Switching your business’s accounting method can feel like navigating a maze, especially when it involves dealing with the IRS. Whether you’re a small business owner or managing a larger enterprise, the decision to change from cash basis to accrual basis accounting—or vice versa—can significantly impact how you report income and expenses. The IRS requires businesses to formally request this change using Form 3115, a critical document that ensures compliance and avoids costly penalties.

This guide dives deep into the process of changing accounting methods, explains how to file Form 3115, and provides practical insights, examples, and tips to make the transition as smooth as possible.

Table of Contents

Understanding Accounting Methods: Why They Matter

Every business must choose an accounting method when filing its first tax return. The two primary methods are cash basis and accrual basis, though some businesses use a hybrid approach combining elements of both. Your choice affects how and when you record income and expenses, which in turn influences your tax obligations.

The cash basis method records income when cash is received and expenses when they are paid. For example, if you invoice a client in December but don’t receive payment until January, the income is recorded in January. This method is straightforward and often preferred by small businesses, freelancers, or sole proprietors with simple financial structures.

The accrual basis method, on the other hand, records income when it’s earned and expenses when they’re incurred, regardless of when money changes hands. Using the same example, the income from that December invoice would be recorded in December, even if payment arrives later. This method is common among larger businesses or those with complex transactions, as it provides a clearer picture of financial health over time.

Some businesses use a hybrid method, blending cash and accrual methods for different aspects of their accounting. For instance, a company might use accrual for sales but cash for expenses. However, once you select a method and report it to the IRS, you’re generally required to stick with it. Changing methods without IRS approval can lead to penalties, making Form 3115 a critical tool for businesses seeking flexibility.

Why Change Your Accounting Method?

There are several reasons a business might want to switch accounting methods. Understanding these reasons can help you determine if filing Form 3115 is the right move.

Business Growth and Complexity

As your business grows, your accounting needs may evolve. A small business using the cash method might find it insufficient when dealing with large contracts, inventory, or credit-based transactions. For example, a retail store that starts offering credit to customers may benefit from the accrual method to better track accounts receivable.

Tax Planning and Compliance

Switching methods can optimize your tax strategy. The accrual method might allow you to deduct expenses earlier, while the cash method could defer income recognition to a later tax year. For instance, a consulting firm expecting a large payment in January might switch to the cash method to delay reporting that income, potentially lowering their tax bill for the current year.

Industry Requirements

Certain industries or lenders may require specific accounting methods. For example, businesses with significant inventory, like manufacturing companies, are often required to use the accrual method to comply with IRS regulations or secure loans.

Correcting Errors

If you initially chose an incorrect method or failed to follow IRS guidelines, you may need to file Form 3115 to correct your accounting practices. For example, a contractor who mistakenly used the cash method despite holding large inventories might need to switch to accrual to align with IRS rules.

Example: A Growing Bakery

Consider a bakery that started as a small operation using the cash method. As it expands to supply local cafes and manage bulk orders, tracking accounts receivable and inventory becomes critical. Switching to the accrual method allows the bakery to record sales when orders are placed, providing a clearer financial picture for planning and loan applications.

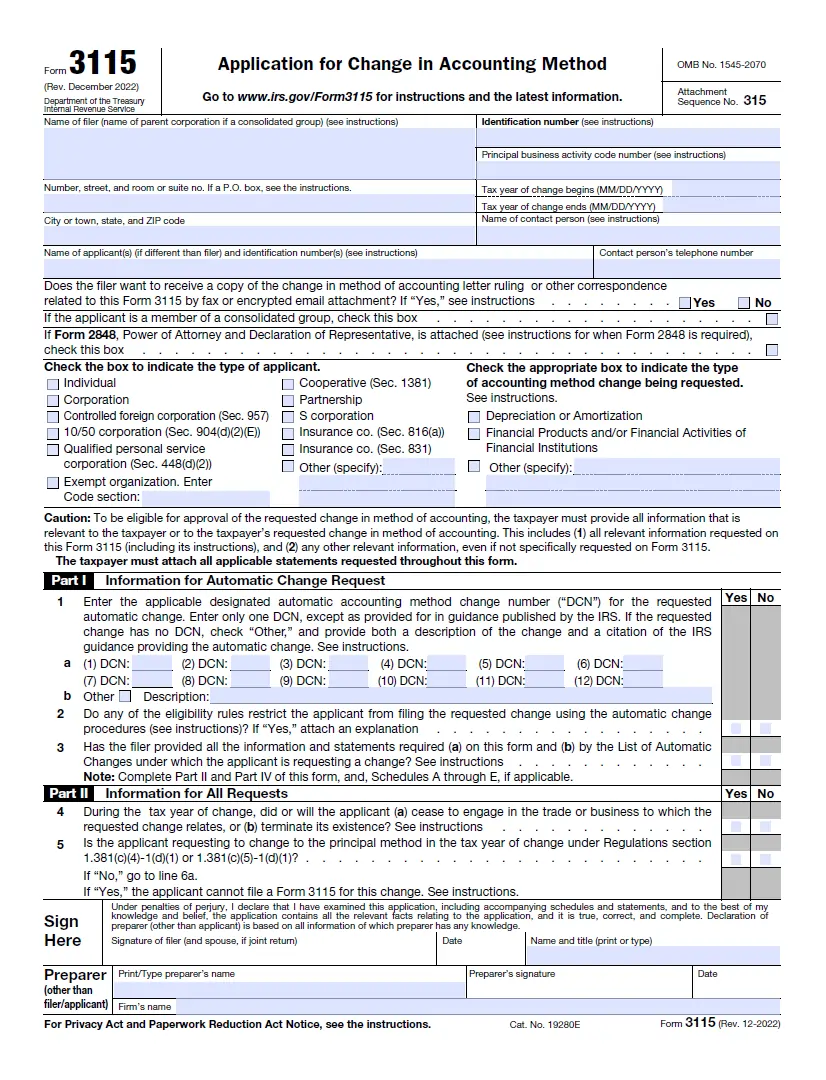

What Is IRS Form 3115?

IRS Form 3115, officially titled “Application for Change in Accounting Method,” is the IRS’s required document for businesses seeking to change their accounting method. It applies to changes in your overall accounting method (e.g., from cash to accrual) and specific changes in how you account for particular items, such as inventory valuation or depreciation.

The form ensures that the IRS is aware of the change and that it’s applied consistently to avoid discrepancies in tax reporting. Failing to file Form 3115 when changing methods can result in audits, penalties, or adjustments to your tax returns, potentially leading to a larger tax bill.

Types of Changes Covered by Form 3115

Form 3115 isn’t just for switching between cash and accrual methods. It’s also used for:

- Changing how you value inventory (e.g., from cost to lower of cost or market).

- Adjusting depreciation or amortization methods (e.g., switching from accelerated to straight-line depreciation).

- Correcting improper accounting treatments, such as expensing an item that should be capitalized.

For example, a construction company might file Form 3115 to change how it accounts for long-term contracts, ensuring compliance with IRS rules for percentage-of-completion accounting.

Automatic vs. Non-Automatic Change Requests

The IRS categorizes accounting method changes into two types: automatic and non-automatic. Understanding the difference is crucial for filing Form 3115 correctly.

Automatic Change Requests

Automatic changes are pre-approved by the IRS for specific situations outlined in IRS guidance (e.g., Revenue Procedures). These changes are simpler and don’t require a user fee. Examples include switching from cash to accrual for businesses meeting certain criteria or correcting minor accounting errors.

To file an automatic change request, you must submit Form 3115 in duplicate:

- Attach the original to your federal income tax return for the year of the change (including extensions).

- Send a copy to the IRS in Ogden, Utah, no earlier than the first day of the year of the change and no later than when you file your tax return.

The IRS doesn’t send a confirmation for automatic changes, so accurate record-keeping is essential.

Non-Automatic Change Requests

Non-automatic changes require explicit IRS approval and are subject to stricter eligibility rules. These changes often involve complex or unique accounting adjustments, such as changing methods for a business with significant revenue or altering industry-specific accounting practices. A user fee, which can range from hundreds to thousands of dollars depending on the change, is required.

For non-automatic requests, you file Form 3115 in duplicate, sending one copy to the IRS National Office in Washington, D.C., and attaching the other to your tax return. The IRS typically acknowledges receipt within 60 days.

Example: A Tech Startup’s Transition

A tech startup initially uses the cash method but grows rapidly, securing venture capital and signing multi-year contracts. To better reflect its financial position, it decides to switch to the accrual method. Since this is a common change for growing businesses, it qualifies as an automatic change, saving the startup from paying a user fee and simplifying the process.

Step-by-Step Guide to Filing Form 3115

Filing Form 3115 can seem daunting, but breaking it down into steps makes it manageable. Here’s a detailed guide to help you navigate the process.

Step 1: Determine Eligibility

Confirm that your desired change qualifies as automatic or non-automatic. The IRS publishes a list of automatic changes in its Revenue Procedures (e.g., Rev. Proc. 2023-24). If your change isn’t listed, it’s likely non-automatic, requiring additional scrutiny and a user fee.

Step 2: Gather Financial Information

Collect financial records, including prior tax returns, income statements, and balance sheets. You’ll need to calculate the Section 481(a) adjustment, which reconciles differences between your old and new accounting methods. For example, switching from cash to accrual may require recognizing income or expenses not previously reported.

Step 3: Complete Form 3115

Form 3115 is a detailed document requiring information such as:

- Your business’s name, address, and taxpayer identification number.

- The type of accounting method change (overall or specific item).

- The year of the change.

- The Section 481(a) adjustment, if applicable.

- A description of why the change is necessary.

Be precise, as errors can delay processing or trigger IRS scrutiny.

Step 4: Submit the Form

For automatic changes:

- Attach the original Form 3115 to your federal income tax return.

- Mail a copy to: Internal Revenue Service, 1973 N. Rulon White Blvd., Ogden, UT 84201, Attn: M/S 6111.

For non-automatic changes:

- Mail a copy to: Internal Revenue Service, Attn: CC:PA:LPD:DRU, P.O. Box 7604, Benjamin Franklin Station, Washington, DC 20044.

- Attach the original to your tax return.

- Include the user fee with your submission.

If using a private delivery service, use the corresponding addresses provided earlier.

Step 5: Monitor and Maintain Records

For automatic changes, keep copies of all documents, as the IRS won’t confirm receipt. For non-automatic changes, expect an acknowledgment within 60 days. Retain all correspondence and calculations for at least three years, as the IRS may request them during an audit.

Table: Filing Requirements for Form 3115

| Requirement | Automatic Change | Non-Automatic Change |

|---|---|---|

| IRS Approval Needed | Pre-approved by IRS guidance | Requires explicit IRS approval |

| User Fee | None | Required (varies by change) |

| Filing Deadline | Attach to tax return; send copy by tax return filing date | Same, but earlier filing recommended |

| Submission Address | Ogden, UT | Washington, D.C. |

| Acknowledgment | None | Within 60 days |

| Eligibility | Listed in IRS Revenue Procedures | Must meet specific IRS criteria |

Common Pitfalls and How to Avoid Them

Filing Form 3115 is complex, and mistakes can lead to delays or penalties. Here are common pitfalls and tips to avoid them:

Incomplete or Inaccurate Forms

Errors in Form 3115, such as missing signatures or incorrect Section 481(a) adjustments, can cause rejections. Double-check all entries and consult a tax professional if unsure.

Missing Deadlines

While there’s no strict deadline for Form 3115, filing early in the tax year simplifies the process. For automatic changes, ensure the copy is mailed to the IRS by the time you file your tax return.

Failing to Request Permission

Some businesses mistakenly change methods without filing Form 3115, assuming the IRS won’t notice. This can trigger audits and penalties. Always file Form 3115 before implementing the change.

Ignoring the Section 481(a) Adjustment

The Section 481(a) adjustment ensures that income or expenses aren’t duplicated or omitted during the transition. For example, a business switching to accrual might need to report income from prior years’ invoices. Failing to calculate this correctly can lead to tax underpayments.

Example: A Retail Store’s Mistake

A retail store switches from cash to accrual without filing Form 3115, assuming it’s a minor change. During an audit, the IRS discovers unreported income from credit sales, resulting in penalties and interest. Filing Form 3115 upfront would have avoided this costly error.

Special Considerations: Depreciation and Inventory Changes

Beyond overall method changes, Form 3115 is often used for adjustments to depreciation or inventory valuation. These changes have unique rules.

Depreciation Changes

Switching depreciation methods (e.g., from accelerated to straight-line) usually requires IRS approval, except in specific cases. For example, correcting an improper depreciation method (like expensing an asset that should be depreciated) requires Form 3115. The straight-line method often qualifies for automatic changes, but consult a tax professional to confirm.

Inventory Valuation

Businesses with inventory must use the accrual method for purchases and sales, per IRS rules. Changing how you value inventory—such as switching from cost to lower of cost or market—requires Form 3115. For instance, a car dealership might file Form 3115 to adopt a more accurate inventory method after expanding its lot.

Example: A Manufacturer’s Adjustment

A manufacturer realizes it’s been using an incorrect depreciation schedule for its machinery, leading to overstated expenses. By filing Form 3115, it corrects the method and recalculates depreciation, ensuring compliance and optimizing tax deductions.

Practical Tips for a Smooth Transition

Changing accounting methods is a significant decision. Here are additional tips to ensure success:

Consult a Tax Professional

The rules governing Form 3115 are complex, and errors can be costly. A CPA or tax advisor can help determine eligibility, calculate adjustments, and ensure accurate filing.

Plan for the Section 481(a) Adjustment

The adjustment can result in a large taxable amount if income is recognized upfront. For example, a business switching to accrual might owe taxes on previously unreported receivables. Spread the adjustment over four years (if eligible) to ease the tax burden.

Update Your Accounting Systems

Ensure your bookkeeping software and processes align with the new method. For example, switching to accrual may require tracking accounts receivable and payable more closely.

Communicate with Stakeholders

Inform lenders, investors, or partners about the change, as it may affect financial statements. For instance, accrual-based reports might show higher revenue, impacting loan covenants.

Example: A Freelancer’s Strategy

A freelance graphic designer switches from cash to accrual to better track project-based income. By working with a CPA, she files Form 3115, updates her accounting software, and spreads the Section 481(a) adjustment over four years, minimizing her tax impact.

Long-Term Benefits of Changing Accounting Methods

While filing Form 3115 requires effort, the benefits can be substantial:

- Improved Financial Reporting: The accrual method provides a clearer picture of long-term financial health, aiding decision-making.

- Tax Optimization: Strategic changes can defer income or accelerate deductions, reducing tax liability.

- Compliance: Proper filing avoids IRS penalties and audits, ensuring peace of mind.

- Scalability: The right method supports growth, making it easier to secure funding or comply with industry standards.

For example, a tech company switching to accrual gains credibility with investors by presenting more accurate financials, paving the way for a successful funding round.

Conclusion: Take Control of Your Accounting Future

Changing your business’s accounting method is a strategic move that can enhance financial clarity, optimize taxes, and ensure IRS compliance. By filing Form 3115, you gain the flexibility to adapt your accounting practices to your business’s evolving needs. Whether you’re a small business owner or a CFO of a growing enterprise, understanding the process, avoiding pitfalls, and seeking professional guidance are key to a successful transition.

Take the time to assess your business’s needs, gather accurate data, and follow IRS guidelines meticulously. With careful planning and the right approach, Form 3115 can be a powerful tool to align your accounting method with your business goals, setting the stage for long-term success.

Frequently Asked Questions

FAQ 1: What Is IRS Form 3115, and Why Is It Important for Businesses?

Form 3115, known as the Application for Change in Accounting Method, is a critical document businesses use to request IRS approval for changing their accounting method. Whether you’re switching from cash basis to accrual basis or adjusting how you account for specific items like inventory or depreciation, this form ensures your business stays compliant with IRS regulations. Without filing Form 3115, you risk penalties, audits, or unexpected tax bills, making it essential for businesses seeking to adapt their financial reporting.

The importance of Form 3115 lies in its role as a formal request to the IRS. When you first file a tax return, you choose an accounting method, and the IRS expects consistency. If your business grows, changes industries, or needs to correct an error, you may need to switch methods. For example, a small retail shop might switch to accrual accounting to better track credit sales. Filing Form 3115 prevents discrepancies in your tax reporting and ensures the IRS is aware of the change.

Additionally, Form 3115 helps calculate the Section 481(a) adjustment, which reconciles differences between your old and new accounting methods. This adjustment ensures you don’t double-count income or miss deductions, maintaining accurate tax reporting. By filing this form correctly, businesses avoid costly mistakes and align their accounting with their financial goals.

FAQ 2: When Should a Business Consider Changing Its Accounting Method?

Businesses may need to change their accounting method for several reasons, often tied to growth, compliance, or financial strategy. The decision to file Form 3115 typically arises when your current method no longer suits your business’s needs or IRS requirements. Understanding these triggers can help you decide when to make the switch.

One common reason is business growth. Small businesses often start with the cash basis method because it’s simple, recording income and expenses when cash changes hands. However, as a business expands—say, a freelance designer starts handling large corporate contracts—the accrual basis method may better reflect financial performance by recording income when earned. Another reason is tax planning. Switching methods can defer income or accelerate deductions, optimizing your tax liability. For instance, a consulting firm might switch to cash basis to delay reporting a large year-end payment.

Industry requirements or compliance issues also prompt changes. Businesses with significant inventory, like manufacturers, are often required to use accrual accounting for purchases and sales. Similarly, correcting an improper accounting method, such as expensing assets that should be depreciated, requires Form 3115. Consulting a tax professional can help determine if your business’s situation warrants a change.

FAQ 3: What Are the Differences Between Cash and Accrual Accounting Methods?

The cash basis and accrual basis accounting methods are the two primary ways businesses track income and expenses, and each has distinct features. Understanding these differences is crucial before filing Form 3115 to change methods, as the switch impacts how you report taxes and manage finances.

In cash basis accounting, you record income when you receive payment and expenses when you pay them. For example, if a bakery invoices a client in December but gets paid in January, the income is recorded in January. This method is straightforward, making it ideal for small businesses or freelancers with simple transactions. However, it may not accurately reflect long-term financial health, especially for businesses with delayed payments or large inventories.

Conversely, accrual basis accounting records income when it’s earned and expenses when they’re incurred, regardless of when money changes hands. Using the bakery example, the December invoice would be recorded as income in December, even if payment arrives later. This method provides a clearer picture of financial performance, making it suitable for larger businesses or those with complex transactions. However, it requires more robust bookkeeping to track receivables and payables. Businesses must weigh these factors when deciding which method suits their needs before requesting a change via Form 3115.

FAQ 4: What Types of Accounting Method Changes Require Form 3115?

Form 3115 is required for a wide range of accounting method changes, not just switching between cash and accrual methods. The IRS mandates its use for any change in how you report income or expenses to ensure consistency and compliance. Knowing the types of changes covered helps businesses prepare for the filing process.

Overall method changes, like moving from cash to accrual or vice versa, are the most common. For instance, a growing tech startup might switch to accrual to better track multi-year contracts. Form 3115 is also needed for specific item changes, such as adjusting how you value inventory. A car dealership, for example, might file to switch from cost-based inventory valuation to the lower of cost or market method to reflect declining vehicle values.

Changes in depreciation or amortization methods often require Form 3115, though some straight-line depreciation adjustments qualify for automatic approval. Additionally, correcting improper accounting treatments—like expensing a capital asset instead of depreciating it—requires the form. Each change may involve a Section 481(a) adjustment to reconcile differences, so businesses should consult a tax professional to ensure all requirements are met.

FAQ 5: What Is the Difference Between Automatic and Non-Automatic Change Requests?

When filing Form 3115, businesses must choose between automatic and non-automatic change requests, each with distinct processes and requirements. Understanding these differences ensures you follow the correct procedure and avoid delays or penalties.

Automatic change requests are pre-approved by the IRS for specific situations outlined in its Revenue Procedures. These changes, such as switching from cash to accrual for eligible small businesses, are simpler and don’t require a user fee. You file Form 3115 in duplicate, attaching one copy to your tax return and sending another to the IRS in Ogden, Utah. The IRS doesn’t acknowledge receipt, so accurate record-keeping is vital. For example, a retail store switching to accrual due to increased credit sales might qualify for an automatic change, streamlining the process.

Non-automatic change requests require explicit IRS approval and are typically for complex or unique changes, like adjusting industry-specific accounting practices. These requests involve a user fee, which varies based on the change, and stricter eligibility criteria. You send one copy of Form 3115 to the IRS National Office in Washington, D.C., and attach another to your tax return. The IRS acknowledges receipt within 60 days. Businesses should carefully review IRS guidelines or consult a professional to determine which process applies.

FAQ 6: How Do I File Form 3115 Correctly?

Filing Form 3115 correctly is essential to avoid IRS rejection or penalties. The process involves several steps, from determining eligibility to submitting the form, and requires careful attention to detail. Here’s how to get it right.

Start by confirming whether your change qualifies as automatic or non-automatic using IRS Revenue Procedures. Gather financial records, including prior tax returns and balance sheets, to calculate the Section 481(a) adjustment, which reconciles differences between methods. For example, a contractor switching to accrual might need to report previously unrecognized income from long-term projects. Complete Form 3115 with accurate details, including your business’s information, the type of change, and the reason for it.

For automatic changes, attach the original Form 3115 to your federal income tax return and mail a copy to the IRS in Ogden, Utah, by the tax filing date. For non-automatic changes, send a copy to the IRS National Office in Washington, D.C., include the user fee, and attach the original to your return. Keep copies of all documents, as the IRS may request them during an audit. Consulting a tax professional can help ensure accuracy and compliance.

FAQ 7: What Is the Section 481(a) Adjustment, and Why Is It Important?

The Section 481(a) adjustment is a critical component of Form 3115, ensuring that income and expenses are not duplicated or omitted when changing accounting methods. It reconciles differences between your old and new methods, maintaining tax accuracy and preventing manipulation of taxable income.

When you switch methods, your financial records may show discrepancies. For example, a business moving from cash to accrual might have unreported income from invoices issued but not yet paid. The Section 481(a) adjustment calculates this amount, which is then included in your taxable income, often spread over four years to ease the tax burden. Conversely, switching from accrual to cash might reduce taxable income if expenses were recorded but not paid.

This adjustment is important because it ensures compliance with IRS rules and prevents under- or over-reporting. For instance, a manufacturer switching methods might owe taxes on previously unreported receivables but can spread the adjustment to minimize the immediate impact. Failing to calculate it correctly can lead to IRS scrutiny, so businesses should work with a tax professional to ensure accuracy.

FAQ 8: What Are the Consequences of Not Filing Form 3115?

Failing to file Form 3115 when changing your accounting method can lead to serious consequences, including financial and legal repercussions. The IRS requires businesses to request approval for method changes to ensure consistent tax reporting, and bypassing this step can create problems.

One major consequence is penalties. If you change methods without IRS approval, the IRS may view it as non-compliance, leading to fines or interest on underpaid taxes. For example, a retailer switching to accrual without filing Form 3115 might underreport income from credit sales, triggering an audit and additional tax liabilities. Another risk is forced adjustments. During an audit, the IRS may require you to retroactively adjust your accounting, resulting in a larger tax bill.

Additionally, not filing can disrupt financial planning. Inconsistent accounting methods may misrepresent your business’s financial health, affecting loan applications or investor confidence. To avoid these issues, always file Form 3115 before implementing a change and consult a tax professional to ensure compliance.

FAQ 9: Can I Change My Depreciation or Inventory Methods Using Form 3115?

Yes, Form 3115 is used to change not only overall accounting methods but also specific treatments like depreciation and inventory valuation. These changes often require IRS approval, and Form 3115 ensures they’re implemented correctly.

For depreciation, Form 3115 is needed to switch methods, such as from accelerated to straight-line depreciation, or to correct improper treatments, like expensing an asset that should be depreciated. Some straight-line depreciation changes qualify as automatic, simplifying the process. For example, a construction company might file Form 3115 to correct an incorrect depreciation schedule for its equipment, ensuring accurate tax deductions.

For inventory, businesses must use the accrual method for purchases and sales if they maintain significant inventory. Form 3115 is required to change valuation methods, such as switching from cost to lower of cost or market. A car dealership, for instance, might file to adopt a more accurate valuation method after expanding its inventory. Always verify eligibility with IRS guidelines or a tax professional to ensure proper filing.

FAQ 10: How Can a Tax Professional Help with Filing Form 3115?

Navigating Form 3115 can be complex, and a tax professional can provide invaluable assistance to ensure accuracy and compliance. Their expertise helps businesses avoid costly mistakes and streamline the process of changing accounting methods.

A tax professional can assess whether your desired change qualifies as automatic or non-automatic, saving time and ensuring you follow the correct procedure. They can also help calculate the Section 481(a) adjustment, which requires detailed financial analysis to reconcile differences between methods. For example, a CPA might help a retailer switching to accrual accurately report previously unrecognized income, avoiding IRS penalties.

Additionally, tax professionals stay updated on IRS guidelines, such as Revenue Procedures, ensuring your Form 3115 meets current requirements. They can also advise on tax planning strategies, like spreading adjustments over four years to minimize tax impact. For businesses with complex changes, such as industry-specific accounting adjustments, their guidance is essential for navigating non-automatic requests and user fees.

FAQ 11: How Does the Section 481(a) Adjustment Work When Changing Accounting Methods?

The Section 481(a) adjustment is a crucial element when filing Form 3115 to change your business’s accounting method, as it ensures that income and expenses are not duplicated or omitted during the transition. This adjustment reconciles differences between your old and new accounting methods, maintaining tax accuracy and preventing discrepancies that could trigger IRS scrutiny. For instance, a business switching from cash basis to accrual basis might have income from unpaid invoices that wasn’t previously reported, and the Section 481(a) adjustment accounts for this amount to ensure it’s taxed appropriately.

The process begins by analyzing your financial records to identify any income or expenses that would be reported differently under the new method. For example, a landscaping company moving to accrual accounting might need to include income from services billed but not yet paid for in prior years. This adjustment can result in a significant taxable amount, but the IRS often allows businesses to spread it over four years to ease the tax burden. This flexibility is particularly helpful for small businesses transitioning to a new method, as it prevents a sudden spike in tax liability.

Calculating the Section 481(a) adjustment requires careful attention to detail, as errors can lead to under- or over-reporting income. Businesses must review prior tax returns, accounts receivable, and accounts payable to determine the adjustment’s impact. Consulting a tax professional is highly recommended to ensure accuracy, as they can navigate complex scenarios, such as adjusting for inventory or long-term contracts, and ensure compliance with IRS rules.

FAQ 12: Who Needs to File Form 3115 for an Accounting Method Change?

Any business seeking to change its accounting method, whether it’s the overall method or a specific item, must file Form 3115 to gain IRS approval. This requirement applies to a wide range of entities, including sole proprietors, partnerships, corporations, and LLCs, ensuring that all taxpayers follow consistent tax reporting practices. For example, a freelance writer switching from cash basis to accrual basis to better track project-based income must file Form 3115, just as a large manufacturing company would when adjusting inventory valuation methods.

The need to file arises whenever a business wants to alter how it recognizes income or expenses for tax purposes. This could include switching from cash to accrual, changing depreciation schedules, or correcting improper accounting treatments. For instance, a retail business that initially expensed equipment instead of depreciating it over time would need to file Form 3115 to correct this error. Even businesses using a hybrid method—combining elements of cash and accrual—must file if they modify any aspect of their accounting approach.

Small businesses, especially those with limited accounting expertise, may not realize they need to file Form 3115, but failing to do so can lead to penalties or audits. The IRS requires this form to maintain transparency and prevent tax evasion through inconsistent reporting. Regardless of the business size or industry, consulting a tax professional can clarify whether Form 3115 is necessary for your specific change.

FAQ 13: What Are the Benefits of Switching from Cash to Accrual Accounting?

Switching from cash basis to accrual basis accounting can offer significant benefits for businesses, particularly those experiencing growth or operating in complex industries. The accrual method records income when it’s earned and expenses when they’re incurred, providing a more accurate picture of a company’s financial health. For example, a software company with multi-year contracts can better track revenue and expenses over time, making it easier to plan for future investments or secure financing.

One major advantage is improved financial reporting. Unlike the cash method, which only reflects cash flow, accrual accounting shows a business’s true financial position by including accounts receivable and payable. This is critical for businesses with delayed payments, such as a construction firm waiting on client invoices. Additionally, the accrual method aligns with Generally Accepted Accounting Principles (GAAP), which may be required by lenders, investors, or regulatory bodies, enhancing credibility with stakeholders.

Another benefit is tax planning flexibility. While the initial switch may require a Section 481(a) adjustment to account for previously unreported income, businesses can often spread this adjustment over four years, reducing the immediate tax impact. Over time, accrual accounting may allow for earlier expense deductions, optimizing tax outcomes. For businesses aiming to scale or attract investment, the accrual method’s clarity and compliance advantages make it a strategic choice, though filing Form 3115 is essential to make the transition legally.

FAQ 14: Can Small Businesses File Form 3115, or Is It Only for Large Companies?

Small businesses, just like larger corporations, can and often need to file Form 3115 when changing their accounting methods. The IRS applies the same rules to all taxpayers, regardless of size, ensuring consistency in tax reporting. Whether you’re a sole proprietor running a home-based bakery or a small retail store expanding to multiple locations, filing Form 3115 is necessary if you want to switch from cash basis to accrual basis, adjust inventory methods, or correct accounting errors.

For small businesses, the automatic change request process is particularly relevant, as many common changes, such as switching to accrual accounting, qualify for this streamlined procedure. This process doesn’t require a user fee, making it accessible for businesses with limited resources. For example, a freelance photographer who starts offering credit terms to clients might file Form 3115 to adopt accrual accounting, ensuring accurate tracking of unpaid invoices without incurring additional costs.

However, small businesses may face challenges due to limited accounting expertise or resources. Calculating the Section 481(a) adjustment or navigating IRS guidelines can be complex, so many small business owners benefit from consulting a tax professional. This ensures the form is filed correctly and helps avoid penalties, making Form 3115 a practical tool for small businesses seeking to adapt their accounting practices to growth or compliance needs.

FAQ 15: What Happens If the IRS Rejects My Form 3115 Filing?

If the IRS rejects your Form 3115 filing, it can disrupt your accounting method change and potentially lead to compliance issues, but understanding the reasons for rejection and next steps can help you address the problem. Rejections typically occur due to incomplete or inaccurate forms, failure to meet eligibility criteria, or missing documentation, such as the Section 481(a) adjustment calculations. For example, a manufacturing company filing for a non-automatic change might be rejected if it doesn’t include the required user fee or provide a clear explanation for the change.

When a rejection happens, the IRS will notify you, often outlining the reasons for denial. For non-automatic change requests, you may receive feedback within 60 days, as the IRS acknowledges receipt of these filings. You can then revise and resubmit Form 3115, addressing the IRS’s concerns. For instance, if the rejection was due to an incorrect adjustment calculation, a tax professional can help recalculate and refile. If the change doesn’t qualify, you may need to continue using your current method or explore an alternative that meets IRS guidelines.

To avoid rejection, ensure all sections of Form 3115 are complete, double-check eligibility using IRS Revenue Procedures, and include all required documentation. For complex changes, working with a CPA can minimize errors. If rejected, acting quickly to correct the issue is crucial to maintain compliance and avoid penalties for unauthorized method changes.

FAQ 16: How Long Does It Take to Process Form 3115?

The processing time for Form 3115 depends on whether you’re filing an automatic or non-automatic change request, as each follows a different IRS review process. Understanding these timelines can help businesses plan their accounting method changes effectively and avoid disruptions in tax reporting.

For automatic change requests, the IRS typically doesn’t actively review or acknowledge the filing, as these changes are pre-approved under specific guidelines. Once you attach the original Form 3115 to your tax return and mail a copy to the IRS in Ogden, Utah, the change is generally considered effective for the tax year specified, provided the form is accurate. For example, a retail business switching to accrual basis might implement the change immediately after filing, assuming no errors. However, businesses should retain copies of all documents, as the IRS may review them during an audit.

Non-automatic change requests take longer, as they require explicit IRS approval. After submitting Form 3115 to the IRS National Office in Washington, D.C., you can expect an acknowledgment within 60 days, but full approval may take several months, depending on the complexity of the change. For instance, a large corporation adjusting industry-specific accounting practices might wait longer due to additional scrutiny. To expedite the process, ensure your form is complete, include the user fee, and consult a tax professional to avoid delays.

FAQ 17: Can I File Form 3115 to Correct an Incorrect Accounting Method?

Yes, Form 3115 is the appropriate form for correcting an incorrect accounting method, ensuring your business complies with IRS regulations and avoids penalties. If you’ve been using an improper method—such as expensing assets that should be depreciated or using cash basis when accrual basis is required—filing Form 3115 allows you to rectify the mistake and align with IRS rules. This is particularly important for businesses that face audits or need to maintain accurate financial records.

For example, a construction company that mistakenly used the cash method despite holding significant inventory might file Form 3115 to switch to accrual accounting, as required by the IRS for inventory-heavy businesses. The form requires you to calculate a Section 481(a) adjustment to account for any income or expenses misreported under the incorrect method. This adjustment ensures that all financial activity is properly reported, preventing discrepancies that could lead to tax underpayments or overpayments.

Correcting an improper method often qualifies as an automatic change request, simplifying the process and eliminating the need for a user fee. However, the rules can be complex, and errors in the correction process can lead to further issues. Businesses should consult a tax professional to ensure the form is filed correctly and that the adjustment accurately reflects the change, protecting against future IRS challenges.

FAQ 18: What Are the Costs Associated with Filing Form 3115?

Filing Form 3115 to change your business’s accounting method involves various costs, depending on whether you’re submitting an automatic or non-automatic change request, as well as the complexity of the change and whether you seek professional assistance. Understanding these costs is essential for businesses to budget effectively and avoid unexpected expenses during the process. While some changes are relatively low-cost, others may require significant investment, particularly for complex or industry-specific adjustments.

For automatic change requests, the IRS does not charge a user fee, making this option more accessible for small businesses or those making common changes, such as switching from cash basis to accrual basis. For example, a freelance consultant transitioning to accrual accounting to better track client invoices can file Form 3115 without paying the IRS directly. However, even automatic changes may involve indirect costs, such as hiring a CPA or tax professional to ensure accurate completion of the form and calculation of the Section 481(a) adjustment. These professional fees can range from a few hundred to several thousand dollars, depending on the business’s financial complexity and the expertise required.

Non-automatic change requests, on the other hand, require a user fee paid to the IRS, which varies based on the type of change and can range from hundreds to thousands of dollars. For instance, a large corporation adjusting industry-specific accounting practices, such as a construction company adopting percentage-of-completion accounting, may face a higher fee due to the IRS’s additional review process. Additionally, non-automatic requests often involve more complex eligibility criteria and documentation, increasing the likelihood of needing professional help, which adds to the overall cost. Businesses should carefully evaluate these expenses against the long-term benefits of the accounting method change, such as improved financial reporting or tax optimization, and consult a tax professional to ensure cost-effective compliance.

FAQ 19: How Does Changing Accounting Methods Affect My Business’s Tax Return?

Changing your accounting method by filing Form 3115 can significantly impact your business’s tax return, as it alters how and when income and expenses are reported. The transition may affect your taxable income for the year of the change, primarily due to the Section 481(a) adjustment, which reconciles differences between your old and new methods. Understanding these effects is crucial for accurate tax planning and avoiding surprises during tax season.

For example, switching from cash basis to accrual basis may require you to report income from unpaid invoices or expenses from unpaid bills that weren’t previously included, potentially increasing your taxable income. A retail business with significant accounts receivable might face a larger tax bill in the year of the change due to this adjustment. However, the IRS often allows businesses to spread the Section 481(a) adjustment over four years, reducing the immediate tax impact and providing financial flexibility.

The change can also affect future tax returns by altering the timing of income and expense recognition. Accrual accounting, for instance, may allow earlier deductions for expenses, optimizing your tax strategy over time. Businesses should work closely with a tax professional to prepare accurate tax returns, calculate the adjustment correctly, and ensure compliance with IRS requirements, as errors can lead to penalties or audits.

FAQ 20: What Records Should I Keep After Filing Form 3115?

Maintaining thorough records after filing Form 3115 is essential for IRS compliance and to protect your business in case of an audit. The IRS may request documentation to verify the accounting method change, especially if errors or discrepancies arise. Proper record-keeping ensures you can respond quickly and avoid penalties or delays in resolving issues.

You should keep copies of the completed Form 3115, including both the original filed with your tax return and the copy sent to the IRS. Additionally, retain all financial records used to calculate the Section 481(a) adjustment, such as prior tax returns, income statements, balance sheets, and details of accounts receivable or payable. For example, a manufacturing business switching methods should keep records of inventory valuations and depreciation schedules to support the change.

For non-automatic change requests, save the IRS acknowledgment letter and any correspondence, as these confirm the status of your request. It’s also wise to document the reasoning behind the change, such as business growth or compliance requirements, in case the IRS questions the purpose. The IRS recommends retaining these records for at least three years, though longer retention is advisable for complex changes. Consulting a tax professional can help ensure you maintain all necessary documentation and stay prepared for potential IRS inquiries.

Also, Read these Articles in Detail

- A Guide to Creating a Track Spending Spreadsheet for Home Business

- Understanding SEC Form D: A Comprehensive Guide to Exempt Securities Offerings

- Understanding Quotes, Estimates, and Bids: A Comprehensive Guide for Businesses

- Mastering Accruals: A Guide to Understanding and Managing Accrued Accounts

- Building a Robust Emergency Fund for Your Small Business: A Guide to Financial Security

- How to Determine Your Business Valuation: A Comprehensive Guide for Sellers

- Mastering Business Cost Categorization: A Guide to Tracking and Managing Expenses

- Why Every Small Business Owner Needs an Accountant: Your Guide to Financial Success

- Return on Ad Spend (ROAS): Your Ultimate Guide to Measuring Advertising Success

- Innovative Small Business Marketing Ideas to Skyrocket Your Success

- Market and Marketing Research: The Key to Unlocking Business Success

- Target Audience: A Comprehensive Guide to Building Effective Marketing Strategies

- SWOT Analysis: A Comprehensive Guide for Small Business Success

- Market Feasibility Study: Your Blueprint for Business Success

- Mastering the Art of Selling Yourself and Your Business with Confidence and Authenticity

- 10 Powerful Ways Collaboration Can Transform Your Small Business

- The Network Marketing Business Model: Is It the Right Path for You?

- Crafting a Memorable Business Card: 10 Essential Rules for Small Business Owners

- Bootstrap Marketing Mastery: Skyrocketing Your Small Business on a Shoestring Budget

- Mastering Digital Marketing: The Ultimate Guide to Small Business Owner’s

- Crafting a Stellar Press Release: Your Ultimate Guide to Free Publicity

- Reciprocity: Building Stronger Business Relationships Through Give and Take

- Business Cards: A Comprehensive Guide to Designing and Printing at Home

- The Ultimate Guide to Marketing Firms: How to Choose the Perfect One

- Direct Marketing: A Comprehensive Guide to Building Strong Customer Connections

- Mastering Marketing for Your Business: A Comprehensive Guide

- Crafting a Winning Elevator Pitch: Your Guide to Captivating Conversations

- A Complete Guide to Brand Valuation: Unlocking Your Brand’s True Worth

- B2B Marketing vs. B2C Marketing: A Comprehensive Guide to Winning Your Audience

- Pay-Per-Click Advertising: A Comprehensive Guide to Driving Traffic and Maximizing ROI

- Multi-Level Marketing: A Comprehensive Guide to MLMs, Their Promises, and Pitfalls

- Traditional Marketing vs. Internet Marketing for Small Businesses

- Branding: Building Trust, Loyalty, and Success in Modern Marketing

- How to Craft a Winning Marketing Plan for Your Home Business

- The Synergy of Sales and Marketing: A Comprehensive Guide

- Mastering the Marketing Mix: A Comprehensive Guide to Building a Winning Strategy

- Return on Investment (ROI): Your Guide to Smarter Business Decisions

- How to Create a Winning Website Plan: A Comprehensive Guide

- Top Sources of Capital: A Comprehensive Guide to Funding Your Business

- Why Do Businesses Go Bankrupt? Understanding the Causes and Solutions

- Inventory Management: The Ultimate Guide to Optimizing Your Business Inventory

- Implied Contracts: A Comprehensive Guide to Avoiding Unintended Obligations

- Business Contracts Through Change: What Happens When a Company Transforms?

- Principal Place of Business for Tax Deductions: A Comprehensive Guide

- Mastering the 5 Ps of Marketing to Skyrocket Your Home Business Success

- A Comprehensive Guide to Spotting Red Flags in Your Financial Statements

- Income Payments on Form 1099: A Guide for Businesses and Individuals

- The Challenges of Forming a Corporation: Is It Worth the Leap?

- Socially and Economically Disadvantaged Businesses: Pathways to Opportunity

- Business Viability: A Comprehensive Guide to Building a Thriving Enterprise

- The Art of Achieving Business Goals: A Comprehensive Guide to Success

- The Art & Science of Raising Your Business Rates: A Guide for Entrepreneurs

- Crafting a Winning Business Proposal: Your Ultimate Guide to Securing Clients

- The Art of the Business Letter: A Guide to Professional Communication

- 7 Key Components of a Business Proposal: Your Ultimate Guide to Securing Contracts

- Calculating Costs for Leasing a Retail Store: A Comprehensive Guide

- Understanding Gross Margin vs. Gross Profit: A Comprehensive Guide

- Mastering Initial Markup (IMU): The Key to Retail Profitability

- Understanding Retailers: The Heart of Consumer Commerce

- Stock Keeping Units (SKUs): The Backbone of Retail Inventory Management

- Why Your Business Must Embrace an Online Presence in Today’s World

- Finding the Perfect Wholesale Distributor for Your Small Business

- The Art of Building a Thriving Online Business

- A Guide to Buying a Great, Affordable Domain Name

- The Art of Writing an RFP: A Comprehensive Guide

- Don’t Try to Boil the Ocean: Mastering Focus in Business Strategy

- Mastering Project Management: Your Ultimate Guide to Success

- A Comprehensive Guide to Critical Success Factors and Indicators in Business

Acknowledgement

The creation of the article “IRS Form 3115: Instructions and Guide to Changing Your Accounting Method” was made possible through the valuable insights and detailed information sourced from reputable online resources. Special thanks are extended to Internal Revenue Service (irs.gov) for providing authoritative guidance on tax forms, accounting methods, and IRS procedures, which served as the foundation for ensuring the accuracy and compliance of the content. The comprehensive details from this source helped clarify the complexities of Form 3115 and its filing requirements, enabling a thorough and accessible guide for businesses.

The following points highlight the contributions of these sources:

- Authoritative IRS Guidelines: The Internal Revenue Service website offered critical information on Form 3115, including eligibility criteria for automatic and non-automatic change requests, filing procedures, and the importance of the Section 481(a) adjustment, ensuring the article’s alignment with current tax regulations.

- Detailed Procedural Insights: Information from Internal Revenue Service clarified the distinctions between cash and accrual accounting methods, as well as the specific requirements for depreciation and inventory changes, enhancing the article’s depth and practical applicability.

- Practical Examples and Clarity: The structured explanations provided by Internal Revenue Service inspired the inclusion of real-world examples, such as scenarios involving retail stores and tech startups, making the article relatable and easier to understand for business owners.

- Compliance and Penalty Information: Guidance from Internal Revenue Service underscored the consequences of failing to file Form 3115, enabling the article to emphasize the importance of proper filing to avoid penalties and audits.

Disclaimer

The information provided in the article “IRS Form 3115: Instructions and Guide to Changing Your Accounting Method” is intended for general informational purposes only and should not be considered professional tax or legal advice. While efforts have been made to ensure the accuracy and reliability of the content, based on information from reputable sources, tax laws and IRS regulations are complex and subject to change.

Businesses are strongly encouraged to consult a qualified tax professional or certified public accountant before filing Form 3115 or making changes to their accounting methods to ensure compliance with current IRS requirements and to address their specific financial circumstances. The author and publisher are not responsible for any errors, omissions, or adverse outcomes resulting from the use of this information.