Navigating the world of taxes can feel like wandering through a maze, especially when it comes to reporting income payments on Form 1099. Whether you’re a small business owner, a freelancer, or someone who’s received a 1099 form, understanding these forms is crucial for staying compliant with the IRS and avoiding costly penalties.

This guide delves into what income payments on Form 1099 are, who needs to report them, how to file them correctly, and why they are important. With clear explanations, real-world examples, and practical tips, this article aims to demystify the process and empower you with the knowledge to handle 1099 forms confidently.

Table of Contents

What Are Income Payments on Form 1099?

Income payments on Form 1099 refer to money paid by a business to an individual or entity who is not an employee. These payments are typically made to freelancers, independent contractors, vendors, or other non-employees for services or other types of income. The IRS requires businesses to report these payments to ensure proper tax reporting by both the payer and the recipient. The two primary forms used for this purpose are Form 1099-NEC (Nonemployee Compensation) and Form 1099-MISC (Miscellaneous Payments).

Also, Read this in Detail: A Comprehensive Guide to Understanding and Filing Form 1099-NEC.

Think of Form 1099 as the IRS’s way of keeping tabs on income that doesn’t come from a traditional employer-employee relationship. For example, if you hire a graphic designer to create a logo for your business and pay them $1,000, that payment must be reported on a Form 1099-NEC if it meets the IRS threshold. Similarly, if you pay rent to a landlord for your office space, that might be reported on a Form 1099-MISC. These forms help the IRS track income to ensure it’s taxed appropriately.

The introduction of Form 1099-NEC in 2020 marked a significant change in how businesses report nonemployee compensation. Before 2020, these payments were reported on Form 1099-MISC, but the IRS separated them to streamline reporting and align with new deadlines. This shift was partly due to the Protecting Americans from Tax Hikes (PATH) Act, which accelerated the filing deadline for nonemployee compensation to January 31.

Why Are 1099 Forms Important?

For businesses, issuing 1099 forms is a legal obligation that ensures transparency in financial transactions. For recipients, these forms serve as a record of income that must be reported on their tax returns. Failing to issue or file these forms correctly can lead to penalties, audits, or even legal trouble. Understanding the nuances of these forms can save you time, money, and stress.

Also, Read this in Detail: 1099 Forms: A Comprehensive Guide for Businesses and Individuals.

Who Needs to Report Income Payments on Form 1099?

Any business or individual paying $600 or more in a calendar year to a non-employee in the course of doing business must issue a Form 1099. This threshold applies to the total payments made to a single recipient over the year, not per transaction. For instance, if you pay a freelancer $300 in March and another $400 in September, the total of $700 triggers the need for a 1099 form.

Here’s a breakdown of who typically needs to issue these forms:

- Business Owners: If you run a business and pay freelancers, contractors, or vendors for services, you’re responsible for issuing 1099 forms.

- Landlords: If you pay rent to an individual or non-corporate entity for business property, you may need to issue a Form 1099-MISC.

- Organizations Paying Prizes or Awards: If your business awards prizes, such as in a contest, those payments may need to be reported.

- Attorneys or Medical Professionals: Payments to attorneys for legal services or to healthcare providers for medical services often require a 1099.

However, there are exceptions. Payments to corporations (like C corporations or S corporations) generally don’t require a 1099, except in specific cases like payments to attorneys. Similarly, personal payments, such as paying a friend to help you move or hiring a lawyer for a personal matter like a divorce, don’t require a 1099 because they’re not business-related.

Real-World Example

Imagine you own a small bakery and hire a local carpenter to build custom shelves for $800. Since the carpenter is an independent contractor and the payment exceeds $600, you must issue a Form 1099-NEC to report this payment. If you also pay $1,200 in rent to an individual landlord for your bakery’s storefront, you’ll need to issue a Form 1099-MISC for the rent. Keeping track of these payments throughout the year is essential to avoid last-minute scrambles.

Types of 1099 Forms: 1099-NEC vs. 1099-MISC

The IRS uses two main forms to report income payments to non-employees: Form 1099-NEC and Form 1099-MISC. Each serves a distinct purpose, and understanding the difference is critical for compliance.

Form 1099-NEC: Nonemployee Compensation

The Form 1099-NEC is used to report payments made to non-employees for services performed in the course of your business. This includes:

- Payments to freelancers (e.g., writers, designers, or consultants).

- Payments to independent contractors (e.g., plumbers, electricians, or IT specialists).

- Fees paid to attorneys for legal services (even if they’re a corporation).

- Other professional service fees.

For example, if you pay a freelance photographer $1,500 to shoot a promotional campaign for your business, you’ll report that payment in Box 1 of Form 1099-NEC.

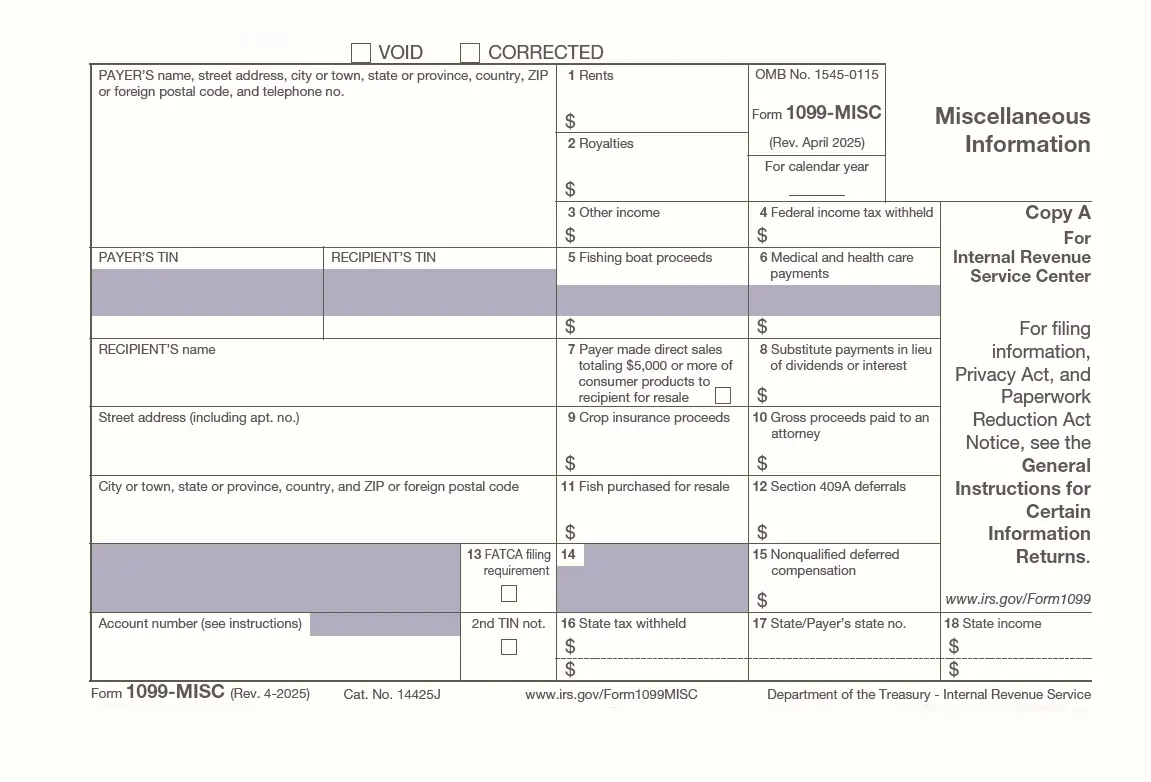

Form 1099-MISC: Miscellaneous Payments

The Form 1099-MISC covers a broader range of payments, including:

- Rents: Payments for leasing business property, like an office or warehouse.

- Prizes and Awards: Cash or equivalent awards, such as contest winnings.

- Medical and Healthcare Payments: Payments to physicians or other healthcare providers.

- Crop Insurance Proceeds: Payments to farmers for insured crop losses.

- Fishing Boat Proceeds: Payments to crew members of fishing boats.

- Proceeds to an Attorney: Payments for legal settlements or services.

- Section 409A Deferrals: Certain deferred compensation arrangements.

- Nonqualified Deferred Compensation: Payments from nonqualified retirement plans.

- Consumer Product Sales: Payments of $5,000 or more for consumer products sold for resale (outside a permanent retail establishment).

For instance, if your business pays $10,000 in rent to an individual landlord for your office space, you’ll report that amount in Box 1 of Form 1099-MISC.

Key Differences Between 1099-NEC and 1099-MISC

| Aspect | Form 1099-NEC | Form 1099-MISC |

|---|---|---|

| Purpose | Reports nonemployee compensation for services | Reports miscellaneous income (e.g., rent, prizes) |

| Common Uses | Freelancers, contractors, attorneys | Rent, awards, medical payments, crop insurance |

| Filing Deadline | January 31 (for both recipient and IRS) | March 1 (paper), March 31 (electronic) |

| Box for Primary Payment | Box 1: Nonemployee Compensation | Box 1: Rents, Box 3: Other Income, etc. |

How to Prepare and File Form 1099

Filing a Form 1099 might seem daunting, but breaking it down into steps makes it manageable. Here’s a step-by-step guide to ensure you get it right:

Step 1: Collect Form W-9 from Recipients

Before you make any payments, ask your vendors, contractors, or other recipients to complete a Form W-9. This form provides critical information, including:

- The recipient’s legal name.

- Their address.

- Their Taxpayer Identification Number (TIN), which could be a Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN).

Having a completed W-9 upfront saves you from chasing down this information at tax time. For example, if you hire a freelance writer, ask them to submit a W-9 when you sign the contract.

Step 2: Track Payments Throughout the Year

Use your bookkeeping system to track all payments to non-employees. Categorize them based on the type of payment (e.g., services, rent, or prizes) and ensure you note whether they exceed the $600 threshold. Software like QuickBooks or Xero can simplify this process by generating reports at year-end.

Step 3: Determine Which Form to Use

Based on the type of payment, decide whether to use Form 1099-NEC or Form 1099-MISC. If you’re unsure, consult a tax professional to avoid errors. For instance, paying a consultant for marketing services requires a 1099-NEC, while paying a prize for a business contest requires a 1099-MISC.

Step 4: Complete the 1099 Form

Fill out the appropriate 1099 form with the following details:

- Payer Information: Your business’s name, address, and TIN.

- Recipient Information: The recipient’s name, address, and TIN (from their W-9).

- Payment Amount: The total amount paid in the relevant box (e.g., Box 1 for 1099-NEC or Box 1 for rent on 1099-MISC).

- Tax Year: The year the payments were made.

You can obtain 1099 forms from the IRS website, office supply stores, or through tax software.

Step 5: Submit the Forms

You must send copies of the 1099 form to both the recipient and the IRS. Here are the deadlines:

- Form 1099-NEC: By January 31 of the following year for both the recipient and the IRS.

- Form 1099-MISC: By January 31 for the recipient, March 1 for paper filing with the IRS, or March 31 for electronic filing.

For example, for payments made in 2025, you must provide the recipient with their 1099-NEC by January 31, 2026, and file with the IRS by the same date. For 1099-MISC, you have until March 1, 2026, for paper filing or March 31, 2026, for electronic filing.

Step 6: File Form 1096 with the IRS

When submitting 1099 forms to the IRS, you must also include Form 1096, which acts as a summary or transmittal form. It totals the amounts reported on all 1099 forms you’re filing. Submit one Form 1096 for each type of 1099 form (e.g., one for 1099-NEC and one for 1099-MISC).

Step 7: Consider Electronic Filing

Electronic filing is often more efficient and can extend the filing deadline for Form 1099-MISC. The IRS’s FIRE (Filing Information Returns Electronically) system allows businesses to submit 1099 forms online. If you’re filing 250 or more 1099 forms, electronic filing is mandatory.

Common Mistakes to Avoid When Filing Form 1099

Even seasoned business owners can make mistakes when filing 1099 forms. Here are some pitfalls to watch out for:

- Missing the $600 Threshold: Failing to issue a 1099 for payments totaling $600 or more to a single recipient can lead to penalties.

- Using the Wrong Form: Reporting nonemployee compensation on Form 1099-MISC instead of 1099-NEC is a common error post-2020.

- Incorrect TIN: Mismatching the recipient’s name and TIN can trigger IRS notices. Always verify information using the W-9.

- Late Filing: Missing deadlines can result in penalties ranging from $60 to $630 per form, depending on how late you file.

- Not Providing Recipient Copies: Forgetting to send the recipient their copy by January 31 can cause confusion and reporting errors.

Example of a Mistake

Suppose you pay a contractor $700 for website development but forget to collect their W-9. At tax time, you realize you don’t have their TIN, delaying your filing. To avoid this, always collect W-9s upfront and double-check your records.

Penalties for Non-Compliance

Failing to file 1099 forms correctly or on time can lead to significant penalties. The IRS imposes fines based on the severity and timing of the violation:

| Violation | Penalty (2025) |

|---|---|

| Filing late (within 30 days) | $60 per form (max $630,500) |

| Filing late (after 30 days but before August 1) | $120 per form (max $1,891,500) |

| Filing after August 1 or not at all | $310 per form (max $3,783,000) |

| Intentional disregard | $630 per form (no maximum) |

Small businesses with gross receipts of $5 million or less face lower maximum penalties. To avoid these fines, file on time and ensure accuracy. If you anticipate delays, request a 30-day extension using Form 8809, but note that this only extends the IRS filing deadline, not the deadline for providing copies to recipients.

Tips for Streamlining the 1099 Process

To make filing 1099 forms easier, consider these practical tips:

- Use Accounting Software: Tools like QuickBooks, FreshBooks, or Wave can track payments and generate 1099 forms automatically.

- Collect W-9s Early: Request W-9s from all non-employees before making payments to avoid last-minute hassles.

- Set Reminders for Deadlines: Mark January 31, March 1, and March 31 on your calendar to stay on top of filing deadlines.

- Work with a Tax Professional: If you’re unsure about any aspect of 1099 reporting, consult an accountant to ensure compliance.

- Verify TINs: Use the IRS’s TIN Matching Program to confirm that the recipient’s name and TIN match IRS records.

- File Electronically: Electronic filing is faster, reduces errors, and extends the 1099-MISC deadline to March 31.

Special Considerations for Recipients

If you’re a freelancer or contractor receiving a 1099 form, here’s what you need to know:

- Report All Income: Even if you don’t receive a 1099, you’re responsible for reporting all income on your tax return. The 1099 simply helps the IRS cross-check your reported income.

- Check for Errors: Review the 1099 form for accuracy. If the amount or TIN is incorrect, contact the payer immediately to request a corrected form.

- Pay Estimated Taxes: Since taxes aren’t withheld from 1099 income, you may need to make quarterly estimated tax payments to avoid penalties.

- Keep Records: Maintain records of your income and expenses to support deductions and ensure accurate tax reporting.

For example, if you’re a freelance writer who earns $20,000 from various clients, you might receive multiple 1099-NEC forms. Use these forms to calculate your total income and deduct business expenses, like software subscriptions or home office costs, to reduce your taxable income.

The Bigger Picture: Why 1099 Compliance Matters

Properly reporting income payments on Form 1099 isn’t just about avoiding penalties—it’s about maintaining trust and transparency in business transactions. For businesses, accurate 1099 filing demonstrates professionalism and compliance with tax laws. For recipients, it ensures that their income is properly documented, reducing the risk of IRS audits or disputes.

Moreover, the rise of the gig economy has made 1099 forms more common than ever. With millions of Americans working as freelancers or contractors, the IRS relies on these forms to track income and ensure tax compliance. By staying organized and proactive, both payers and recipients can navigate the 1099 process with confidence.

Conclusion

Income payments on Form 1099 are a critical part of tax reporting for businesses and non-employees alike. Whether you’re issuing a Form 1099-NEC for freelance services or a Form 1099-MISC for rent or prizes, understanding the rules and deadlines is essential for staying compliant with the IRS. By collecting W-9s, tracking payments, and filing accurately, you can avoid penalties and streamline the process. For recipients, 1099 forms are a reminder to report all income and plan for taxes accordingly.

With the right tools and knowledge, handling 1099 forms doesn’t have to be overwhelming. Whether you’re a small business owner or a gig worker, taking the time to understand these forms will pay off in the long run, keeping you on the right side of the IRS and ensuring your financial records are in order.

Also, Read these Articles in Detail

- How to Obtain and File W-2 and 1099 Forms for Your Business

- 1099 Forms: A Comprehensive Guide for Businesses and Individuals

- 1099 Forms Late-Filing Penalties: A Comprehensive Guide for Small Businesses

- A Comprehensive Guide to Understanding and Filing Form 1099-NEC

- Avoiding Common Form 1099 Filing Mistakes and Correcting Errors with Confidence

- Understanding Chapter 7 Bankruptcy: A Comprehensive Guide to Debt Relief

- Chapter 11 Bankruptcy: A Guide to Reorganization, Benefits, and Challenges

- Chapter 13 Bankruptcy: A Comprehensive Guide to Financial Recovery

- Understanding Royalties: A Comprehensive Guide to Intellectual Property Payments

- The Rise of Independent Contracting: Current and Future Prospects for a Flexible Workforce

- Should Your Salespeople Be Independent Contractors or Employees?

- Sales Employees vs. Independent Contractors for Field Sales Roles

- Understanding Step Costs: A Comprehensive Guide to Managing Business Expenses

- A Comprehensive Guide to Business Restructuring After Bankruptcy

- Crafting a Compelling Diversity and Inclusion Statement: Building a Culture That Thrives

- Protecting the Company’s Digital Assets in the 21st Century: A Comprehensive Guide

- Exculpatory Clause: A Comprehensive Guide to Safeguarding Your Business

- Business Divestiture: The Art and Strategy Behind Unlocking Growth Potential

- Understanding the ABC Test: A Comprehensive Guide to Worker Classification

- Principal-Agent Relationship: A Guide to Trust, Responsibility, and Business Efficiency

- Embracing Diversity and Inclusion: A Game-Changer for Small Businesses

- Golden Parachutes: A Deep Dive into Executive Compensation and Corporate Transitions

- Understanding Principal Business Codes: A Comprehensive Guide for Business Owners

- A Guide to Choosing the Right Debt Collection Agency for Your Small Business

- Understanding Implied Authority: A Deep Dive into Agency and Responsibility

- Controlled Foreign Corporations: A Guide to CFCs and Their Tax Implications

- How to Turn Small Business Failure into Lasting Success

- A Guide to a Smooth Dissolution: The End of a Business Partnership

- PayPal Merchant Fees: A Guide to Reducing Costs for Your Business

- How to Write a Letter of Indemnity: A Guide for Businesses Transactions

- Blog vs. Website: Unraveling the Differences and Choosing What’s Right for You

- Small Business Development Centers: Your Comprehensive Guide to Success

- Crafting an Effective Job Application Form: A Comprehensive Guide for Employers

- The Shareholders Agreements for Small Businesses: Everything You Need to Know

- Assignment of Contract: A Guide to Transferring Rights and Obligations

- Common-Law Employees: A Comprehensive Guide to Employment Classifications

- Business Growth with the Rule of 78: A Guide to Building Recurring Revenue Streams

- Crafting a Licensing Agreement That Benefits Both Parties: A Comprehensive Guide

- Mastering Your Home Business Workday: A Guide to Productivity and Success

- Top Sources of Capital: A Comprehensive Guide to Funding Your Business

- Why Do Businesses Go Bankrupt? Understanding the Causes and Solutions

- Inventory Management: The Ultimate Guide to Optimizing Your Business Inventory

- Implied Contracts: A Comprehensive Guide to Avoiding Unintended Obligations

- Business Contracts Through Change: What Happens When a Company Transforms?

- Principal Place of Business for Tax Deductions: A Comprehensive Guide

- Mastering the 5 Ps of Marketing to Skyrocket Your Home Business Success

- A Comprehensive Guide to Spotting Red Flags in Your Financial Statements

Frequently Asked Questions

FAQ 1: What Are Income Payments on Form 1099?

Income payments on Form 1099 are amounts paid by a business to individuals or entities who are not employees, such as freelancers, independent contractors, or vendors. These payments are reported to the IRS to ensure proper tax reporting. The two main forms used are Form 1099-NEC for nonemployee compensation, like payments for services, and Form 1099-MISC for other types of income, such as rent or prizes. The IRS uses these forms to track income that isn’t subject to traditional payroll taxes, ensuring both the payer and recipient report it correctly.

For example, if a business hires a freelance web developer for $1,000 to build a website, that payment must be reported on a Form 1099-NEC if it meets the $600 annual threshold. Similarly, paying $2,000 in rent for an office space to an individual landlord requires a Form 1099-MISC. These forms help maintain transparency in financial transactions and prevent tax evasion. Businesses must issue these forms annually, and recipients use them to report income on their tax returns.

FAQ 2: Who Needs to Issue a Form 1099?

Any business or individual paying $600 or more in a calendar year to a non-employee for business-related services or other income must issue a Form 1099. This applies to small business owners, corporations, and even nonprofits engaging freelancers, contractors, or vendors. For instance, if you run a bakery and pay a graphic designer $700 for a new logo, you’re required to issue a Form 1099-NEC. The same applies to landlords receiving rent for business properties or organizations awarding cash prizes.

However, there are exceptions. Payments to corporations (except for certain attorney fees) typically don’t require a 1099, nor do personal payments, like hiring a lawyer for a divorce. The $600 threshold is cumulative, meaning multiple smaller payments to the same recipient that total $600 or more trigger the requirement. Keeping accurate records and collecting Form W-9 from recipients upfront ensures you have the necessary information to file correctly.

FAQ 3: What’s the Difference Between Form 1099-NEC and Form 1099-MISC?

The Form 1099-NEC and Form 1099-MISC serve distinct purposes for reporting income payments. The 1099-NEC is used for nonemployee compensation, such as payments to freelancers, contractors, or attorneys for services. For example, if you pay a consultant $1,200 for marketing advice, you report it on a 1099-NEC. This form was reintroduced in 2020 to separate service-related payments from other miscellaneous income, streamlining IRS processing.

In contrast, the Form 1099-MISC covers a broader range of payments, including rents, prizes and awards, medical payments, crop insurance proceeds, and payments of $5,000 or more for consumer products sold for resale outside a retail setting. For instance, if you pay $10,000 in rent for your business’s office, you’d use a 1099-MISC. The key difference lies in their filing deadlines: 1099-NEC is due by January 31 for both recipients and the IRS, while 1099-MISC is due to recipients by January 31 but can be filed with the IRS by March 1 (paper) or March 31 (electronic).

FAQ 4: When Are Form 1099 Filing Deadlines?

The deadlines for filing Form 1099 depend on the form type. For Form 1099-NEC, you must provide copies to recipients and file with the IRS by January 31 of the following year. For example, payments made in 2025 require 1099-NEC forms to be sent by January 31, 2026. This tight deadline reflects the IRS’s focus on timely reporting of nonemployee compensation under the PATH Act.

For Form 1099-MISC, recipients must receive their copies by January 31, but businesses have until March 1 for paper filing with the IRS or March 31 for electronic filing. If you miss these deadlines, penalties can range from $60 to $630 per form, depending on how late you file. Businesses can request a 30-day extension using Form 8809, but this only extends the IRS filing deadline, not the recipient copy deadline. Staying organized and using electronic filing can help meet these deadlines efficiently.

FAQ 5: How Do I Prepare a Form 1099?

Preparing a Form 1099 involves several steps to ensure accuracy and compliance. First, collect a Form W-9 from each non-employee before making payments. The W-9 provides the recipient’s legal name, address, and Taxpayer Identification Number (TIN), which you’ll need for the 1099. Next, track all payments in your bookkeeping system, noting whether they exceed the $600 threshold and fall under categories like services (1099-NEC) or rent (1099-MISC).

When filling out the form, include your business’s details, the recipient’s information, and the total payment amount in the appropriate box (e.g., Box 1 for nonemployee compensation on 1099-NEC). Use tax software or IRS-provided forms to complete the process. Finally, send copies to the recipient and file with the IRS, along with Form 1096, which summarizes all 1099s you’re submitting. Double-checking TINs and amounts prevents errors that could trigger IRS notices.

FAQ 6: What Happens If I Don’t File a Form 1099?

Failing to file a Form 1099 when required can lead to significant penalties from the IRS. If you file late within 30 days, the penalty is $60 per form, up to a maximum of $630,500 for small businesses. Filing after 30 days but before August 1 incurs a $120 penalty per form, with a cap of $1,891,500. Missing the August 1 deadline or not filing at all results in a $310 penalty per form, with a maximum of $3,783,000. Intentional disregard can lead to a $630 penalty per form with no cap.

Beyond fines, not filing can trigger IRS audits or notices, as the IRS cross-checks 1099s with recipients’ tax returns. For recipients, not receiving a 1099 doesn’t exempt them from reporting income, but it can complicate their tax filing. To avoid these issues, businesses should maintain accurate records, collect W-9s, and file on time. If you anticipate delays, filing Form 8809 for an extension can provide some relief.

FAQ 7: Do I Need to Issue a 1099 for Payments to Corporations?

In most cases, payments to corporations (like C corporations or S corporations) do not require a Form 1099. This exception applies to services, rent, or other payments that would typically trigger a 1099 for individuals or partnerships. However, there’s an important exception: payments to attorneys for legal services, even if they operate as a corporation, must be reported on a Form 1099-NEC (for services) or Form 1099-MISC (for settlements).

For example, if you pay a corporate law firm $1,000 for legal advice, you must issue a 1099-NEC. But if you pay a corporate cleaning company $1,000 for janitorial services, no 1099 is required. Always verify the recipient’s business structure using their Form W-9 to determine if a 1099 is necessary. When in doubt, consult a tax professional to ensure compliance.

FAQ 8: What Should Freelancers Do When They Receive a Form 1099?

If you’re a freelancer or independent contractor receiving a Form 1099-NEC or Form 1099-MISC, you’re responsible for reporting that income on your tax return, typically on Schedule C (Profit or Loss from Business). First, verify the form’s accuracy, checking the payer’s information, your TIN, and the reported amount. If there’s an error, contact the payer immediately to request a corrected form.

Since 1099 income doesn’t have taxes withheld, you may need to make quarterly estimated tax payments to cover income and self-employment taxes. Keep detailed records of your income and business expenses, like equipment or travel costs, to reduce your taxable income. Even if you don’t receive a 1099, you must report all income. For example, if you earned $500 from a client who didn’t issue a 1099, you still report it to avoid IRS penalties.

FAQ 9: Can I File Form 1099 Electronically?

Yes, businesses can file Form 1099 electronically using the IRS’s FIRE (Filing Information Returns Electronically) system, which is faster and reduces errors compared to paper filing. Electronic filing is mandatory if you’re submitting 250 or more 1099 forms, but even smaller businesses can benefit from the convenience. For Form 1099-MISC, electronic filing extends the IRS deadline to March 31, compared to March 1 for paper filing.

To file electronically, you’ll need to register with the FIRE system, ensure your forms are accurate, and submit them with a Form 1096 transmittal. Many accounting software platforms, like QuickBooks, integrate with the FIRE system, simplifying the process. Electronic filing also provides confirmation of receipt, giving you peace of mind that your forms were submitted successfully.

FAQ 10: How Can Businesses Avoid Common 1099 Filing Mistakes?

Avoiding mistakes when filing Form 1099 is crucial to prevent penalties and IRS scrutiny. Common errors include missing the $600 threshold, using the wrong form (e.g., 1099-MISC instead of 1099-NEC), entering incorrect TINs, or missing deadlines. To avoid these, collect Form W-9 from all non-employees before payments, ensuring you have accurate recipient information. Use accounting software to track payments and categorize them correctly.

Double-check forms for accuracy before filing, and use the IRS’s TIN Matching Program to verify recipient information. Set calendar reminders for deadlines: January 31 for 1099-NEC and recipient copies of 1099-MISC, and March 1 or 31 for 1099-MISC IRS filing. If you’re unsure about any step, consult a tax professional. For example, a business that mistakenly reports contractor payments on a 1099-MISC could face penalties, but proper planning prevents such errors.

FAQ 11: Why Was Form 1099-NEC Reintroduced in 2020?

The Form 1099-NEC was reintroduced in 2020 to address the growing need for clearer reporting of nonemployee compensation, such as payments to freelancers and independent contractors. Before 2020, these payments were reported on Form 1099-MISC, which caused confusion because it mixed service-related payments with other types of income like rents or prizes. The Protecting Americans from Tax Hikes (PATH) Act accelerated the filing deadline for nonemployee compensation to January 31, prompting the IRS to create a dedicated form to streamline the process.

This change benefits both businesses and the IRS. For businesses, it clarifies which payments go on which form, reducing errors. For the IRS, it ensures faster processing of compensation data, especially with the rise of the gig economy. For example, if you pay a freelance graphic designer $800 for a project, you report it on Form 1099-NEC, while a $1,000 prize for a contest goes on Form 1099-MISC. Understanding this distinction helps businesses stay compliant and avoid penalties.

FAQ 12: What Information Do I Need to Collect for Form 1099?

To prepare a Form 1099, you need specific information from the recipient, which is typically collected using Form W-9. This form provides the recipient’s legal name, address, and Taxpayer Identification Number (TIN), which could be a Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN). Collecting this information upfront, ideally when you first engage a freelancer, contractor, or vendor, ensures you’re ready to file 1099 forms at tax time.

You also need to track the total payments made to each recipient during the year and categorize them correctly (e.g., services for 1099-NEC or rent for 1099-MISC). For example, if you hire a consultant for $1,200, their W-9 provides the TIN you’ll enter on the 1099-NEC. Without a W-9, you risk reporting errors or delays, which could lead to IRS penalties. Using accounting software to organize this data can simplify the process and ensure accuracy.

FAQ 13: What Are the Penalties for Incorrectly Filing Form 1099?

Filing Form 1099 incorrectly, such as using the wrong form or reporting an incorrect TIN, can lead to IRS penalties. Penalties vary based on the error’s severity and timing. For example, providing an incorrect TIN or mismatching the recipient’s name and TIN can result in a $310 penalty per form if not corrected promptly. If the IRS finds intentional disregard, the penalty jumps to $630 per form with no maximum limit, which can be costly for businesses filing multiple forms.

To avoid these issues, verify recipient information using the IRS’s TIN Matching Program before filing. For instance, if you mistakenly report a freelancer’s payment on a 1099-MISC instead of a 1099-NEC, the IRS may issue a notice. Correcting errors quickly, ideally before the filing deadline, can minimize penalties. Businesses should also keep detailed records and consult a tax professional if unsure about reporting requirements to ensure compliance.

FAQ 14: Can I Issue a Form 1099 for Personal Payments?

No, Form 1099 is only required for payments made in the course of business activities, not for personal payments. For example, if you pay a friend $1,000 to help you move or hire a lawyer for a personal matter like a divorce, you don’t need to issue a 1099-NEC or 1099-MISC. These forms are designed for business-related transactions, such as paying a freelancer for services or a landlord for business property rent.

However, the line between personal and business payments can sometimes blur. If you run a home-based business and pay a contractor to renovate your office space, that payment may require a 1099 if it exceeds $600. Always clarify the purpose of the payment and check with a tax professional if you’re unsure. Keeping business and personal expenses separate in your accounting records helps avoid confusion when determining 1099 requirements.

FAQ 15: What Is Form 1096, and How Does It Relate to Form 1099?

Form 1096 is a summary or transmittal form that businesses must submit to the IRS when filing Form 1099. It acts as a cover sheet, totaling the amounts reported on all 1099 forms of the same type (e.g., one Form 1096 for all 1099-NEC forms and another for all 1099-MISC forms). You need to include details like your business’s name, address, TIN, and the number of 1099 forms being submitted.

For example, if you issue ten 1099-NEC forms to freelancers and five 1099-MISC forms for rent payments, you’ll submit two separate Form 1096 documents—one for each form type. This form is only sent to the IRS, not to recipients. Filing Form 1096 accurately is crucial, as errors can delay processing or trigger penalties. Using tax software or electronic filing can simplify the process by generating Form 1096 automatically based on your 1099 data.

FAQ 16: How Do I Correct a Mistake on a Form 1099?

If you discover an error on a Form 1099 after filing, such as an incorrect payment amount or TIN, you must file a corrected form as soon as possible. To do this, complete a new 1099-NEC or 1099-MISC with the correct information and check the “Corrected” box at the top. Send the corrected form to the recipient and the IRS, along with a new Form 1096 marked as a correction.

For example, if you reported $1,500 instead of $1,000 for a freelancer’s payment on a 1099-NEC, submit a corrected form with the accurate amount. Prompt corrections can prevent penalties or IRS notices. If the error involves a wrong TIN, use the IRS’s TIN Matching Program to verify the recipient’s information before resubmitting. Consulting a tax professional can help ensure the correction process is handled correctly, especially for complex errors.

FAQ 17: Do I Need to Issue a Form 1099 for Payments Under $600?

No, you are not required to issue a Form 1099 for payments totaling less than $600 to a single recipient in a calendar year. This threshold applies to business-related payments, such as those for services, rent, or prizes. For instance, if you pay a contractor $500 for a one-time job, you don’t need to issue a 1099-NEC. However, if you make additional payments to the same contractor that push the total over $600, you must issue a 1099 for the full amount.

Keep in mind that recipients are still required to report all income, even if they don’t receive a 1099. Businesses should track all payments, regardless of amount, to avoid missing the threshold. Using accounting software can help monitor cumulative payments and ensure you issue 1099s when necessary. If you’re unsure whether a payment qualifies, consult a tax professional to stay compliant.

FAQ 18: What Should I Do If I Don’t Have a Recipient’s TIN for Form 1099?

If you don’t have a recipient’s Taxpayer Identification Number (TIN) for a Form 1099, you may face challenges filing accurately, as the IRS requires this information. To avoid this, always request a Form W-9 from freelancers, contractors, or vendors before making payments. If a recipient fails to provide a W-9, you may be required to withhold backup withholding (typically 24% of the payment) and remit it to the IRS, as mandated by IRS rules.

For example, if you pay a freelancer $1,000 but they refuse to provide a W-9, you must withhold $240 and report it on Form 945. To prevent such issues, include a W-9 request in your onboarding process for non-employees. If you’ve already made payments without a TIN, contact the recipient immediately to obtain it. If they still don’t comply, consult a tax professional to navigate backup withholding and avoid penalties.

FAQ 19: How Does the Gig Economy Impact Form 1099 Reporting?

The rise of the gig economy has significantly increased the use of Form 1099-NEC for reporting payments to freelancers, independent contractors, and gig workers, such as rideshare drivers or delivery couriers. As more people earn income through platforms like ride-sharing or freelance marketplaces, businesses and platforms must issue 1099 forms for payments exceeding $600 per year. This ensures the IRS can track income that isn’t subject to traditional payroll taxes.

For example, a rideshare company paying a driver $2,000 for services must issue a 1099-NEC by January 31. Gig workers, in turn, use these forms to report income and calculate self-employment taxes. The gig economy’s growth has made accurate 1099 reporting more critical than ever, as the IRS closely monitors this income to prevent underreporting. Businesses should stay organized and use tools like accounting software to manage the high volume of 1099s required in this sector.

FAQ 20: What Are the Benefits of Using Accounting Software for Form 1099?

Using accounting software like QuickBooks, FreshBooks, or Wave can significantly simplify the process of preparing and filing Form 1099. These tools track payments to freelancers, contractors, and vendors throughout the year, categorizing them for 1099-NEC or 1099-MISC reporting. They also generate 1099 forms automatically, pulling data like recipient TINs from stored Form W-9 records, reducing manual errors.

For example, if you pay multiple contractors varying amounts, software can calculate which payments exceed the $600 threshold and produce accurate forms. Many platforms also integrate with the IRS’s FIRE system for electronic filing, saving time and extending the 1099-MISC filing deadline to March 31. Additionally, software provides reports to ensure compliance and can flag missing information, like a contractor’s TIN, before filing. Investing in such tools can save businesses time, reduce stress, and minimize the risk of penalties.

Acknowledgement

The article “Income Payments on Form 1099: A Comprehensive Guide for Businesses and Individuals” was meticulously crafted by drawing on a wealth of information from various authoritative sources to ensure accuracy and depth. I sincerely express my gratitude to the following reputable websites for their valuable resources, which provided critical insights into IRS regulations, Form 1099 requirements, and tax compliance. These sources were instrumental in shaping a comprehensive guide that is both informative and accessible for businesses and individuals navigating the complexities of 1099 reporting.

- IRS (irs.gov) for official guidelines on Form 1099-NEC and 1099-MISC filing requirements and deadlines.

- Tax Foundation (taxfoundation.org) for insights into the tax implications of nonemployee compensation.

- H&R Block (hrblock.com) for practical advice on preparing and filing 1099 forms.

- TurboTax (turbotax.intuit.com) for explanations of common 1099-related questions for freelancers.

- QuickBooks (quickbooks.intuit.com) for guidance on using accounting software to streamline 1099 processes.

- Nolo (nolo.com) for legal insights into business tax obligations and exceptions.

- Forbes (forbes.com) for articles on the gig economy’s impact on 1099 reporting.

- Investopedia (investopedia.com) for detailed explanations of tax forms and penalties.

- Accounting Today (accountingtoday.com) for updates on IRS filing changes and deadlines.

- The Balance (thebalance.com) for tips on avoiding common 1099 mistakes.

- CPA Practice Advisor (cpapracticeadvisor.com) for professional perspectives on tax compliance.

- Journal of Accountancy (journalofaccountancy.com) for in-depth analysis of IRS regulations.

- Small Business Administration (sba.gov) for resources on small business tax responsibilities.

- TaxSlayer (taxslayer.com) for user-friendly explanations of self-employment taxes.

- Bench (bench.co) for practical bookkeeping tips related to 1099 forms.

Disclaimer

The information provided in the article “Income Payments on Form 1099: A Comprehensive Guide for Businesses and Individuals” is intended for general informational purposes only and should not be considered professional tax, legal, or financial advice. While every effort has been made to ensure the accuracy and completeness of the content, tax laws and IRS regulations are complex and subject to change.

Readers are strongly encouraged to consult a qualified tax professional or accountant to address their specific circumstances and ensure compliance with current IRS guidelines. The author and publisher are not responsible for any errors, omissions, or consequences arising from the use of this information. Always verify details with official IRS resources or a licensed professional before making tax-related decisions.