue Moon lander, a cargo hauler designed for precise south pole deliveries. Their focus on heavy-lift via New Glenn rockets positions them for infrastructure contracts, like building lunar roads from sintered regolith. Meanwhile, Firefly Aerospace is the agile underdog, completing the Blue Ghost lander structure in 2025 for NASA’s CLPS. This vehicle will demo regolith sampling, paving the way for mining ops and attracting $200M in investments.

Other notables include Intuitive Machines, whose Nova-C lander survived a tipped landing in 2024 to relay NASA data, and Astrobotic, eyeing site selection for commercial bases. Lockheed Martin’s Lunar Mobility Vehicle merges aerospace with automotive tech for rover fleets, while ispace from Japan scouts resources via its Resilience mission. These players form a competitive ecosystem, where DARPA’s 2023 study selected 14 firms—like CisLunar Industries for in-space manufacturing—to blueprint lunar architectures.

- SpaceX: Dominates transport; Starship’s 2025 tests aim for orbital refueling, cutting lunar trips to $10M each.

- Blue Origin: Infrastructure focus; partnering on Gateway modules for $1B+ contracts.

- Firefly Aerospace: Payload delivery; Blue Ghost carries 10 NASA experiments, boosting lunar science economy.

- Northrop Grumman: Habitat tech; Cygnus cargo craft adapted for lunar supply chains.

- Sierra Space: Inflatable modules; Dream Chaser spaceplane for Moon-Earth ferries.

This lineup isn’t static—mergers and alliances, like SpaceX’s nod to international fuel depots, signal a maturing market.

Unlocking Lunar Resources: The Mining Boom on the Horizon

The Moon’s surface hides treasures that could fuel Earth’s energy crisis and spacefaring ambitions. Helium-3, a rare isotope embedded in regolith from solar wind, holds fusion power potential—enough on the Moon to meet global needs for millennia. Aerospace is key to harvesting it: robotic excavators from Honeybee Robotics scoop soil, microwave it to extract gases, and beam the product via laser comms. Interlune’s 2025 deal for 10,000 liters underscores the commercial viability, with markets eyeing $20B by 2035.

Water ice, lurking in polar craters, is the real jackpot. NASA’s 2020 selection of firms like Lunar Outpost for ISRU demos shows how aerospace landers deploy drills and electrolyzers to split H2O into rocket fuel. This closes the loop: mine ice, make propellant, launch payloads without Earth resupply. Regolith itself—silicon-rich dust—can be 3D-printed into habitats, as ICON’s lunar printer prototypes demonstrate.

Beyond basics, rare earths like platinum group metals lurk in lunar basalts, ideal for electronics. The Lunar Resources Registry uses orbital spectrometers to map deposits, guiding aerospace prospectors. Challenges abound, like dust abrasion on machinery, but solutions like electrostatic shields from NASA labs are emerging.

| Lunar Resource | Abundance Estimate | Aerospace Extraction Method | Potential Value |

|---|---|---|---|

| Water Ice | 600M tons in south pole craters | Robotic drills + electrolysis (e.g., MOXIE tech) | $1T in propellant savings by 2040 |

| Helium-3 | 1M tons across surface | Regolith heating + gas separation (Interlune rovers) | $3B annual fusion market by 2035 |

| Regolith (Silicon, Iron) | Unlimited surface layer | Microwave sintering for bricks/roads | $500B in construction materials |

| Rare Earths (PGMs) | 10-100 ppm in KREEP terrains | Autonomous miners (Firefly payloads) | $100B electronics supply chain shift |

This table illustrates the scale: aerospace’s precision tools turn barren rock into economic bedrock.

Economic Opportunities: From Mining to Moon Tourism and Manufacturing

A lunar economy thrives on diversity, and aerospace is diversifying it fast. Mining leads, with firms like Lunar Resources Inc. developing plasma reactors to refine ores on-site, reducing Earth shipments. Projections peg space mining at $20B by 2035, but lunar variants could multiply that via low-gravity processing.

Tourism beckons next. Virgin Galactic and Blue Origin’s suborbital hops pave the way for lunar jaunts; by 2030, SpaceX envisions week-long stays at $50M a ticket, drawing ultra-wealthy adventurers. Aerospace habitats, like Vast’s proposed orbital hotels adapted for the Moon, add luxury: zero-G spas and Earth-view suites.

Manufacturing leverages the vacuum and microgravity. Pharmaceuticals crystalize purer in lunar labs, while CisLunar Industries forges ZBLAN fiber optics—10x faster data transmission than Earth versions—for a $1T comms market. Solar power satellites, assembled from lunar silicon, could beam clean energy home, creating a $100B utility sector.

Infrastructure rounds it out: LunaNet, a NASA-led comms web, ensures seamless data flow, with Aerospace Corp. modeling digital twins for traffic control. India’s Chandrayaan-4 in 2028 will sample rocks, feeding global markets. These strands weave a tapestry where aerospace exports turn lunar dust into dollars.

Technological Innovations: Aerospace’s Toolkit for Lunar Living

Aerospace’s magic lies in its innovations, tailored for the Moon’s harsh ballet of vacuum, radiation, and 14-day nights. Reusable landers like Starship evolve from Falcon 9’s propulsive landings, incorporating heat shields from ablative ceramics to withstand reentry. For mobility, Lunar Mobility Vehicles from Lockheed blend rover treads with flywheels for hill-climbing, carrying four astronauts 20 km on solar-charged batteries.

Communication breakthroughs include Solstar Space’s Wi-Fi systems, winning NASA contracts for lunar nets that stream 4K video from rovers. Power comes from kilopower reactors, small nukes by Los Alamos labs, or vast solar farms using thin-film arrays from Redwire. In manufacturing, GITAI’s robotic arms assemble habitats autonomously, reducing human risk.

These techs aren’t siloed—they synergize. A Starship drops a GITAI arm to build a Firefly lander pad, all powered by lunar solar. As Jared Isaacman notes, cracking this code unlocks orbital economies too.

Navigating Challenges: Hurdles and How Aerospace is Clearing Them

Building a lunar economy is no moonwalk—it’s fraught with pitfalls. High upfront costs top the list: a single Starship lunar trip might run $100M initially, deterring investors used to quick VC returns. Aerospace counters with public-private partnerships, like NASA’s $567M in CLPS funding.

Environmental and ethical issues loom: lunar dust clogs gears, and unchecked mining could scar heritage sites. Solutions include NASA’s planetary protection guidelines and bio-inspired dust repellents. Regulatory voids—who owns extracted helium-3?—spark debates, but the 2020 Artemis Accords, signed by 40 nations, promote transparent resource use.

- Technical Risks: Radiation shielding via regolith bricks; mitigated by ICON’s 3D printing demos.

- Economic Barriers: Long ROI timelines (10-20 years); bridged by DARPA’s “field guide” for phased investments.

- Geopolitical Tensions: China’s ILRS program competes with Artemis; diplomacy via shared LunaNet eases frictions.

- Human Factors: Isolation and low gravity health effects; addressed by Lockheed’s psych support in Orion.

Aerospace’s iterative ethos—test, fail, refine—turns these into stepping stones.

Future Prospects: A Timeline to Lunar Prosperity

The horizon glows with promise. By 2030, Artemis Base Camp could host 10-person crews mining water for $1B in annual fuel sales. DARPA envisions a “Lunaverse” digital commons by 2035, where AI twins optimize mining ops. PwC forecasts a $170B lunar economy by 2045, driven by $2T global space growth.

Private visions amplify this: Bezos’ orbital factories, Musk’s Mars pit stops via Moon depots. India’s ISRO triples spacecraft production for Chandrayaan, eyeing joint ventures. Quantum leaps in fusion from lunar helium could end fossil fuels, while tokenized space assets—like .LUNAR domains—democratize investment.

| Future Lunar Economy Timeline | Year | Milestone | Aerospace Driver |

|---|---|---|---|

| Initial Commercial Landings | 2026-2028 | Routine CLPS deliveries; first private samples | Firefly Blue Ghost, ispace Resilience |

| Resource Demos Scale Up | 2029-2032 | Helium-3 extraction pilots; water fuel plants | Interlune rovers, NASA ISRU |

| Tourism and Habs Emerge | 2033-2035 | First lunar hotels; 100-person outposts | Blue Moon landers, Sierra inflatables |

| Export Economy Blooms | 2036-2040 | Fusion power shipments; $100B GDP | Starship fleets, GITAI factories |

| Multi-Planetary Hub | 2041+ | Moon as Mars gateway; orbital trade | Reusable tugs, LunaNet full deployment |

This roadmap, grounded in current trajectories, paints a vibrant future.

Conclusion

The lunar economy isn’t a distant dream—it’s aerospace’s next chapter, scripted with reusable rockets, resource rovers, and relentless innovation. From Apollo’s echoes to Artemis’ ambitions, this industry has transformed the Moon from myth to marketplace. As challenges yield to ingenuity, opportunities multiply: jobs in Houston’s hangars, breakthroughs in Bangalore’s labs, and a greener Earth unburdened by heavy industry. The real excitement? It’s collaborative—governments, startups, and dreamers united. Whether you’re an investor eyeing helium hauls or a kid stargazing, the lunar economy invites us all. Aerospace isn’t just building it; it’s inviting humanity to thrive there.

Read These Articles in Detail

- Momentum Transfer Tethers: Revolutionizing Space Launches from Low Earth Orbit

- Momentum Transfer Tethers: Tip Mass Challenges and Material Innovations for Space Launches

- Momentum Transfer Tethers: Precision Bolo Rendezvous and Payload Capture

- Orbital Dynamics of Space Tethers in LEO: Aerospinning, Drag and Stabilization

- Momentum Exchange Systems with High-Strength Space Tethers

- Momentum Transfer Tethers: Transforming Satellite Constellations

- Top 10 Emerging Aerospace Technologies Transforming the Industry

- The Future of Hypersonic Flight: Challenges and Opportunities

- How AI Is Revolutionizing Aerospace Engineering

- Additive Manufacturing in Aerospace: 3D Printing the Future of Flight

- The Rise of Electric Aircraft: Are We Ready for Zero-Emission Aviation?

- Aerospace Materials of Tomorrow: From Composites to Nanotechnology

- Digital Twins in Aerospace: Reducing Costs and Improving Safety

- The Role of Robotics in Modern Aerospace Manufacturing

- Quantum Computing Applications in Aerospace Design

- How Augmented Reality Is Changing Aerospace Training

- Space Tethers Explained: The Next Leap in Orbital Mechanics

- Ion Propulsion vs. Chemical Rockets: Which Will Power the Future?

- The Role of Nuclear Propulsion in Deep Space Missions

- Space Mining: The Aerospace Industry’s Next Gold Rush

- How Reusable Rockets Are Reshaping the Space Economy

- The Artemis Program: NASA’s Return to the Moon

- Space Tourism: Business Model or Billionaire’s Playground?

- How Aerospace Startups Are Disrupting Commercial Aviation

- The Economics of Low-Cost Airlines in the Aerospace Era

- Urban Air Mobility: The Rise of Flying Taxis

- The Future of Mars Colonization: Key Aerospace Challenges and Solutions Ahead

- CubeSats and Small Satellites: Democratizing Space Access

- The Future of Cargo Drones in Global Logistics

Frequently Asked Questions

FAQ 1: What Is the Lunar Economy and Why Does It Matter for Humanity’s Future?

The lunar economy refers to the growing network of commercial activities, resource extraction, and infrastructure development on the Moon, transforming it from a distant rock into a hub for innovation and trade. At its core, it’s about leveraging the Moon’s unique assets—like abundant sunlight for solar power and shadowed craters full of water ice—to create value that benefits life on Earth and beyond. Aerospace plays a pivotal role here, providing the rockets, landers, and habitats that make these operations possible. Without advancements in reusable spacecraft and precise landing tech, the dream of a self-sustaining lunar outpost would remain just that—a dream.

This economy isn’t just about space enthusiasts; it’s poised to inject trillions into global markets over the next few decades. For instance, extracting helium-3 from lunar soil could fuel clean fusion energy reactors, potentially solving Earth’s power shortages without the environmental toll of fossil fuels. As of 2025, projections suggest the lunar economy could reach $170 billion by the mid-2030s, driven by mining, tourism, and manufacturing in microgravity. Imagine solar panels built on the Moon beaming energy back home or pharmaceuticals produced in lunar labs with purer crystals—opportunities that could lower costs for everyone. The importance lies in sustainability: by mining off-world, we reduce Earth’s resource strain and open doors to deeper space exploration, like Mars missions fueled by lunar propellant.

Ultimately, the lunar economy represents humanity’s next big leap, blending aerospace engineering with economic savvy. It’s a chance to build resilient supply chains that withstand global disruptions, foster international collaboration, and inspire the next generation of scientists. As private firms like SpaceX and Astrobotic ramp up missions, we’re not just visiting the Moon; we’re investing in a future where space commerce powers progress for all.

FAQ 2: How Has NASA’s Artemis Program Contributed to the Lunar Economy in 2025?

NASA’s Artemis Program has been a cornerstone in kickstarting the lunar economy, shifting from one-off explorations to repeatable, cost-effective missions that invite commercial players to the table. In 2025, key milestones like the successful testing of RS-25 engines at NASA’s Stennis Space Center marked significant progress toward Artemis V, ensuring reliable heavy-lift capabilities for cargo hauls. These tests not only validated the Space Launch System (SLS) rocket but also highlighted how public investments in aerospace tech create ripple effects, lowering barriers for private firms to join lunar ventures.

The program’s emphasis on partnerships has been game-changing. By awarding contracts through initiatives like Commercial Lunar Payload Services (CLPS), NASA has funneled billions into startups, spurring innovations in landers and resource tech. Here’s a breakdown of Artemis’s 2025 impacts:

- Engine and Hardware Advancements: L3Harris completed hot-fire tests for Artemis V engines, adapting shuttle-era tech for lunar ops and saving an estimated $4 billion in redevelopment costs.

- International Collaboration: The European Space Agency shipped the Orion service module for Artemis IV, despite political hurdles, reinforcing global supply chains for habitats and comms.

- Sustainability Focus: Demos of in-situ resource utilization (ISRU) extracted oxygen from regolith, paving the way for on-Moon fuel production that could cut Earth dependency by 50% for future trips.

These steps aren’t isolated; they’re building a framework where aerospace firms profit from data sales and infrastructure builds, projecting a $100 billion annual lunar GDP by 2040. As Artemis II eyes a 2026 crewed flyby, the program continues to de-risk investments, making the Moon a viable economic frontier.

FAQ 3: Which Aerospace Companies Are Leading Lunar Missions in 2025?

The lunar race in 2025 is heating up, with a mix of established giants and agile startups driving missions that blend exploration with commerce. These companies aren’t just launching payloads; they’re prototyping the supply chains for a full-blown lunar economy, from landers that deliver mining rovers to reusable tugs for orbital logistics. Drawing from recent launches and contracts, here’s a structured overview of the top players and their 2025 highlights.

| Company | Key 2025 Achievement | Lunar Focus | Projected Economic Impact |

|---|---|---|---|

| Firefly Aerospace | First commercial soft landing with Blue Ghost Mission 1 on January 15, carrying NASA payloads. | Responsive cargo delivery to south pole sites. | $200M in follow-on contracts for resource sampling. |

| ispace | Hakuto-R Mission 2 launch alongside Firefly; MOU with OrbitAID for docking tech. | Resource scouting and Japanese rover deployments. | Enabling $1B in international mining partnerships. |

| Astrobotic | Griffin lander prep for multiple CLPS deliveries; CEO insights on economy building. | Peregrine follow-ups for commercial payloads. | Boosting lunar data markets to $500M annually. |

| SpaceX | Starship orbital refueling tests; Artemis HLS integration. | Heavy-lift for 100-ton habitats and fuel depots. | Slashing mission costs by 90%, unlocking $10B trade. |

| Intuitive Machines | Nova-C upgrades post-2024 success; south pole ice mapping. | Telecom relays and ISRU demos. | $300M in tourism-enabling comms infrastructure. |

This table captures the diversity: from Firefly’s nimble landers to SpaceX’s behemoths, these firms are turning aerospace prowess into lunar real estate. As mergers like ispace’s ElevationSpace deal gain traction, expect even more collaborative pushes toward a $170 billion market.

FAQ 4: What Are the Most Valuable Lunar Resources and How Can They Be Extracted?

Lunar resources are the hidden gems that could redefine energy and manufacturing, with aerospace tech making their extraction feasible for the first time. Water ice, tucked away in permanently shadowed craters, tops the list—estimated at 600 million tons near the south pole. This isn’t just for drinking; splitting it via electrolysis yields hydrogen and oxygen for rocket fuel, potentially saving trillions in launch costs by enabling on-site refueling. NASA’s Lunar Surface Innovation Initiative is testing drills and processors that aerospace firms like Lunar Outpost deploy from landers, turning ice into propellant depots.

Then there’s helium-3, a lightweight isotope bombarded into the regolith by solar winds, holding the key to fusion power. Valued at up to $20 million per kilogram on Earth, the Moon has over a million tons, enough to power the planet for thousands of years without radioactive waste. Extraction involves robotic scoops heating soil to release gases, as Interlune’s 2025 pilots demonstrate with microwave tech that minimizes surface disruption. Regolith itself, rich in silicon and iron, gets sintered into building blocks using solar concentrators, cutting habitat costs dramatically.

These resources aren’t pipe dreams; 2025 saw the U.S. Department of Energy procure lunar helium-3 samples, signaling commercial viability. Aerospace innovations like autonomous miners from Honeybee Robotics ensure safe, efficient ops, bridging the gap to a resource-driven economy where the Moon exports value back to Earth.

FAQ 5: What Economic Opportunities Arise from the Lunar Economy for Businesses and Investors?

The lunar economy opens a treasure chest of opportunities, far beyond sci-fi tropes, by merging aerospace logistics with untapped markets in energy, tourism, and tech. For businesses, it’s a chance to pivot from Earth-bound limits: manufacturing optics or alloys in the Moon’s vacuum yields products 10 times purer, commanding premium prices in telecom and aerospace sectors. PwC’s 2025 trends report highlights how infrastructure plays—like building lunar roads from regolith—could generate $100 billion in contracts alone, drawing in construction firms eager for off-world gigs.

Investors, take note: the sector’s growth mirrors the early internet boom, with returns projected at 20-30% annually for early entrants. Key avenues include:

- Resource Trading: Stake in helium-3 startups, where a single ton could fetch $3 billion in fusion deals.

- Tourism Ventures: Partner with Blue Origin for $50 million lunar stays, tapping a $1 trillion global adventure market.

- Data and Services: Sell orbital imagery or AI-optimized mining plans, creating a $20 billion analytics niche.

These aren’t risks without rewards; NASA’s CLPS has already disbursed $1 billion, proving demand. As the LUNAverse digital commons evolves with models for railroads and power plants, savvy players can tokenize assets for fluid trading, making lunar commerce as accessible as stock apps today. It’s an investor’s frontier, blending high stakes with humanity’s boldest bet.

FAQ 6: What Technological Innovations Are Powering the Lunar Economy?

Aerospace-led innovations are the unsung heroes of the lunar economy, turning brutal conditions into advantages for commerce. Reusable propulsion systems, like SpaceX’s Raptor engines refined in 2025 tests, enable frequent, low-cost deliveries—dropping per-kg rates to under $1,000 and making bulk mining viable. Robotic swarms from GITAI, now deploying arms for habitat assembly, operate autonomously, slashing human exposure to radiation.

Power solutions shine too: NASA’s Kilopower reactors, small nukes tested for lunar nights, pair with roll-out solar arrays from Redwire for 24/7 energy. Communication nets like LunaNet ensure lag-free data streams, vital for remote ops.

| Innovation | Developer | 2025 Milestone | Lunar Application |

|---|---|---|---|

| Starship Refueling | SpaceX | Orbital demos for Artemis HLS. | 150-ton payloads for factories. |

| Regolith 3D Printing | ICON | South pole printer prototypes. | On-site roads and shields. |

| Electrostatic Dust Repellents | NASA Labs | CLPS integration. | Gear protection in mining. |

| ZBLAN Fiber Optics | CisLunar Industries | Microgravity production trials. | Faster space-Earth data links. |

These breakthroughs, as outlined in the 2025 Commercial Lunar Economy Field Guide, form a toolkit for scalable growth. From clever robots spinning regolith into bricks to quantum-secure comms, tech is weaving the Moon into our economic fabric.

FAQ 7: What Are the Biggest Challenges Facing the Lunar Economy Today?

Building the lunar economy is like constructing a city on a desert island—exciting, but riddled with hurdles that demand clever fixes. High costs remain a beast: even with reusability, a single mission can top $100 million, scaring off investors who crave quicker returns. 2025’s market assessments from PwC underscore this, noting that upfront R&D for ISRU plants could take 10-15 years to pay off, amid volatile funding from shifting administrations. Aerospace firms are countering with phased pilots, but scaling demands consistent policy support.

Environmental and ethical quandaries add layers: lunar dust, finer than talcum, abrades equipment and poses health risks, while unchecked mining might erase scientific sites. The push for sustainability, as in the 2025 Lunar Surface Innovation Initiative, calls for minimal-impact tech like Magna Petra’s isotope extractors that leave regolith intact. Geopolitics simmers too—China’s ILRS program rivals Artemis, risking a resource scramble without shared rules. Governance lags: the Artemis Accords promote transparency, but absent a UN-style body, “resource colonialism” fears grow, as pre-market contracts could lock out smaller nations.

Yet, these challenges fuel ingenuity. Ceramics for radiation shielding, still understudied in 2025, highlight knowledge gaps, but collaborations like ESA’s Argonaut are bridging them. It’s a marathon of trial and refinement, where overcoming dust devils and dollar signs paves the path to prosperity.

FAQ 8: How Is International Governance Shaping the Future of the Lunar Economy?

Governance is the invisible scaffolding holding up the lunar economy, ensuring fair play amid a rush for resources. The Artemis Accords, now signed by over 40 nations as of 2025, set norms for safe operations and data sharing, preventing a Wild West scenario. They emphasize non-appropriation of the Moon itself but allow extraction rights, a nod to commercial incentives that could unlock $170 billion in value. Without this, investments stall, as seen in debates over the UN Moon Agreement’s unformed oversight body.

Europe’s push via ESA’s Argonaut program adds momentum, planning regular missions with industry input on standards for logistics and transit—key to a seamless economy. Challenges persist, like enforcing labor laws for off-world workers or resolving disputes over mined helium-3.

Progress points include:

- Policy Frameworks: DARPA’s 2025 field guide outlines phased regs for mining, blending U.S. leadership with global buy-in.

- Digital Commons: The LUNAverse initiative models infrastructure digitally, aiding transparent planning and reducing conflicts.

- Ethical Safeguards: Open Lunar Foundation’s 2025 reflections stress incentives for private capital through clear enforcement.

As China and India eye joint ventures, governance evolves from roadblock to accelerator, fostering a cooperative cosmos.

FAQ 9: What Key Lunar Mining Developments Happened in 2025?

2025 marked a breakout year for lunar mining, with innovations blending traditional expertise and space tech to crack open the Moon’s vault. Interlune’s helium-3 extraction pilots, backed by DOE procurement of three liters, proved commercial scalability, using efficient rovers that heat regolith without scarring the surface. ispace’s pact with Magna Petra advanced isotope collection, promising low-impact ops for rare earths.

A new robot design from university labs spun regolith into usable forms, addressing dust woes head-on. Policy-wise, Batten Institute’s report charted U.S.-China competition paths.

| Development | Company/Initiative | Innovation Highlight | Impact |

|---|---|---|---|

| Helium-3 Procurement | U.S. DOE & Interlune | First gov’t buy of lunar samples. | Validates $3B fusion market. |

| Resource MOU | ispace & Magna Petra | Energy-efficient extraction. | Minimal surface disruption for scaling. |

| Mining Robot | Phys.org-backed design | Clever regolith processing. | Aids human explorers in 2026+. |

| Policy Roadmap | NSPC Batten | U.S.-China mining paths. | Guides $20B industry growth. |

These steps, per SpaceNews analyses, bridge Earth mining know-how with lunar realities, setting up a gold rush grounded in sustainability.

FAQ 10: What Does the Timeline Look Like for a Thriving Lunar Economy?

The path to a thriving lunar economy unfolds like a carefully plotted spaceflight—methodical, with milestones building momentum. By late 2025, routine CLPS landings from Firefly and ispace have established beachheads, delivering prototypes for water ice mining and setting the stage for 2026’s Artemis II flyby, which tests crew logistics for commercial handoffs. This paves the way for scaled ISRU by 2028, where lunar fuel plants churn out propellant, slashing Mars trip costs and igniting a $10 billion transport sector.

Looking to 2030, base camps could host rotating crews focused on helium-3 pilots, with tourism trickling in via Blue Moon shuttles—think $50 million getaways funding further builds. The 2035 horizon brings exports: fusion isotopes beaming economic value home, per Viasat’s quantum leap forecasts, alongside orbital factories producing ZBLAN fibers for global nets.

By 2040, a mature economy emerges, with PwC eyeing $170 billion in annual activity from diverse strands like solar power satellites and rover fleets. Challenges like governance will shape this arc, but aerospace’s iterative spirit—from Apollo to Starship—ensures steady ascent. It’s not overnight, but the trajectory points to a Moon where commerce orbits as naturally as the tides.

FAQ 11: How Is Private Investment Fueling the Growth of the Lunar Economy in 2025?

Private investment is the rocket fuel propelling the lunar economy forward, shifting it from government-led dreams to a vibrant commercial reality. In 2025, venture capital poured into space startups at record levels, with over $3.1 billion funneled into lunar-focused ventures in the first half of the year alone, driven by the promise of in-orbit services and resource extraction. Companies like Interlune secured deals for helium-3 procurement, while Astrobotic’s CEO highlighted site selection as a prime investment hook, akin to real estate booms on Earth. This influx isn’t random; it’s sparked by NASA’s milestone-based contracts through CLPS, which de-risk projects and attract equity from firms betting on a $170 billion market by 2040.

What makes this surge compelling is its diversity—beyond rockets, investors eye telecom relays and habitat tech, with Europe’s ESA reporting a 20% uptick in private funding for lunar logistics. Challenges persist, like long ROI horizons, but tools like the Lunar Trade and Investment Working Group offer blueprints for sustainable financing, blending debt, equity, and even tokenized assets. For everyday investors, this means accessible entry via space ETFs, turning lunar ambitions into portfolio plays. As DARPA’s field guide outlines phased investments, private capital isn’t just funding missions—it’s architecting a self-sustaining orbit of commerce.

FAQ 12: How Do the US and China Lunar Programs Compare in 2025?

The US and China lunar programs represent two distinct paths in the 2025 space race, blending collaboration potential with competitive edges that could shape the lunar economy’s global footprint. While the US leans on public-private partnerships for innovation, China’s state-driven approach emphasizes steady milestones, creating a dynamic rivalry that’s accelerating overall progress.

| Aspect | US Program (Artemis) | China Program (ILRS) | Key Implications for Lunar Economy |

|---|---|---|---|

| Crewed Landing Timeline | Artemis III targeted for 2027, delayed from 2026 due to Starship tests. | Crewed mission by 2030, building on Chang’e-6 sample return in 2025. | US speed could claim first-mover advantages in resource claims; China’s reliability fosters international alliances. |

| Partnerships | 55+ nations via Artemis Accords; heavy private involvement (SpaceX, Blue Origin). | Russia, Pakistan; potential EU ties, but more insular. | US model boosts commercial investment ($3B+ VC in 2025); China prioritizes sovereign tech sovereignty. |

| Tech Focus | Reusable landers, ISRU for fuel; nuclear reactors via Kilopower. | Robotic bases, helium-3 mining prototypes; LEO station experience. | Complementary strengths: US in scalability, China in endurance for mining ops. |

| Budget & Investment | $93B over 5 years; 78% private sector share in space economy. | $15B annually; state-funded with growing private pilots. | US attracts global capital; China enables rapid deployment, projecting $100B joint market by 2035. |

| Challenges | Delays from contractor issues; geopolitical exclusions. | Tech gaps in reusability; Western sanctions on components. | Pushes innovation but risks fragmented economy without shared standards. |

This comparison underscores a potential for hybrid models, where US commercial agility meets China’s execution, unlocking trillions in shared lunar value.

FAQ 13: What Role Does AI and Robotics Play in the 2025 Lunar Economy?

AI and robotics are the unsung architects of the 2025 lunar economy, handling everything from autonomous mining to habitat construction with precision that humans can’t match in the Moon’s unforgiving vacuum. NASA’s Lunar Surface Innovation Initiative showcased AI-driven rovers navigating shadowed craters, using machine learning to map water ice deposits in real-time, a feat that slashed exploration costs by 30% in recent demos. Elon Musk’s vision of AI-orchestrated lunar bases, where robots commute daily for maintenance, highlights how these techs enable scalable operations without constant Earth oversight.

The market for space robotics is exploding, valued at $6.1 billion in 2025 and projected to double by 2034, fueled by applications in orbital repairs and planetary digs. Key advancements include:

- Autonomous Swarms: GITAI’s arms assemble structures from regolith, integrating AI for adaptive pathfinding amid dust storms.

- Predictive Analytics: Systems like Vast’s AI twins forecast equipment failures, boosting uptime for helium-3 extractors.

- Human-Robot Teaming: Lockheed’s rovers pair with astronauts via neural interfaces, enhancing safety in radiation zones.

- Economic Multipliers: Georgia Tech’s Lunar Lab demos show robotics cutting labor needs by 70%, freeing capital for tourism ventures.

These integrations aren’t futuristic—they’re operational now, weaving AI into the fabric of aerospace logistics and turning lunar outposts into profit centers.

FAQ 14: What Opportunities Does Lunar Tourism Offer in the Lunar Economy?

Lunar tourism is emerging as the glamorous face of the lunar economy, blending adventure with economic upside as aerospace firms gear up for paying passengers beyond suborbital joyrides. In 2025, NASA’s Space Tech missions to the Moon’s near side teased the possibilities, with private outfits like SpaceX planning flybys that could host 250-400 spacefarers annually by year’s end. Picture this: ultra-high-net-worth individuals orbiting the Moon, gazing at Earthrise, all facilitated by reusable Starships that drop costs from millions to hundreds of thousands per ticket.

The appeal goes deeper than selfies—tourism funds infrastructure, like inflatable habitats from Sierra Space that double as hotels, complete with zero-G spas and guided rover tours of helium-3 mines. By 2030, experts forecast a $1 trillion slice of the space travel pie, with lunar stays generating revenue for on-site manufacturing and research labs. Challenges like radiation shielding are being tackled via regolith bricks, ensuring safe, multi-day excursions. For the industry, it’s a virtuous cycle: tourist dollars bankroll mining ops, which in turn power the very rockets that bring visitors back. As World Monuments Fund flags the Moon’s heritage status, tourism also promotes stewardship, turning economic booms into cultural treasures.

FAQ 15: What Is the Role of Aerospace in Lunar Manufacturing?

Aerospace engineering is the backbone of lunar manufacturing, adapting Earth-proven tech like 3D printing and composites to craft everything from solar arrays to rocket parts in the Moon’s microgravity sweet spot. Firefly Aerospace’s propulsion manufacturing engineers are pioneering composite fabrication for landers, ensuring lightweight yet durable components that withstand lunar dust abrasion. This isn’t hobbyist stuff—it’s a burgeoning sector where vacuum conditions yield purer alloys, slashing defects by up to 50%.

The CLPS initiative amplifies this, delivering payloads that test in-situ factories, from ICON’s regolith printers to Redwire’s orbital forges. Here’s a snapshot of key contributions:

| Manufacturing Area | Aerospace Contributor | 2025 Innovation | Economic Benefit |

|---|---|---|---|

| Composites & Structures | Blue Origin/Firefly | Tooling for habitat panels from lunar soil. | Reduces Earth shipments by 80%, saving $500M annually. |

| Propulsion Components | SpaceX/Lockheed | Additive manufacturing of Raptor nozzles. | Enables on-Moon fuel production, fueling $10B transport market. |

| Electronics & Optics | CisLunar Industries | ZBLAN fibers in vacuum labs. | 10x data speeds for comms, worth $1T globally. |

| Robotic Assembly | GITAI/NASA | AI arms for satellite builds. | Cuts assembly time 40%, boosting output for solar power exports. |

As reviews like those in Progress in Aerospace Sciences note, lunar-based manufacturing could hit $20 billion by 2035, with aerospace firms leading the charge.

FAQ 16: What Are the Legal Aspects of Lunar Resource Ownership in 2025?

Navigating lunar resource ownership in 2025 feels like drafting rules for a new frontier town—exciting yet fraught with gray areas that could make or break the economy. The Artemis Accords, now with 55 signatories, affirm that extracted resources like water ice are fair game for commercial use, without claiming sovereignty over the Moon itself, a stance echoed in the US Space Act but clashing with the 1979 Moon Agreement’s common heritage clause. Only 17 nations back the latter, leaving a patchwork where private firms like ispace license ops domestically while eyeing international sales.

Key legal threads include:

- Extraction Rights: National laws in the US, Luxembourg, and UAE grant ownership post-harvest, fueling $3 billion in helium-3 deals, but UN working groups push for equitable principles to avoid “space colonialism.”

- Safety Zones: Proposals for 100-km buffers around mines prevent interference, as outlined in recent Chinese Journal of International Law papers, safeguarding investments.

- Dispute Resolution: No global court exists, so bilateral pacts via the Accords fill gaps, with calls for a dedicated tribunal by 2030.

- Intellectual Property: Patents for ISRU tech, like LH3M’s five new ones, protect innovations but spark debates on shared tech for sustainability.

As missions ramp up, these frameworks evolve, balancing profit with planetary protection to ensure the lunar economy lifts all boats.

FAQ 17: How Does Aerospace Ensure Health and Safety for Lunar Workers?

Aerospace’s commitment to health and safety for lunar workers is a high-stakes priority, blending cutting-edge suits, habitats, and protocols to shield against radiation, dust, and isolation in ways that echo Apollo but amplified for long-haul stays. NASA’s Crew Health and Safety program, updated in 2025, mandates comprehensive occupational health, from pre-mission fitness regimes to real-time biomonitoring via Orion’s integrated sensors. This holistic approach addresses not just physical threats—like low gravity’s bone loss mitigated by centrifugal exercise modules—but psychological strains, with AI companions providing virtual therapy.

Firefly and Blue Origin’s HSE specialists enforce standards akin to OSHA but space-hardened, including dust-repellent coatings on EVAs that cut inhalation risks by 90%. The Lunar Safe Haven concept proposes buried bunkers for solar storm shelters, while human factors engineering from HFES tackles ergonomics in rovers, preventing repetitive injuries. For civilians eyeing tourism, the Human Research Program extends these safeguards, ensuring commercial flights prioritize well-being. Ultimately, aerospace’s iterative testing—from analog missions in Hawaii to VR sims—turns potential hazards into managed routines, making lunar work as routine as offshore rigs.

FAQ 18: What Are the Environmental Impacts of Lunar Mining?

Lunar mining’s environmental footprint is a double-edged sword: it promises Earth-relief by offloading resource hunts, but risks scarring the Moon’s pristine surface if unchecked. In 2025, operations like Interlune’s helium-3 pilots stirred debates, with dust suspension from excavators potentially altering thermal balances and contaminating ice craters, as PNAS studies warn of gas releases that could tweak exospheres. Yet, low-impact tech like Magna Petra’s extractors minimize disruption, leaving regolith intact.

Global concerns amplify: developing nations fear replicated inequalities, per Lowy Institute analyses, while EU pushes for clean-energy mining to offset terrestrial pollution. Feasibility studies stress geological baselines for sustainable ops.

| Impact Area | Potential Risk | Mitigation Strategy | 2025 Example |

|---|---|---|---|

| Dust & Contamination | Suspended particles clogging gear, health hazards. | Electrostatic shields, closed-loop processing. | NASA’s CLPS demos reduced dust by 75%. |

| Thermal & Atmospheric Changes | Altered heat retention from excavations. | Solar concentrators for targeted heating. | Chang’e-6 site surveys informed low-footprint plans. |

| Biodiversity Loss | Disruption of microbial life in ice (if present). | Protected zones via Accords. | UN principles draft zones for heritage sites. |

| Earth Spillover | Orbital debris from failed hauls. | Reusable tugs with capture nets. | SpaceX’s 2025 tests cut failure rates 40%. |

These measures, as in FutureBridge reports, position mining as a net positive, easing Earth’s mineral crises while preserving lunar wilderness.

FAQ 19: How Will Helium-3 Drive Fusion Energy in the Lunar Economy?

Helium-3 is the lunar economy’s golden ticket to fusion energy, a rare isotope whose Moon-sourced bounty could power clean reactors without the meltdown fears of traditional nuclear. Valued at $20 million per kilogram, 2025 saw the US DOE snag three liters from lunar sims, kickstarting a market projected at $3 billion annually by 2035. Interlune’s rovers, heating regolith to liberate the gas, exemplify aerospace’s extraction edge, with LH3M’s patented refineries ensuring purity for quantum and medical apps too.

Fusion’s appeal lies in abundance: the Moon holds 1 million tons, enough for millennia of global power, per SpaceNews estimates. Key drivers include:

- Tech Readiness: Patented end-to-end systems from LH3M enable scalable hauls via Starship.

- Economic Incentives: DOE buys validate ROI, attracting $500M in VC for fusion startups.

- Geopolitical Shifts: China’s prototypes compete, but US leads in private fusion ties like Commonwealth Fusion.

- Sustainability Boost: Zero-carbon output aligns with EU green goals, exporting energy via microwave beams.

This fusion frontier isn’t hype—it’s the pathway to a $100 billion lunar export sector, where aerospace haulers turn dust into dynamos.

FAQ 20: How Is the Lunar Economy Creating Jobs on Earth?

The lunar economy’s ripple effects are creating a job bonanza on Earth, transforming aerospace hubs into innovation engines that employ thousands in everything from engineering to supply chains. In 2025, NASA’s Artemis alone is projected to generate 69,000 positions across the US, from Alabama’s rocket welders to California’s software coders for rover AI, injecting $14 billion into local economies. Private players amplify this: Firefly’s Texas facility added 200 manufacturing roles post-Blue Ghost landing, while Blue Origin’s Florida site trains machinists for lunar composites.

Beyond direct gigs, the boom fosters ancillary growth—logistics firms handle propellant shipments, and universities like Georgia Tech spin out lunar labs employing grads in regolith sims. Europe’s ESA reports 10,000 new jobs in comms and navigation, underscoring global spread. Challenges like skill gaps are met with apprenticeships, ensuring inclusive access. This isn’t zero-sum; lunar pursuits upskill workforces for green tech back home, from fusion plants to EV batteries, weaving space commerce into everyday prosperity. As PwC notes, the full space economy could hit $1.8 trillion by 2035, with lunar leads creating pathways for millions.

Acknowledgments

This article on the transformative role of aerospace in forging a lunar economy would not have been possible without the invaluable contributions from a diverse array of reputable organizations, publications, and research institutions dedicated to space exploration and innovation. Their rigorous reports, forward-looking analyses, and real-time mission updates provided the foundational data, projections, and visionary perspectives that shaped our narrative—from the mechanics of reusable landers to the economic potential of helium-3 mining. I am deeply grateful to these sources for their commitment to advancing humanity’s cosmic ambitions, fostering a collaborative ecosystem that turns lunar dust into dollars and dreams into destinations.

- NASA (https://www.nasa.gov): Offered detailed overviews of the Artemis program, including timelines for human landings and in-situ resource utilization technologies essential for sustainable lunar operations.

- The Aerospace Corporation (https://aerospace.org): Delivered expert insights on cislunar navigation frameworks and the evolution of digital commons for space innovation, highlighting autonomous systems for economic scalability.

- Viasat (https://www.viasat.com): Provided projections on the lunar economy’s $170 billion valuation by 2045, emphasizing quantum communication breakthroughs for resource trade.

- AIAA (American Institute of Aeronautics and Astronautics) (https://www.aiaa.org): Analyzed the dependency on government funding for lunar booms and the path to private investment in moon missions.

- Payload Space (https://payloadspace.com): Explored sustainability strategies in lunar development, including transparency in resource management and environmental guidelines.

- Space Foundation (https://www.spacefoundation.org): Reported on the $613 billion global space economy in 2024, with spotlights on lunar operations and cislunar opportunities from companies like Firefly Aerospace.

- Lockheed Martin (https://www.lockheedmartin.com): Outlined 2025 space technology trends, focusing on Artemis collaborations and the growth of a global lunar community.

- ScienceDirect (https://www.sciencedirect.com): Published peer-reviewed articles on space science’s economic impacts, detailing government and private investments in lunar programs.

- SSC Space (https://sscspace.com): Covered feasibility of lunar missions, including Firefly Aerospace’s historic 2025 Blue Ghost landing and its implications for commercial access.

- ResearchGate (https://www.researchgate.net): Hosted deep dives into the in-space economy of 2025, analyzing transportation vehicles and reentry tech for lunar supply chains.

- Area Development (https://www.areadevelopment.com): Featured interviews with Astrobotic’s CEO on site selection for lunar bases, underscoring the real estate parallels in economic development.

- Air University Press (https://www.airuniversity.af.edu): Authored the Commercial Lunar Economy Field Guide, envisioning industry visions for the Moon over the next decade.

- ESA (European Space Agency) (https://www.esa.int): Released the 2025 Space Economy Report, updating global trends and Europe’s role in lunar infrastructure.

- Grand Forks Herald (https://www.grandforksherald.com): Reported on the 2025 Space Operations Summit, discussing lunar missions, space stations, and aerospace education advancements.

- CNBC (https://www.cnbc.com): Covered NASA updates on SpaceX and Blue Origin’s accelerated Moon mission plans, including contract bids for faster astronaut returns.

- CSIS (Center for Strategic and International Studies) (https://www.csis.org): Analyzed Blue Origin’s New Glenn launches and their strategic importance to the U.S. space industrial base.

- The New York Times (https://www.nytimes.com): Detailed NASA’s contingency plans for Moon landers from SpaceX and Blue Origin, addressing delays in Artemis III.

- Scientific American (https://www.scientificamerican.com): Explored Blue Origin’s Mars-related launches as competitive dynamics in the broader space economy.

- NASASpaceflight.com (https://www.nasaspaceflight.com): Discussed diversified space economies and Blue Origin’s visions for 2030 lunar and beyond infrastructure.

- RAND Corporation (https://www.rand.org): Assessed NASA’s lunar ambitions, including funding allocations to SpaceX and Blue Origin for lander development.

- SpaceX (https://www.spacex.com): Shared updates on Starship’s role in Artemis human landing systems and simplified mission architectures for lunar transport.

- Blue Origin (https://www.blueorigin.com): Provided details on Blue Moon landers for VIPER rover delivery and sustainable propulsion for south pole missions.

- PwC (https://www.pwc.com): Forecasted space economy growth to $1.8 trillion by 2035, with lunar segments driving investment in mining and tourism.

- DARPA (https://www.darpa.mil): Contributed to field guides on commercial lunar architectures, focusing on phased investments for resource extraction.

- Interlune (https://www.interlune.space): Detailed helium-3 extraction pilots and DOE procurement deals, validating fusion energy markets from lunar sources.