Running a business means juggling a lot of responsibilities, and payroll is one of the most critical. If you’re a small business owner or handling HR for a growing team, you’ve probably heard about payroll registers but might not know exactly how to set one up or why it’s so essential. A payroll register acts like a central hub for all your payroll data in a given pay period, pulling together totals from individual employee records to give you a clear picture of wages, deductions, and taxes. It’s not just a spreadsheet—it’s a tool that helps ensure compliance, accuracy, and smooth financial operations.

In this comprehensive guide, we’ll walk you through everything from the basics to advanced tips, including step-by-step instructions, real-world examples, and insights on avoiding pitfalls. Whether you’re doing it manually or with software, you’ll have all the tools to create a robust payroll register that keeps your business on track.

Table of Contents

What is a Payroll Register and Why Does Your Business Need One?

A payroll register is a detailed record that summarizes payroll information for all employees during a specific pay period, such as weekly, bi-weekly, or monthly. It compiles data from each employee’s earnings record, showing totals for gross pay, various deductions, and net pay. Think of it as the “big picture” document that ties everything together, making it easier to handle tax obligations and financial reporting.

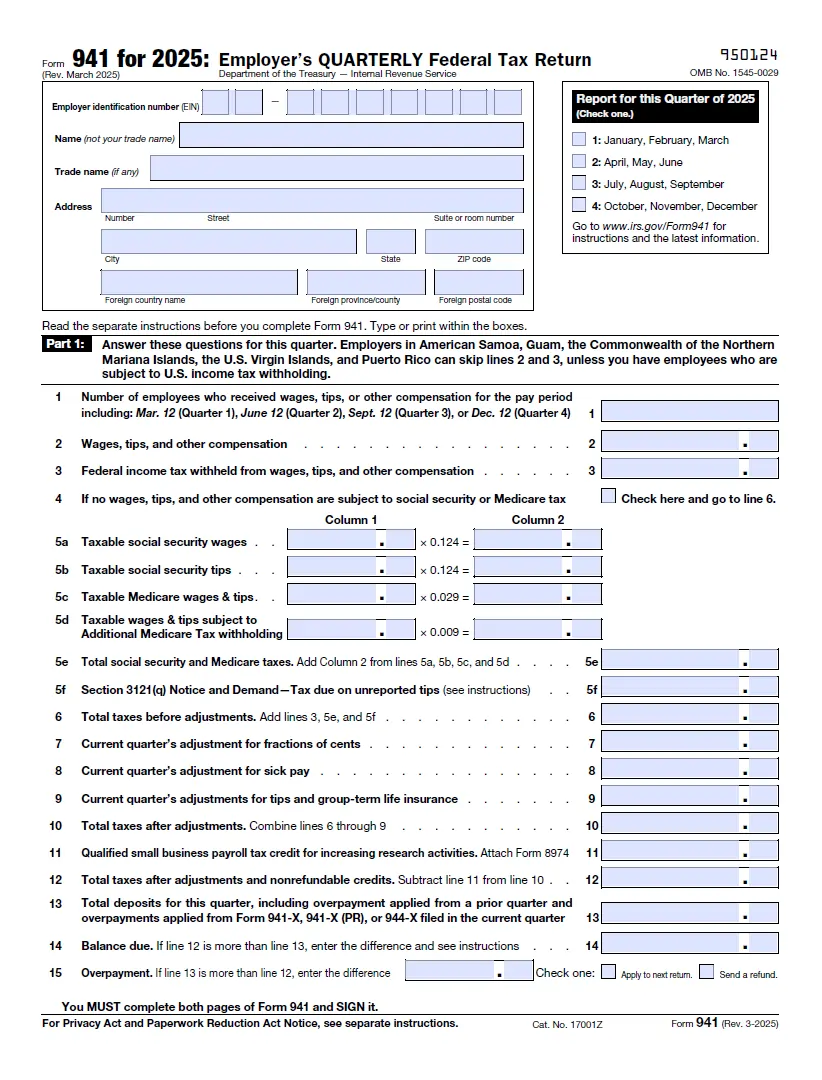

Why bother with one? For starters, it simplifies key tasks like making timely payroll tax deposits, filing quarterly reports on IRS Form 941, and preparing annual wage statements for employees and the Social Security Administration. Without a well-maintained register, you risk errors that could lead to penalties, audits, or unhappy employees. In today’s fast-paced business environment, where remote work and gig economies are common, a payroll register also helps track variable elements like bonuses or commissions, ensuring fairness and transparency.

Beyond compliance, it serves as a financial snapshot. For instance, if you’re analyzing labor costs for budgeting, the register highlights trends in overtime or benefits deductions. Small businesses often overlook this, but maintaining one can prevent cash flow surprises, like unexpected tax liabilities at quarter’s end.

Key Components: What Does a Payroll Register Include?

A solid payroll register isn’t just a list of names and numbers—it’s a comprehensive breakdown that covers every aspect of compensation and withholding. You must include totals for all employees, focusing on wages subject to taxes and various deductions. This ensures you’re ready for audits and reporting.

Here’s a breakdown of essential elements:

- Employee Information: Full legal names, Social Security numbers, addresses, and employment dates. This is crucial for tax forms and verifying eligibility.

- Wage Details: Total gross wages, including regular pay, overtime, bonuses, and commissions. Separate columns for Social Security wages (up to the annual maximum) and Medicare wages.

- Tax Withholdings: Totals for federal, state, and local income taxes withheld from employee paychecks.

- FICA Contributions: Employee portions of Social Security and Medicare taxes, plus the employer’s matching amounts set aside.

- Other Deductions: Voluntary items like 401(k) contributions, health insurance premiums, union dues, or charitable donations.

- Net Pay: The final amount each employee takes home after all deductions.

- Employer Liabilities: Amounts owed for unemployment taxes (federal and state) based on gross wages.

In addition, track any non-taxable reimbursements, like mileage, to avoid miscategorizing them as income. For businesses with international employees, include notes on residency status (resident or nonresident) to handle withholding correctly.

To visualize this, consider this extensive table outlining a sample structure for a payroll register. This format can be adapted in a spreadsheet for easy calculations.

| Employee Name | SSN | Gross Wages | Overtime Pay | Bonuses | Total Taxable Wages | Federal Income Tax Withheld | State Income Tax Withheld | Social Security Withheld (Employee) | Medicare Withheld (Employee) | Health Insurance Deduction | 401(k) Contribution | Other Deductions | Net Pay | Employer Social Security | Employer Medicare | FUTA | SUTA |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| John Doe | 123-45-6789 | $2,500 | $300 | $0 | $2,800 | $350 | $150 | $173.60 | $40.60 | $100 | $125 | $50 | $1,811 | $173.60 | $40.60 | $16.80 | $28 |

| Jane Smith | 987-65-4321 | $3,000 | $0 | $200 | $3,200 | $400 | $180 | $198.40 | $46.40 | $120 | $150 | $0 | $2,105 | $198.40 | $46.40 | $19.20 | $32 |

| Alex Johnson | 456-78-9012 | $2,200 | $150 | $0 | $2,350 | $280 | $120 | $145.70 | $34.08 | $90 | $110 | $30 | $1,540 | $145.70 | $34.08 | $14.10 | $23.50 |

| Totals | N/A | $7,700 | $450 | $200 | $8,350 | $1,030 | $450 | $517.70 | $121.08 | $310 | $385 | $80 | $5,456 | $517.70 | $121.08 | $50.10 | $83.50 |

This table shows a bi-weekly period for three employees, with formulas embedded for totals. Notice how employer contributions are tracked separately—these become payables.

Step-by-Step Guide to Creating a Payroll Register Manually

If you’re starting small or prefer hands-on control, creating a payroll register manually is straightforward, though time-consuming. You’ll need a payroll book from an office supply store, federal and state tax booklets (available at courthouses or online government portals), and access to tax tables.

Start by gathering employee data. Enter each employee’s full legal name, residency status (R for resident, NR for nonresident), address, SSN, and pay rate. This forms the foundation for accurate tax filings.

Next, set up your pay period calendar. Cross out closed days (like weekends for a Monday-Friday operation) and record daily hours worked. Calculate total hours, including overtime (typically 1.5 times regular rate for hours over 40 per week).

Then, compute gross pay using the formula: (Regular Hours x Pay Rate) + (Overtime Hours x Overtime Rate) + Bonuses.

Refer to tax tables for deductions. Deduct federal income tax based on W-4 forms, state taxes per local rules, Social Security (6.2% on wages up to the 2025 limit of $168,600), and Medicare (1.45% on all wages). Add voluntary deductions like garnishments or retirement contributions.

Subtract all deductions from gross pay to get net pay. Issue checks or direct deposits for this amount.

Finally, total everything across employees to populate the register. Update your accounting ledger with these figures for payables.

For a unique twist, imagine a boutique coffee shop with seasonal staff. During holidays, track extra tips as taxable income, ensuring the register separates them to avoid overtaxing.

Real-World Example: Building a Payroll Register for a Tech Startup

Let’s dive into a practical scenario. Suppose you run a small tech startup with five developers and two admins, paying bi-weekly. Your lead developer, Sarah, works 80 regular hours at $50/hour, plus 10 overtime hours. Gross pay: (80 x 50) + (10 x 75) = $4,000 + $750 = $4,750.

Deductions: Federal tax $600 (from tables), state $250, Social Security $294.50, Medicare $68.88, health premium $200, 401(k) $237.50.

Net pay: $4,750 – ($600 + $250 + $294.50 + $68.88 + $200 + $237.50) = $3,098.62.

Aggregate for all: Gross total $25,000, deductions $7,500, net $17,500. This register helps spot if overtime is spiking costs, prompting schedule adjustments.

Here’s a detailed table for this startup’s register, including unique columns for remote work allowances (non-taxable).

| Employee | Position | Hours Regular | Hours OT | Pay Rate | Gross Pay | Remote Allowance | Federal Tax | State Tax | SS Employee | Medicare Employee | Benefits Deduct | Net Pay | Employer SS | Employer Medicare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sarah Lee | Developer | 80 | 10 | $50 | $4,750 | $100 | $600 | $250 | $294.50 | $68.88 | $437.50 | $3,098.62 | $294.50 | $68.88 |

| Mike Chen | Developer | 80 | 5 | $45 | $3,825 | $0 | $480 | $200 | $237.15 | $55.46 | $300 | $2,552.39 | $237.15 | $55.46 |

| Lisa Patel | Admin | 80 | 0 | $30 | $2,400 | $50 | $300 | $120 | $148.80 | $34.80 | $150 | $1,646.40 | $148.80 | $34.80 |

| Tom Ruiz | Developer | 80 | 15 | $48 | $4,920 | $0 | $620 | $260 | $305.04 | $71.34 | $400 | $3,263.62 | $305.04 | $71.34 |

| Emma Wong | Admin | 80 | 0 | $28 | $2,240 | $50 | $280 | $110 | $138.88 | $32.48 | $140 | $1,538.64 | $138.88 | $32.48 |

| Raj Singh | Developer | 80 | 8 | $52 | $4,784 | $100 | $610 | $255 | $296.61 | $69.37 | $380 | $3,172.02 | $296.61 | $69.37 |

| Kim Park | Developer | 80 | 0 | $47 | $3,760 | $0 | $470 | $190 | $233.12 | $54.52 | $280 | $2,532.36 | $233.12 | $54.52 |

| Totals | N/A | 560 | 38 | N/A | $26,679 | $300 | $3,360 | $1,385 | $1,653.10 | $386.85 | $2,087.50 | $17,803.55 | $1,653.10 | $386.85 |

This example highlights how adding custom columns like allowances can tailor the register to your business needs, improving accuracy for hybrid teams.

Manual vs. Automated Payroll Registers: Which is Right for You?

While manual methods work for tiny operations, automated software streamlines everything for larger teams. Manual is cheap and gives full control but prone to errors and time sinks. Automated options calculate taxes instantly, integrate with accounting, and ensure compliance updates.

Pros of manual: Low cost, no learning curve for basics, easy customization in spreadsheets.

Cons: Error-prone (e.g., miscalculating overtime), slow for growth, hard to scale.

Automated pros: Accuracy, time savings, built-in reports for Form 941. Features like direct deposit and employee portals reduce admin work.

Cons: Subscription fees, potential data security risks if not vetted.

For a side-by-side comparison, check this table:

| Aspect | Manual Payroll Register | Automated Payroll Register |

|---|---|---|

| Cost | Low (spreadsheets free) | Monthly fees ($10-$50/user) |

| Time Required | High (hours per period) | Low (minutes with auto-calc) |

| Error Rate | High (human mistakes) | Low (software checks) |

| Scalability | Poor for >10 employees | Excellent for any size |

| Compliance | Manual updates needed | Auto-updates tax rates |

| Integration | None (manual entry to accounting) | Seamless with QuickBooks, etc. |

| Customization | High (add columns easily) | Medium (depends on software) |

| Security | Basic (local files) | Advanced (encryption, backups) |

If your business is expanding, switching to automated can save 50% on processing time.

Creating Payables from Your Payroll Register

Once your register is complete, use it to identify payables—amounts your business owes but hasn’t paid yet. These include FICA taxes (employee + employer shares), withheld income taxes, and unemployment taxes.

For FICA, double the employee Social Security and Medicare withholdings for your share. Federal unemployment (FUTA) is 6% on first $7,000 per employee annually, often reduced by state credits. State unemployment (SUTA) varies by state and experience rating.

Voluntary deductions create payables too—like remitting 401(k) funds to providers or health premiums to insurers. Set aside these in a separate account to avoid mixing with operating funds.

In practice, for a restaurant with high turnover, track SUTA closely as claims affect rates. Use the register totals to schedule deposits: semi-weekly or monthly for federal taxes, per IRS rules.

IRS Recordkeeping Requirements and Legal Compliance

The IRS mandates keeping payroll records for at least four years after taxes are due or paid, whichever is later. This includes registers, timecards, W-2s, and deduction proofs. Fair Labor Standards Act requires details like birth dates for minors, occupations, and workweek start times.

States may require longer retention—up to six years in some cases. Always include proof of payments, like canceled checks, and descriptions of expenses.

For unique compliance, if you have tipped employees, registers must separate tips from wages for accurate FICA credits.

Common Payroll Register Mistakes and How to Avoid Them

Even seasoned pros slip up. One frequent error is misclassifying employees as contractors, leading to under-withheld taxes and penalties. Avoid by reviewing IRS guidelines on control and independence.

Another is inaccurate time tracking, like missing punches or buddy clocking. Implement digital time clocks or apps for verification.

Overtime miscalculations happen when blending rates incorrectly. Use weighted averages for multiple rates.

Incomplete records, such as forgetting fringe benefits, can trigger audits. Always document everything, from bonuses to reimbursements.

Late tax filings cost dearly—penalties up to 25%. Set calendar reminders based on your depositor status.

To dodge these:

- Double-check calculations with a second person.

- Use checklists for each pay run.

- Train staff on updates, like 2025 tax changes.

- Audit registers quarterly for discrepancies.

Best Practices for Efficient Payroll Management

Adopt a payroll checklist: Collect data, calculate pay, apply deductions, process payments, file reports.

Integrate with accounting for seamless journal entries: Debit wage expense, credit cash and liabilities.

For global teams, factor in currency conversions and international taxes.

Leverage templates for consistency—customize with formulas for auto-totals.

Review annually: Adjust for wage base limits, like Social Security’s 2025 cap.

Encourage employee self-service portals to reduce errors in personal data.

Conclusion: Mastering Your Payroll Register for Business Success

Creating and managing a payroll register might seem daunting, but it’s a cornerstone of sound business practices. By following these steps, using examples, and heeding best practices, you’ll ensure accuracy, compliance, and peace of mind. Whether manual or automated, invest time in this process—it’s not just about paying people; it’s about building a sustainable operation. If issues arise, consult a tax professional, but with this guide, you’re well-equipped to handle it yourself.

Frequently Asked Questions

FAQ 1: What is a payroll register, and why is it essential for small businesses in 2025?

A payroll register is a detailed spreadsheet or document that summarizes all payroll information for a specific pay period, such as weekly or bi-weekly, for a business’s employees. It includes critical data like gross wages, tax withholdings, deductions for benefits or contributions, and net pay for each employee, along with totals for the entire workforce. This document pulls together information from individual employee earnings records to provide a comprehensive overview of payroll activities, making it a vital tool for financial and tax management.

For small businesses in 2025, a payroll register is essential because it simplifies compliance with federal and state tax regulations. It helps ensure accurate payroll tax deposits, prepares you for quarterly filings like IRS Form 941, and supports annual reporting to employees and the Social Security Administration through forms like W-2s. Without it, you risk errors that could lead to costly penalties or audits. Beyond compliance, it offers insights into labor costs, helping you budget effectively and spot trends like excessive overtime, which could impact profitability.

Moreover, a payroll register acts as a financial checkpoint. For example, a small retail business with 10 employees can use it to track seasonal bonuses or deductions for health plans, ensuring funds are set aside for payables like FICA taxes or unemployment taxes. By keeping this record organized, you avoid surprises during tax season and maintain trust with employees through accurate paychecks.

FAQ 2: What key components must be included in a payroll register?

A payroll register must capture a wide range of data to ensure compliance and accurate financial tracking. At its core, it includes totals for all employees’ gross wages, which cover regular pay, overtime, bonuses, and commissions. It also breaks down taxable wages for Social Security (up to the 2025 annual limit of $168,600) and Medicare, ensuring you don’t over- or under-report taxable income.

You’ll also need to include tax withholdings for federal, state, and local income taxes, calculated based on employees’ W-4 forms and applicable tax tables. The register should detail FICA contributions, which include the employee’s share of Social Security (6.2%) and Medicare (1.45%), plus the employer’s matching amounts. Other deductions, like 401(k) contributions, health insurance premiums, union dues, or charitable donations, must be tracked to account for voluntary withholdings.

Additionally, include employee details like full legal names, Social Security numbers, and residency status (resident or nonresident) to ensure accurate tax filings. For businesses with unique needs, such as tracking tips for restaurant staff, add custom columns for clarity. Don’t forget employer liabilities like federal unemployment tax (FUTA) and state unemployment tax (SUTA), which are calculated based on total gross wages. This comprehensive approach ensures your register is audit-ready and supports financial planning.

FAQ 3: How do I create a payroll register manually for my small business?

Creating a payroll register manually is a practical option for small businesses with a handful of employees, though it requires attention to detail. Start by purchasing a payroll book or using a spreadsheet template from an office supply store. Gather essential documents, including federal and state tax booklets for withholding tables and employees’ W-4 forms to determine tax rates.

Begin by entering employee information: full legal name, Social Security number, address, and residency status (R for resident, NR for nonresident). Set up a calendar for the pay period, marking closed days (e.g., weekends for a Monday-Friday business). Record each employee’s regular hours and overtime hours, then calculate gross pay using the formula: (Regular Hours x Pay Rate) + (Overtime Hours x 1.5 x Pay Rate) + Bonuses. For example, an employee working 80 regular hours at $20/hour and 5 overtime hours earns $1,600 + $150 = $1,750.

Next, apply deductions using tax tables: federal and state income taxes, Social Security (6.2%), and Medicare (1.45%). Include voluntary deductions like health premiums or retirement contributions. Subtract these from gross pay to get net pay, and issue paychecks accordingly. Total all amounts across employees for the register. Double-check calculations to avoid errors, and update your accounting records with payables like employer FICA contributions. While time-intensive, this method offers full control for small operations.

FAQ 4: Should I use manual or automated payroll register systems in 2025?

Choosing between a manual or automated payroll register depends on your business size, budget, and growth plans. A manual system, using spreadsheets or a payroll book, is cost-effective and customizable, ideal for businesses with fewer than 10 employees. You manually enter hours, calculate wages using tax tables, and track deductions, which gives you hands-on control. However, it’s prone to human error, like miscalculating overtime, and becomes cumbersome as your team grows.

An automated payroll system, typically part of accounting or payroll software, streamlines the process by calculating gross pay, tax withholdings, and deductions instantly. It integrates with accounting tools, generates reports for IRS Form 941, and updates tax rates automatically, saving time and reducing errors. For instance, a growing café with 20 employees could cut payroll processing time by 50% with automation. However, these systems involve subscription costs and require data security measures.

For 2025, automation is recommended if you have more than 10 employees or complex payroll needs, like variable bonuses or remote workers. Smaller businesses can stick with manual methods but should audit regularly to catch mistakes. Combining a spreadsheet template with periodic professional reviews offers a hybrid approach for cost-conscious startups.

FAQ 5: How does a payroll register help with tax compliance?

A payroll register is a cornerstone of tax compliance, ensuring your small business meets federal and state obligations. It consolidates all payroll data—gross wages, tax withholdings, and FICA contributions—making it easier to prepare accurate payroll tax deposits. For example, the register’s totals for federal income tax and FICA (Social Security and Medicare) withheld guide your semi-weekly or monthly deposits to the IRS, avoiding penalties for late payments.

Quarterly, the register simplifies filing IRS Form 941, which reports withheld taxes and employer contributions. By having all calculations pre-recorded, you reduce errors in these filings. Annually, it supports generating W-2 forms for employees and reporting to the Social Security Administration. For instance, a freelance agency can use the register to verify Social Security wages against the 2025 cap of $168,600 per employee, ensuring accurate reporting.

The register also tracks unemployment taxes (FUTA and SUTA), which are based on gross wages. This helps you calculate and pay these taxes quarterly or annually, depending on state rules. By maintaining detailed records, you’re prepared for audits, as the IRS requires payroll records to be kept for at least four years. In short, the register is your roadmap to staying compliant and avoiding costly fines.

FAQ 6: What are payables in a payroll register, and how do I manage them?

Payables are amounts your business owes but hasn’t yet paid, derived from the payroll register totals. These include taxes and deductions withheld from employee paychecks, plus employer contributions. Common payables include FICA taxes (employee and employer shares of Social Security and Medicare), federal income taxes, state income taxes, federal unemployment tax (FUTA), state unemployment tax (SUTA), and voluntary deductions like 401(k) contributions or health insurance premiums.

To manage them, use the register’s totals to set aside funds in a dedicated account, ensuring you don’t spend them on operations. For example, if your register shows $1,000 in employee FICA withholdings, you must also reserve $1,000 for your employer share. Schedule payments based on IRS and state deadlines—semi-weekly or monthly for federal taxes, quarterly for FUTA, and per state rules for SUTA. For voluntary deductions, like charitable contributions, remit funds to the appropriate organizations promptly.

A practical tip: Use accounting software to track payables and generate reminders. For a small gym with 15 staff, this ensures timely payment of health plan deductions to insurers, avoiding lapses. Regularly reconcile these accounts against your register to catch discrepancies early, keeping your business financially sound.

FAQ 7: How do I avoid common mistakes when creating a payroll register?

Creating a payroll register can be tricky, and mistakes can lead to penalties or employee dissatisfaction. One common error is misclassifying employees as independent contractors, resulting in incorrect tax withholdings. To avoid this, review IRS guidelines on worker status, focusing on control and independence. Another frequent issue is inaccurate time tracking, such as missing punches or failing to account for overtime. Use digital time clocks or apps to ensure precise records.

Overtime miscalculations are another pitfall, especially for employees with multiple pay rates. Calculate overtime using a weighted average rate for accuracy. Incomplete records, like omitting fringe benefits or tips, can trigger audits, so document every payment type clearly. Late tax filings or deposits can incur penalties up to 25%, so set calendar reminders based on your depositor status (monthly or semi-weekly).

To minimize errors, double-check calculations with a second person, use a checklist for each pay run, and conduct quarterly audits. For example, a bakery could cross-reference its register with timecards to ensure holiday bonuses are recorded correctly. Staying proactive keeps your register accurate and compliant.

FAQ 8: How long should I keep payroll register records for compliance?

The IRS requires businesses to keep payroll register records for at least four years after taxes are due or paid, whichever is later. This includes registers, timecards, W-2 forms, and proof of deductions, ensuring you’re prepared for audits. The Fair Labor Standards Act (FLSA) also mandates keeping records like employee birth dates (for minors), occupations, and workweek details for three years, with wage records retained for two years.

Some states have stricter rules, requiring retention for up to six years. For example, a consulting firm in California must keep records longer to comply with state labor laws. To stay safe, store both physical and digital copies securely, including canceled checks or bank statements as proof of payment. For tipped employees, like those in a bar, maintain detailed records of tips separately to support FICA tip credits.

Organize records by year and pay period for easy access. Regularly back up digital files to secure cloud storage to prevent data loss. By adhering to these retention rules, you protect your business from legal risks and streamline compliance.

FAQ 9: Can a payroll register help with budgeting and financial planning?

Yes, a payroll register is a powerful tool for budgeting and financial planning. It provides a clear snapshot of labor costs, including gross wages, overtime, bonuses, and deductions, helping you understand your biggest expense—employee compensation. By analyzing trends, like a spike in overtime during peak seasons, you can adjust schedules or hire temporary staff to control costs.

The register also highlights payables, such as FICA taxes and unemployment taxes, allowing you to forecast cash flow needs. For instance, a landscaping business can use its register to predict higher SUTA costs after seasonal layoffs, budgeting accordingly. It also tracks benefits costs, like health insurance or 401(k) contributions, helping you evaluate the affordability of employee perks.

To maximize its value, review your register monthly to identify patterns. For example, if a tech startup notices rising 401(k) deductions, it might negotiate better plan rates. Integrate the register with accounting software to create detailed labor cost reports, ensuring your financial plans align with business goals.

FAQ 10: How can I customize a payroll register for my unique business needs?

Customizing a payroll register ensures it meets your business’s specific requirements, especially if you have unique payroll elements. Start with a standard template, including columns for employee details, gross wages, tax withholdings, and deductions. Then, add custom fields based on your operations. For example, a restaurant might include a column for tips to track taxable income, while a tech company with remote workers could add a remote work allowance column for non-taxable reimbursements.

If your business offers variable compensation, like commissions or bonuses, create separate columns to distinguish them from regular pay. For international employees, include residency status and currency conversion fields to handle global tax compliance. Seasonal businesses might track temporary worker hours separately to manage fluctuating costs.

Use spreadsheet formulas to automate calculations, like summing overtime or applying tax rates. For a boutique with frequent charitable donation deductions, add a column to track these separately for accurate remittance. Regularly review your register’s structure to ensure it captures all relevant data, keeping it both functional and compliant.

FAQ 11: How does a payroll register streamline quarterly IRS Form 941 filings?

A payroll register is a lifeline for small businesses when it comes to preparing and filing IRS Form 941, the quarterly report that details withheld federal income taxes, Social Security, and Medicare contributions. This document consolidates all payroll data for a given period, such as a month or quarter, providing totals for gross wages, tax withholdings, and FICA contributions (both employee and employer shares). By having these figures pre-calculated and organized, you can directly transfer the totals to Form 941, reducing the time spent on manual calculations and minimizing errors that could trigger IRS scrutiny.

The process works seamlessly because the register tracks every relevant detail, from taxable wages to specific deductions like Social Security (capped at $168,600 per employee in 2025) and Medicare. For example, a small bakery with 12 employees can pull the total federal income tax withheld from the register, match it with employer FICA contributions, and input these into Form 941 without digging through individual pay stubs. This clarity is especially helpful for businesses with variable pay, like commissions, ensuring all taxable income is accounted for accurately.

Moreover, the payroll register helps you verify that payroll tax deposits made during the quarter align with Form 941 requirements. If you’re a monthly depositor, the register’s totals ensure you’ve set aside enough for timely payments, avoiding penalties that can reach up to 25% for late filings. Keeping a detailed register also prepares you for potential audits, as the IRS may request supporting documentation. By maintaining an organized record, you can confidently file Form 941 each quarter, knowing your numbers are accurate and compliant.

FAQ 12: What role does a payroll register play in managing employee benefits deductions?

A payroll register is crucial for tracking and managing employee benefits deductions, such as health insurance premiums, 401(k) contributions, or other voluntary withholdings like charitable donations. It acts as a centralized record that captures these deductions for each employee and aggregates them into totals for the pay period. This ensures you know exactly how much to remit to benefit providers, avoiding underpayments that could disrupt employee coverage or overpayments that strain your cash flow.

For instance, consider a small marketing firm offering health insurance and retirement plans. The payroll register lists each employee’s health insurance premium deductions, say $150 per person, and their 401(k) contributions, perhaps 5% of their salary. By totaling these amounts, the register tells you how much to send to the insurance company and retirement plan administrator, ensuring timely payments. This is particularly important for benefits with strict remittance schedules, as delays can lead to penalties or lapsed coverage, affecting employee satisfaction.

Additionally, the register helps you monitor trends in benefits usage. If you notice a significant increase in 401(k) contributions, you might negotiate better plan terms with your provider to reduce fees. It also ensures compliance by separating taxable benefits, like certain bonuses, from non-taxable ones, such as wellness stipends. For businesses with diverse benefits packages, the payroll register provides a clear, organized way to manage these deductions, keeping both employees and providers happy while maintaining financial accuracy.

FAQ 13: How can a payroll register help small businesses prepare for tax audits?

A payroll register is a powerful tool for preparing for tax audits, as it serves as a comprehensive record of all payroll-related transactions, which the IRS or state agencies may scrutinize. The register includes detailed data on gross wages, tax withholdings, FICA contributions, and other deductions, making it easy to provide auditors with accurate, organized information. The IRS requires businesses to retain payroll records for at least four years, and some states extend this to six years, so a well-maintained register ensures you’re ready to comply with these mandates.

During an audit, the IRS often checks for discrepancies in payroll tax deposits, reported wages, and withheld taxes. For example, a small construction company can use its register to show that Social Security withholdings align with the 2025 wage cap of $168,600 per employee, preventing over- or under-reporting. The register also documents employer contributions for FICA and unemployment taxes, proving compliance with federal and state obligations. Including details like employee residency status or tips for tipped workers adds further transparency, addressing specific audit concerns.

To enhance audit readiness, keep supporting documents like timecards, canceled checks, and W-4 forms alongside the register. Regularly reconciling the register with your accounting ledger can catch errors before an audit, such as mismatched tax withholdings. By maintaining a thorough and accurate payroll register, you reduce the stress of audits and demonstrate your commitment to compliance, potentially avoiding costly penalties or prolonged reviews.

FAQ 14: Why is it important to track overtime in a payroll register?

Tracking overtime in a payroll register is critical for both financial accuracy and compliance with labor laws. Overtime pay, typically 1.5 times the regular rate for hours worked over 40 per week, significantly impacts gross wages and, consequently, tax withholdings and employer liabilities like FICA and unemployment taxes. By clearly documenting overtime hours and pay in the register, you ensure employees are compensated correctly and that your business accurately calculates its tax obligations.

For example, a retail store during the holiday season might have employees working 10 extra hours weekly. The payroll register separates regular hours from overtime hours, calculating the higher rate to determine gross pay. This precision prevents underpayment, which could lead to employee disputes or violations of the Fair Labor Standards Act (FLSA), and overpayment, which hurts profitability. It also ensures that overtime wages are correctly included in taxable income, avoiding discrepancies in Social Security or Medicare withholdings.

Beyond compliance, tracking overtime in the register helps with budgeting. If a landscaping business notices a consistent spike in overtime costs, it can use the register’s data to decide whether to hire additional staff or adjust schedules. This proactive approach controls labor costs and improves operational efficiency. By keeping overtime data clear and accessible, the payroll register becomes a strategic tool for managing both legal and financial aspects of your business.

FAQ 15: How does a payroll register support compliance with state unemployment taxes?

A payroll register plays a key role in ensuring compliance with state unemployment taxes (SUTA), which fund unemployment benefits for workers laid off by your business. SUTA is calculated based on a percentage of gross wages, typically up to a state-specific wage base, and the rate varies depending on your business’s experience rating, which reflects past layoffs. The register provides the total gross wages for all employees, making it easy to calculate and remit the correct SUTA amount, usually on a quarterly basis.

For instance, a small manufacturing firm in Texas might have a SUTA rate of 2.7% on the first $9,000 of each employee’s wages. The payroll register’s gross wage totals allow you to quickly determine the taxable amount and set aside funds for payment. This is especially important for businesses with high turnover, like restaurants, where frequent layoffs can increase SUTA rates. By accurately tracking wages, the register helps you avoid underpaying taxes, which could lead to penalties, or overpaying, which ties up cash flow.

Additionally, the register helps you monitor trends that affect SUTA liability. If you notice a pattern of seasonal layoffs, you can plan for higher rates in future quarters. Keeping detailed records also supports audits, as state agencies may request proof of wage calculations. By using the payroll register to stay organized, you ensure timely and accurate SUTA payments, maintaining compliance and financial stability.

FAQ 16: Can a payroll register help manage payroll for remote or international employees?

Managing payroll for remote or international employees can be complex, but a payroll register simplifies the process by providing a flexible framework to track unique compensation elements. For remote workers, the register can include columns for non-taxable reimbursements, such as internet stipends or home office allowances, ensuring these are separated from taxable wages like salaries or bonuses. This clarity prevents overtaxing and keeps your records compliant with IRS rules.

For international employees, the register can be customized to include residency status (resident or nonresident) and currency conversion details, which are critical for accurate tax withholdings. For example, a tech startup with developers in Canada might need to track Canadian tax withholdings alongside U.S. federal taxes for its American employees. The register can include fields for foreign tax credits or exchange rates to ensure proper calculations. This is particularly useful for businesses navigating double taxation agreements between countries.

Moreover, the register helps manage compliance with varying labor laws. Some states or countries require specific deductions, like mandatory pension contributions, which can be tracked in custom columns. Regularly updating the register to reflect changes in international tax laws or remote work policies ensures accuracy. By tailoring the payroll register to these unique needs, you maintain transparency and compliance, even with a geographically diverse workforce.

FAQ 17: How does a payroll register assist with tracking tipped employees’ wages?

For businesses like restaurants or salons with tipped employees, a payroll register is essential for accurately tracking wages and ensuring compliance with tax and labor laws. Tips are considered taxable income, subject to Social Security, Medicare, and income tax withholdings, and must be reported separately from regular wages. The register allows you to create a dedicated column for tips, ensuring they’re included in gross wages and properly taxed, while also supporting calculations for potential FICA tip credits, which offset employer FICA contributions on tips.

For example, a waiter earning a base wage of $5/hour plus $200 in tips per week needs both amounts recorded in the register. The total gross pay ($300, assuming 40 hours) is used to calculate federal and state taxes, Social Security (6.2%), and Medicare (1.45%). By clearly documenting tips, the register helps you verify that the employee meets the minimum wage after tips, as required by the Fair Labor Standards Act (FLSA). This is critical in states with tipped minimum wage laws, like $2.13/hour federally, to avoid penalties.

The register also aids in reporting tips to the IRS via Form 8027 for businesses with significant tip income. By tracking tips consistently, you ensure accurate annual reporting on W-2 forms and avoid discrepancies during audits. For businesses with frequent tip fluctuations, like during holiday seasons, the register provides a clear record to manage these variations, ensuring both employee satisfaction and regulatory compliance.

FAQ 18: What are the benefits of integrating a payroll register with accounting software?

Integrating a payroll register with accounting software transforms payroll management by streamlining processes and improving accuracy for small businesses. The register’s data, including gross wages, tax withholdings, and deductions, can be automatically synced with your accounting system, eliminating the need for manual journal entries. This integration creates seamless records for wage expenses, tax liabilities, and payables, ensuring your financial statements are always up to date.

For instance, a small retail shop can link its payroll register to software that automatically debits wage expenses and credits cash or liability accounts for taxes and benefits. This reduces errors, like forgetting to record employer FICA contributions, and saves hours of bookkeeping time. Integration also facilitates real-time budgeting, as labor costs are instantly reflected in financial reports, helping you make informed decisions about hiring or cost-cutting.

Additionally, many accounting platforms generate reports for IRS Form 941 or W-2 filings directly from the register’s data, ensuring compliance with tax deadlines. For businesses with complex payrolls, like those with bonuses or commission structures, integration ensures all variables are accounted for accurately. By connecting your payroll register to accounting software, you enhance efficiency, reduce errors, and gain deeper insights into your business’s financial health.

FAQ 19: How can a payroll register help identify and control labor costs?

A payroll register is an invaluable tool for identifying and controlling labor costs, which are often a small business’s largest expense. By providing a detailed breakdown of gross wages, overtime, bonuses, and benefits deductions, the register offers a clear picture of where your payroll dollars are going. This allows you to spot trends, such as excessive overtime or rising benefits costs, and take action to optimize your budget.

For example, a catering company might notice in its register that overtime costs spike during wedding season, accounting for 20% of total wages. By analyzing this data, the owner could hire temporary staff to reduce overtime, saving thousands annually. The register also highlights costs for voluntary deductions, like 401(k) contributions or health insurance premiums, helping you assess whether benefits packages are sustainable or need renegotiation with providers.

Regularly reviewing the register enables proactive cost management. You can set labor cost thresholds, like keeping payroll below 30% of revenue, and use the register to track adherence. For businesses with seasonal fluctuations, like a ski resort, the register helps plan for peak periods by forecasting labor needs based on past data. By leveraging the payroll register’s insights, you maintain financial control and ensure long-term profitability.

FAQ 20: What steps should I take to ensure my payroll register is secure and confidential?

Ensuring the payroll register remains secure and confidential is critical, as it contains sensitive information like employees’ Social Security numbers, wages, and deductions. To protect this data, store digital registers in encrypted, password-protected files or cloud-based systems with robust security features, such as two-factor authentication. For physical payroll books, keep them in a locked filing cabinet accessible only to authorized personnel, like the business owner or HR manager.

Regularly back up digital registers to a secure external drive or cloud service to prevent data loss from hardware failures or cyberattacks. For example, a small law firm could schedule weekly backups to ensure records are preserved for the IRS-mandated four-year retention period. Limit access to the register to key staff, and train them on data privacy practices to avoid accidental leaks, such as sharing files via unsecured email.

For businesses using payroll software, choose platforms with strong encryption and compliance with data protection laws, like GDPR for international employees. Conduct periodic audits to check for unauthorized access or discrepancies. If you outsource payroll, ensure your provider signs a confidentiality agreement. By prioritizing security, you protect employee trust and avoid legal risks from data breaches, keeping your payroll register safe and compliant.

Also, Read these Articles in Detail

- A Guide to Creating a Track Spending Spreadsheet for Home Business

- Understanding SEC Form D: A Comprehensive Guide to Exempt Securities Offerings

- Understanding Quotes, Estimates, and Bids: A Comprehensive Guide for Businesses

- Mastering Accruals: A Guide to Understanding and Managing Accrued Accounts

- Building a Robust Emergency Fund for Your Small Business: A Guide to Financial Security

- How to Determine Your Business Valuation: A Comprehensive Guide for Sellers

- Mastering Business Cost Categorization: A Guide to Tracking and Managing Expenses

- Why Every Small Business Owner Needs an Accountant: Your Guide to Financial Success

- Inventory Management: A Comprehensive Guide to Streamlining Your Business Operations

- Mastering Cash Flow: Effective Strategies to Conserve Cash and Maximize Profits

- Inventory Management: A Comprehensive Guide to Streamlining Your Business Operations

- Mastering Cash Flow: Effective Strategies to Conserve Cash and Maximize Profits

- Financial Statements: What Investors Really Want to Know About Your Business

- Historical Cost Principle: Definition, Examples, and Impact on Asset Valuation

- Return on Ad Spend (ROAS): Your Ultimate Guide to Measuring Advertising Success

- Innovative Small Business Marketing Ideas to Skyrocket Your Success

- Market and Marketing Research: The Key to Unlocking Business Success

- Target Audience: A Comprehensive Guide to Building Effective Marketing Strategies

- SWOT Analysis: A Comprehensive Guide for Small Business Success

- Market Feasibility Study: Your Blueprint for Business Success

- Mastering the Art of Selling Yourself and Your Business with Confidence and Authenticity

- 10 Powerful Ways Collaboration Can Transform Your Small Business

- The Network Marketing Business Model: Is It the Right Path for You?

- Crafting a Memorable Business Card: 10 Essential Rules for Small Business Owners

- Bootstrap Marketing Mastery: Skyrocketing Your Small Business on a Shoestring Budget

- Mastering Digital Marketing: The Ultimate Guide to Small Business Owner’s

- Crafting a Stellar Press Release: Your Ultimate Guide to Free Publicity

- Reciprocity: Building Stronger Business Relationships Through Give and Take

- Business Cards: A Comprehensive Guide to Designing and Printing at Home

- The Ultimate Guide to Marketing Firms: How to Choose the Perfect One

- Direct Marketing: A Comprehensive Guide to Building Strong Customer Connections

- Mastering Marketing for Your Business: A Comprehensive Guide

- Crafting a Winning Elevator Pitch: Your Guide to Captivating Conversations

- A Complete Guide to Brand Valuation: Unlocking Your Brand’s True Worth

- B2B Marketing vs. B2C Marketing: A Comprehensive Guide to Winning Your Audience

- Pay-Per-Click Advertising: A Comprehensive Guide to Driving Traffic and Maximizing ROI

- Multi-Level Marketing: A Comprehensive Guide to MLMs, Their Promises, and Pitfalls

- Traditional Marketing vs. Internet Marketing for Small Businesses

- Branding: Building Trust, Loyalty, and Success in Modern Marketing

- How to Craft a Winning Marketing Plan for Your Home Business

- The Synergy of Sales and Marketing: A Comprehensive Guide

- Mastering the Marketing Mix: A Comprehensive Guide to Building a Winning Strategy

- Return on Investment (ROI): Your Guide to Smarter Business Decisions

- How to Create a Winning Website Plan: A Comprehensive Guide

Acknowledgement

The creation of the article “How to Create and Manage a Payroll Register for Small Businesses” was made possible through the wealth of information provided by several reputable sources. I express my gratitude to IRS (www.irs.gov) for its comprehensive guidelines on payroll tax requirements and recordkeeping standards, which ensured the accuracy of compliance-related details. I also appreciate Paychex (www.paychex.com) for its insights into payroll management best practices, which enriched the article’s practical advice. Additionally, QuickBooks (www.quickbooks.intuit.com) provided valuable information on integrating payroll with accounting systems, enhancing the article’s guidance on automation.

The following key points highlight the contributions of these sources:

- IRS: Provided detailed regulations on payroll tax deposits, Form 941 filings, and record retention requirements, ensuring the article aligns with 2025 federal standards.

- Paychex: Offered practical tips on avoiding common payroll mistakes and managing employee benefits, adding depth to the article’s actionable strategies.

- QuickBooks: Contributed insights on streamlining payroll through software integration, making the article relevant for businesses adopting automated systems.

Disclaimer

The information provided in the article “How to Create and Manage a Payroll Register for Small Businesses” is intended for general informational purposes only and should not be considered professional financial, tax, or legal advice. While the content is based on reputable sources and aims to reflect accurate and up-to-date payroll practices, tax laws, and regulations, these can vary by jurisdiction and change over time.

Readers are strongly encouraged to consult with a qualified accountant, tax professional, or legal advisor to ensure compliance with federal, state, and local regulations specific to their business. The author and publisher are not responsible for any errors, omissions, or consequences arising from the use of this information. Always verify details with relevant authorities or professionals before implementing payroll processes.