Break-even analysis stands as a cornerstone tool in the world of small business finance, offering a clear snapshot of when your revenues will finally cover all your expenses. Imagine launching a new venture or introducing a fresh product line; without understanding your break-even point, you’re essentially navigating in the dark.

This analysis reveals the exact sales volume where your business stops losing money and starts paving the way for profits. It’s not just about survival; it’s about strategic growth. For small business owners, grasping this concept can transform vague financial guesses into precise, actionable plans. Whether you’re a startup founder juggling limited resources or an established entrepreneur eyeing expansion, break-even analysis empowers you to make informed decisions that safeguard your bottom line.

Table of Contents

At its core, break-even analysis calculates the point where total revenues equal total costs, resulting in zero profit or loss. This equilibrium is crucial because any sales beyond this threshold translate directly into pure profit. For instance, if your break-even point is 500 units sold per month, selling 501 units means that extra sale contributes entirely to your earnings after covering all overheads. This tool isn’t reserved for large corporations; it’s particularly vital for small businesses where margins are tight and every dollar counts. By identifying this pivotal number, you can set realistic sales targets, adjust pricing strategies, and even negotiate better terms with suppliers to lower costs.

The beauty of break-even analysis lies in its simplicity, yet it packs a powerful punch for financial planning. It helps in forecasting how changes in costs or prices impact your profitability, allowing you to simulate various scenarios before committing resources. Small businesses often operate on thin margins, so knowing your break-even point can be the difference between thriving and merely surviving. It’s a proactive approach that aligns your operations with financial realities, ensuring you’re not caught off guard by unexpected expenses or market shifts.

What Is Break-Even Analysis and Why Does It Matter?

Break-even analysis is a financial calculation that determines the number of products or services you need to sell to cover your costs exactly. Once you hit this point, every additional sale generates profit. This concept is rooted in basic accounting principles, separating costs into fixed and variable categories to pinpoint where income balances outgoings. Fixed costs remain constant regardless of production levels, such as rent, salaries for administrative staff, and insurance premiums. Variable costs, on the other hand, fluctuate with output, including raw materials, direct labor, and shipping fees.

Why does this matter for small businesses? In a competitive landscape, understanding your break-even point provides a safety net. It informs critical decisions like whether to invest in new equipment or hire more staff. For example, if you’re running a boutique coffee shop, calculating break-even might reveal you need to sell 200 cups daily to cover utilities, beans, and barista wages. Falling short means dipping into reserves; exceeding it builds your nest egg. This analysis also highlights inefficiencies; if variable costs are too high, it signals a need to source cheaper suppliers or streamline production.

Moreover, break-even analysis fosters confidence when seeking external funding. Lenders and investors scrutinize your financial projections, and presenting a solid break-even calculation demonstrates fiscal responsibility. It shows you’ve thought through the viability of your business model, making your pitch more compelling. In essence, it’s a roadmap that guides you from potential losses to sustainable profits, adapting to economic changes like inflation or supply chain disruptions.

The Importance of Break-Even Analysis in Financial Planning

Incorporating break-even analysis into your financial planning arsenal offers multifaceted benefits. First, it aids in efficient pricing for new products. By knowing your costs, you can set prices that not only cover expenses but also yield desired margins. For a small artisan bakery introducing gluten-free muffins, the analysis might show a break-even at $4 per unit, allowing you to price at $6 for a healthy profit while remaining competitive.

Second, it shapes overall cash flow and profit strategies. You can evaluate product lines individually, deciding which to promote or discontinue based on their break-even points. A clothing retailer might discover that seasonal scarves have a lower break-even than year-round t-shirts, prompting a shift in inventory focus. This granular insight ensures resources are allocated where they generate the most return.

Third, when planning for financing, break-even figures strengthen your case for loans or investments. Banks appreciate seeing how quickly you’ll recoup funds, reducing perceived risk. If your analysis projects a break-even within six months, it reassures lenders of your venture’s potential. Additionally, it helps in budgeting for expansions, like opening a second location, by forecasting the additional sales needed to offset new fixed costs.

Beyond these, break-even analysis encourages scenario planning. What if material costs rise by 10 percent? Or if demand drops due to economic downturns? By tweaking variables, you prepare contingency plans, enhancing resilience. It’s a dynamic tool that evolves with your business, providing ongoing value in uncertain markets.

Gathering Essential Information for Your Break-Even Analysis

Before diving into calculations, compile accurate data to ensure reliable results. Start by listing all costs related to your product or service. For a potential new gadget in a tech startup, this includes facility rents, material supplies, machinery maintenance, and employee wages for assembly and packaging.

Next, outline your pricing range, beginning from zero to explore various possibilities. Similarly, estimate sales quantities from none upward, helping visualize scalability. Crucially, distinguish between fixed and variable costs. Fixed costs persist even without sales, like office utilities or loan repayments. Variable costs tie directly to production, such as components per unit or commissions on sales.

To gather this, review financial statements, consult suppliers for quotes, and analyze past sales data. If launching something novel, market research can inform quantity estimates. Accuracy here is key; underestimating costs could lead to unrealistic break-even points, derailing your plans. Tools like spreadsheets simplify organization, allowing easy updates as new information emerges.

Step-by-Step Guide to Performing a Break-Even Analysis

Creating a break-even analysis involves a systematic approach that demystifies the process. Follow these detailed steps to build yours from scratch.

Step 1: Calculate Variable Unit Costs

Begin by determining the variable costs per unit. These are expenses incurred for each item produced or sold. For a handmade jewelry business, this might include beads at $2, wire at $1, and labor at $3 per piece, totaling $6. Sum all direct costs accurately, as they directly affect your margin.

Step 2: Identify Fixed Costs

Tally your fixed costs, which don’t vary with output. Examples include monthly rent of $1,000, insurance at $200, and salaries for non-production staff at $3,000. Add everything needed to keep operations running, even at zero sales. This figure forms the baseline you must cover.

Step 3: Set the Unit Selling Price

Decide on your product’s price. Research competitors and consider value perception. If variable costs are $6 and you aim for profit, a $15 price might work. Test different prices to see how they shift break-even.

Step 4: Estimate Sales Volume and Adjust Prices

Project sales volumes based on market analysis. Start low and scale up. The break-even will fluctuate with these variables, revealing optimal combinations.

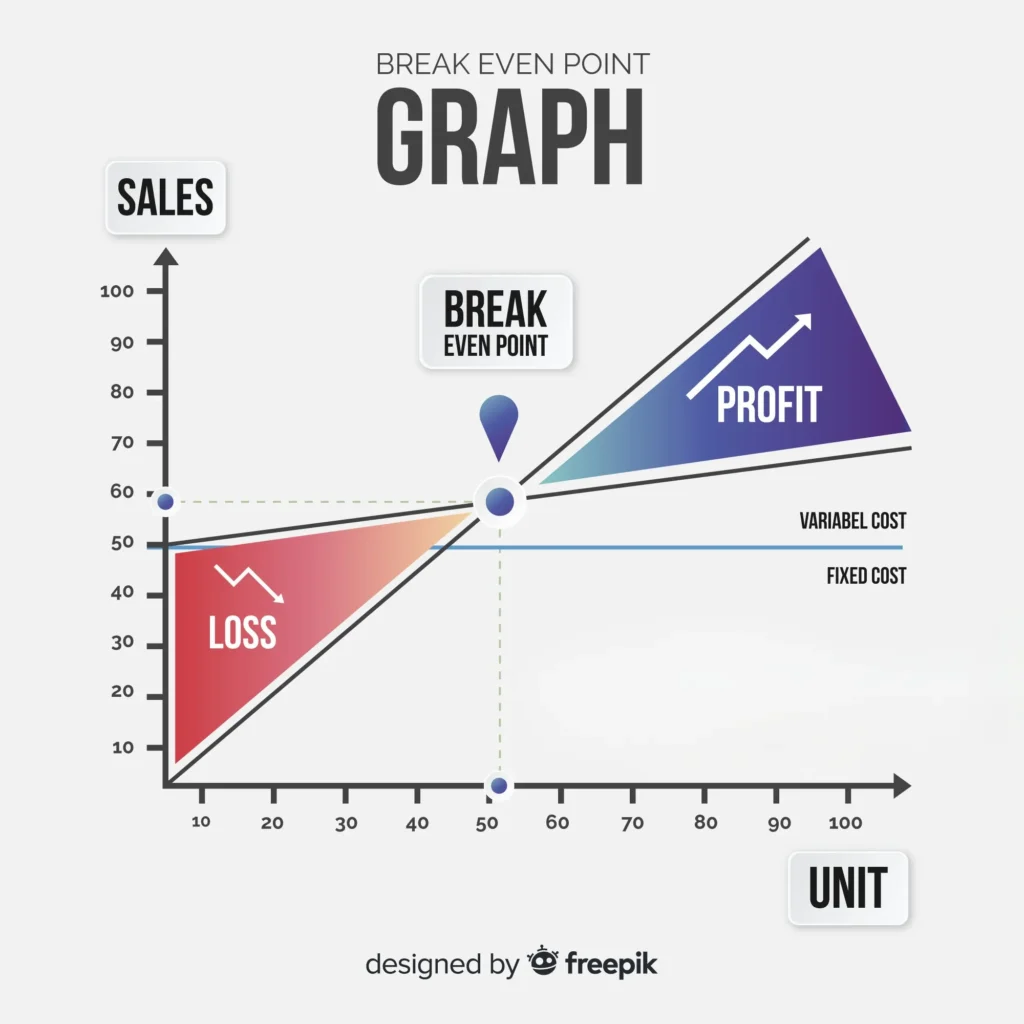

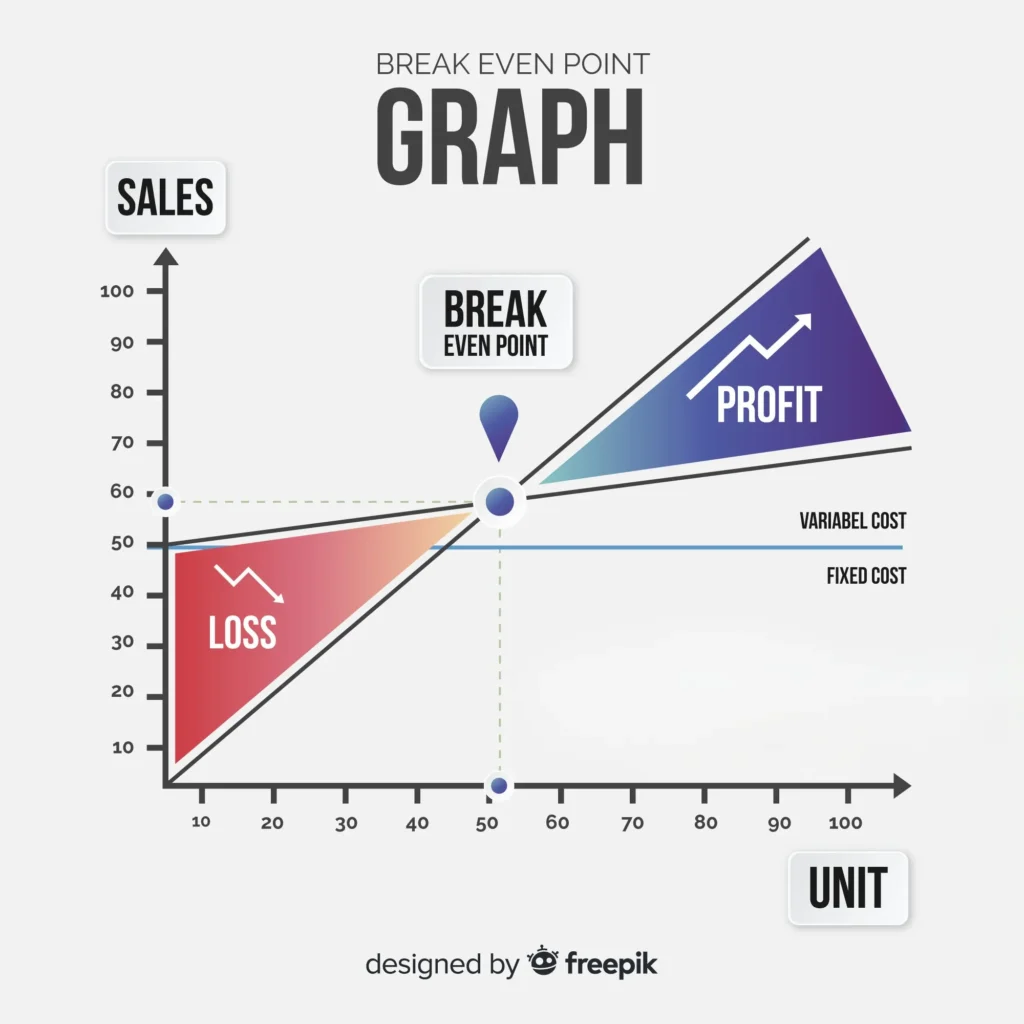

Step 5: Build a Spreadsheet and Generate a Graph

Use spreadsheet software to input data. Create columns for units sold, total variable costs, total fixed costs, total costs, and revenues. Plot these on a graph with costs and revenues as lines; their intersection is your break-even point.

Step 6: Apply the Break-Even Formula

The core formula is Break-Even Quantity = Fixed Costs / (Sales Price per Unit – Variable Cost per Unit). For fixed costs of $5,000, price of $20, and variables of $10, it’s 5,000 / (20 – 10) = 500 units.

Step 7: Analyze and Iterate

Review results and simulate changes. Lower variables? Raise prices? This step refines your strategy.

The Break-Even Formula Explained in Depth

The fundamental break-even formula is straightforward yet versatile: Break-Even Point in Units = Fixed Costs Divided by (Selling Price per Unit Minus Variable Cost per Unit). This contribution margin approach highlights how much each sale contributes to covering fixed costs.

For dollars, it’s Break-Even Sales = Fixed Costs / Contribution Margin Ratio, where the ratio is (Selling Price – Variable Cost) / Selling Price. These formulas adapt to different needs, like service-based businesses focusing on hours billed.

Real-World Applications and Examples of Break-Even Analysis

Let’s explore practical examples to illustrate application.

Example 1: Coffee Shop Startup

A new cafe has fixed costs of $4,000 monthly (rent, utilities). Variable costs per cup are $1 (beans, milk). Selling at $4, break-even is 4,000 / (4 – 1) = 1,333 cups, or about 44 daily. This guides staffing and marketing.

Example 2: Online T-Shirt Business

Fixed costs: $2,000 (website, ads). Variables: $8 per shirt. Price: $25. Break-even: 2,000 / (25 – 8) = 118 shirts. Scaling to 200 shirts yields profit.

Example 3: Restaurant Expansion

A bistro adding delivery: Extra fixed costs $1,500 (vehicles). Variables $10 per meal. Price $30. Additional break-even: 1,500 / (30 – 10) = 75 meals, justifying the move if demand exists.

Example 4: Tech Gadget Launch

A startup’s smartwatch: Fixed $50,000 (R&D, factory). Variables $40. Price $100. Break-even: 50,000 / (100 – 40) = 833 units. Market research confirms feasibility.

These scenarios show versatility across industries.

Advantages of Using Break-Even Analysis

Break-even analysis boasts several strengths that make it indispensable.

It provides a solid foundation for pricing decisions, ensuring prices cover costs while remaining attractive.

It helps set realistic revenue targets, guiding sales teams toward achievable goals.

By separating costs, it identifies areas for efficiency, like negotiating better supplier deals.

It supports risk assessment for new ventures, quantifying what’s needed for success.

In funding pitches, it demonstrates financial acumen, boosting credibility.

It facilitates what-if scenarios, preparing for changes in market conditions.

Overall, it simplifies complex finances into digestible insights.

Disadvantages and Limitations to Consider

Despite benefits, break-even analysis has drawbacks.

It assumes costs and prices remain constant, ignoring fluctuations from economies of scale or inflation.

It presumes all produced units sell, overlooking inventory buildup or demand variability.

The model is linear, not accounting for stepped costs like additional machinery at certain volumes.

It focuses solely on costs and revenues, neglecting factors like competition or customer preferences.

Data accuracy is crucial; errors in estimates lead to misleading results.

It’s a static snapshot, requiring regular updates for dynamic businesses.

Recognizing these helps use it alongside other tools for balanced planning.

How to Create a Break-Even Chart in Excel

Excel makes visualizing break-even intuitive. Start by setting up a data table.

Enter fixed costs in one cell, say B1: 5000.

In column A, list units from 0 to 1000 in increments of 100.

Column B: Total Fixed Costs = $B$1 for each row.

Column C: Total Variable Costs = Units * Variable Cost (e.g., 10).

Column D: Total Costs = B + C.

Column E: Revenue = Units * Selling Price (e.g., 20).

Select data, insert a line chart. Lines for total costs and revenue intersect at break-even.

Use Goal Seek under Data > What-If Analysis to find exact units by setting profit to zero.

This visual aid clarifies impacts of changes.

Advanced Tips for Optimizing Your Break-Even Analysis

To elevate your analysis, incorporate sensitivity testing. Vary assumptions by 10-20 percent to see resilience.

Consider multiple products? Calculate break-even for each, then aggregate for overall picture.

Integrate with cash flow forecasts to account for timing of expenses and receipts.

For seasonal businesses, compute monthly break-evens to manage off-peak periods.

Leverage software add-ons for automated charts and scenarios.

Regularly review and update data to reflect real-world changes.

These tips transform basic analysis into a strategic powerhouse.

Comprehensive Break-Even Calculation Table for a Sample Bakery Business

| Units Sold | Fixed Costs | Variable Costs (per Unit $5) | Total Variable Costs | Total Costs | Revenue (per Unit $15) | Profit/Loss |

|---|---|---|---|---|---|---|

| 0 | 3000 | 5 | 0 | 3000 | 0 | -3000 |

| 100 | 3000 | 5 | 500 | 3500 | 1500 | -2000 |

| 200 | 3000 | 5 | 1000 | 4000 | 3000 | -1000 |

| 300 | 3000 | 5 | 1500 | 4500 | 4500 | 0 |

| 400 | 3000 | 5 | 2000 | 5000 | 6000 | 1000 |

| 500 | 3000 | 5 | 2500 | 5500 | 7500 | 2000 |

| 600 | 3000 | 5 | 3000 | 6000 | 9000 | 3000 |

| 700 | 3000 | 5 | 3500 | 6500 | 10500 | 4000 |

| 800 | 3000 | 5 | 4000 | 7000 | 12000 | 5000 |

| 900 | 3000 | 5 | 4500 | 7500 | 13500 | 6000 |

| 1000 | 3000 | 5 | 5000 | 8000 | 15000 | 7000 |

This table shows break-even at 300 units, where profit turns positive.

Scenario Comparison Table: Impact of Cost Changes on Break-Even

| Scenario Description | Fixed Costs | Variable Cost per Unit | Selling Price per Unit | Break-Even Units | Margin of Safety (at 500 Units Sales) |

|---|---|---|---|---|---|

| Base Case | 5000 | 10 | 20 | 500 | 0 |

| Reduced Variables by 20% | 5000 | 8 | 20 | 417 | 83 Units |

| Increased Fixed Costs by 10% | 5500 | 10 | 20 | 550 | -50 Units (Loss) |

| Price Hike by 15% | 5000 | 10 | 23 | 385 | 115 Units |

| Combined: Lower Variables + Higher Price | 5000 | 8 | 23 | 333 | 167 Units |

| High Demand Projection | 5000 | 10 | 20 | 500 | 200 Units (at 700 Sales) |

| Economic Downturn: Higher Variables | 5000 | 12 | 20 | 625 | -125 Units |

| Expansion: Added Fixed Costs | 7000 | 10 | 20 | 700 | -200 Units |

| Efficiency Gains: Lower Fixed | 4000 | 10 | 20 | 400 | 100 Units |

| Competitive Pricing Drop | 5000 | 10 | 18 | 625 | -125 Units |

| Bulk Purchasing: Lower Variables | 5000 | 9 | 20 | 455 | 45 Units |

This extensive table compares scenarios, illustrating how adjustments affect break-even and safety margins.

Analyzing Your Break-Even Results: Key Insights and Actions

Once calculated, interpret your break-even chart deeply. The intersection point is your target; below it, losses accrue; above, profits grow. Examine slopes: Steeper revenue lines indicate higher margins.

Test price sensitivity: Higher prices lower break-even but may reduce demand. Lower prices increase volume needs but could boost market share.

Assess cost reductions: Cutting fixed costs shifts the line down, easing break-even. Variable tweaks widen margins.

Volume impacts: Higher output might trigger economies, lowering per-unit costs – factor this in advanced models.

Use for long-term planning: Project multi-year break-evens to align with growth goals.

Common Mistakes to Avoid in Break-Even Analysis

Overlooking indirect costs leads to underestimated break-even.

Ignoring market demand assumes unlimited sales.

Failing to update for changes renders analysis obsolete.

Confusing cash flow with break-even; the latter doesn’t account for payment timings.

Relying solely on it without qualitative factors like branding.

Avoid these for more accurate outcomes.

Integrating Break-Even with Other Financial Tools

Pair break-even with profit and loss statements for comprehensive views.

Combine with ROI calculations for investment decisions.

Use alongside budgeting to monitor progress.

Incorporate into SWOT analysis for strategic depth.

This integration maximizes utility.

Conclusion

Mastering break-even analysis equips you with the knowledge to steer your small business toward profitability and sustainability. By regularly performing this analysis, you not only mitigate risks but also uncover opportunities for growth. Remember, it’s a living tool – revisit and refine it as your business evolves. With practice, you’ll turn financial uncertainties into confident strategies, setting the stage for lasting success.

Frequently Asked Questions

FAQ 1: What is a break-even analysis, and why is it important for small businesses?

A break-even analysis is a financial tool that helps small business owners determine the exact point at which their revenues equal their total costs, resulting in neither profit nor loss. This critical number, known as the break-even point, shows how many units of a product or service must be sold, or how much revenue is needed, to cover all expenses. For small businesses, understanding this point is vital because it acts as a financial compass, guiding pricing, sales targets, and cost management. Without it, you’re essentially guessing whether your business can sustain itself or grow.

This analysis is particularly valuable for small businesses operating on tight budgets. For example, if you run a small bakery, a break-even analysis tells you how many cupcakes you need to sell daily to cover rent, ingredients, and staff wages. Knowing this helps you set realistic goals and avoid financial pitfalls. It also provides clarity when making big decisions, like launching a new product or expanding operations, by showing whether the venture is financially viable. Beyond internal planning, presenting a break-even analysis to lenders or investors can strengthen your case for funding, as it demonstrates a clear grasp of your business’s financial health.

Moreover, break-even analysis fosters strategic flexibility. By tweaking variables like fixed costs (e.g., rent) or variable costs (e.g., materials), you can explore how changes impact profitability. This empowers you to adjust pricing or cut costs proactively, ensuring your business remains competitive in dynamic markets. Ultimately, it’s a straightforward yet powerful tool that transforms uncertainty into actionable insights for small business success.

FAQ 2: How do you calculate the break-even point for a small business?

Calculating the break-even point is a straightforward process that involves a simple formula and some key data about your business. The basic formula is: Break-Even Quantity = Fixed Costs / (Selling Price per Unit – Variable Cost per Unit). This tells you how many units you need to sell to cover all costs. To perform this calculation, you need to gather three pieces of information: your fixed costs, variable costs per unit, and the selling price per unit. Let’s break it down step by step.

First, identify your fixed costs, which are expenses that stay constant regardless of how much you produce, such as rent, utilities, or salaries for non-production staff. For example, a small coffee shop might have fixed costs of $3,000 per month. Next, determine the variable cost per unit, which includes costs tied directly to producing each item, like coffee beans or cups, say $1 per cup. Then, set your selling price per unit, such as $4 per cup. Using the formula, the break-even point would be $3,000 / ($4 – $1) = 1,000 cups per month. This means selling 1,000 cups covers all costs.

To make this calculation practical, use a spreadsheet to input different scenarios, such as varying prices or cost reductions, to see how they affect the break-even point. Creating a break-even chart visually maps costs against revenues, making it easier to spot the intersection point where profits begin. Regularly updating this data ensures your calculations reflect real-world changes, like rising supplier costs or seasonal sales fluctuations, keeping your business strategy sharp.

FAQ 3: What are fixed costs and variable costs in a break-even analysis?

In a break-even analysis, understanding the difference between fixed costs and variable costs is crucial because they form the foundation of your calculations. Fixed costs are expenses that remain constant regardless of how many products or services you sell. These include things like rent, insurance, utilities, and salaries for administrative staff. For instance, a small retail store pays $2,000 monthly in rent whether it sells 10 items or 1,000. These costs are unavoidable and must be covered even if sales are zero.

Variable costs, on the other hand, fluctuate based on production or sales volume. These are costs directly tied to creating or delivering your product, such as raw materials, packaging, or labor for production. For example, a candle-making business might spend $3 on wax and wicks per candle. If they produce 100 candles, the variable cost is $300, but if they produce 200, it doubles to $600. Accurately separating these costs ensures your break-even point is precise, as misclassifying them can skew results.

Why does this distinction matter? In the break-even formula, variable costs reduce the contribution margin (selling price minus variable cost per unit), which determines how quickly you cover fixed costs. By analyzing both, you can identify opportunities to lower expenses—perhaps negotiating cheaper rent (fixed) or sourcing less expensive materials (variable). This clarity helps small businesses optimize operations and reach profitability faster.

FAQ 4: How can break-even analysis help with pricing a new product?

Pricing a new product can feel like a guessing game, but a break-even analysis provides a data-driven approach to set prices that ensure profitability. By calculating the break-even point, you determine the minimum sales volume needed to cover costs at different price points, helping you find a sweet spot that balances affordability for customers and profit for your business. This process starts with understanding your fixed costs and variable costs, then testing various selling prices to see their impact.

For example, imagine you’re launching a handmade soap line. Your fixed costs (rent, equipment) are $1,500 monthly, and variable costs (oils, molds) are $2 per bar. If you price the soap at $6, the break-even point is $1,500 / ($6 – $2) = 375 bars. Testing a higher price, say $8, lowers the break-even to $1,500 / ($8 – $2) = 250 bars, but you must consider if customers will pay more. A break-even analysis lets you experiment with these scenarios to find a price that’s competitive yet profitable.

Beyond setting an initial price, this analysis helps you respond to market changes. If competitors lower prices, you can recalculate to see how adjusting your price or reducing costs affects your break-even point. It also highlights the importance of contribution margin, ensuring each sale contributes enough to cover fixed costs quickly. By grounding pricing decisions in data, you avoid underpricing that erodes profits or overpricing that deters customers.

FAQ 5: What are the benefits of using break-even analysis for small businesses?

Break-even analysis offers small businesses a range of benefits that simplify financial planning and boost strategic decision-making. First and foremost, it provides clarity on the minimum sales needed to avoid losses, giving you a clear target to aim for. This is especially helpful for startups or businesses launching new products, where resources are limited, and every sale counts. By knowing your break-even point, you can set realistic goals for sales teams or marketing campaigns.

Another key benefit is its role in pricing strategies. The analysis helps you understand how different price points affect the number of units you need to sell, ensuring prices are both competitive and profitable. It also aids in cost management by highlighting whether fixed or variable costs are too high, prompting actions like negotiating supplier deals or streamlining operations. For instance, a small gym might discover that lowering utility costs reduces its break-even point, making profitability easier to achieve.

Additionally, break-even analysis enhances credibility with lenders and investors. Including it in your business plan shows you’ve done the math to ensure viability, making it easier to secure funding. It also supports scenario planning, letting you test what happens if costs rise or demand drops. This proactive approach builds resilience, helping small businesses navigate economic uncertainties with confidence and precision.

FAQ 6: What are the limitations of break-even analysis for small businesses?

While break-even analysis is a powerful tool, it has limitations that small business owners should understand to use it effectively. One major drawback is its assumption that costs and prices remain constant. In reality, variable costs like raw materials can fluctuate due to supply chain issues, and fixed costs like rent may increase over time. This can make the break-even point less accurate if not updated regularly.

Another limitation is that it assumes all units produced are sold, which isn’t always the case. For example, a clothing boutique might produce 500 shirts but only sell 300 due to low demand, leaving unsold inventory that ties up capital. The analysis also follows a linear model, ignoring stepped costs—like needing new equipment after reaching a certain production level—which can complicate real-world scenarios.

Additionally, break-even analysis focuses solely on costs and revenues, overlooking qualitative factors like competition, customer preferences, or brand strength. For instance, a unique product might command a higher price, but the analysis won’t account for market perception. To overcome these limitations, pair break-even analysis with other tools like market research or cash flow projections for a more holistic view of your business’s financial health.

FAQ 7: How do you create a break-even chart for a small business?

Creating a break-even chart is an excellent way to visualize when your small business will start making a profit. This chart plots your total costs (fixed plus variable) against revenues, with the intersection point showing the break-even point. Using spreadsheet software like Excel makes this process accessible, even for those with basic tech skills. Here’s how to do it.

Start by gathering your data: fixed costs (e.g., $4,000 monthly for a pet store), variable costs per unit (e.g., $5 per pet toy), and selling price per unit (e.g., $15). In a spreadsheet, create a table with columns for units sold (from 0 to, say, 1,000), total fixed costs (constant at $4,000), total variable costs (units × $5), total costs (fixed + variable), and revenue (units × $15). Plot two lines on a graph: one for total costs and one for revenue. The point where they cross is your break-even point—in this case, $4,000 / ($15 – $5) = 400 toys.

This visual tool is powerful because it shows how changes in price or costs shift the break-even point. For example, reducing variable costs to $4 lowers the break-even to 364 units, making profitability easier. Regularly update the chart with real data to keep it relevant, and use features like Excel’s Goal Seek to pinpoint exact break-even units. This approach makes complex financial data easy to understand and act upon.

FAQ 8: How can break-even analysis assist with securing business financing?

When seeking business financing, whether from a bank loan or an investor, a break-even analysis can significantly strengthen your pitch. It demonstrates to lenders that you’ve thoroughly analyzed your business’s financial viability, showing exactly how many sales are needed to cover costs and start generating profit. This clarity reduces perceived risk, making funders more likely to support your venture.

For example, if you’re opening a fitness studio, your analysis might show a break-even point of 200 memberships at $50 each, covering $10,000 in monthly fixed costs and $10 in variable costs per member. Presenting this in your business plan illustrates a clear path to profitability, reassuring lenders that you can repay a loan. It also helps justify your funding request by tying it to specific needs, like covering initial fixed costs until sales ramp up.

Additionally, break-even analysis allows you to present scenario analyses to investors, showing how you’ll handle challenges like rising costs or slower-than-expected sales. This proactive approach builds trust, as it shows you’re prepared for various outcomes. By including a break-even chart, you make your financial projections visually compelling, further enhancing your credibility and increasing your chances of securing the funds needed to grow.

FAQ 9: Can break-even analysis be used for service-based businesses?

Absolutely, break-even analysis is just as valuable for service-based businesses as it is for product-based ones, though the approach differs slightly. Instead of focusing on physical units sold, service businesses calculate break-even based on service hours, clients, or projects. The core principle remains: determine the point where revenues cover all fixed costs and variable costs, allowing you to plan effectively.

For example, a freelance graphic designer might have fixed costs of $2,000 monthly (software subscriptions, office space) and variable costs of $20 per project (printing, stock images). If they charge $100 per project, the break-even point is $2,000 / ($100 – $20) = 25 projects per month. Alternatively, they could calculate based on billable hours. If they charge $50 per hour and variable costs are $10 per hour, with fixed costs of $2,000, the break-even is $2,000 / ($50 – $10) = 50 hours.

This analysis helps service businesses set pricing, decide how many clients to take on, or evaluate whether to hire additional staff. It also highlights inefficiencies, like high software costs, prompting cost-saving measures. By adapting the break-even formula to hours or services, businesses like consultants, salons, or tutors can gain clear insights into their financial thresholds, ensuring sustainable operations.

FAQ 10: How often should a small business update its break-even analysis?

A break-even analysis isn’t a one-time task; it should be updated regularly to remain relevant as your small business evolves. The frequency depends on your business’s dynamics, but a good rule of thumb is to revisit it quarterly or whenever significant changes occur. This ensures your analysis reflects current costs, prices, and market conditions, keeping your financial planning accurate and actionable.

For instance, if a small restaurant sees a 10% increase in food costs due to inflation, its variable costs rise, pushing the break-even point higher. Without updating, the owner might underestimate the sales needed to stay profitable. Similarly, launching a new service, adjusting prices, or adding fixed costs like new equipment warrants a recalculation. Seasonal businesses, like holiday decor shops, may need monthly updates to account for fluctuating demand.

Regular updates also allow you to test new strategies. For example, if you lower prices to attract more customers, a fresh break-even analysis shows how many additional sales are needed to maintain profitability. By staying proactive, you can catch potential issues early, like rising costs eating into margins, and adjust your approach—whether by cutting expenses or boosting marketing—to keep your business on track for success.

FAQ 11: How can break-even analysis help small businesses manage cash flow?

A break-even analysis is a powerful tool for small businesses looking to maintain healthy cash flow, as it provides a clear picture of the sales needed to cover all expenses. By pinpointing the break-even point, where total revenues equal total costs, business owners can better understand the minimum income required to keep operations running without dipping into reserves. This insight is critical for cash flow management, especially for small businesses where liquidity is often tight. For instance, a small catering company can use the analysis to determine how many events it needs to book monthly to cover fixed costs like kitchen rent and variable costs like ingredients, ensuring it has enough cash to pay bills on time.

Beyond setting sales targets, break-even analysis helps businesses anticipate cash flow challenges. By calculating the number of units or services needed to break even, owners can align their cash inflows with outflows, avoiding shortfalls during slow periods. For example, a seasonal ice cream shop might discover it needs to sell 2,000 cones monthly to break even. If summer sales are strong but winter sales drop, the owner can plan ahead by saving surplus cash or diversifying offerings to maintain revenue. This proactive approach prevents cash crunches that could otherwise force reliance on loans or credit.

Additionally, the analysis encourages businesses to monitor and adjust costs to improve cash flow. By examining fixed costs like utilities or variable costs like packaging, owners can identify areas to cut expenses, freeing up cash for other needs. Regularly updating the break-even analysis ensures it reflects changes in costs or market conditions, keeping cash flow projections accurate. This dynamic tool empowers small businesses to stay financially stable, plan for growth, and avoid the stress of unexpected cash shortages.

FAQ 12: What role does break-even analysis play in launching a new product?

Launching a new product is a high-stakes decision for any small business, and a break-even analysis provides a roadmap to assess its financial viability. By calculating the break-even point, business owners can determine how many units of the new product must be sold to cover both fixed costs (like research and development) and variable costs (like materials). This clarity helps set realistic sales goals and informs pricing strategies to ensure the product generates profit. For example, a small tech startup developing a new gadget might find it needs to sell 1,000 units at $50 each to break even, guiding decisions on whether the market can support that volume.

The analysis also helps evaluate the risk of a new product launch. By testing different pricing scenarios, businesses can see how price changes affect the break-even point and profitability. A higher price might lower the number of units needed but could reduce demand, while a lower price might require higher sales volume. For instance, a boutique launching a new line of scarves can use the analysis to weigh whether a $30 price point is more feasible than $40 based on expected sales. This data-driven approach reduces the guesswork, helping owners make informed decisions about production and marketing investments.

Furthermore, break-even analysis supports resource allocation during a launch. By identifying the costs involved, businesses can prioritize spending on critical areas like advertising or packaging while cutting unnecessary expenses. It also provides a compelling case for investors or lenders, showing that the product has a clear path to profitability. By integrating break-even analysis into the launch strategy, small businesses can mitigate risks, optimize pricing, and increase the chances of a successful product rollout.

FAQ 13: How does break-even analysis differ for startups versus established businesses?

While both startups and established businesses benefit from break-even analysis, the application and context differ due to their unique financial landscapes. For startups, the analysis is often a critical tool for validating a business idea. With limited operating history and potentially high initial fixed costs (like equipment or office setup), startups use break-even analysis to determine whether their business model is sustainable. For example, a new yoga studio might calculate that it needs 150 monthly memberships to cover costs, helping the founder decide if the market can support that demand before committing funds.

Established businesses, on the other hand, use break-even analysis to optimize existing operations or evaluate growth opportunities, such as adding a new product line or expanding to a new location. These businesses typically have more data, like historical sales and cost trends, allowing for more accurate projections. For instance, a well-established bakery might use the analysis to decide whether introducing gluten-free pastries is profitable, leveraging past sales to estimate demand. Unlike startups, established businesses may also have higher fixed costs due to larger operations, which can raise the break-even point but provide economies of scale.

The mindset also differs: startups focus on survival, using the analysis to ensure they can stay afloat, while established businesses aim for efficiency and expansion. However, both benefit from the analysis’s ability to highlight cost structures and set clear financial targets. By tailoring the approach to their stage—whether forecasting for a new venture or refining an existing one—businesses can use break-even analysis to navigate their specific challenges and drive long-term success.

FAQ 14: How can break-even analysis inform marketing strategies for small businesses?

A break-even analysis is a game-changer for crafting effective marketing strategies, as it reveals the sales volume needed to cover costs, guiding how much to invest in promotional efforts. By understanding the break-even point, small business owners can set specific marketing goals to achieve or exceed that threshold. For example, a small pet store with a break-even point of 400 toys sold monthly at $15 each knows it needs to drive enough foot traffic to hit that target. This insight shapes marketing budgets, helping allocate funds to campaigns that boost sales efficiently.

The analysis also helps prioritize marketing channels. By calculating the contribution margin (selling price minus variable costs), businesses can determine how much profit each sale generates, allowing them to assess whether high-cost marketing, like social media ads, is worth the investment. For instance, if a coffee shop’s break-even analysis shows a high margin per cup, it might justify spending more on targeted ads to attract new customers. Conversely, a low margin might push the business toward low-cost strategies like email campaigns or local partnerships.

Additionally, break-even analysis supports campaign evaluation. By comparing actual sales post-campaign to the break-even point, businesses can measure marketing effectiveness. If a florist’s campaign generates sales far above the break-even point, it’s a sign to replicate that strategy; if not, it’s time to pivot. This data-driven approach ensures marketing efforts are aligned with financial goals, maximizing return on investment and driving sustainable growth for small businesses.

FAQ 15: Why is it important to separate fixed and variable costs in a break-even analysis?

Separating fixed costs and variable costs is the backbone of an accurate break-even analysis, as these two cost types behave differently and directly impact the calculation. Fixed costs, such as rent, insurance, or salaries for non-production staff, remain constant regardless of how much you produce or sell. In contrast, variable costs, like raw materials or shipping fees, scale with production volume. Properly distinguishing them ensures the break-even formula—fixed costs divided by the contribution margin—yields a reliable result. Misclassifying costs can lead to a skewed break-even point, misguiding business decisions.

For example, a small craft brewery might have fixed costs of $5,000 monthly for its facility and variable costs of $2 per bottle for ingredients. If it mistakenly treats ingredient costs as fixed, the break-even calculation will overestimate the sales needed, potentially causing the owner to overprice beers or overestimate demand. Accurate separation allows the brewery to see that selling 2,000 bottles at $5 each covers costs, guiding realistic pricing and production plans.

This distinction also informs cost-cutting strategies. By isolating fixed costs, businesses can negotiate long-term expenses like leases, while analyzing variable costs might reveal opportunities to source cheaper materials. This clarity empowers owners to optimize their cost structure, lower the break-even point, and reach profitability faster. Without this separation, the analysis loses its precision, risking financial missteps that could harm a small business’s viability.

FAQ 16: How can break-even analysis help small businesses during economic downturns?

During economic downturns, small businesses face challenges like reduced demand or rising costs, making break-even analysis an essential tool for survival. By calculating the break-even point, owners can quickly assess how many sales are needed to stay afloat under changing conditions. For instance, a boutique clothing store might find that a drop in customer spending increases its break-even point from 200 to 250 items monthly. This insight prompts immediate action, such as cutting costs or boosting promotions to maintain sales volume.

The analysis also helps businesses adapt to economic shifts by testing scenarios. If variable costs like materials rise due to supply chain issues, owners can recalculate the break-even point to see how it affects profitability. For example, a bakery facing higher flour prices might need to sell 10% more bread to break even, prompting a price adjustment or a search for cheaper suppliers. Similarly, if fixed costs like rent remain high but sales drop, the analysis highlights the urgency of negotiating with landlords or finding new revenue streams.

Moreover, break-even analysis provides a framework for strategic pivoting. During a recession, a restaurant might use it to evaluate offering takeout services, calculating whether the new revenue covers additional costs like delivery packaging. By providing clear financial targets, the analysis helps small businesses make tough decisions—whether to reduce staff hours, shift marketing focus, or diversify offerings—ensuring they weather economic storms with resilience and clarity.

FAQ 17: How does break-even analysis support long-term business planning?

Break-even analysis is not just for short-term decisions; it’s a cornerstone for long-term business planning by providing a foundation for sustainable growth. By identifying the break-even point, small business owners can set long-term sales and revenue goals that align with their vision. For example, a small bookstore aiming to expand to a second location can use the analysis to calculate how many additional books it needs to sell to cover new fixed costs like rent, ensuring the expansion is financially feasible over time.

The analysis also supports strategic forecasting. By projecting break-even points over multiple years, businesses can account for expected changes, such as inflation increasing variable costs or planned investments raising fixed costs. A landscaping company might anticipate needing new equipment in year two, adjusting its break-even calculations to ensure it can sustain higher costs while growing its client base. This forward-looking approach helps owners plan for capital investments, hiring, or market expansion without overextending resources.

Additionally, break-even analysis integrates with other long-term tools like profit and loss projections or cash flow forecasts. By combining these, businesses can create comprehensive plans that balance immediate needs with future ambitions. For instance, a tech startup might use the analysis to time its product launches, ensuring each new release achieves break-even before scaling up. This disciplined approach keeps long-term goals grounded in financial reality, paving the way for sustained success.

FAQ 18: Can break-even analysis be used for businesses with multiple products?

Yes, break-even analysis can be adapted for businesses with multiple products, though it requires a more nuanced approach to account for varying costs and prices. For a multi-product business, you can calculate the break-even point for each product individually and then aggregate the results to understand the overall business break-even. This helps identify which products are most profitable and where to focus resources. For example, a bakery selling cakes, cookies, and bread can analyze each product line to see which contributes most to covering fixed costs like rent and utilities.

To perform a multi-product break-even analysis, calculate the contribution margin (selling price minus variable costs) for each product and estimate their sales mix—the proportion of total sales each product represents. For instance, if cakes contribute 50% of sales, cookies 30%, and bread 20%, the bakery can weight the contribution margins accordingly to find a blended break-even point. This might reveal that selling 100 cakes, 200 cookie packs, and 150 loaves covers all costs, guiding inventory and marketing decisions.

This approach also highlights underperforming products. If cookies have a low contribution margin, the bakery might raise their price or reduce their variable costs to improve profitability. However, multi-product analysis assumes a stable sales mix, which may not hold if customer preferences shift. Regularly updating the analysis and combining it with market research ensures accuracy, helping businesses with diverse offerings optimize their product portfolio and achieve financial stability.

FAQ 19: How does break-even analysis account for seasonal fluctuations in small businesses?

Seasonal businesses, like holiday gift shops or summer tour operators, face unique challenges due to fluctuating demand, and break-even analysis can help manage these swings effectively. By calculating the break-even point for different periods—peak and off-peak seasons—owners can set tailored sales targets to cover fixed costs like rent and variable costs like inventory. For example, a Christmas tree farm might need to sell 500 trees in December to break even for the year, but only 50 in off-season months, allowing it to plan inventory and staffing accordingly.

During peak seasons, the analysis helps maximize profitability by showing how far sales exceed the break-even point, generating surplus cash to sustain the business during slower periods. A beach resort, for instance, might break even with 200 room bookings in summer but struggle in winter. By saving excess profits from high season, the resort can cover fixed costs year-round. The analysis also informs pricing adjustments; raising rates slightly during peak demand can lower the break-even point, boosting margins.

For off-peak seasons, break-even analysis highlights the need for creative strategies, like offering discounts or new services to maintain sales. A ski shop might introduce equipment rentals in summer to approach its break-even point. Regularly recalculating the analysis for each season ensures it reflects changing costs or demand patterns, helping seasonal businesses stay financially resilient and prepared for annual cycles.

FAQ 20: What mistakes should small businesses avoid when conducting a break-even analysis?

Conducting a break-even analysis is straightforward, but small businesses can stumble if they overlook key details. One common mistake is inaccurate cost classification, such as treating variable costs like raw materials as fixed costs, or vice versa. This distorts the break-even point, leading to flawed pricing or sales targets. For example, a jewelry maker who counts design software as a variable cost might underestimate the units needed to break even, risking losses.

Another frequent error is assuming all units produced will sell. In reality, demand fluctuations or unsold inventory can push the break-even point higher. A toy store producing 1,000 units but selling only 600 will miss its financial targets if it doesn’t account for this gap. Similarly, failing to update the analysis regularly is a pitfall. Costs like rent or materials can change, and outdated calculations may mislead planning. A restaurant ignoring a 10% increase in food costs might set unrealistic sales goals.

Lastly, relying solely on break-even analysis without considering external factors, like competition or customer trends, can limit its effectiveness. A café might hit its break-even point but lose market share if competitors offer better value. To avoid these mistakes, double-check cost data, validate sales projections with market research, and update the analysis frequently. Combining it with other tools, like cash flow forecasts, ensures a well-rounded approach to financial decision-making.

Also, Read these Articles in Detail

- A Guide to Creating a Track Spending Spreadsheet for Home Business

- Understanding SEC Form D: A Comprehensive Guide to Exempt Securities Offerings

- Understanding Quotes, Estimates, and Bids: A Comprehensive Guide for Businesses

- Mastering Accruals: A Guide to Understanding and Managing Accrued Accounts

- Building a Robust Emergency Fund for Your Small Business: A Guide to Financial Security

- How to Determine Your Business Valuation: A Comprehensive Guide for Sellers

- Mastering Business Cost Categorization: A Guide to Tracking and Managing Expenses

- Why Every Small Business Owner Needs an Accountant: Your Guide to Financial Success

- Inventory Management: A Comprehensive Guide to Streamlining Your Business Operations

- Mastering Cash Flow: Effective Strategies to Conserve Cash and Maximize Profits

- Inventory Management: A Comprehensive Guide to Streamlining Your Business Operations

- Mastering Cash Flow: Effective Strategies to Conserve Cash and Maximize Profits

- Financial Statements: What Investors Really Want to Know About Your Business

- Historical Cost Principle: Definition, Examples, and Impact on Asset Valuation

- Generally Accepted Accounting Principles (GAAP)

- Invoices and Receipts: A Comprehensive Guide to Mastering Your Business Transactions

- 15 Proven Strategies to Slash Small Business Costs Without Sacrificing Quality

- Trade Finance: Definition, How It Works, and Why It’s Important

- Cross Elasticity of Demand: Definition, Formula, and Guide to Pricing & Consumer Behavior

- IRS Form 3115: Instructions and Guide to Changing Your Accounting Method

- Understanding Costs and Expenses: Definition, Differences, and Business Examples

- Choosing the Right Financial Professional: Accountant, Advisor, or CFO for Your Business

- Pricing Strategies for Small Businesses: A Comprehensive Guide to Setting Profitable Prices

- Excel for Small Business Accounting: Step-by-Step Guide for Beginners

- Business Cost Categorization Guide: Track and Manage Expenses Effectively

- How to Master Cost-Benefit Analysis for Smarter Decisions

- Understanding Debt-to-Equity Swaps for Financial Restructuring

- Corporate Records Book Guide: Compliance, Protection & Success

- How to Create and Manage a Payroll Register for Small Businesses

- DIY Payroll and Tax Guide 2025: Save Time & Avoid Penalties

- Return on Ad Spend (ROAS): Your Ultimate Guide to Measuring Advertising Success

- Innovative Small Business Marketing Ideas to Skyrocket Your Success

- Market and Marketing Research: The Key to Unlocking Business Success

- Target Audience: A Comprehensive Guide to Building Effective Marketing Strategies

- SWOT Analysis: A Comprehensive Guide for Small Business Success

- Market Feasibility Study: Your Blueprint for Business Success

- Mastering the Art of Selling Yourself and Your Business with Confidence and Authenticity

- 10 Powerful Ways Collaboration Can Transform Your Small Business

- The Network Marketing Business Model: Is It the Right Path for You?

- Crafting a Memorable Business Card: 10 Essential Rules for Small Business Owners

- Bootstrap Marketing Mastery: Skyrocketing Your Small Business on a Shoestring Budget

- Mastering Digital Marketing: The Ultimate Guide to Small Business Owner’s

- Crafting a Stellar Press Release: Your Ultimate Guide to Free Publicity

- Reciprocity: Building Stronger Business Relationships Through Give and Take

- Business Cards: A Comprehensive Guide to Designing and Printing at Home

- The Ultimate Guide to Marketing Firms: How to Choose the Perfect One

- Direct Marketing: A Comprehensive Guide to Building Strong Customer Connections

- Mastering Marketing for Your Business: A Comprehensive Guide

- Crafting a Winning Elevator Pitch: Your Guide to Captivating Conversations

- A Complete Guide to Brand Valuation: Unlocking Your Brand’s True Worth

- B2B Marketing vs. B2C Marketing: A Comprehensive Guide to Winning Your Audience

- Pay-Per-Click Advertising: A Comprehensive Guide to Driving Traffic and Maximizing ROI

- Multi-Level Marketing: A Comprehensive Guide to MLMs, Their Promises, and Pitfalls

- Traditional Marketing vs. Internet Marketing for Small Businesses

- Branding: Building Trust, Loyalty, and Success in Modern Marketing

- How to Craft a Winning Marketing Plan for Your Home Business

- The Synergy of Sales and Marketing: A Comprehensive Guide

- Mastering the Marketing Mix: A Comprehensive Guide to Building a Winning Strategy

- Return on Investment (ROI): Your Guide to Smarter Business Decisions

- How to Create a Winning Website Plan: A Comprehensive Guide

Acknowledgement

Crafting the article How to Do Break-Even Analysis: Step-by-Step Guide for Small Business Owners would not have been possible without the wealth of insights and practical guidance provided by several reputable online resources. These platforms offered valuable information on financial planning, cost management, and strategic business tools, which enriched the content and ensured its accuracy and depth. I extend my gratitude to the following sources for their comprehensive data and expert advice, which served as the foundation for this detailed guide:

- QuickBooks (quickbooks.intuit.com) for its detailed tutorials on using financial tools like spreadsheets for break-even calculations.

- Investopedia (www.investopedia.com) for its clear explanations of financial concepts and practical applications of break-even analysis.

- Entrepreneur (www.entrepreneur.com) for its actionable insights tailored to small business owners navigating financial challenges.

- SCORE (www.score.org) for its practical templates and guidance on financial planning for startups and established businesses.

- Small Business Administration (SBA) (www.sba.gov) for its authoritative resources on business budgeting and cost analysis.

Disclaimer

The information provided in How to Do Break-Even Analysis: Step-by-Step Guide for Small Business Owners is intended for general informational purposes only and should not be considered professional financial or business advice. While the content is based on insights from reputable sources and aims to offer accurate and practical guidance, it is not a substitute for consulting with a qualified accountant, financial advisor, or business consultant. Every business is unique, and factors such as market conditions, cost structures, and economic variables can significantly impact the application of break-even analysis.

Readers are encouraged to verify data, perform their own calculations, and seek professional advice tailored to their specific circumstances before making financial or strategic decisions. The author and publisher are not liable for any losses or damages resulting from the use of this information.