Navigating the world of tax preparation can feel overwhelming, especially when you’re trying to save money by using free tax software. With so many options available, it’s crucial to understand what each service offers, their limitations, and how they stack up against one another. In this comprehensive guide, we’ll dive deep into the best free tax software options for 2025, exploring their features, pros, cons, and unique offerings. Whether you’re a student, a freelancer, or someone with a straightforward tax situation.

This comprehensive guide will help you choose the right tool to file your taxes conveniently, accurately, and—most importantly—for free. Let’s break down the top contenders, including H&R Block Free Online, TaxACT Free Edition, IRS Free File, TaxSlayer SimplyFree Edition, and TurboTax Free Edition, while also providing additional insights to ensure you make an informed decision.

Table of Contents

Why Choose Free Tax Software?

Tax season is a yearly ritual that can be both time-consuming and costly if you opt for professional services or paid software. Fortunately, free tax software has evolved significantly, offering robust features for a wide range of taxpayers. These platforms are designed to simplify the tax filing process, providing step-by-step guidance, real-time calculations, and access to common deductions and credits. However, not all free tax software is created equal. Some services impose income restrictions, limit supported tax forms, or charge for state filings. Understanding these nuances is key to avoiding unexpected costs and ensuring your tax return is accurate.

Free tax software is ideal for individuals with simple tax situations, such as those earning W-2 income, claiming standard deductions, or qualifying for basic credits like the Earned Income Tax Credit (EITC) or Child Tax Credit (CTC). However, even complex filers, such as those with unemployment income or student loan interest, can find free options that suit their needs. By comparing the top platforms, you can identify which one aligns with your financial situation and filing requirements. Below, we’ll explore each major free tax software option in detail, highlighting their strengths, weaknesses, and unique features.

Key Considerations When Choosing Free Tax Software

Before diving into the specifics of each platform, it’s important to understand what to look for when selecting free tax software. Here are some critical factors to consider:

- Income Restrictions: Many free tax software programs limit eligibility based on Adjusted Gross Income (AGI). For example, some services are only free for taxpayers earning below a certain threshold, such as $73,000.

- Supported Tax Forms: Not all free versions support complex forms like 1099-B (investment income) or Schedule C (self-employment income). Ensure the software supports the forms relevant to your situation.

- State Filing Fees: While federal filing may be free, some platforms charge for state tax returns, which can add up quickly.

- Ease of Use: Look for intuitive interfaces, step-by-step guides, and features like W-2 photo capture to streamline the process.

- Customer Support: Free versions often offer limited support, but some provide access to tax professionals via chat or email.

- Hidden Costs: Be wary of upsells that prompt you to upgrade to paid versions for additional features or forms.

By keeping these factors in mind, you can avoid surprises and select a platform that meets your needs without breaking the bank. Let’s now explore the top free tax software options for 2025.

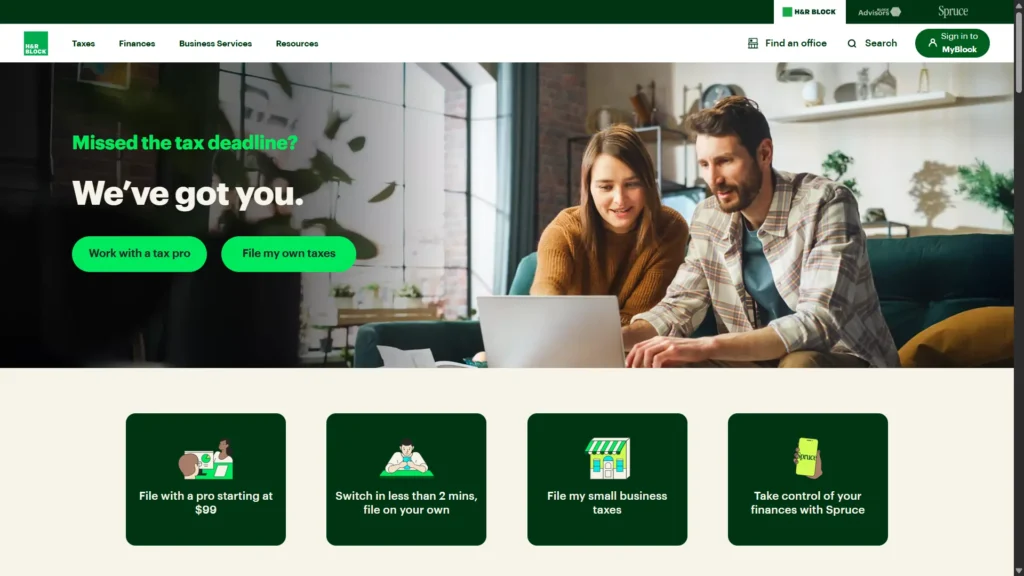

H&R Block Free Online: Comprehensive and User-Friendly

H&R Block Free Online is a standout choice for taxpayers seeking a balance of simplicity and functionality. This platform is known for its user-friendly interface and ability to handle slightly more complex tax situations compared to some competitors. It’s particularly appealing for those with W-2 income, unemployment income (Form 1099-G), or those claiming common deductions like the EITC or CTC.

Features of H&R Block Free Online

H&R Block’s free version offers a robust set of tools designed to make tax filing accessible and efficient. Here are some key features:

- Real-Time Refund Results: As you input your information, H&R Block displays your potential refund or tax owed in real time, helping you understand your financial outcome instantly.

- W-2 Photo Capture: Users can snap a photo of their W-2 form, and the software automatically populates the relevant fields, saving time and reducing errors.

- Step-by-Step Guidance: The platform guides you through the filing process with clear instructions, making it ideal for first-time filers or those with limited tax knowledge.

- Online Chat Support: While in-depth help from tax professionals requires a paid upgrade, basic tax questions can be answered via online chat.

Pros and Cons of H&R Block Free Online

| Size | Pros | Cons |

|---|---|---|

| Small | Real-time refund results | Must upgrade for DeductionPro (charitable donation optimization) |

| Medium | W-2 photo capture for easy data entry | No support for 1099-B investment income |

| Large | Step-by-step guide for completing taxes | Self-employment or small business income requires paid version |

| Huge | Advice on common deductions and credits like EITC and CTC | No support for simple freelancer expenses |

Who Should Use H&R Block Free Online?

H&R Block Free Online is best suited for individuals with straightforward tax situations, such as W-2 employees, students, or those receiving unemployment income. Its support for Form 1099-G sets it apart from competitors like TurboTax, which may not include this in their free tier. However, if you have investment income, self-employment income, or need to optimize charitable donations, you’ll need to upgrade to a paid version, which could be a drawback for some users.

Additional Insights

H&R Block also offers a mobile app, allowing users to file taxes on the go. The app mirrors the desktop experience, with features like W-2 photo capture and real-time refund tracking. For those who value flexibility, this is a significant advantage. Additionally, H&R Block’s free version occasionally prompts users to upgrade to paid tiers, but these prompts are less intrusive than some competitors. If you’re looking for a reliable, user-friendly option with decent support for common tax scenarios, H&R Block is a strong contender.

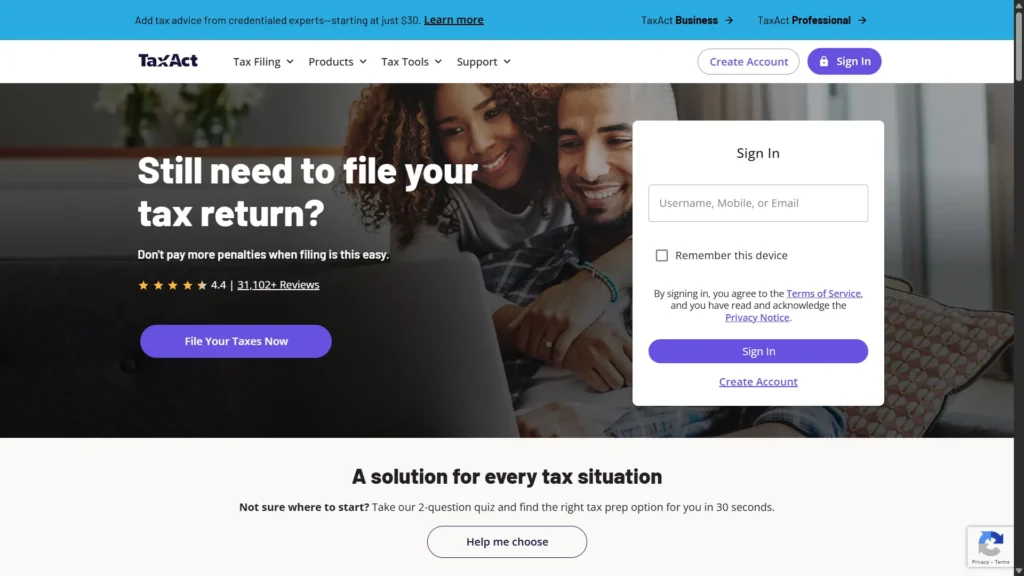

TaxACT Free Edition: Broad Form Support for Complex Filers

TaxACT Free Edition is a lesser-known but powerful option for taxpayers who need to file a variety of tax forms without paying a dime. Unlike some competitors, TaxACT’s free version supports a wide range of tax forms, making it a great choice for those with slightly more complex tax situations.

Features of TaxACT Free Edition

TaxACT stands out for its ability to handle diverse income sources and tax credits. Key features include:

- Wide Form Support: TaxACT’s free version allows users to input data from dozens of tax forms, covering various income types, credits, and deductions.

- Import Capabilities: Users can import tax data from other major services like H&R Block or TurboTax, making it easy to switch platforms without starting from scratch.

- Accuracy Guarantee: TaxACT promises accurate calculations and maximum refunds, with a guarantee to cover penalties or interest caused by software errors.

Pros and Cons of TaxACT Free Edition

| Size | Pros | Cons |

|---|---|---|

| Small | Supports a wide range of tax forms | No support for investment income |

| Medium | Imports data from H&R Block and TurboTax | No W-2 photo import option |

| Large | Covers various income types, credits, and deductions | Non-cash charitable donations and like-kind exchanges not supported |

| Huge | Accuracy guarantee for peace of mind | Limited customer support compared to paid versions |

Who Should Use TaxACT Free Edition?

TaxACT Free Edition is ideal for taxpayers with diverse income sources, such as those with multiple W-2s, rental income, or specific deductions like student loan interest. Its ability to import data from other platforms is a major plus for users transitioning from services like H&R Block or TurboTax. However, if you have investment income or need to report non-cash charitable donations, you’ll need to upgrade or look elsewhere.

Additional Insights

TaxACT’s interface is straightforward but not as polished as competitors like TurboTax or H&R Block. Still, its strength lies in its versatility, making it a go-to for filers who need more flexibility without the cost. The platform also offers a mobile-friendly version, though it lacks features like W-2 photo capture. For those prioritizing form support over bells and whistles, TaxACT is an excellent choice.

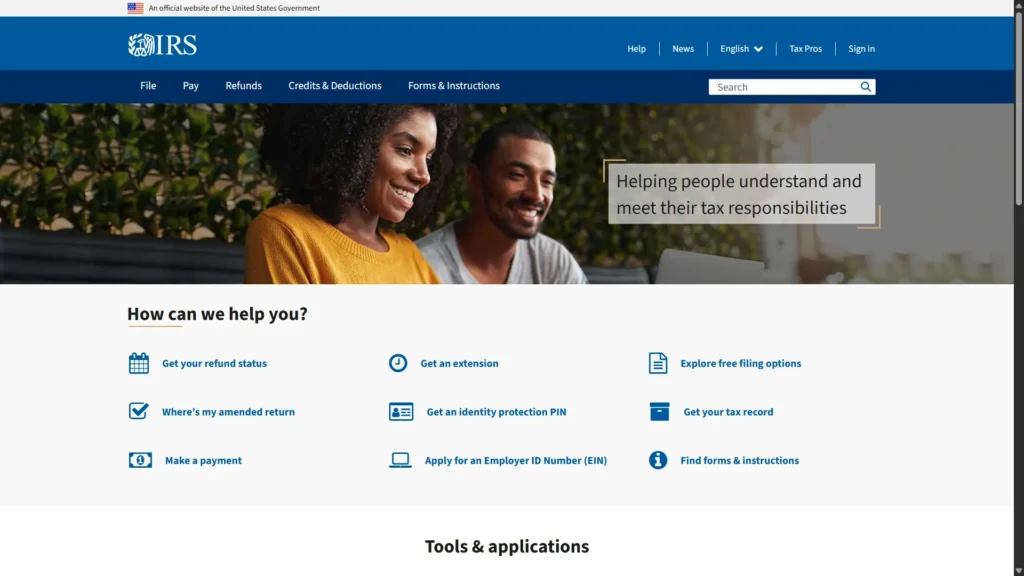

IRS Free File: A Direct and Cost-Free Option

For those who prefer filing directly with the government, the IRS Free File program is a unique offering. This service connects taxpayers with free tax software from partnered providers or allows direct e-filing through the IRS website. It’s designed for individuals with Adjusted Gross Income (AGI) below a certain threshold, typically around $73,000, though this varies by provider.

Features of IRS Free File

The IRS Free File program offers two main options: guided tax preparation through partnered software and fill-in forms for direct e-filing. Key features include:

- Access to Multiple Providers: IRS Free File partners with reputable tax software companies, giving users a choice of platforms based on their needs.

- Free State Filing: Depending on your income and chosen provider, state tax returns may also be free.

- Direct E-Filing: For those comfortable with tax forms, the fill-in forms option allows direct submission without third-party software.

Pros and Cons of IRS Free File

| Size | Pros | Cons |

|---|---|---|

| Small | Access to multiple free tax software options | Income limits may exclude higher earners |

| Medium | Free state filing for eligible users | Higher earners may need to fill out forms manually |

| Large | Simplifies the process of finding free tax software | Limited guidance for complex tax situations |

| Huge | Direct e-filing option for confident filers | Software features vary by provider |

Who Should Use IRS Free File?

IRS Free File is best for taxpayers with AGI below $73,000 who want a no-frills, cost-free filing experience. It’s also a good option for those who are comfortable navigating tax forms independently. However, higher earners or those with complex tax situations may find the program’s limitations restrictive.

Additional Insights

The IRS Free File program is particularly valuable for low- to moderate-income taxpayers, as it ensures access to reputable software without hidden costs. The program’s website provides a tool to match you with the right provider based on your income and filing needs. For those who qualify, it’s one of the most straightforward ways to file both federal and state taxes for free.

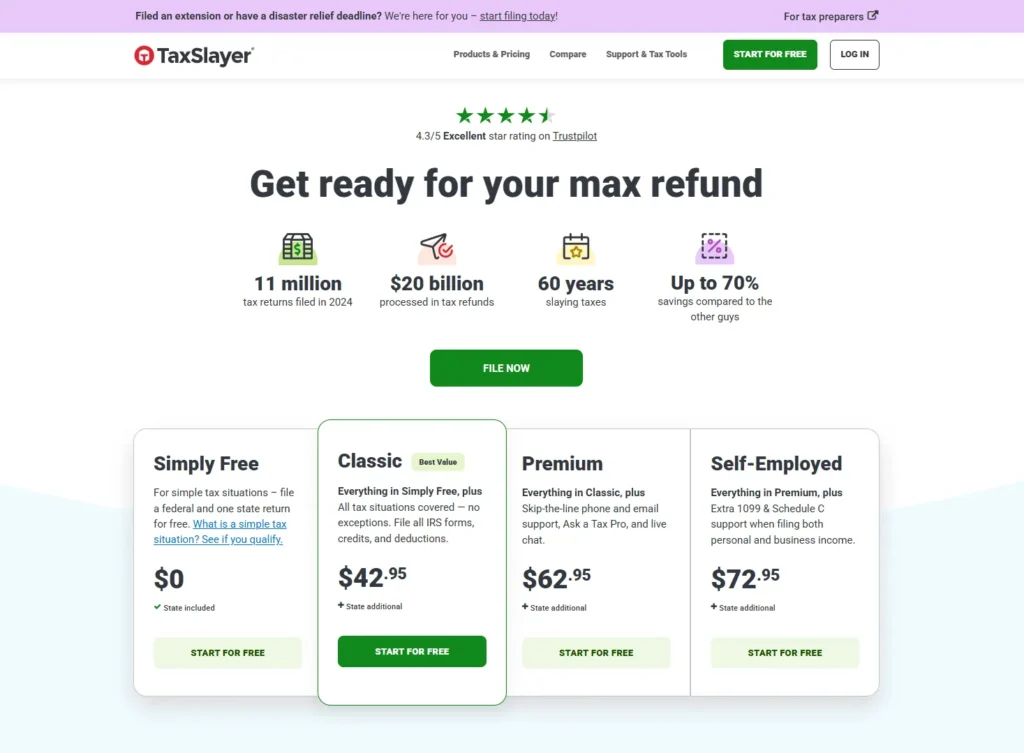

TaxSlayer SimplyFree Edition: Simple and Military-Friendly

TaxSlayer SimplyFree Edition is tailored for taxpayers with basic tax situations, such as W-2 income or 1040 returns. It also offers unique perks for active-duty military personnel, making it a standout for service members.

Features of TaxSlayer SimplyFree Edition

TaxSlayer’s free version is designed for simplicity, with features that cater to specific groups. Key offerings include:

- Student Loan and Education Support: The free version covers student loan interest and education expenses, making it ideal for students.

- Military Benefits: Active-duty military members receive free federal filing for more complex tax situations.

- Phone and Email Support: Unlike some free versions, TaxSlayer offers free support via phone and email, though it’s limited compared to paid tiers.

Pros and Cons of TaxSlayer SimplyFree Edition

| Size | Pros | Cons |

|---|---|---|

| Small | Covers student loan interest and education expenses | Limited support compared to paid versions |

| Medium | Free phone and email support | Only supports basic W-2 and 1040 returns |

| Large | Free federal filing for active-duty military | No support for complex income sources |

| Huge | Simple interface for quick filing | Upsells to paid versions for additional features |

Who Should Use TaxSlayer SimplyFree Edition?

TaxSlayer SimplyFree Edition is perfect for students, active-duty military, or those with basic W-2 income and 1040 returns. Its support for education-related deductions makes it a strong choice for young filers. However, those with investment income or self-employment income will need to upgrade or choose another service.

Additional Insights

TaxSlayer’s paid versions are among the most affordable on the market, so if you outgrow the free version, upgrading is a cost-effective option. The platform’s military-friendly features also extend to its paid tiers, offering discounted rates for service members. For those seeking a no-frills, budget-friendly option, TaxSlayer is worth considering.

TurboTax Free Edition: Polished but Limited

TurboTax Free Edition is one of the most well-known tax software options, thanks to its polished interface and extensive marketing. While its free version is limited in scope, it offers valuable features for simple filers.

Features of TurboTax Free Edition

TurboTax Free Edition is designed for ease of use, with features that streamline the filing process:

- User-Friendly Interface: The platform’s intuitive design guides users through each step, making it accessible for beginners.

- Free Tax Adviser Access: Unlimited help from a tax adviser is included, a rare feature for free software.

- Expedited Filing for Return Customers: TurboTax can complete up to 50% of a return with a single click for users who filed with the service previously.

Pros and Cons of TurboTax Free Edition

| Size | Pros | Cons |

|---|---|---|

| Small | Supports some tax credits | Most forms not supported in free version |

| Medium | Easy-to-use interface | Frequent prompts to upgrade to paid versions |

| Large | Unlimited free tax adviser help | Paid services are more expensive than competitors |

| Huge | Expedited service for return customers | Limited to basic tax situations |

Who Should Use TurboTax Free Edition?

TurboTax Free Edition is ideal for first-time filers or those with simple W-2 income and basic tax credits. Its free tax adviser support is a major draw, but the frequent upsell prompts and limited form support may frustrate users with more complex needs.

Additional Insights

TurboTax’s reputation for ease of use is well-earned, but its free version is less comprehensive than competitors like TaxACT or H&R Block. The platform’s mobile app is highly rated, offering a seamless experience for filing on the go. If you value a polished interface and don’t mind navigating upsell prompts, TurboTax is a solid choice for simple returns.

Comparing the Top Free Tax Software Options

To help you decide which platform is right for you, here’s a comparative overview of the key features and limitations of each service:

| Feature | H&R Block Free Online | TaxACT Free Edition | IRS Free File | TaxSlayer SimplyFree | TurboTax Free Edition |

|---|---|---|---|---|---|

| W-2 Photo Capture | Yes | No | Varies | No | No |

| Unemployment Income Support | Yes | Yes | Varies | No | No |

| Student Loan Interest | Yes | Yes | Varies | Yes | Yes |

| Investment Income Support | No | No | Varies | No | No |

| Free State Filing | No | No | Yes (some) | No | No |

| Military Benefits | No | No | Varies | Yes | No |

| Customer Support | Chat (limited) | Limited | Varies | Phone/Email (limited) | Tax Adviser (unlimited) |

Additional Tips for Using Free Tax Software

To maximize your experience with free tax software, consider the following tips:

- Verify Eligibility: Check income limits and supported forms before starting to avoid unexpected fees.

- Gather Documents: Have all necessary documents, such as W-2s, 1099s, and receipts for deductions, ready to streamline the process.

- Double-Check Calculations: Even with accuracy guarantees, review your return for errors before submitting.

- Explore Paid Options: If your tax situation is complex, compare the cost of paid versions to ensure you’re getting the best value.

- File Early: Filing early reduces the risk of errors and ensures faster processing of your refund.

Conclusion: Choosing the Right Free Tax Software for You

Selecting the best free tax software depends on your unique financial situation, filing needs, and comfort level with tax preparation. H&R Block Free Online is ideal for those with unemployment income or common deductions, while TaxACT Free Edition excels for filers needing broad form support. IRS Free File offers a direct, cost-free option for eligible taxpayers, and TaxSlayer SimplyFree Edition caters to students and military members. TurboTax Free Edition shines for its ease of use and free tax adviser access, but its limited scope may not suit everyone.

By carefully evaluating each platform’s features, pros, and cons, you can file your taxes confidently and for free. Always read the fine print to avoid hidden fees, and consider upgrading to a paid version if your tax situation requires additional support. With the right free tax software, you can save time, money, and stress during tax season.

Disclaimer

The information provided in “The Ultimate Guide to the Best Free Tax Software in 2025: Save Money and File with Confidence” is intended for general informational purposes only and should not be considered professional tax or financial advice. Tax laws and regulations are complex and subject to change, and the suitability of any tax software depends on your individual financial situation.

This website Manishchanda.net strive to provide accurate and up-to-date information, this website cannot guarantee the completeness, accuracy, or applicability of the content to your specific circumstances. Always consult with a qualified tax professional or financial advisor before making decisions about your taxes. The use of any tax software mentioned in this article is at your own risk, and we are not liable for any errors, omissions, or financial outcomes resulting from its use.

Acknowledgements

I express my gratitude to the numerous reputable sources that provided valuable insights and data for the creation of “The Ultimate Guide to the Best Free Tax Software in 2025: Save Money and File with Confidence” Their comprehensive resources, expert reviews, and up-to-date information on tax software features, limitations, and eligibility criteria were instrumental in shaping this article. Below is a list of key websites that contributed to the research and development of this guide, ensuring a thorough and accurate comparison of the best free tax software options available in 2025.

- IRS: Provided detailed information on the IRS Free File program and eligibility requirements.

- H&R Block: Offered insights into the features and limitations of H&R Block Free Online.

- TurboTax: Contributed data on TurboTax Free Edition’s interface and support options.

- TaxACT: Supplied information on supported tax forms and import capabilities.

- TaxSlayer: Provided details on military benefits and student-focused features.

- Forbes: Shared expert reviews and comparisons of tax software.

- NerdWallet: Offered in-depth analyses of free tax software pros and cons.

- CNET: Contributed user-friendly breakdowns of tax software features.

- PCMag: Provided detailed reviews of tax software performance and usability.

- Investopedia: Shared insights on tax software suitability for various income levels.

- The Balance: Offered practical advice on choosing free tax software.

- Bankrate: Provided comparisons of tax software costs and features.

- Consumer Reports: Contributed user-focused evaluations of tax filing platforms.

- Money: Shared tips on avoiding hidden fees in free tax software.

- Kiplinger: Provided guidance on tax software for specific tax situations.

- TechRadar: Offered technical insights into tax software interfaces.

- U.S. News & World Report: Contributed rankings and reviews of tax software.

- Business Insider: Shared practical advice for first-time filers.

- CNBC: Provided updates on tax software trends and features.

- The New York Times: Offered consumer-focused insights on tax filing options.

Frequently Asked Questions (FAQs)

FAQ 1: What is the best free tax software for simple tax returns in 2025?

For individuals with simple tax returns, such as those with W-2 income or basic deductions, several free tax software options stand out in 2025. TurboTax Free Edition and TaxSlayer SimplyFree Edition are particularly well-suited due to their user-friendly interfaces and support for basic tax situations. TurboTax offers an intuitive design with step-by-step guidance, making it ideal for first-time filers or those with straightforward 1040 returns. Its free tax adviser access is a unique feature, allowing users to get answers to basic tax questions without additional cost. TaxSlayer, on the other hand, is tailored for students and active-duty military personnel, offering free federal filing for simple returns and covering student loan interest deductions.

However, H&R Block Free Online is another strong contender, especially for those with slightly more complex situations, such as unemployment income (Form 1099-G). It provides features like W-2 photo capture and real-time refund tracking, which streamline the filing process. While IRS Free File is a great option for those with Adjusted Gross Income (AGI) below $73,000, it may require more manual input for those opting for the fill-in forms option. For the simplest returns, TurboTax and TaxSlayer are often preferred for their ease of use, but H&R Block is a better choice if you need support for additional income types.

- Key Considerations: Ensure your income falls within the software’s eligibility limits, and check if state filing is included to avoid unexpected fees.

- Example: A recent college graduate with a single W-2 and student loan interest would find TaxSlayer’s free version sufficient, while someone with unemployment income might prefer H&R Block.

- Tip: File early to avoid errors and take advantage of features like TurboTax’s expedited filing for returning users, which can complete up to 50% of your return with one click.

FAQ 2: Can I file my state taxes for free using free tax software in 2025?

Filing state taxes for free can be a challenge, as many free tax software programs charge additional fees for state returns. However, IRS Free File stands out as a notable exception, offering free state filing for eligible taxpayers, depending on the partnered provider and your AGI (typically under $73,000). The availability of free state filing varies by provider, so it’s essential to check the specific terms when selecting a software through the IRS Free File program. Other platforms like H&R Block Free Online, TurboTax Free Edition, TaxACT Free Edition, and TaxSlayer SimplyFree Edition typically require an upgrade to a paid version for state tax filing, which can range from $20 to $40 depending on the service.

To avoid surprises, always review the fine print before starting your return. For example, a taxpayer earning $50,000 with a simple W-2 might qualify for free state filing through IRS Free File but would need to pay extra with TurboTax. If you’re in a state with no income tax, such as Texas or Florida, federal-only filing may suffice, making platforms like TaxSlayer or H&R Block more cost-effective. For those who qualify, IRS Free File remains the most reliable option for free state tax filing.

- Key Considerations: Verify your state’s tax requirements and the software’s state filing fees before proceeding.

- Example: A military member using TaxSlayer SimplyFree might get free federal filing but still need to pay for state taxes unless they qualify through IRS Free File.

- Tip: Use the IRS Free File lookup tool to find a provider that includes free state filing for your income level.

FAQ 3: Which free tax software supports unemployment income in 2025?

Unemployment income (Form 1099-G) can complicate tax filing, but some free tax software options handle it effectively. H&R Block Free Online is a top choice for taxpayers with unemployment income, as it explicitly supports Form 1099-G in its free version, unlike competitors like TurboTax Free Edition, which may require an upgrade for this form. H&R Block’s platform provides real-time refund results and a step-by-step guide, making it easier to input unemployment income accurately. TaxACT Free Edition also supports a wide range of tax forms, including those for unemployment income, making it another viable option for filers with this income type.

When filing unemployment income, ensure you have your 1099-G form from your state’s unemployment office, which details the total benefits received and any taxes withheld. Be aware that unemployment income is taxable at the federal level and, in some cases, at the state level, which may increase your tax liability or reduce your refund. Both H&R Block and TaxACT offer accuracy guarantees to minimize errors, but you should double-check your entries to ensure compliance.

- Key Considerations: Confirm that the free version supports Form 1099-G and check for state-specific tax implications.

- Example: A freelancer who received $10,000 in unemployment benefits in 2024 could use H&R Block Free Online to file without upgrading, while TurboTax might prompt for a paid version.

- Tip: Use H&R Block’s W-2 photo capture feature if your unemployment income is reported alongside W-2 income for faster data entry.

FAQ 4: Is free tax software suitable for freelancers or self-employed individuals in 2025?

Free tax software is generally designed for simple tax situations, and most options in 2025, such as H&R Block Free Online, TurboTax Free Edition, and TaxSlayer SimplyFree Edition, do not support self-employment income (Schedule C) or simple freelancer expenses in their free versions. These platforms typically require users to upgrade to paid tiers to handle forms related to self-employment, such as 1099-NEC or Schedule C. However, TaxACT Free Edition offers broader form support, which may cover some freelance income scenarios, though it still excludes complex deductions like non-cash charitable contributions or like-kind exchanges.

For freelancers with minimal expenses and straightforward income, TaxACT might suffice, but most self-employed individuals will find the limitations of free software restrictive. Paid versions of these platforms, such as H&R Block’s Deluxe or TurboTax’s Self-Employed editions, provide tools like DeductionPro (for optimizing charitable donations) and support for business expenses, which are critical for maximizing deductions. If your freelance income is below the IRS Free File threshold ($73,000 AGI), you might find a partnered provider that supports basic self-employment forms, but this varies by provider.

- Key Considerations: Check if the software supports Schedule C and related forms, and be prepared to upgrade for complex deductions.

- Example: A part-time Uber driver with $15,000 in 1099-NEC income would likely need to upgrade to a paid version of TurboTax or use a paid TaxACT plan for full support.

- Tip: Track all business expenses throughout the year to ensure accurate deductions when upgrading to a paid plan.

FAQ 5: How does IRS Free File differ from other free tax software options in 2025?

IRS Free File is a unique program that sets itself apart from other free tax software by offering direct access to tax filing through the IRS website or partnered providers. Unlike standalone platforms like H&R Block Free Online or TurboTax Free Edition, IRS Free File connects taxpayers with Adjusted Gross Income (AGI) below $73,000 to a variety of free tax software options from reputable companies. It also offers a fill-in forms option for those comfortable completing tax forms manually, which is not available in most commercial free software.

The program’s strength lies in its flexibility and potential for free state filing, depending on the provider and your income level. However, its limitations include income restrictions and varying features across providers, which can make the experience less consistent than using a single platform like TaxSlayer or TurboTax. For example, some IRS Free File partners may offer W-2 photo capture or robust customer support, while others may not. This makes it essential to use the IRS Free File lookup tool to find a provider that matches your needs.

- Key Considerations: Ensure your AGI qualifies, and compare provider features to find the best fit.

- Example: A taxpayer earning $60,000 with W-2 income might use IRS Free File to access a provider like TaxACT for free federal and state filing, saving $30-$40 compared to TurboTax.

- Tip: Use the fill-in forms option if you’re confident with tax forms and want to avoid third-party software altogether.

FAQ 6: What are the limitations of free tax software for investment income in 2025?

Most free tax software options in 2025, including H&R Block Free Online, TurboTax Free Edition, TaxACT Free Edition, and TaxSlayer SimplyFree Edition, do not support investment income (Form 1099-B) in their free versions. This is a significant limitation for taxpayers with capital gains, dividends, or other investment-related income, as these require specialized forms that are typically reserved for paid tiers. For example, H&R Block requires an upgrade to handle 1099-B forms, including cost basis calculations, and TurboTax frequently prompts users to upgrade when investment income is entered.

IRS Free File may offer some providers that support basic investment income, but this depends on the specific partner and your AGI. If you have substantial investment income, such as from stock trading or cryptocurrency transactions, you’ll likely need to upgrade to a paid version of software like TurboTax Premier or H&R Block Premium, which offer robust tools for tracking cost basis and reporting gains or losses. Always verify the supported forms before starting your return to avoid mid-process upgrades.

- Key Considerations: Confirm whether the free version supports Form 1099-B or related investment forms.

- Example: An investor with $5,000 in stock sale proceeds would need to upgrade to H&R Block’s paid version to report 1099-B data accurately.

- Tip: Keep detailed records of your investment transactions to simplify reporting when using a paid plan.

FAQ 7: Which free tax software offers the best customer support in 2025?

Customer support is a critical factor when choosing free tax software, especially for first-time filers or those with questions about their returns. TurboTax Free Edition leads the pack with its unlimited free tax adviser access, allowing users to ask questions via chat or phone without additional cost. This is a rare feature for free software and sets TurboTax apart from competitors. H&R Block Free Online offers online chat support for basic questions, but in-depth assistance from tax professionals requires a paid upgrade. TaxSlayer SimplyFree Edition provides free phone and email support, though it’s limited compared to its paid tiers.

TaxACT Free Edition and IRS Free File typically offer minimal customer support in their free versions, with TaxACT relying on FAQs and limited email assistance, and IRS Free File support varying by provider. For example, a TurboTax user can get real-time help with a question about the Child Tax Credit, while a TaxACT user might need to search for answers independently. If customer support is a priority, TurboTax or TaxSlayer are the best options, but always check the scope of support offered in the free tier.

- Key Considerations: Evaluate the type and availability of support (chat, phone, email) before choosing a platform.

- Example: A first-time filer confused about deductions could benefit from TurboTax’s free adviser access to clarify eligibility for the EITC.

- Tip: Prepare specific questions in advance to make the most of limited support sessions.

FAQ 8: Can students use free tax software to claim education-related deductions in 2025?

Students with education-related expenses, such as student loan interest or tuition credits, can benefit from free tax software like TaxSlayer SimplyFree Edition, H&R Block Free Online, TaxACT Free Edition, and TurboTax Free Edition, all of which support student loan interest deductions in their free versions. TaxSlayer stands out for its focus on education expenses, covering both student loan interest and certain education credits like the American Opportunity Credit. H&R Block and TurboTax also provide guidance on these deductions, with H&R Block offering a step-by-step guide to ensure students maximize their credits.

However, more complex education-related forms, such as those for 529 plan distributions, may require an upgrade to a paid version. IRS Free File can also be a good option for students with AGI below $73,000, as some partnered providers support education credits. Students should gather their 1098-E (student loan interest) and 1098-T (tuition) forms to ensure accurate reporting. For example, a student paying $1,500 in loan interest could deduct up to $2,500 using TaxSlayer’s free version, potentially reducing their taxable income significantly.

- Key Considerations: Verify support for education-related forms like 1098-E and 1098-T in the free version.

- Example: A graduate student with $2,000 in tuition payments could use H&R Block Free Online to claim the Lifetime Learning Credit without upgrading.

- Tip: Check with your educational institution for all relevant tax forms to maximize deductions.

FAQ 9: How can military personnel benefit from free tax software in 2025?

Active-duty military personnel have unique tax filing needs, and TaxSlayer SimplyFree Edition is a standout choice in 2025, offering free federal filing for military members, even for more complex tax situations. This includes support for W-2 income, combat pay exclusions, and certain military-specific deductions. Other platforms like H&R Block Free Online, TurboTax Free Edition, and TaxACT Free Edition do not offer specific military benefits in their free versions, requiring upgrades for complex military income scenarios.

IRS Free File may also provide military-friendly options through partnered providers, especially for those with AGI below $73,000. Military members should ensure their software supports forms like Form 3903 (moving expenses) if they’ve relocated due to service. For example, a service member with combat pay and relocation expenses could use TaxSlayer’s free version to file federally at no cost, but they may need to pay for state filing unless using IRS Free File. Always verify military-specific features before starting your return.

- Key Considerations: Look for software with explicit military benefits and check for free state filing options.

- Example: An active-duty soldier with $40,000 in income could file federally for free with TaxSlayer, saving on filing costs compared to TurboTax.

- Tip: Keep records of military-specific expenses, such as moving costs, to maximize deductions.

FAQ 10: How can I avoid hidden fees when using free tax software in 2025?

Avoiding hidden fees is a top concern when using free tax software, as many platforms upsell users to paid versions for additional features or forms. To stay within the free tier, start by verifying your eligibility, particularly income limits (e.g., $73,000 AGI for IRS Free File) and supported forms. Platforms like TurboTax Free Edition and H&R Block Free Online may prompt upgrades for forms like 1099-B or Schedule C, so ensure your tax situation aligns with the free version’s capabilities. IRS Free File is a safer bet for avoiding fees, as it connects you with providers that guarantee free filing for eligible users, often including state returns.

Always read the fine print before starting, and be cautious of state filing fees, which are a common extra cost with platforms like TaxACT and TaxSlayer. For example, a taxpayer with a simple W-2 might complete their federal return for free with TurboTax but face a $30 fee for state filing. Gathering all tax documents beforehand and double-checking calculations can also prevent errors that might require paid support. Filing early and using features like W-2 photo capture (available with H&R Block) can streamline the process and reduce the need for upgrades.

- Key Considerations: Check for state filing fees, supported forms, and income restrictions before starting.

- Example: A filer with $50,000 in W-2 income could use IRS Free File to avoid state filing fees, saving money compared to TurboTax’s paid state option.

- Tip: Use the software’s refund calculator to estimate your return before committing to a platform, ensuring no unexpected upgrades are needed.