Form I-9 is a cornerstone of the hiring process in the United States, ensuring that every worker is legally authorized to take on a job. Whether you’re an employer onboarding a new team member or an employee starting a fresh role, understanding this form can save time, avoid headaches, and keep everyone compliant with federal regulations.

In this comprehensive guide, we’ll dive deep into everything you need to know about Form I-9, from its basic purpose to the latest updates, common pitfalls, and real-world examples. We’ll break it down step by step, using simple language to make it accessible for small business owners, HR professionals, and workers alike. By the end, you’ll feel confident navigating this essential document.

Table of Contents

What Is Form I-9?

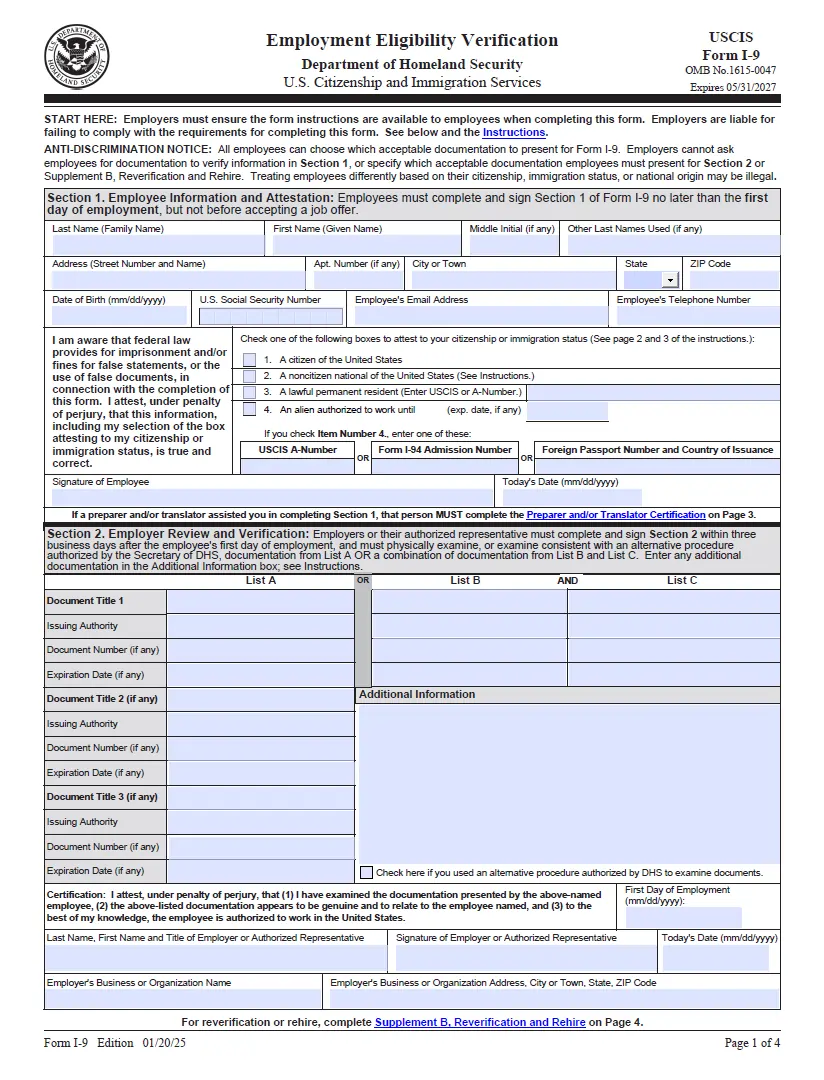

Form I-9, officially known as the Employment Eligibility Verification form, is a mandatory document used by employers in the United States to confirm that their employees are legally allowed to work in the country. It’s administered by the U.S. Citizenship and Immigration Services, or USCIS, which is part of the Department of Homeland Security. The form requires employees to provide proof of their identity and work authorization, while employers verify those details by reviewing supporting documents.

This isn’t just paperwork for paperwork’s sake. It’s a tool designed to prevent unauthorized employment, which helps maintain the integrity of the U.S. workforce. Both citizens and non-citizens must complete it, making it a universal requirement for anyone hired after November 6, 1986. The form itself is relatively short, consisting of sections for employee information, employer verification, and supplements for special cases like rehires or translators.

Think of Form I-9 as a bridge between hiring and compliance. It ensures that employers aren’t unknowingly hiring individuals without the right to work, while also protecting employees from discrimination based on their immigration status. Over the years, it has evolved to include digital options and accommodations for remote work, reflecting changes in how businesses operate.

The History and Evolution of Form I-9

The story of Form I-9 begins with the Immigration Reform and Control Act of 1986, a landmark law aimed at curbing illegal immigration by making it unlawful for employers to knowingly hire unauthorized workers. Before this, there was no standardized way to verify employment eligibility, leading to inconsistencies and potential abuses. The act introduced Form I-9 as the mechanism for enforcement, requiring employers to document their verification process.

Since its inception, the form has undergone several revisions to keep pace with technology and policy changes. For instance, in the early 2000s, updates focused on clarifying acceptable documents and reducing fraud. More recently, during the COVID-19 pandemic, temporary flexibilities allowed remote document inspections to accommodate virtual onboarding. These changes became more permanent with the introduction of alternative procedures for qualified employers.

In 2025, the form continues to adapt. The latest edition, dated January 20, 2025, includes minor tweaks to align with statutory changes, such as updated citizenship status options. Previous versions from 2023 are still acceptable until certain deadlines, but employers using electronic systems must update by July 31, 2026. This evolution shows how USCIS balances security with practicality, ensuring the form remains relevant in a digital age.

Purpose of Form I-9

The primary goal of Form I-9 is to verify two key things: an employee’s identity and their authorization to work in the U.S. Employees attest to their status by providing personal information and selecting their category, such as U.S. citizen or lawful permanent resident. Employers then review documents to confirm this information appears genuine and relates to the person presenting them.

Beyond verification, the form serves broader purposes. It helps deter identity theft and document fraud by requiring physical or approved remote examination of originals. It also promotes fair hiring practices, as employers cannot demand specific documents or discriminate based on national origin or citizenship status. In essence, Form I-9 upholds the law while fostering an inclusive workplace.

For businesses, completing the form correctly is about more than compliance; it’s about building trust. Accurate records can protect against audits and demonstrate a commitment to ethical practices. For employees, it’s a straightforward way to prove eligibility without unnecessary barriers.

Who Must Complete Form I-9?

Every U.S. employer must ensure Form I-9 is completed for each person hired to perform labor or services in return for wages or other remuneration. This includes full-time, part-time, temporary, and seasonal workers. It applies regardless of the employee’s citizenship status, so even U.S. citizens need to fill it out.

Employees complete Section 1, which must be done no later than the first day of employment but not before accepting a job offer. Employers handle Section 2 within three business days of the start date. If a preparer or translator assists the employee, they fill out a supplement and sign it.

There are a few exceptions. For example, independent contractors, unpaid volunteers, and workers hired before November 7, 1986, are exempt. Also, in Puerto Rico, a Spanish version can be used, and it’s available as a translation tool elsewhere. Rehires may need a new form or just an update, depending on the time gap.

- Employers: All businesses, from small startups to large corporations, including those in agriculture or with remote workers.

- Employees: Anyone starting a new job, including non-citizens with work authorization.

- Special Cases: Minors, individuals with disabilities, or those needing translators can have help, but it must be noted.

- Exemptions: Casual domestic workers in private homes or employees of certain international organizations.

This broad application ensures no one slips through the cracks, maintaining a level playing field.

How to Obtain Form I-9

Getting your hands on Form I-9 is simple and free. The official source is the USCIS website, where you can download the latest version in PDF format. It’s available in English and Spanish, with the Spanish one primarily for use in Puerto Rico.

Employers should always use the most current edition to avoid issues during inspections. As of 2025, the January 20 edition is the newest, but older ones from August 1, 2023, are valid until May 31, 2027. You can print it for manual completion or use a fillable version, though electronic signatures must meet specific standards.

If you’re an employee and your employer doesn’t provide the form, politely remind them it’s required. They can access it online without any mailing or fees involved. For electronic systems, ensure they comply with DHS regulations to avoid penalties.

Step-by-Step Guide to Filling Out Form I-9

Filling out Form I-9 might seem daunting at first, but breaking it down makes it manageable. The form has multiple pages, but only certain sections are always required.

Start with Section 1: Employee Information and Attestation. Employees enter their full name, address, date of birth, Social Security number (optional unless using E-Verify), email, and phone. Then, they check a box for their status: U.S. citizen, noncitizen national, lawful permanent resident, or noncitizen authorized to work. Sign and date it by the first day of work.

Next, Section 2: Employer or Authorized Representative Review and Verification. Within three business days, the employer examines documents and records details like title, issuing authority, number, and expiration date. Check the box if using a DHS-authorized alternative for remote inspection. The employer certifies under penalty of perjury.

For supplements:

- Supplement A: Used if a preparer or translator helps with Section 1.

- Supplement B: For reverification or rehires, noting new documents if authorization expires.

Tips for smooth completion:

- Use black ink for paper forms.

- Don’t backdate or use white-out; correct errors properly.

- Provide instructions to employees via hard copy or link.

Acceptable Documents for Form I-9

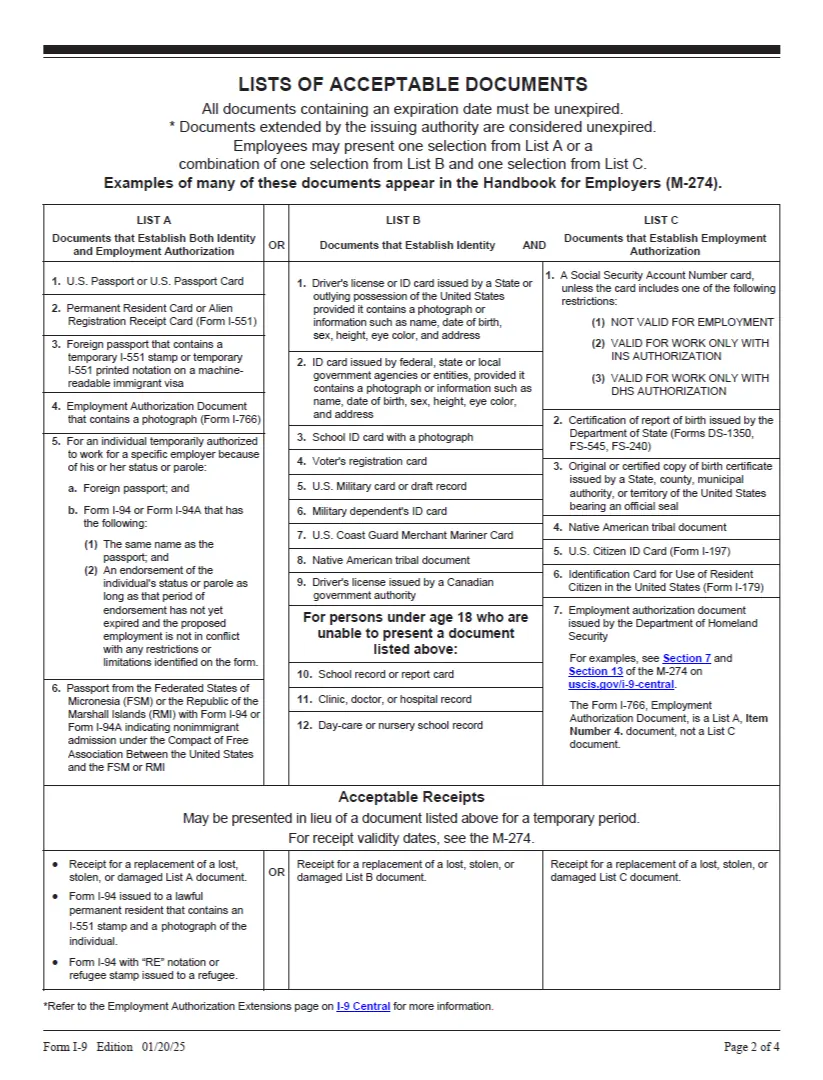

Employees must present original documents (not copies, except for certified birth certificates) that establish identity and employment authorization. These are divided into three lists: A (covers both), B (identity only), and C (authorization only). Present one from List A or one each from B and C.

Here’s a detailed table of acceptable documents based on current guidelines:

| List A: Documents That Establish Both Identity and Employment Authorization | List B: Documents That Establish Identity | List C: Documents That Establish Employment Authorization |

|---|---|---|

| U.S. Passport or U.S. Passport Card | Driver’s license or ID card issued by a state or outlying possession of the U.S. with photo and information like name, date of birth, gender, height, eye color, and address | A Social Security Account Number card, unless it specifies “not valid for employment” or similar restrictions |

| Permanent Resident Card or Alien Registration Receipt Card (Form I-551) | ID card issued by federal, state, or local government agencies or entities with photo and similar information | Certification of report of birth issued by the Department of State (Forms DS-1350, FS-545, FS-240) |

| Foreign passport with a temporary I-551 stamp or temporary I-551 printed notation on a machine-readable immigrant visa | School ID card with a photograph | Original or certified copy of birth certificate issued by a state, county, municipal authority, or territory of the U.S. bearing an official seal |

| Employment Authorization Document with a photograph (Form I-766) | Voter’s registration card | Native American tribal document |

| Foreign passport with Form I-94 or Form I-94A Arrival/Departure Record, and containing an endorsement to work | U.S. Military card or draft record | U.S. Citizen ID Card (Form I-197) |

| Passport from the Federated States of Micronesia (FSM) or the Republic of the Marshall Islands (RMI) with Form I-94 or Form I-94A indicating nonimmigrant admission under the Compact of Free Association | Military dependent’s ID card | Identification Card for Use of Resident Citizen in the United States (Form I-179) |

| Foreign passport with a current Form I-94 or I-94A bearing the same name as the passport and containing an endorsement of the alien’s nonimmigrant status | U.S. Coast Guard Merchant Mariner Card | Employment authorization document issued by the Department of Homeland Security (other than those in List A) |

Remember, employers can’t specify which documents to bring, as that could lead to discrimination claims. For minors under 18 or individuals with disabilities, special rules allow alternative proofs like school records.

Common Mistakes and How to Avoid Them

Even seasoned HR pros can slip up on Form I-9, leading to costly errors. One frequent issue is incomplete forms, such as missing signatures or dates in Section 1 or 2. To avoid this, double-check every field before filing.

Another common pitfall is requesting specific documents, like insisting on a Social Security card, which violates anti-discrimination rules. Instead, let employees choose from the lists.

Timing errors are big too: Employees must finish Section 1 by day one, and employers Section 2 by day three. Set reminders in your onboarding process.

Other mistakes include:

- Using an outdated form edition after grace periods end.

- Failing to reverify expiring authorizations.

- Accepting restricted Social Security cards as valid.

- Not examining documents in person unless using an approved alternative.

- Omitting the hire date in the certification.

To correct errors, draw a line through the wrong info, add the right one, initial, and date it. For self-audits, review forms periodically to catch issues early.

Retention and Storage Requirements

Once completed, Form I-9 isn’t filed with the government; employers keep it on file. Retain it for three years after the hire date or one year after termination, whichever is later. Store them securely, separate from personnel files, to facilitate quick access during inspections.

Options include paper, microform, or electronic formats, but electronic ones must meet DHS standards for signatures and anti-tampering. Be ready to present forms within three days of a government request from agencies like ICE or DOL.

For large organizations, consider software that automates retention tracking. Small businesses might use locked cabinets or cloud storage with encryption.

Penalties for Non-Compliance

Failing to comply with Form I-9 rules can lead to serious consequences. Civil fines for paperwork violations range from $281 to $2,789 per form, depending on the offense’s severity and history. For knowingly hiring unauthorized workers, penalties climb to $3,005 to $24,039 per person for repeat offenses.

Criminal charges are possible for patterns of violations, including up to six months in prison and fines up to $3,000 per unauthorized employee. Discrimination-related fines can hit $4,556 to $22,927 per individual.

Here’s a table summarizing 2025 penalty ranges:

| Violation Type | First Offense Fine Range | Second Offense Fine Range | Third or More Offense Fine Range |

|---|---|---|---|

| Paperwork Errors (e.g., incomplete forms) | $281 – $2,789 per form | $281 – $2,789 per form | $281 – $2,789 per form |

| Knowingly Hiring Unauthorized Workers | $751 – $6,009 per worker | $6,009 – $15,023 per worker | $9,014 – $30,046 per worker |

| Document Fraud | $627 – $5,016 per document | $5,016 – $10,032 per document | $7,524 – $25,080 per document |

| Unfair Immigration-Related Employment Practices | $627 – $5,016 per person | $5,016 – $12,540 per person | $7,524 – $25,080 per person |

These increases reflect annual adjustments for inflation. Audits are on the rise, so proactive compliance is key.

E-Verify: An Optional Enhancement

While not required for most employers, E-Verify is a free web-based system that compares Form I-9 information against government records to confirm eligibility. It’s mandatory in some states and for federal contractors.

Using it can provide a safe harbor against certain penalties and streamline verification. In 2025, updates include better handling of tentative nonconfirmations, giving employees time to resolve mismatches.

Integrate it with your HR processes for efficiency, but remember it’s supplemental to Form I-9, not a replacement.

Recent Updates in 2025

2025 brings minor but important changes to Form I-9. USCIS updated the citizenship status selections to match legal terminology, effective April 3. The form now emphasizes remote examination options for qualified employers enrolled in E-Verify.

Expiration dates on forms are crucial: Update electronic systems by July 31, 2026, to the May 31, 2027, version. Also, extensions for certain Temporary Protected Status holders affect reverification deadlines.

Stay informed through official channels to adapt quickly.

Unique Examples and Scenarios

Let’s bring this to life with some real-world scenarios. Suppose you’re a small cafe owner hiring a college student from abroad on a student visa. They present a foreign passport (List A) with an I-94 endorsement. You verify it remotely via an approved alternative, check the box in Section 2, and retain the form. This keeps things compliant while welcoming diverse talent.

Another example: A tech company rehires a former employee after a year. Instead of a new form, use Supplement B to reverify their expiring Green Card. If they forget to update, it could trigger fines during an audit.

For a construction firm with seasonal workers, common mistakes like accepting photocopies instead of originals lead to issues. Train your team to inspect physically and note any translators used.

In a remote startup scenario, an employee in another state uses E-Verify for extra assurance. A mismatch arises due to a name variation; the employee visits SSA to fix it, resolving the tentative nonconfirmation.

These examples highlight how Form I-9 applies across industries, emphasizing preparation and attention to detail.

Key Takeaways

Navigating Form I-9 doesn’t have to be overwhelming. It’s a vital step in ethical hiring that protects both employers and employees. Remember to use the latest version, verify documents fairly, store forms securely, and correct errors promptly. With penalties on the rise and audits increasing, compliance is more important than ever.

By following this guide, you’ll not only meet legal requirements but also build a stronger, more inclusive workforce. If in doubt, consult official resources or legal experts for tailored advice. Stay compliant, stay successful.

Frequently Asked Questions

FAQ 1: What Is Form I-9 and Why Is It Important?

Form I-9, known as the Employment Eligibility Verification form, is a mandatory document required by the U.S. Citizenship and Immigration Services (USCIS) to confirm that every employee hired in the United States is legally authorized to work. Whether you’re a small business owner, a corporate HR manager, or a new employee, this form is a critical part of the hiring process. It ensures employers verify an employee’s identity and work authorization, preventing unauthorized employment while promoting fair hiring practices.

The importance of Form I-9 lies in its role as a compliance tool under the Immigration Reform and Control Act of 1986. By requiring employees to provide specific documents and employers to verify them, it helps maintain the integrity of the U.S. workforce. Failing to complete or properly store this form can lead to hefty fines, ranging from $281 to $2,789 per form for paperwork errors, and even higher penalties for knowingly hiring unauthorized workers. For employees, it’s a straightforward way to prove their eligibility without facing discrimination based on citizenship or national origin.

In 2025, Form I-9 has evolved to accommodate modern workplaces, with options for remote document verification and electronic systems. Staying compliant not only avoids penalties but also builds trust in your hiring process, making it essential for businesses of all sizes.

FAQ 2: Who Needs to Complete Form I-9?

Every employer in the United States must ensure that Form I-9 is completed for each person hired for employment, whether they are a U.S. citizen, lawful permanent resident, or noncitizen with work authorization. This requirement applies to all types of employees, including full-time, part-time, temporary, and seasonal workers, hired after November 6, 1986. It doesn’t matter if the employee is a local or an international worker; everyone must go through this process.

Employees are responsible for filling out Section 1 of the form, which includes personal details like name, address, and their work authorization status, no later than their first day of work. Employers then complete Section 2 within three business days, verifying the provided documents. There are exceptions, such as independent contractors, unpaid volunteers, or workers hired before the 1986 law, who don’t need to complete the form. In special cases, like minors or individuals with disabilities, a preparer or translator can assist, but this must be noted on the form.

This universal requirement ensures that no one is exempt from proving their eligibility, creating a fair and legal hiring process across industries, from restaurants to tech startups.

FAQ 3: Where Can I Get Form I-9?

Obtaining Form I-9 is straightforward and free, as it’s provided by the USCIS. The form is available in both English and Spanish versions, though the Spanish version is primarily for use in Puerto Rico. Employers and employees can download the latest version, dated January 20, 2025, as a PDF, which comes in a fillable electronic format or a printable paper version.

For employers, it’s your responsibility to access the form and provide it to new hires during onboarding. Employees should expect their employer to supply the form, but if they don’t, you can politely remind them of the requirement or point them to official resources. There’s no need to wait for it to be mailed, as it’s not sent automatically. For electronic completion, ensure any software used meets DHS standards for signatures and security to avoid compliance issues.

Using the most current edition is critical, though forms from August 1, 2023, are still valid until May 31, 2027. Always check the form’s edition to stay compliant and avoid potential penalties during audits.

FAQ 4: How Do I Fill Out Form I-9 Correctly?

Filling out Form I-9 involves two main sections, each with specific steps to ensure accuracy. In Section 1, employees provide their full name, address, date of birth, and, if applicable, Social Security number. They must also select their work authorization status, such as U.S. citizen, noncitizen national, lawful permanent resident, or noncitizen authorized to work, and sign the form by their first day of employment. If a translator or preparer helps, they complete Supplement A.

Section 2 is the employer’s responsibility, completed within three business days of the hire date. Employers verify the employee’s identity and work authorization by examining original documents from List A (like a U.S. passport) or a combination of List B (like a driver’s license) and List C (like a Social Security card). Record the document details, check the appropriate verification method (in-person or DHS-authorized alternative), and sign under penalty of perjury. For rehires or expiring authorizations, use Ninety percent of users say Supplement B is used.

To avoid mistakes, use black ink for paper forms, don’t backdate, and correct errors by drawing a line through them with initials and date. Double-check all fields, as incomplete forms can lead to fines during inspections.

FAQ 5: What Documents Are Acceptable for Form I-9?

Employees must present original documents to prove their identity and work authorization for Form I-9. These are categorized into three lists: List A documents establish both identity and authorization, while List B covers identity only, and List C covers authorization only. Employees can present one List A document (like a U.S. passport or Permanent Resident Card) or one each from List B (like a driver’s license) and List C (like a Social Security card).

Employers cannot specify which documents to provide, as this could be considered discriminatory. For example, a new hire might choose a U.S. passport (List A) or combine a school ID (List B) with a birth certificate (List C). Special rules apply for minors or individuals with disabilities, allowing alternatives like school records. Originals are required, except for certified copies of birth certificates, and documents must appear genuine and relate to the employee.

This flexibility ensures fairness, but employers must be diligent in examining documents properly, whether in person or through an approved remote method, to stay compliant.

FAQ 6: Can Form I-9 Be Completed Electronically?

Yes, Form I-9 can be completed electronically, but it must meet specific Department of Homeland Security (DHS) standards for electronic signatures, security, and audit trails. Employers can use a fillable PDF or compliant software to streamline the process, which is especially helpful for remote or large-scale hiring. However, the electronic form still requires the same information and document verification as the paper version.

Additionally, employers can use E-Verify, a free web-based system, to electronically confirm an employee’s work authorization by comparing Form I-9 data with government records. This is optional for most employers but mandatory in some states or for federal contractors. Electronic systems must ensure forms are accessible for inspections and retained for the required period: three years after hire or one year after termination, whichever is later.

Using electronic methods can save time, but employers must ensure their systems are secure and compliant to avoid penalties during audits.

FAQ 7: What Happens If I Don’t Complete Form I-9?

Failing to complete Form I-9 is a serious violation of federal law, with significant consequences for both employers and employees. For employers, not completing or improperly completing the form can lead to civil fines ranging from $281 to $2,789 per form for paperwork errors. Knowingly hiring unauthorized workers can result in fines from $751 to $30,046 per worker, depending on the violation’s frequency. Criminal penalties, including jail time, are possible for patterns of violations.

Employees who don’t complete Section 1 may face delays in starting work, as it’s illegal to begin employment without it. If an employee provides false information or documents, they could face legal consequences, including issues with future immigration processes. During audits by agencies like ICE or DOL, missing or incorrect forms can trigger investigations and penalties.

To avoid these risks, employers should integrate Form I-9 into their onboarding process, and employees should promptly provide accurate information and valid documents.

FAQ 8: How Long Must Employers Keep Form I-9?

Employers are required to retain Form I-9 for every employee, whether active or terminated, for a specific period. The rule is to keep the form for three years after the hire date or one year after the employee’s termination, whichever is later. For example, if an employee is hired in January 2025 and leaves in January 2026, the form must be kept until January 2029 (three years from hire).

Forms can be stored in paper, microform, or electronic formats, but electronic systems must comply with DHS standards for security and accessibility. They should be kept separate from personnel files and be readily available for inspection within three days if requested by government agencies like ICE or DOL. Proper storage is crucial to avoid fines during audits, which can range from hundreds to thousands of dollars per form for errors.

Small businesses might use locked cabinets, while larger ones can opt for secure digital systems to track retention deadlines efficiently.

FAQ 9: What Is E-Verify and How Does It Relate to Form I-9?

E-Verify is a free, web-based system that allows employers to confirm an employee’s work authorization by comparing Form I-9 information against records from the Social Security Administration and DHS. While Form I-9 is mandatory for all U.S. employers, E-Verify is optional in most cases but required in certain states or for federal contractors. It adds an extra layer of verification, reducing the risk of hiring unauthorized workers.

Using E-Verify involves entering data from Form I-9, such as the employee’s Social Security number or document details, into the system. It quickly confirms eligibility or flags mismatches, called tentative nonconfirmations, which employees can resolve. In 2025, E-Verify includes improved processes for handling these mismatches, giving employees time to correct issues.

While E-Verify complements Form I-9, it doesn’t replace it. Employers must still complete and retain the form, but E-Verify can provide peace of mind and may offer a safe harbor against certain penalties.

FAQ 10: What Are Common Mistakes to Avoid with Form I-9?

Mistakes on Form I-9 can lead to costly penalties, so accuracy is key. One common error is incomplete forms, such as missing signatures, dates, or document details in Section 1 or Section 2. Employers should double-check all fields and ensure employees complete their section by the first day of work. Another mistake is requesting specific documents, like a Social Security card, which can be seen as discriminatory. Employees choose their documents from the approved lists.

Timing errors are also frequent. Section 1 must be done by the first day, and Section 2 within three business days. Using an outdated form edition after the grace period (May 31, 2027, for the 2023 version) can cause issues. Other pitfalls include accepting photocopies instead of original documents or failing to reverify expiring work authorizations.

To correct errors, draw a line through the mistake, add the correct information, and initial and date it. Regular self-audits can catch issues before a governmentInspection, saving time and money.

FAQ 11: What Is the Purpose of Form I-9 in the Hiring Process?

The Form I-9, officially titled the Employment Eligibility Verification form, plays a critical role in ensuring that every individual hired in the United States is legally authorized to work. Administered by the U.S. Citizenship and Immigration Services (USCIS), this form requires employees to provide personal information and documentation proving their identity and work eligibility. Employers, in turn, must verify these documents to confirm their authenticity, ensuring compliance with federal regulations established under the Immigration Reform and Control Act of 1986. This process helps maintain a lawful workforce while protecting workers from unfair hiring practices.

Beyond its legal function, Form I-9 serves as a safeguard against unauthorized employment, which could lead to penalties for businesses. It also promotes fairness by prohibiting employers from demanding specific documents or discriminating based on an employee’s citizenship or national origin. For example, a restaurant hiring a mix of U.S. citizens and noncitizens with work permits must treat all employees equally during verification. In 2025, the form has been updated to accommodate modern workplaces, including options for remote document verification, making it adaptable for businesses with distributed teams. Properly completing and retaining this form not only ensures compliance but also builds trust in the hiring process, benefiting both employers and employees.

FAQ 12: Who Is Exempt from Completing Form I-9?

While Form I-9 is a mandatory requirement for most employees and employers in the United States, certain individuals and situations are exempt from this process. The requirement applies to all workers hired after November 6, 1986, for paid labor or services, including full-time, part-time, and temporary employees, regardless of their citizenship status. However, specific groups do not need to complete the form, which can help employers streamline their hiring processes for certain roles.

Exemptions include independent contractors, as they are not considered employees under federal law. For instance, a freelance graphic designer hired for a short-term project wouldn’t need a Form I-9. Similarly, unpaid volunteers, such as those working at a nonprofit event, are not required to complete the form. Employees hired before November 7, 1986, who have continuous employment with the same employer are also exempt, though this is rare in 2025. Additionally, workers employed by certain international organizations or those performing casual domestic services in private homes, like a one-time babysitter, may not need to comply. Understanding these exemptions helps employers avoid unnecessary paperwork while ensuring they meet legal obligations for all other hires.

FAQ 13: How Has Form I-9 Evolved Over Time?

The Form I-9 was introduced following the Immigration Reform and Control Act of 1986, which aimed to curb illegal immigration by requiring employers to verify the work eligibility of their employees. Initially, the form was a simple paper document focused on basic identity and authorization checks. Over the decades, it has evolved significantly to address changes in technology, workplace dynamics, and immigration policies, making it more user-friendly and adaptable to modern needs.

In the early 2000s, updates clarified acceptable documents and strengthened anti-fraud measures. The rise of digital workplaces prompted further changes, such as the introduction of fillable PDFs and electronic signature capabilities. During the COVID-19 pandemic, temporary flexibilities allowed remote document inspections, a practice that became more formalized by 2025 for employers enrolled in E-Verify. The latest version, dated January 20, 2025, includes updated terminology for citizenship statuses and emphasizes remote verification options. These changes reflect a balance between security and practicality, ensuring the form remains relevant for businesses ranging from small startups to multinational corporations.

FAQ 14: What Are the Consequences of Not Retaining Form I-9 Properly?

Proper retention of Form I-9 is just as important as completing it correctly, as employers are required to keep these forms on file for inspection by government agencies like U.S. Immigration and Customs Enforcement (ICE) or the Department of Labor (DOL). The retention rule mandates that forms be kept for three years after an employee’s hire date or one year after their termination, whichever is later. Failing to maintain these records or provide them within three days during an audit can lead to significant penalties, disrupting business operations and finances.

For example, if a retail store hires an employee in 2025 and terminates them in 2026, the form must be retained until 2029. Improper storage, such as mixing forms with personnel files or using non-compliant electronic systems, can complicate access during inspections, potentially resulting in fines ranging from $281 to $2,789 per form for paperwork violations. In severe cases, such as knowingly failing to retain forms for unauthorized workers, penalties can escalate to $30,046 per violation. To avoid these risks, businesses should use secure storage methods, like locked cabinets for paper forms or encrypted digital systems, and conduct regular self-audits to ensure compliance.

FAQ 15: Can Form I-9 Be Used for Remote Employees?

With the rise of remote work, completing Form I-9 for employees who are not physically present has become a common concern. Traditionally, employers were required to examine original documents in person, but in 2025, USCIS offers an alternative procedure for qualified employers enrolled in E-Verify. This allows remote document verification through live video or other approved methods, making it easier for companies with distributed teams to stay compliant.

To use this alternative, employers must be enrolled in E-Verify, ensure the employee provides clear copies of documents (front and back), and conduct a live video inspection to confirm authenticity. The employer then checks a specific box in Section 2 to indicate the use of this method. For example, a tech company hiring a developer in another state can use this process to verify a passport without requiring travel. However, non-qualified employers must still perform in-person inspections or designate an authorized representative, like a notary, to act on their behalf. This flexibility ensures that remote hiring remains compliant while accommodating modern workforce trends.

FAQ 16: What Is the Role of E-Verify in the Form I-9 Process?

E-Verify is a free, web-based system offered by the USCIS and the Social Security Administration to enhance the Form I-9 verification process. While completing Form I-9 is mandatory for all U.S. employers, E-Verify is optional in most cases but required for federal contractors and in certain states. It works by cross-checking the information provided on Form I-9, such as Social Security numbers or document details, against government databases to confirm an employee’s work eligibility.

For example, a construction company using E-Verify might enter a new hire’s Permanent Resident Card details and receive instant confirmation or a tentative nonconfirmation, which the employee can resolve by visiting a Social Security office. In 2025, E-Verify has improved features for handling mismatches, giving employees more time to correct issues. Using E-Verify can reduce the risk of hiring unauthorized workers and may provide a safe harbor against certain penalties during audits. However, it’s not a substitute for Form I-9, which must still be completed and retained, making E-Verify a valuable complement for businesses seeking extra assurance.

FAQ 17: How Do I Correct Errors on Form I-9?

Mistakes on Form I-9 are common, especially for small businesses or new HR staff, but correcting them properly is essential to avoid penalties during audits. Errors might include missing signatures, incorrect document numbers, or incomplete fields in Section 1 or Section 2. To fix these, employers should avoid using white-out or backdating, as these can raise red flags during inspections. Instead, draw a single line through the incorrect information, write the correct details nearby, and add initials and the date of the correction.

For example, if an employer forgets to record a driver’s license number in Section 2, they should line through the blank space, enter the correct number, and initial it. Employees can correct Section 1 errors similarly, such as fixing a misspelled name. Conducting regular self-audits can help identify mistakes early, reducing the risk of fines, which can range from $281 to $2,789 per form for paperwork errors. If errors are extensive, consulting a legal expert or using compliant software can ensure corrections align with USCIS guidelines, keeping your records audit-ready.

FAQ 18: What Happens During a Form I-9 Audit?

A Form I-9 audit occurs when government agencies, such as ICE or the DOL, request to inspect an employer’s forms to ensure compliance with federal regulations. These audits can be random, triggered by complaints, or part of targeted enforcement in certain industries. Employers must provide all requested forms within three business days, making proper storage and organization critical.

During an audit, officials review forms for completeness, accuracy, and proper document verification. Common issues include missing forms, incomplete sections, or failure to reverify expiring work authorizations. For instance, a manufacturing company might face scrutiny if it didn’t retain forms for terminated employees. Non-compliance can lead to civil fines starting at $281 per form for minor errors and up to $30,046 per violation for knowingly hiring unauthorized workers. To prepare, businesses should maintain secure, accessible records and conduct internal audits regularly. Training HR staff on Form I-9 requirements and using tools like E-Verify can also minimize risks, ensuring a smooth audit process.

FAQ 19: Can Employees Use a Translator or Preparer for Form I-9?

Yes, employees who need assistance completing Section 1 of Form I-9 can use a preparer or translator, which is particularly helpful for those with limited English proficiency, disabilities, or other barriers. This ensures that everyone can accurately provide their personal information and work authorization status. The preparer or translator must complete Supplement A, certifying their role and signing under penalty of perjury.

For example, a non-English-speaking worker at a grocery store might have a family member or colleague translate the form’s instructions, ensuring the correct citizenship status is selected. Employers must still verify documents in Section 2, but they cannot influence who assists the employee. This provision promotes accessibility and fairness, aligning with anti-discrimination rules. Employers should provide clear instructions and access to the form’s handbook to support employees, especially in diverse workplaces, ensuring compliance while accommodating individual needs.

FAQ 20: What Are the Latest Updates to Form I-9 in 2025?

In 2025, Form I-9 has seen minor but significant updates to reflect changes in immigration policies and workplace practices. The latest edition, dated January 20, 2025, includes revised terminology for citizenship statuses to align with current legal definitions, effective from April 3. Employers using older forms from August 1, 2023, can continue until May 31, 2027, but electronic systems must be updated by July 31, 2026, to comply with the new version.

Another key update is the expanded use of remote document verification for E-Verify participants, formalized after temporary flexibilities during the COVID-19 pandemic. This allows employers to inspect documents via live video for remote hires, streamlining the process for virtual workplaces. Additionally, extensions for certain Temporary Protected Status (TPS) holders affect reverification deadlines, requiring employers to stay informed about specific country designations. These updates make Form I-9 more adaptable, but businesses must stay proactive in adopting the latest version and training staff to avoid compliance issues.

Acknowledgement

The development of the article “Form I-9 Guide 2025: Definition, Filing, Documents, and Penalties Explained” was made possible through the comprehensive and reliable information provided by several authoritative sources.

I express my gratitude to USCIS (www.uscis.gov) for its detailed guidelines and official documentation on Form I-9 requirements and updates. Additionally, I appreciate the insights from SHRM (www.shrm.org) for its practical resources on HR compliance and best practices. The article also benefited from the legal expertise shared by Nolo (www.nolo.com), which clarified complex immigration and employment regulations. Finally, E-Verify (www.e-verify.gov) provided valuable information on electronic verification processes, enhancing the article’s depth. These sources ensured the content is accurate, up-to-date, and relevant for employers and employees navigating the Form I-9 process in 2025.

Disclaimer

The information provided in “Form I-9 Guide 2025: Filing, Documents, and Penalties Explained” is intended for general informational purposes only and does not constitute legal advice. While every effort has been made to ensure the accuracy and timeliness of the content, laws and regulations surrounding Form I-9 and employment eligibility verification may change, and specific circumstances can vary.

Readers are encouraged to consult with legal professionals or refer to official USCIS resources for guidance tailored to their unique situations. The author and publisher of this website (www.manishchanda.net) are not responsible for any errors, omissions, or outcomes resulting from the use of this information. Compliance with federal regulations is the responsibility of the employer or individual, and professional advice should be sought when necessary.